GBP/USD, USD/JPY, EUR/USD, and AUD/USD

Wednesday, September 11, Week 37

Welcome to this market analysis, which is intended to provide you with critical insights and actionable intelligence. This week, we are focused on four primary currency pairs: GBP/USD, USD/JPY, EUR/USD, and AUD/USD. These pairs are chosen for their liquidity, sensitivity to global macroeconomic trends, and potential trading opportunities.

Today's US CPI data will offer additional insights into the trajectory of U.S. inflation, shaping trader positioning for a potential 25bps or 50 bps rate cut by the Federal Reserve at their meeting on the 18th of this month.

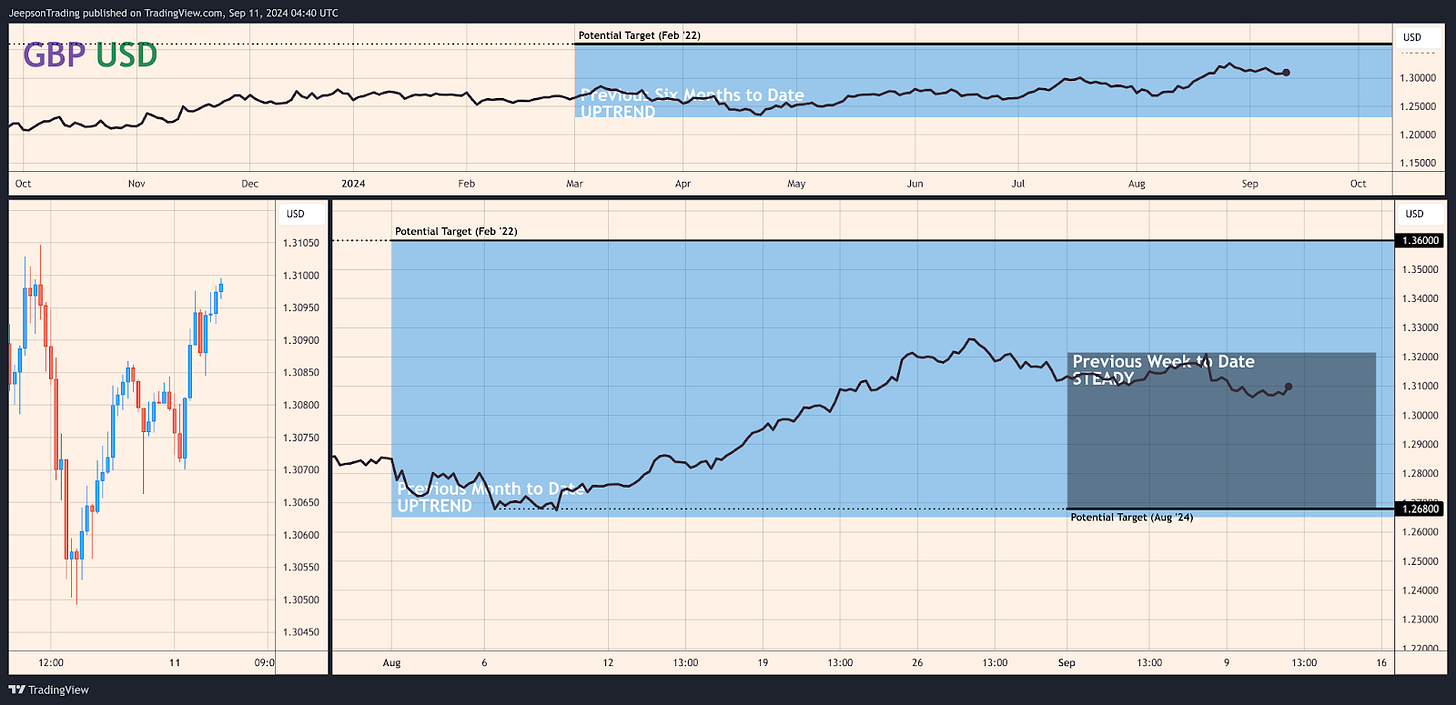

GBP/USD: Pound's Strength Tested Amidst Global Uncertainty and BoE's Dovish Tilt

GBP/USD is traded by corporations, hedge funds, and central banks to manage exposure to the UK and US economies. Liquidity is driven by interest rate differentials and safe-haven flows. GBP/USD has an inverse relationship with the US dollar.

Over the past week, the GBP/USD pair has remained relatively stable, contrasting with the upward trend seen throughout most of the previous month.

A potential catalyst for a resurgence upwards in the GBP/USD pair during the upcoming week could be a weaker-than-expected US Consumer Price Index (CPI) report for August, which is scheduled to be released today. A lower-than-anticipated CPI reading could strengthen the view that the US economy is slowing down and raise the likelihood of a more significant rate cut by the Federal Reserve (Fed). Consequently, this could lead to a weakening of the US dollar and provide support for the GBP/USD pair.

Key Indicators / Events to Watch

Wednesday, September 11th, Week 37: UK GDP MoM (JUL). The consensus forecast for UK GDP growth in July is 0.20%. A weaker-than-expected GDP figure could signal a slowdown in the UK economy, potentially weighing on the GBP and supporting the USD, leading to a rise in the GBPUSD pair.

Wednesday, September 11th, Week 37: UK Goods Trade Balance (JUL). The consensus forecast for the UK goods trade balance in July is -£18 billion. A larger-than-expected trade deficit could signal a deterioration in the UK's trade balance, potentially weighing on the GBP and supporting the USD, leading to a rise in the GBP//USD pair.

Wednesday, September 11th, Week 37: UK Industrial Production MoM (JUL). The consensus forecast for UK industrial production growth in July is 0.30%. A weaker-than-expected industrial production figure could signal a slowdown in the UK manufacturing sector, potentially weighing on the GBP and supporting the USD, leading to a rise in the GBP/USD pair.

USD/JPY: Yen's Safe-Haven Status Tested Amidst BOJ's Hawkish Tilt

USDJ/PY pair, typically traded by multinational corporations, hedge funds, and central banks, is driven by interest rate differentials and safe-haven flows into the Japanese yen. It has an inverse relationship with the Japanese yen.

The USDJPY pair has been falling, potentially targeting 141.00.

A potential catalyst for the USD/JPY pair to reverse its fall during the upcoming week could be a stronger-than-expected US CPI report for August, scheduled for release today. A higher-than-expected CPI reading could alleviate concerns about the US economy and reduce the likelihood of a larger rate cut by the Fed, potentially supporting the US dollar and weighing on the USD/JPY pair.

Key Indicators / Events to Watch

Wednesday, September 11th, Week 37: US CPI YY (Aug). The consensus forecast for US CPI inflation in August is 2.70%. A higher-than-expected CPI figure could alleviate concerns about the US economy and reduce the likelihood of a larger rate cut by the Fed, potentially supporting the US dollar and putting upward pressure on the USD/JPY pair.

Wednesday, September 18th, Week 38: Japan Balance of Trade (AUG). The consensus forecast for the Japan trade balance in August is a deficit. A larger-than-expected trade deficit could signal a deterioration in Japan's trade balance, potentially weighing on the JPY and supporting the USD, leading to a rise in the USD/JPY pair.

EUR/USD: Euro's Uncertain Path Amidst ECB's Cautious Approach

EUR/USD pair is traded by corporations, hedge funds, and central banks to manage exposure to Euro-Area and US economies. High liquidity results from significant trade volume and investment flows between the regions. EUR/USD inverse relationship with the US dollar and positive correlation with Eurozone bond yields.

The EUR/USD pair has been sideways during the previous week to date. This sideways movement contrasts with the uptrend observed during the previous month to date, potentially targeting 1.123.

A potential catalyst for the EUR/USD pair to climb during the upcoming week could be a weaker-than-expected US CPI report for August, scheduled for release today. A lower-than-expected CPI reading could reinforce the view that the US economy is slowing and increase the likelihood of a larger rate cut by the Fed, potentially weakening the US dollar and supporting the EUR/USD pair.

Key Indicators / Events to Watch

Wednesday, September 11th, Week 37: US CPI YY (Aug). The consensus forecast for US CPI inflation in August is 2.70%. A lower-than-expected CPI figure could reinforce the view that the US economy is slowing and increase the likelihood of a larger rate cut by the Fed, potentially weakening the US dollar and supporting the EUR/USD pair.

Wednesday, September 11th, Week 37: Eurozone GDP Growth Rate QoQ 3rd Est (Q2). The preliminary estimate for Eurozone GDP growth in Q2 is 0.30%. If the actual result confirms the preliminary estimate, it could suggest that the Euro-Area's economic recovery remains fragile, potentially weighing on the euro and supporting the EUR/USD pair.

Thursday, September 12th, Week 37: ECB Interest Rate Decision (Euro Area). The benchmark interest rate in the Euro Area was last recorded at 4.250%. If the ECB cuts rates, it could weaken the euro and support the EUR/USD pair.

AUD/USD: Aussie Dollar's Resilience Tested Amidst Global Uncertainty

The AUDUSD pair is traded by commodity producers, consumers, hedge funds, and central banks to manage exposure to the Australian economy and commodity price fluctuations. Liquidity is driven by changes in commodity prices, particularly iron ore, as Australia is a major exporter. The AUDUSD pair has a positive correlation with iron ore prices.

The AUD/USD pair has been falling in value during the previous week to date, potentially targeting 0.659.

The recent downturn in the AUD/USD pair can be attributed to several factors. The strengthening of the US dollar, driven by safe-haven demand amid escalating geopolitical tensions and the potential for a less aggressive Federal Reserve rate cut than initially anticipated, has weighed on the Australian dollar. Additionally, concerns about the Chinese economy, a major importer of Australian commodities, have contributed to the pair's weakness.

A potential catalyst for the AUD/USD pair to return to its climb during the upcoming week could be a weaker-than-expected US CPI report for August, scheduled for release today. A disappointing CPI report could reinforce the view that the US economy is slowing and increase the likelihood of a larger rate cut by the Fed, potentially weakening the US dollar and supporting the AUD/USD pair.

Key Indicators / Events to Watch

Wednesday, September 11th, Week 37: US CPI YY (Aug). The consensus forecast for US CPI inflation in August is 2.70%. A lower-than-expected CPI figure could reinforce the view that the US economy is slowing and increase the likelihood of a larger rate cut by the Fed, potentially weakening the US dollar and supporting the AUD/USD pair.

Sources

Bank of England

Office for National Statistics

Trading Economics

BRC - British Retail Consortium

Confederation of British Industry

GfK Group

S&P Global

Nationwide Building Society

Office for Budget Responsibility

Eurostat

US Bureau of Labor Statistics

Reserve Bank of Australia

Australian Bureau of Statistics

Australian Government

Westpac Banking Corporation

Melbourne Institute

National Australia Bank

S&P Global

Australian Industry Group

CoreLogic

Bank of Canada

Statistics Canada

Department of Finance Canada

2024 Third-Quarter Forecast

2024 Canadian Federal Budget

Bloomberg

Reuters

OECD

IMF

GfK Group

Ifo Institute

Centre for European Economic Research (ZEW)

S&P Global

Ministère de l'Économie et des Finances, France

Bundesagentur für Arbeit, Germany

DARES, France

Newsquawk

Stratfor Worldview

ForexLive