GBP Fundamental Analysis: Five Months of Strength Falters in Recent Weeks, with 12 June US CPI Data Decisive for GBP’s Direction

Saturday, 8 June, Week 23: The GBP has enjoyed a five-month rally, fuelled by cooling inflation and market anticipation of BoE rate cuts. However, this upward momentum has stalled in recent weeks, with geopolitical tensions and a shift in global interest rate expectations casting a shadow over the GBP's outlook. This report provides a comprehensive analysis of the UK's fiscal and monetary policy, economic performance, and the prevailing geopolitical landscape to assess the potential trajectory of the GBP over the next five weeks. The US CPI data, scheduled for release on 12 June, emerges as a pivotal event that could significantly impact the Fed's policy stance and, consequently, the GBP's direction.

Fiscal Policy

The UK government is pursuing a fiscal policy characterised by a delicate balance between supporting economic growth and reining in public borrowing. The Spring Budget 2024, delivered against a backdrop of high debt, subdued economic growth, and elevated interest rates, unveiled a front-loaded package of measures, including significant net tax cuts. These measures, while offering a near-term stimulus, are projected to increase borrowing by an average of £8.0 billion per year, according to the OBR.

The OBR's March 2024 Economic and Fiscal Outlook highlights the challenging fiscal position, stating that "economic and market conditions mean the Government needs to run a primary surplus (revenues minus spending, excluding interest) of around 1.3 per cent of GDP just to stabilise debt in the medium term." This underscores the government's commitment to fiscal responsibility, aiming to achieve a primary surplus and falling debt by 2028-29.

Over the next five weeks, leading up to the general election on 4 July, fiscal policy is likely to remain under scrutiny. The different political parties have presented varying fiscal proposals, introducing a degree of uncertainty. However, the overarching theme of fiscal prudence is expected to persist, regardless of the election outcome. The government's commitment to its fiscal rules, particularly the mandate for public sector net debt to fall by the fifth year of the forecast, will likely guide fiscal decisions in the coming weeks.

Economics

The UK economy is navigating a complex landscape, marked by slowing growth, a tight labour market, easing inflation, and persistent trade deficits.

Economic Growth

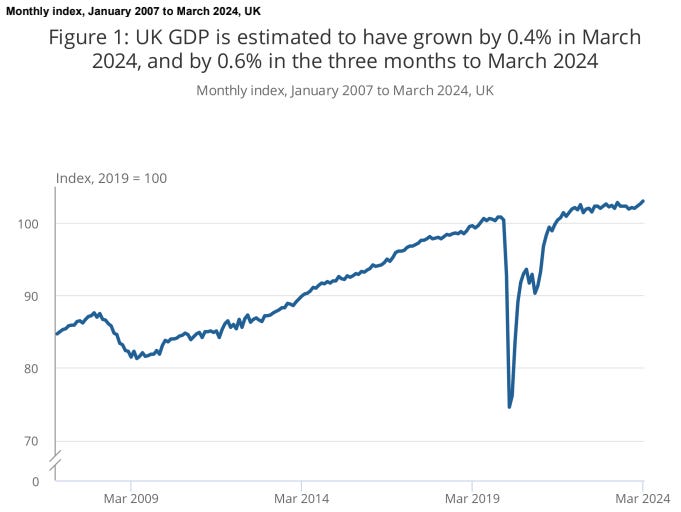

The British economy is experiencing a period of subdued growth, with GDP expanding by a mere 0.1% in 2023, undershooting the OBR's November forecast. However, the first quarter of 2024 brought a glimmer of hope, with GDP growth rebounding to 0.6%, exceeding forecasts and marking the strongest expansion in over two years. This positive momentum is attributed to a 0.7% rise in services output, fuelled by widespread growth across the sector.

Looking ahead, the OBR projects GDP growth to accelerate to 0.8% in 2024, as falling interest rates and recovering real household incomes lend support. However, the OBR cautions that "the medium-term economic outlook remains challenging," with GDP growth projected to hover around 1⅔% per year over the next five years.

The escalating Israel-Hamas conflict poses a significant downside risk to the UK's growth trajectory. A protracted or widening conflict could disrupt global supply chains, potentially leading to higher energy prices and dampening business and consumer confidence.

Labour

The UK labour market remains tight, with the unemployment rate at 4.3% in January to March 2024, slightly up from 4.2% in the previous quarter. Despite this slight uptick, the unemployment rate remains near historic lows, indicating a robust labour market. However, the OBR forecasts a moderate rise in unemployment, peaking at 4.5% in Q4 2024, reflecting subdued economic growth.

Wage growth, a key driver of inflation, is showing signs of moderation. Average weekly earnings, including bonuses, increased by 5.7% year-on-year in the three months to March 2024, in line with the previous period and exceeding forecasts. However, the OBR projects nominal average pay growth to halve in 2024, falling to 3.6% as inflation eases and the labour market loosens.

The persistence of high economic inactivity poses a challenge to the labour market outlook. The inactivity rate, at 22.1% in January to March 2024, remains elevated, with long-term sickness cited as the primary reason for inactivity by a significant proportion of the working-age population. This persistent inactivity could constrain potential output growth and contribute to upward pressure on wages in the medium term.

Price Changes

Inflation, a key concern for policymakers and market participants, has been easing in recent months. CPI inflation fell to 2.3% in April 2024, the lowest since July 2021, driven by falling gas and electricity prices following the lowering of the Ofgem energy price cap.

The OBR projects inflation to fall further, averaging 2.2% in 2024 and 1.5% in 2025, before gradually returning to the 2% target. This easing inflation trend is attributed to both external factors, such as lower global energy prices, and domestic factors, including a loosening labour market and the pass-through of lower energy costs to the broader economy.

However, the conflict in the Middle East presents a significant upside risk to the inflation outlook. A widening of the conflict could disrupt energy supplies, leading to a resurgence in energy prices and reigniting inflationary pressures.

Trade

The UK's trade balance remains in deficit, albeit narrowing to £1.098 billion in March 2024, the smallest in three months. This improvement is attributed to a shrinking trade deficit in goods, driven by a decline in both imports and exports.

The OBR expects trade volumes to remain subdued in the coming years, reflecting sluggish growth in both the UK and global economies, coupled with the evolving impact of Brexit. The conflict in the Middle East adds another layer of complexity, potentially disrupting global trade flows and posing a downside risk to UK exports.

Monetary Policy

The BoE, tasked with maintaining price stability, is currently in a wait-and-see mode, holding Bank Rate at 5.25% in its May meeting. This decision, while maintaining a restrictive stance, reflects the BoE's cautious approach as it assesses the evolving inflation and growth dynamics.

The BoE's May Monetary Policy Report acknowledges the easing inflationary pressures, stating that ""CPI inflation is expected to return to close to the 2% target in the near term."" However, the report also highlights the persistence of domestic inflationary pressures, noting that "services CPI inflation is expected to continue to ease gradually from 6.0% in March."

Market expectations suggest that the BoE will begin cutting rates later this year, with Bank Rate projected to fall to 3.75% by the end of 2024. This anticipated easing cycle is predicated on the assumption that inflation continues to moderate and economic growth remains subdued.

The BoE's monetary policy decisions over the next five weeks will be heavily influenced by incoming economic data, particularly inflation and labour market indicators. The upcoming US CPI data release on 12 June will be a key event for the BoE, as it could signal the Fed's policy intentions and influence global interest rate expectations. A stronger-than-expected US inflation reading could delay BoE rate cuts, while a weaker reading could accelerate the easing cycle.

Geopolitics and Market Themes

UK Election

The upcoming UK general election, scheduled for 4 July 2024, has introduced a layer of political uncertainty, with potential implications for economic and fiscal policy.

The Conservative Party, currently in power, is facing a challenge from the Labour Party, with polls suggesting a tight race.

The two main parties have distinct policy platforms, particularly on fiscal matters, creating uncertainty about the future direction of economic policy.

The outcome of the election could have significant implications for the UK's relationship with the EU, trade policy, and regulatory environment.

The GBP has exhibited some volatility in recent weeks, reflecting the uncertainty surrounding the election outcome.

A Conservative victory is generally perceived as more market-friendly, potentially leading to a stronger GBP.

A Labour victory could lead to increased fiscal spending and a more interventionist approach to economic policy, potentially weighing on the GBP.

Russia-Ukraine War

The protracted war in Ukraine continues to cast a pall over global markets, fuelling risk aversion and uncertainty.

Russia is anticipated to make further tactical gains in the coming months, exploiting Ukraine's resource constraints.

Western support for Ukraine remains steadfast, but concerns linger about the long-term sustainability of aid.

The war's disruptive impact on global supply chains, particularly for energy and agricultural products, continues to contribute to inflationary pressures.

Safe-haven assets, such as the USD and gold, remain in demand amid heightened geopolitical risks.

European currencies, especially the EUR, have weakened against the USD, reflecting the war's impact on the European economy and the potential for further energy supply disruptions.

Energy prices, while off their peaks, remain elevated and susceptible to volatility depending on the war's trajectory.

Israel-Hamas War

The recent escalation of the Israel-Hamas conflict has injected a fresh wave of geopolitical uncertainty, dampening risk appetite and weighing on market sentiment.

Israel's reoccupation of Gaza has raised concerns about a protracted and potentially widening conflict.

Diplomatic efforts to secure a ceasefire have yielded limited progress, leaving the path to a resolution uncertain.

The conflict has exacerbated tensions in the Middle East, with potential spillover effects on regional stability.

The conflict has fuelled risk aversion, driving investors towards safe-haven assets.

Oil prices have risen on concerns about potential supply disruptions from the Middle East, a key energy-producing region.

The Israeli Shekel has weakened against the USD, reflecting the heightened uncertainty surrounding the conflict's duration and potential ramifications.

Global Interest Rate Expectations

The global interest rate environment is in flux, with central banks grappling with persistent inflation and the need to balance price stability with economic growth.

The US Federal Reserve, having paused its aggressive rate hiking cycle, is now in a data-dependent mode, closely monitoring inflation and economic data to guide its next policy move.

The European Central Bank, while having recently cut interest rates, has signalled that further easing is contingent on inflation moderating as expected.

The Bank of England, facing easing inflation and a slowing economy, is expected to embark on a rate-cutting cycle later this year, but remains vigilant about the potential for persistent inflationary pressures.

The USD has strengthened as investors seek higher yields in a rising interest rate environment.

Currencies in countries with lower interest rates, such as the EUR and JPY, have weakened against the USD, reflecting the interest rate differentials.

Stock markets have been volatile, as investors weigh the prospects of slowing economic growth and persistent inflation against the potential for central banks to pivot towards easing.

Conclusion

GBP Upward Support: The GBP could find upward support in the coming five weeks if:

UK economic data surprises to the upside, particularly on inflation and growth, bolstering the case for BoE rate cuts and attracting yield-seeking investors to the GBP.

The US CPI data disappoints, prompting the Fed to signal a more dovish stance and potentially narrowing the interest rate differential between the US and the UK.

The Israel-Hamas conflict de-escalates, easing geopolitical tensions and boosting risk appetite, which would benefit the GBP.

Pivotal Event: US CPI data release on 12 June 2024.

GBP Indifference: The GBP could trade sideways over the next five weeks if:

UK economic data remains mixed, offering no clear signal on the BoE's policy trajectory and keeping uncertainty elevated.

The US CPI data meets expectations, leading the Fed to maintain its current stance and preserving the existing interest rate differential.

The Israel-Hamas conflict persists but does not escalate significantly, maintaining a level of geopolitical uncertainty that limits GBP moves.

Pivotal Event: Bank of England interest rate decision on 20 June 2024.

GBP Downside Pressure: The GBP could face downward pressure in the coming five weeks if:

UK inflation proves stickier than anticipated, or if economic growth disappoints, prompting the BoE to delay or scale back its expected rate cuts.

The US CPI data surprises to the upside, leading to a more hawkish Fed and widening the interest rate differential between the US and the UK.

The Israel-Hamas conflict escalates, for example, spreading to Lebanon, which would heighten geopolitical risks and trigger a flight to safety, weighing on the GBP.

Pivotal Event: US CPI data release on 12 June 2024.

References

Bank of England: https://www.bankofengland.co.uk

Office for Budget Responsibility: https://obr.uk

Office for National Statistics: https://www.ons.gov.uk

Trading Economics: https://tradingeconomics.com

Bloomberg: https://www.bloomberg.com

Reuters: https://www.reuters.com

Financial Times: https://www.ft.com

GDP first quarterly estimate, UK January to March 2024

Labour market overview, UK May 2024

Consumer price inflation, UK April 2024

UK trade March 2024