GBP/USD to Remain Below 50 Day Moving Average unless US Debt Ceiling Crisis is Unresolved

Pound Sterling Playbook

DERBYSHIRE GB / MAY 27 - This is the Pound Sterling Forex Playbook and is intended to be used as a guide to aid in your trade planning.

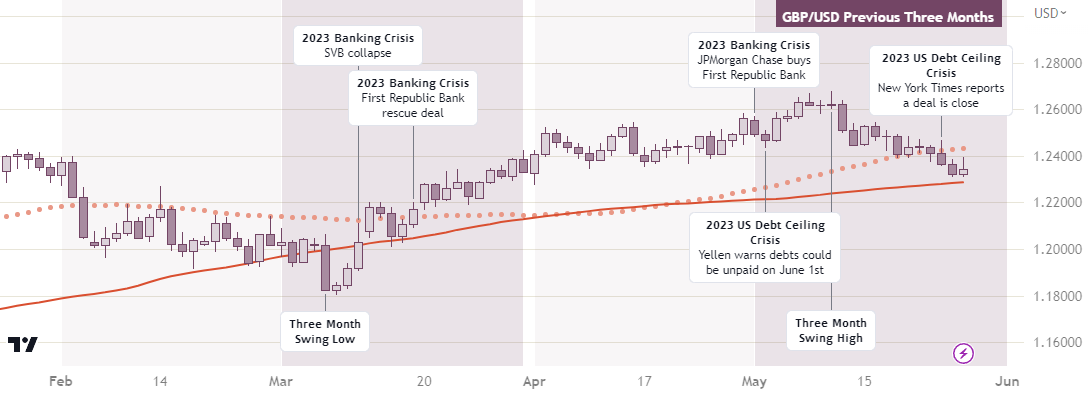

Previous Three Months

In March, the value of the British pound reached a low of 1.18 against the US dollar, which strengthened after Federal Reserve Chair Jerome Powell commented that higher interest rates are needed to control inflation.

However, a few days later, the Silicon Valley Bank (SVB) collapsed, which began the ‘2023 Banking Crisis’. This weakened the USD, as investors theorised that the Federal Reserve would need to cut rates to avoid deepening the crisis. As a result, the GBP has been increasing in value against the USD since then.

On the 1st of May, Treasury Secretary Janet Yellen said that due to the ‘2023 US Debt Ceiling Crisis’, the government may start to default by the 1st of June. This further weakened the USD although it has since strengthened as talks between leaders work towards a deal. This strengthening is evident by the pair falling below the 50 day average.

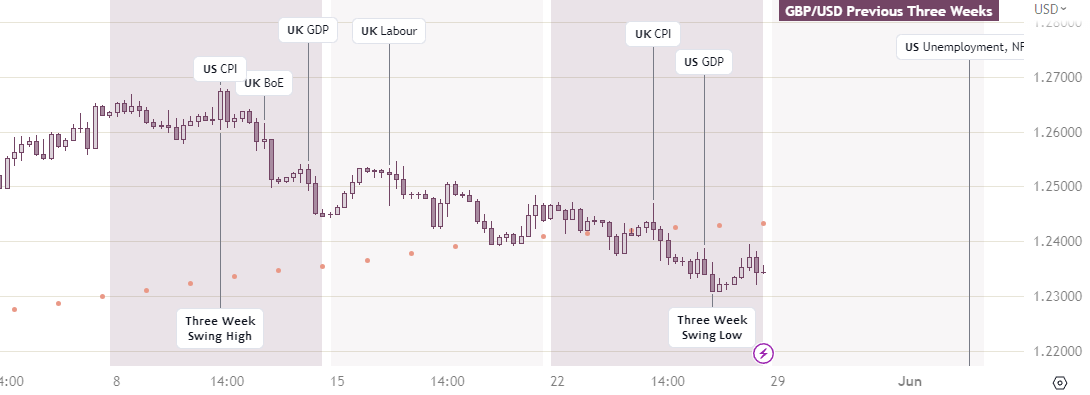

Previous Three Weeks

The value of the British pound has been weakening in recent weeks. After reaching a high of 1.26 on the 10th of May, the exchange rate has since fallen to the 1.24 area.

The strength of the GBP in the previous three months was due to a number of factors, including rising expectations that the Bank of England would raise interest rates to combat inflation, as well as concerns about the US debt ceiling. However, sentiment about the debt ceiling has recently improved, and the US dollar has regained some value as a result.

Short Term Outlook

Strength in the US dollar is being held back by the ‘2023 US Debt Ceiling’ narrative and so a resolution of this issue will likely pressure the GBP/USD lower although some pound strength is possible from the central bank divergence. The Bank of England remains committed to higher rates while the Fed have signalled that they are taking a pause. The CME Group 30-Day Fed Fund futures prices indicate that the odds are in favour and rising (65%) of a 0.25% hike in June. The July meeting is being priced in as a hold (50% and rising).

The events to keep an eye on:

June 2nd: US NFP, Unemployment

June 9th: US Treasury Currency Report

The GBP/USD is expected to remain below the 50 day moving average of 1.24 unless the ‘2023 US Debt Ceiling’ crisis goes unresolved. Moves back above are possible if the US NFP report comes in soft.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 8.6% in 2023 Q1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-