High Stakes for the Dollar: Fed Easing, Election Uncertainty, and Geopolitical Risks Converge

Saturday, October 12, 2024 (Week 41)

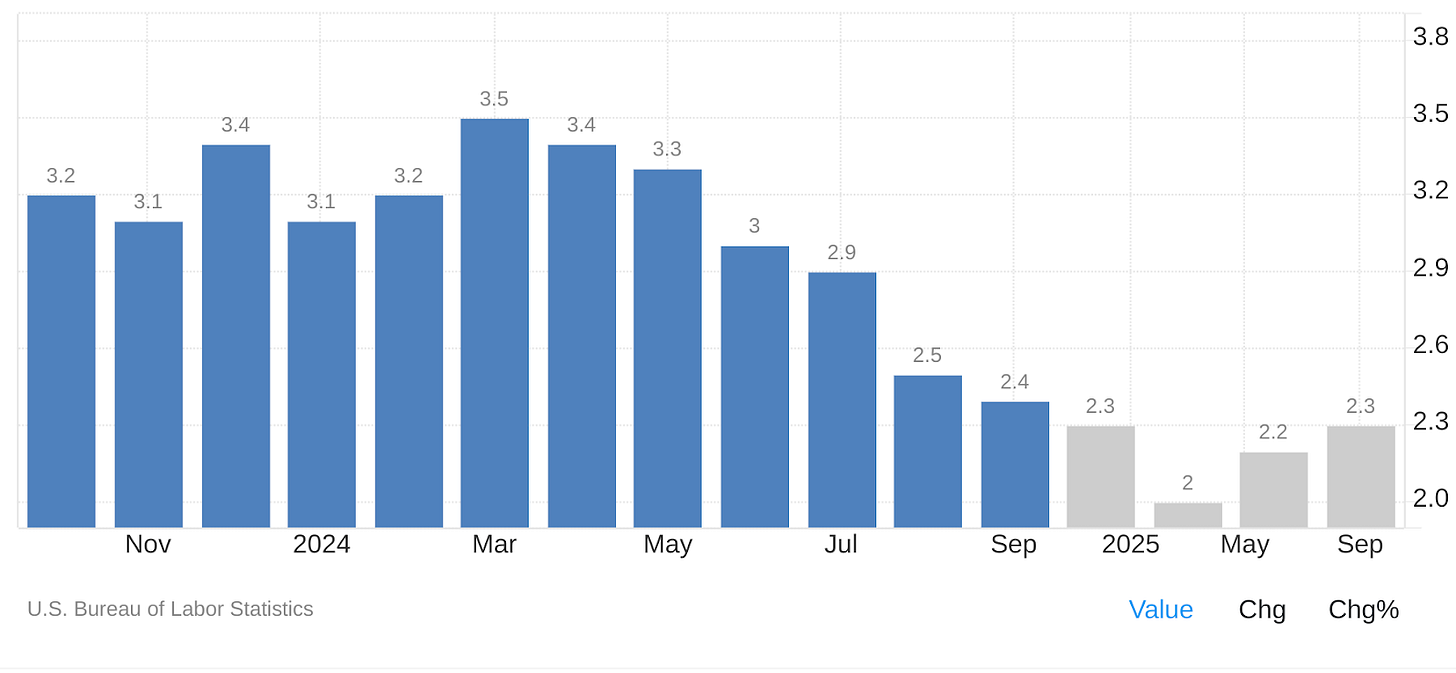

Recently, the dominant theme influencing the US Dollar was a shift in sentiment following hotter-than-anticipated inflation data. The release of the September CPI and core CPI figures on October 10th revealed inflation at 2.4% and core inflation at 3.3% year-on-year, respectively, exceeding forecasts and raising concerns about persistent price pressures. This unexpected development fueled risk-off behaviour, strengthening the USD and pushing Treasury yields higher. Adding to the complexity, initial jobless claims surged to a 14-month high of 258,000, casting a shadow on the labour market's resilience and the narrative of a soft landing.

Over a longer period back, the USD's path has been shaped by a confluence of factors. Initially, weak US jobs data on September 6th, with non-farm payrolls adding only 142K jobs, significantly increased bets on substantial Fed rate cuts, pushing the dollar index to near 13-month lows. However, the narrative shifted as stronger economic data later in the month, including upward revisions to Q2 GDP growth and persistent core inflation figures, tempered expectations of aggressive Fed easing. This resulted in periods of USD strength, despite the Federal Reserve’s 50 bps rate cut on September 18th.

Investment Thesis

Upcoming Week (October 12th - 18th): Neutral. The dollar's trajectory for the upcoming week remains uncertain. Key economic data releases, such as retail sales, initial jobless claims, and the Philadelphia Fed Manufacturing Index, could significantly influence market sentiment and introduce volatility. Therefore, a neutral stance is appropriate.

Upcoming Month (October 12th - November 30th): Neutral. The Presidential election on November 5th introduces considerable political risk, making the dollar's path unpredictable. The market will be closely watching for further signals from the Fed regarding its easing cycle, though the pace and scale of any future rate cuts are highly data-dependent. Persistent core inflation could limit the Fed’s willingness to ease aggressively, offering some support to the USD. Geopolitical tensions could also introduce volatility and potentially drive haven flows, further complicating the outlook.

US Economy: Navigating Uncertain Terrain

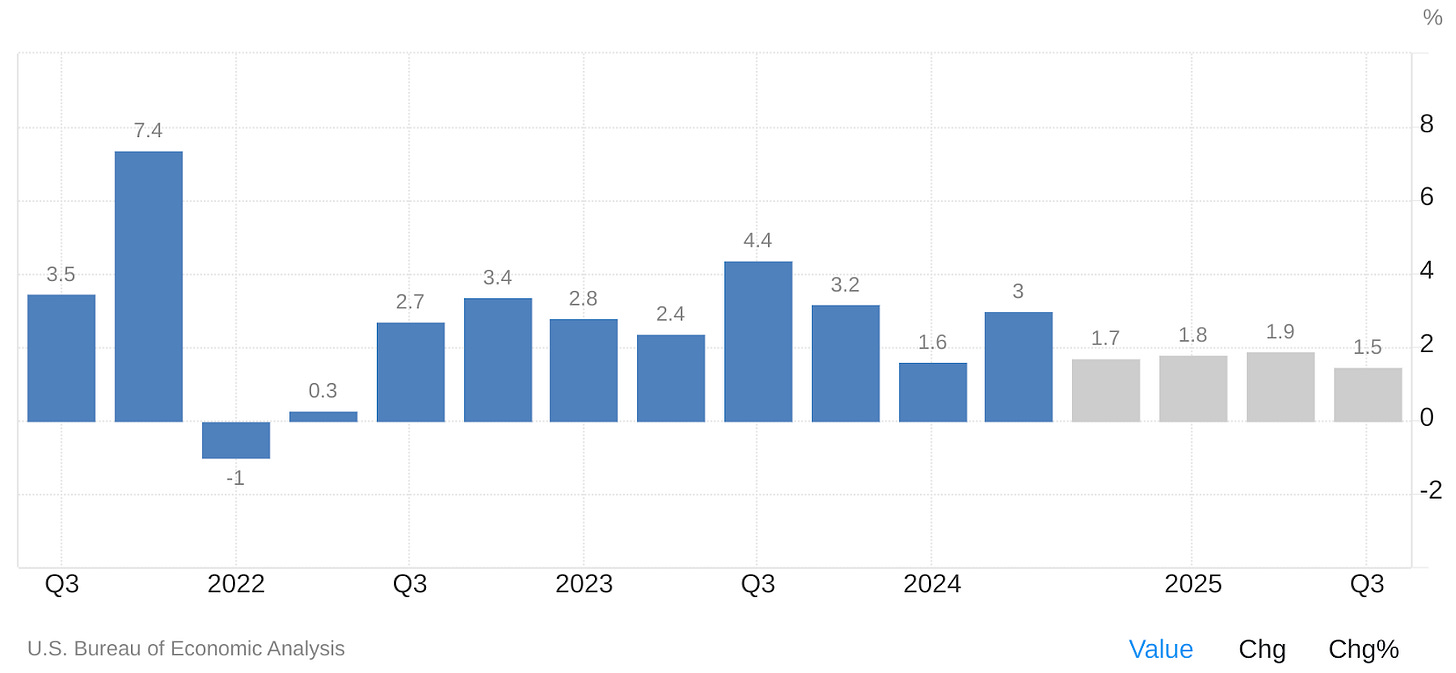

GDP Growth: Balancing Act

The US economy is experiencing a period of moderating growth. Q2 GDP growth was revised up to an annualised 3% (U.S. Bureau of Economic Analysis, September 26th), driven by upward revisions to private inventory investment and federal government spending. However, concerns remain about the economy’s ability to maintain this pace given persistent headwinds. These include higher interest rates, slowing global demand, and escalating geopolitical tensions. Trading Economics projects 1.2% GDP growth for Q3. The dollar's performance will be closely tied to future GDP data releases. Stronger-than-expected growth could temper easing expectations and provide support to the USD. Weaker-than-anticipated data, conversely, could accelerate the Fed’s easing cycle and weigh on the greenback.

Inflation: A Persistent Headwind

Inflation continues to be a significant factor shaping both the US economic outlook and the Fed's policy trajectory. While the headline inflation rate cooled to a three-year low of 2.4% in September (U.S. Bureau of Labor Statistics, October 10th), core inflation edged up to 3.3%, exceeding forecasts. This persistent core inflation suggests underlying price pressures remain, potentially limiting the Fed's ability to cut rates aggressively and offering some support to the USD. Trading Economics forecasts core inflation to reach 2.5% by the end of the quarter. These figures will be closely watched by market participants for clues about the Fed’s next move.

Labour Market: A Mixed Picture

The US labour market is presenting a mixed picture, with recent data releases painting a somewhat contradictory narrative. While September nonfarm payrolls increased by a stronger-than-expected 254K (U.S. Bureau of Labor Statistics, October 10th), initial jobless claims jumped to a 14-month high of 258,000 for the week ending October 5th (U.S. Department of Labor, October 10th). This divergence between jobs added and individuals filing for unemployment makes the labour market's strength a source of debate and uncertainty. Continued increases in jobless claims would signal weakening and exert downward pressure on the dollar, while consistently robust payroll data could lead the Fed to take a more cautious approach to rate cuts, potentially bolstering the USD.

Consumer and Business Sentiment: A Cautious Outlook

Consumer and business sentiment indicators reflect a cautious mood. The University of Michigan consumer sentiment index fell to 68.9 in October, below forecasts (University of Michigan, October 11th). The NFIB Small Business Optimism Index declined to a three-month low of 91.2 in August (NFIB, September 9th). This weakening sentiment could impact spending and economic activity, creating headwinds for growth and potentially weighing on the USD.

Upcoming Economic Data:

Key economic releases for the upcoming week (October 14th - 18th) include:

October 15th: NY Empire State Manufacturing Index

October 17th: Retail Sales, Initial Jobless Claims, Philadelphia Fed Manufacturing Index

October 18th: Building Permits, Housing Starts

US Monetary Policy: Navigating a Tightrope

Federal Reserve: Balancing Act

The Federal Reserve continues to walk a tightrope between supporting a slowing economy and addressing persistent core inflation. The FOMC's decision to cut rates by 50 bps in September (Federal Reserve, September 18th), as detailed in the subsequent meeting minutes, highlighted this challenge. While the move was intended to bolster confidence and address weakening economic data, it also raised concerns among some policymakers, including dissenting Governor Bowman, about prematurely declaring victory over inflation. The Fed's data-dependent stance suggests that the pace and scale of future easing will be determined by incoming economic indicators. Projections from FOMC members point to two additional 25 bps cuts this year, contingent on the data. The dollar’s near-term performance remains sensitive to these developments, with further dovish signals likely weighing on the USD, while stronger economic data could support the greenback.

Intermarket Analysis: A Complex Web

Bond Market: Anticipating Easing

The bond market reflects ongoing expectations of further Fed easing. The 10-year Treasury yield continues to hover near 15-month lows (Trading Economics). Sustained declines in yields could exacerbate downward pressure on the USD as investors seek higher returns in other currencies. However, any indications of a less dovish Fed or stronger-than-expected economic data could lead to a reversal in this trend.

Equity Market: Volatility and Uncertainty

The US equity market's recent performance has been characterised by volatility, mirroring uncertainty surrounding Fed policy, economic growth, and sector-specific developments. While the Fed’s dovish tilt has at times supported the market, concerns about global economic weakness and the impact of rising bond yields on the tech sector have contributed to fluctuating investor sentiment. The interplay between these factors, along with upcoming earnings reports and economic data releases, will be crucial in shaping the equity market’s trajectory and indirectly influencing the USD.

Commodity Market: A Multifaceted Landscape

Commodity markets are grappling with supply disruptions and demand concerns. Geopolitical tensions have supported oil prices, while weakening demand from China has pressured industrial metals such as iron ore. Gold prices reached record highs this month on safe-haven flows (Trading Economics). These diverging trends create a complex impact on the USD, with the direction of influence varying based on the specific commodity and its sensitivities to macroeconomic factors.

Geopolitical Risks and the Greenback

Political Risks: Election Jitters

The Presidential election on November 5th represents a significant political risk. The candidates' differing policy platforms inject uncertainty about the future direction of the US economy. This uncertainty could heighten market volatility as the election nears. The dollar's performance will be impacted by the election outcome and its perceived effects on economic stability.

Geopolitical Risks: Middle East Tensions

The escalating Middle East conflict is a major geopolitical risk. The potential disruption to global oil supplies remains a key concern. Escalating tensions could drive safe-haven flows into the USD, while de-escalation could ease anxieties and reduce demand for the greenback.

Sovereign Risk: US Fiscal Outlook

The US has a relatively low sovereign risk profile, underpinned by the dollar's reserve currency status. However, the widening US budget deficit, which reached $380 billion in August (U.S. Treasury, September 13th), warrants monitoring. Further deterioration in the fiscal outlook could weigh on the dollar’s long-term valuation.

USD Valuation: A Data-Dependent Outlook

The US dollar has weakened over the past month, primarily due to expectations of an aggressive easing cycle by the Fed, solidified by the 50 bps rate cut in September (Federal Reserve, September 18th). While factors such as persistent core inflation and geopolitical risks provided some support, the overall trend has been towards a weaker dollar.

Looking ahead, the USD's valuation will be highly sensitive to economic data. Stronger data could temper easing expectations and bolster the USD, while weaker data could accelerate easing and weigh on the currency. The Presidential election introduces significant uncertainty. The FOMC minutes signalled two more 25bps cuts this year, though the actual path remains data-dependent. This leaves the USD's near-term outlook uncertain.

Key Takeaways and Investment Thesis:

A neutral stance on the USD is maintained for both the upcoming week and month. This reflects the balanced outlook given the complex interplay between potential Fed easing, persistent core inflation, political risks related to the US election, and geopolitical tensions. The dollar’s near-term trajectory remains data-dependent. Stronger-than-expected economic data could slow the pace of Fed easing and support the USD, while weaker data and heightened risk aversion could accelerate easing and weigh on the greenback.