May 21, 2025 update:

Conviction has fallen about the plan to bet against the GBP/JPY and as such, a short trade was not taken.

The main reason for wanting to sell – that UK inflation would be noticeably weak – didn't pan out. In fact, the inflation numbers came in much hotter and showed things are speeding up.

Given that the primary conditions for the trade setup were not, the trade plan is to be aborted without entry.

May 19, 2025

This report is designed for forex traders actively monitoring the United Kingdom Inflation Rate, broader market themes, and the Great British Pound versus Japanese Yen (GBP/JPY) currency pair. By providing an in-depth analysis of recent inflation trends, prevailing market dynamics, and potential future scenarios, this document aims to equip you with valuable insights to inform your trading decisions for the upcoming week.

Interpreting Key Economic and Thematic Undercurrents

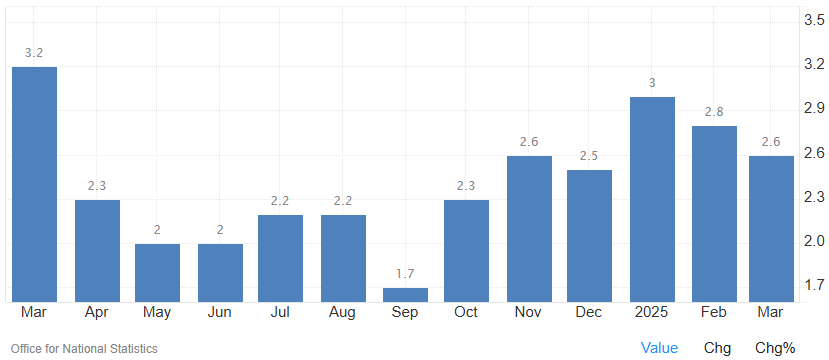

UK inflation was 2.6% in March 2025, still above the Bank of England's 2% target, but lower than earlier in the year. Experts predict it will temporarily rise to about 3.5-3.7% in mid-2025. For later on, they think it'll drop back to around 2.6% in 2026 and 1.9% in 2027.

Lately, the British Pound/Japanese Yen (GBP/JPY) exchange rate has been influenced by concerns about the US economy and different approaches to interest rates in the UK and Japan. The Bank of England cut rates, while the Bank of Japan is expected to adjust its policies.

This week, the UK's April inflation data, due on May 21, will be key. Higher-than-expected inflation could boost the Pound at first, but might cause problems later on. The Yen will likely get stronger if the US economy stumbles or if risk goes down. Overall, things are looking weaker for the Pound against the Yen.

TRADE PLAN: A Tactical Approach for GBP/JPY in the Week Ahead

Given the fundamental assessments suggesting a "Moderately Weak Strength / Moderately Bearish Influence" for the Great British Pound and a "Moderately Strong Strength / Moderately Bullish Influence" for the Japanese Yen, coupled with the speculation indicating a bearish GBP/JPY outlook, a strategy leaning towards short positions appears appropriate. The UK April CPI data on May 21 offers a key trigger.

Trade Trigger and Bias:

The primary bias for the week is bearish GBP/JPY.

Optimal Trigger for Short Entry: A UK April CPI YoY reading that is notably lower than consensus forecasts, or an in-line reading with demonstrably weak underlying components (e.g., core inflation significantly undershooting). This outcome would reinforce market expectations for further Bank of England monetary easing, thereby weakening the Pound.

Alternative Trigger for Short Entry: A UK April CPI YoY figure that is significantly higher than expected (e.g., exceeding 3.0 percent, suggesting a premature move towards the Bank of England's Q3 forecast of 3.5-3.7 percent), if this is met with a market interpretation of stagflation risk (i.e., rising inflation coupled with fears of slowing growth, which could be informed by subsequent PMI/Retail Sales data). An initial spike in GBP could provide a better entry level for a short if this narrative takes hold.

Entry Level: Enter a short position if, post-CPI, GBP/JPY either firmly rejects levels around or above 193.50 - 194.00, or decisively breaks below key intraday support, for instance, below 193.00.

Stop Loss: Place a stop loss 100 pips above the entry point.

Take Profit Targets:

Primary Target: 191.50

Extended Target: 190.10

The daily progression of events leading up to and following the UK CPI release will be crucial for trade management:

Wednesday, May 21: UK April CPI is the day's primary focus. This is the main trigger for the proposed trade. Also scheduled are the ECB Non-Monetary Policy Meeting outcome and Japan's April Trade Balance. Based on the CPI outcome (actual vs. forecast and market reaction), a short entry decision should be made if conditions align with the triggers outlined above.

Thursday, May 22: A significant data day. Flash PMIs for the UK, Eurozone, US, Japan, and Australia will be released, offering crucial insights into global economic health. US Existing Home Sales and Japan's Machinery Orders are also due. If a short GBP/JPY trade is active, disappointing UK PMI figures could accelerate downside momentum. Conversely, surprisingly strong UK PMIs might necessitate tightening the stop loss or re-evaluating the trade's conviction if the initial CPI trigger was only mildly bearish. New Zealand also delivers its Budget 2025.

Friday, May 23: Key data includes UK April Retail Sales, Japan's April National CPI, US New Home Sales, and Eurozone Q1 Negotiated Wage Growth. Weak UK retail sales, especially following a concerning CPI print, would solidify bearish sentiment for GBP/JPY. Stronger-than-expected Japanese CPI could further strengthen the Yen, adding downward pressure to GBP/JPY. If the trade is active and profitable, consider taking partial profits or tightening the stop loss ahead of the weekend to manage risk. An abort of the short position could be warranted if UK data (e.g., blowout retail sales) is exceptionally strong and accompanied by a significant shift to risk-on sentiment globally, causing GBP/JPY to decisively break above key resistance levels.

Concluding Thoughts

This week's UK April inflation data is key for GBP/JPY. Combine it with global risk and the general Pound/Yen outlook to plan your trades. Fundamentals lean towards GBP/JPY falling. Thinking about the inflation figures alongside other market news will help you decide. Remember, markets change fast, so stay alert and manage your risk.