GBP/USD Trade Plan (WN42)

Wait for the leadership contest to be completed

SUMMARY

Risk Level 1 sell orders to be placed on $GBP/USD at the year on year downtrend break-zone. This stance is to be maintained unless there is a significant improvement on the outlook of global growth which would weaken the US Dollar.

SENTIMENT

The sentiment that is presently influencing valuations on the Pound and the United States Dollar is the narrative regarding rate hikes and how aggressive the central banks will be. Additionally, the UK us going through the turmoil of a government is disaray as recently selected leader Truss has resigned, paving the way for another leadership contest.

The near-term attention of speculators is on the UK’s leadership contest which is expected to be finalised before the end of the month.

FUNDAMENTALS

UNITED KINGDOM

The Monetary Policy Committee of the Bank of England (BoE) met last month on the 22nd of September and a decision was made to hike the Bank Rate (Interest Rate) by 50bps to 2.25 percent from 1.75 percent which was as expected. The policy outlook is hawkish as the MPC provided a projection in August of 3.00 percent in 2023 although due to recent events, Trading Economics are forecasting it to rise to 6.25 percent next year in 2023 (prev. ). The next scheduled meeting for the Monetary Policy Committee is next month on Thursday the 3rd of November.

The outlook for:

- UK GDP is pessimistic deterioration (pr. )

- UK CPI is pessimistic improvement (pr. )

- UK Unemployment is pessimistic indifference (pr. )

UNITED STATES

The Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) met last month on the 21st of September and a decision was made to hike the Federal Funds Rate (Interest Rate) by 75bps to 3.00-3.25 percent from 2.25-2.50 percent which was as expected. The policy outlook is hawkish as the FOMC also provided a projection of 4.6 percent for next year in 2023 which is up nearly a percent from the 3.8 which they projected in June. The next scheduled meeting for the FOMC is Wednesday the 2nd of November and the CME FedWatch tool indicates 99 percent odds of a 75bps hike (up from 54 before the recent inflation report).

The outlook for:

- US GDP is pessimistic improvement (pr. )

- US CPI is optimistic improvement (pr. )

- US Unemployment is pessimistic deterioration (pr. )

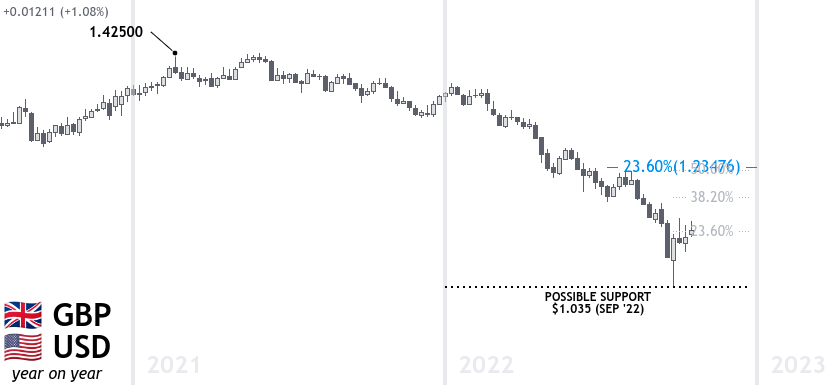

YEAR ON YEAR CHART

TREND

On a year to year view, the GBP/USD is in a downtrend since the high of 1.425 in February 2021. This is supported by the fundamental analysis which indicates that the USD is the stronger of the pair.

RETRACEMENT

The pair retraced 23.6 percent during July as speculators buy from historically low levels.

POTENTIAL TARGET

The downtrend is potentially looking to fall back to the all-time low of 1.035 USD which was tested a few weeks ago following the mini-budget by the-then chancellor Kwateng.

FORECAST

Trading Economics forecast 1.04 USD by Oct '23 (prev.)

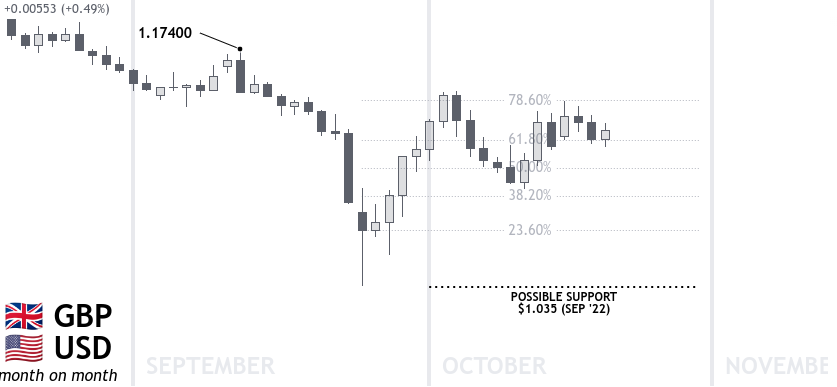

MONTH ON MONTH CHART

TREND

On a month to month view, the GBP/USD is in a downtrend since the high of 1.1740 in September. This is supported by the fundamental analysis which indicates that the USD is the stronger of the pair.

RETRACEMENT

The pair has not yet completed a retracement although is undergoing a pull-back which began towards the end of September.

POTENTIAL TARGET

The downtrend is potentially looking to fall towards 1.035 USD which was previously tested last month.

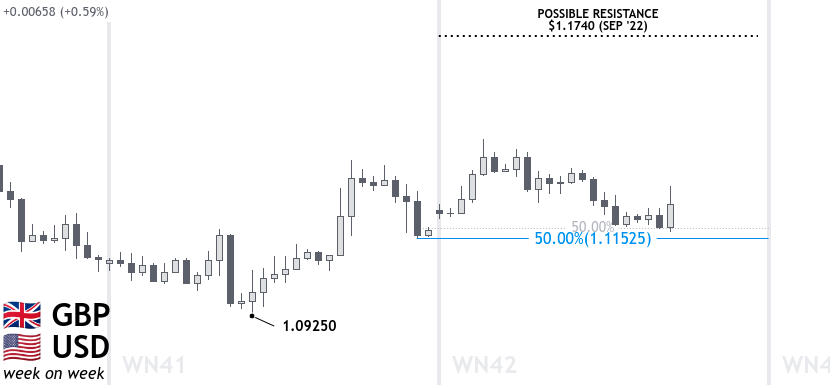

WEEK ON WEEK CHART

TREND

On a week to week view, the GBP/USD is in an uptrend since the low of 1.0925 on Wednesday last week. This is not supported by a sentiment narrative, instead this can be attributed to a move away from less pessimistic views as new Chancellor Hunt reverses the tax cuts and increased borrowing proposed by the out-going Truss government.

RETRACEMENT

The pair retraced 50.0 percent towards the end of last week which can be attributed to speculators looking to benefit from a strong dollar as the fundamentals point to hawkish interest rate hikes.

POTENTIAL TARGET

The uptrend is potentially looking to climb towards 1.1740 USD which was previously tested last month in September.

FORECAST

Trading Economics forecast 1.10 USD by Dec '22 (prev. )

TRADE-PLAN

HIGH RISK PLAN

The year on year resistance level at 1.23 has only had a single test but is at such an elevated level that it would be suitable for a Risk Level One order to sell, however any moves towards this level are unlikely unless the fundamental picture were to change, at which point this plan should be evaluated.

The optimum position for the Stop Loss is at 1.244.

LOW RISK PLAN

The month on month chart has no resistance level to lean against and so there is no suitable trade plan that can be created.

MICRO RISK PLAN

The week on week performance shows that an uptrend has formed which goes against what is forecasted by the fundamental analysis. The resistance level is 1.115 and has been leaned against over multiple candlesticks. PM Truss has resigned which is likely to support Sterling although until a successor is chosen, the outlook is very much in doubt. There is no suitable trade plan that can be created.

- Copy traders will automatically be entered into all orders placed by JeepsonTrading.

- subscribe for full access to research and analysis www.jeepsontrading.substack.com

END DISCLAIMER

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk.