Monday, 06 October 2025

During the weekend, Japan’s Liberal Democratic Party picked pro-stimulus lawmaker Sanae Takaichi as its new leader. This has caused traders to rethink how hawkish the Bank of Japan can be as they may come under pressure to hold rates rather than hike. The Yen subsequently lost value and thus, the pair triggered its Stop Loss.

Wednesday, 03 September 2025

UK Fiscal Pressures Create Bearish Opportunity

The United Kingdom faces a deepening crisis of investor confidence in its fiscal position, creating a "bearish feedback loop" that is expected to weigh heavily on the British Pound. Soaring government borrowing costs are forcing a stagflationary dilemma on the Bank of England, compelling it toward a path of fiscal tightening that will likely act as a significant drag on an already fragile economy.

This creates a strategic opportunity to short the British Pound against a stable counterpart. The Japanese Yen is an ideal candidate due to the predictable and accommodative stance of the Bank of Japan, making it a stable funding currency. Furthermore, its traditional safe-haven status could attract capital flows amid broader European political risks, potentially amplifying the GBP/JPY pair's decline.

THE STRATEGIC TRADE PLAN

A Bearish Strategy for GBP/JPY

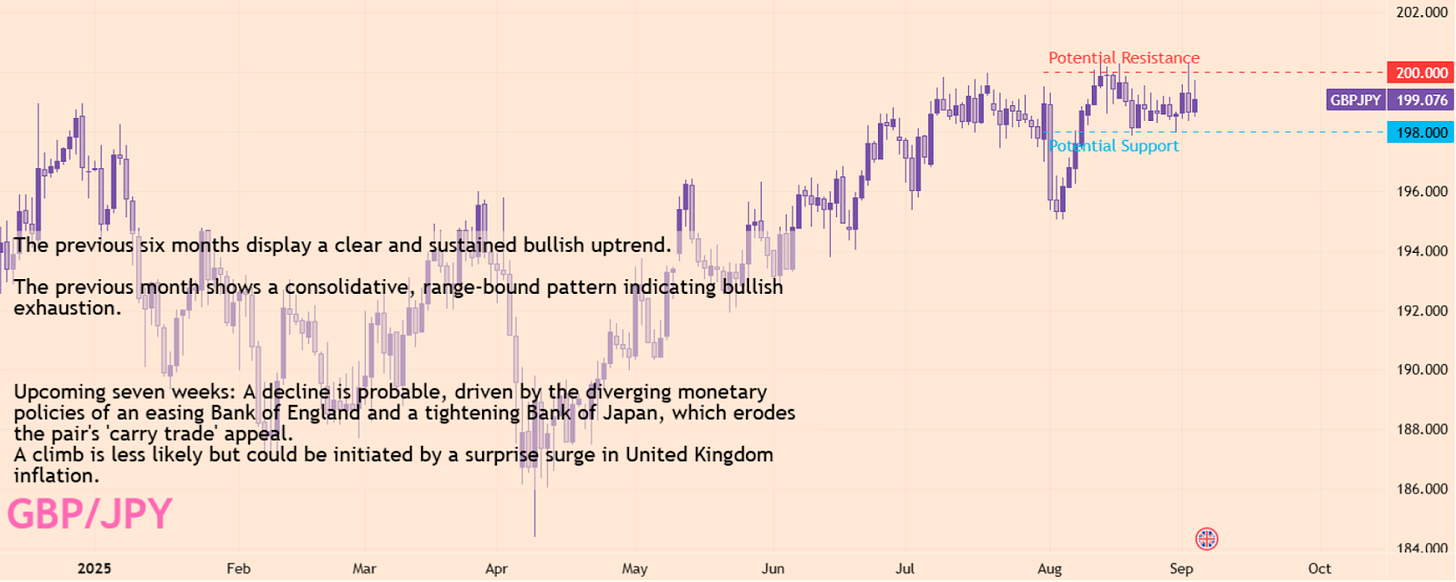

After a strong six-month uptrend, the GBP/JPY rally has stalled, with the past month showing clear consolidation below a major resistance level. This technical exhaustion, combined with the powerful bearish fundamental driver of the UK's fiscal crisis, suggests the path of least resistance is lower. The strategy is to enter a short position on a potential rally toward the peak of this range.

The proposed trade plan is as follows:

Entry (Sell): A short position could be initiated near 199.50 Japanese Yen. This level is strategically positioned just below the formidable 200.00 Japanese Yen resistance zone, an area that has capped multiple rally attempts over the past two months. An entry here assumes a final test of this ceiling before a reversal.

Stop Loss: A stop loss should be placed at 201.50 Japanese Yen. This 200-pip stop is set decisively above the 200.00 Japanese Yen psychological barrier and recent highs, providing a buffer against market volatility while defining a clear point of invalidation if a strong bullish breakout occurs.

Take Profit: A preliminary profit target is set at 196.50 Japanese Yen. The initial major support level rests at 198.00 Japanese Yen. A break of this floor is anticipated given the fundamental pressures. This target offers a favourable risk-reward ratio while aiming to capture the first significant leg of the potential downturn. Longer-term forecasts project a possible decline toward the 183.00 to 186.00 Japanese Yen range.

Key Catalysts and Data to Watch

The success of this trade is contingent on the developing monetary policy divergence between the UK and Japan, which will be heavily influenced by upcoming data and political events. The primary risk is a surprisingly hawkish turn from the Bank of England, likely triggered by a high inflation report, which could cause a temporary surge in the British Pound.

Key dates to monitor in the coming weeks:

September 8: French Government Confidence Vote. A collapse of the French government, which is the market's base case, is expected to trigger a flight to safety. This would likely strengthen the safe-haven Japanese Yen and add significant downward pressure to the GBP/JPY pair.

September 12: UK Monthly GDP (July). This is the first official growth reading for the third quarter. Another weak or negative figure would cement expectations of a dovish Bank of England and add further weight to the British Pound.

September 17: UK Consumer Price Index (CPI). This is the most critical near-term risk. Another high inflation reading, particularly for services, could challenge the case for a Bank of England rate cut and cause a rally that threatens the stop-loss level. A softer number would be a strong bearish catalyst.

September 18: Bank of England Interest Rate Decision. This is a "live" meeting with a highly uncertain outcome. While markets anticipate a rate cut, a decision to hold is a distinct possibility. A cut would be bearish for the Pound, while a hold would be bullish. The vote split will be crucial.

September 19: Bank of Japan Interest Rate Decision. No change to the 0.50 percent policy rate is expected. A stable and predictable outcome will reinforce the Yen's role in this strategy.