GBP/USD STRATEGIC TRADE PLAN

Wednesday, November 26 2025

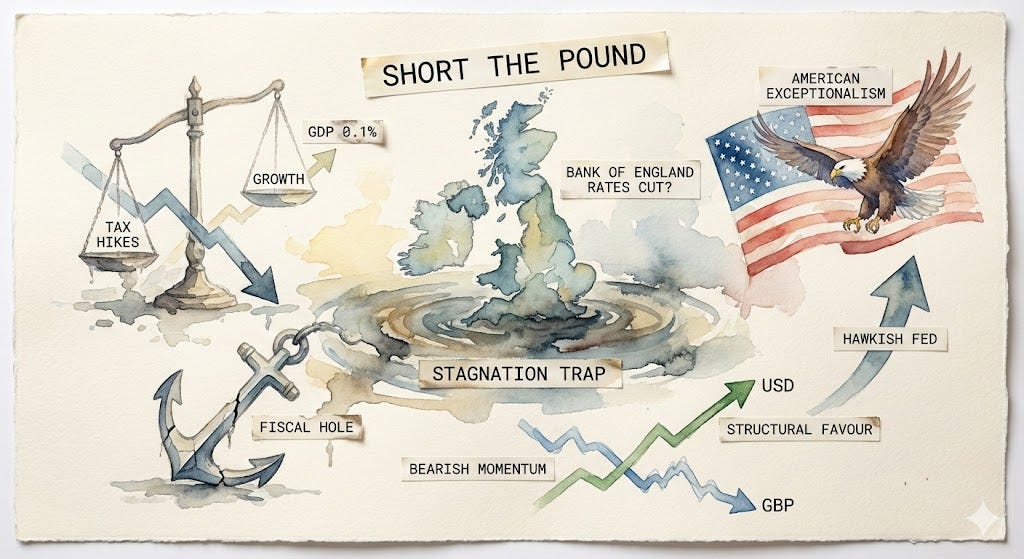

THE FUNDAMENTAL ARCHITECTURE OF UK BUDGET PESSIMISM AND DOLLAR RESILIENCE

The fundamental argument for shorting the British Pound relies on the stagnation trap theory. While today’s Autumn Budget aims to fix a fiscal hole via tax hikes, this tightening risks choking growth in an economy already stalling at zero point one percent Gross Domestic Product growth. This dynamic pressures the Bank of England to cut rates aggressively. Conversely, American exceptionalism supports a hawkish Federal Reserve, creating a divergence that structurally favours the US Dollar over the Pound in the coming weeks. The recent seven-week bearish momentum reflects this fear, contrasting sharply with the optimism seen earlier in the year.

Keep reading with a 7-day free trial

Subscribe to Jeepson Trading to keep reading this post and get 7 days of free access to the full post archives.