How Powell’s Words Became a Market Tsunami

Weekly Forex Briefing (WN45)

Reading the market is like navigating a ship through a storm; you watch the major currents, but you must also be aware of the sudden squalls that can throw you off course. Last week, the Federal Reserve’s policy meeting was the storm’s eye, a powerful force that reshaped the entire ocean. The hawkish surprise sent a tidal wave of US Dollar strength crashing across the globe, swamping nearly every other currency in its path. But even in this deluge, smaller, country-specific storms were brewing, like the one that completely capsized the Canadian Dollar on Friday. Our job as traders is to understand these interacting weather patterns—the global and the local—to find the safest passage and the most favorable winds. This coming week, our ship is sailing into a fog bank; the US government shutdown has blacked out our usual navigational charts, forcing us to rely on secondary signals to find our way.

The Rear-View Mirror: How the Fed’s Surprise Upended the Market

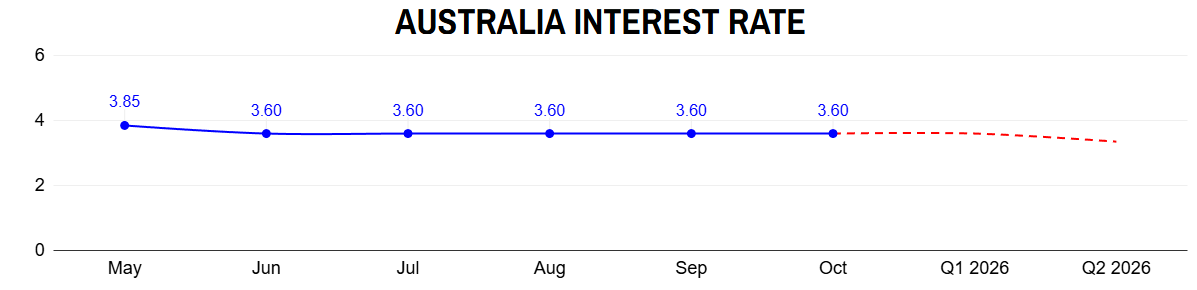

The market narrative last week was a monolithic story written by one author: the US Federal Reserve. The week began on Monday, October 27, with a wave of optimism after a US-China trade truce framework was announced, sparking a global risk-on rally that initially boosted equities and commodity-linked currencies. This positive sentiment, however, proved to be merely the calm before the storm. This brief period of optimism saw assets like the New Zealand and Australian Dollars gain ground, while safe-havens like the Japanese Yen came under pressure. The Australian equity market rose, and even the beleaguered British Pound found some support in the broad risk-on mood.

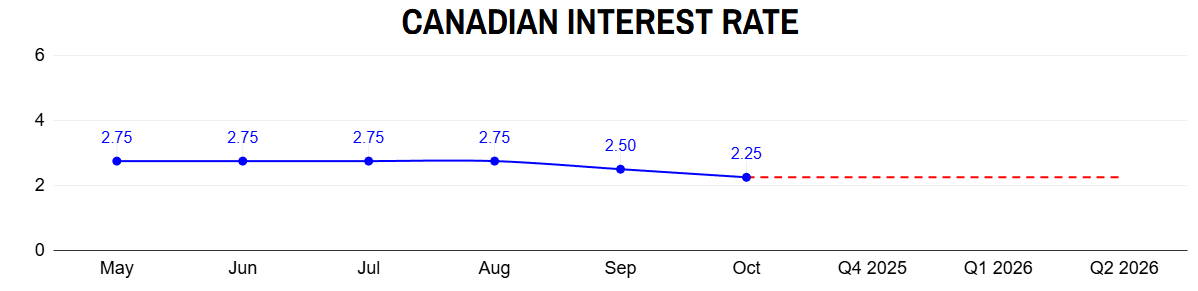

The first major jolt came from Canada on Wednesday, October 29, when the Bank of Canada delivered a “hawkish cut.” They lowered their rate by 25 basis points as expected but explicitly signaled that their easing cycle was likely over. This sent the Canadian Dollar soaring, a brief moment of independent strength before it was swallowed by the much larger event unfolding south of the border.

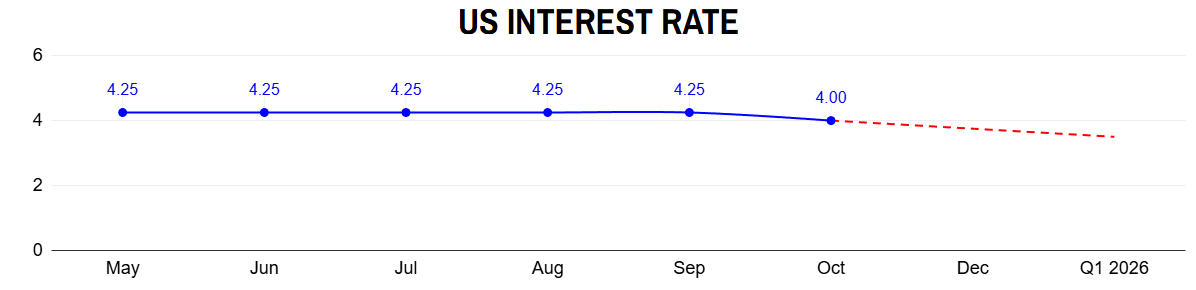

The true tempest was unleashed later that day. The Federal Reserve also cut its rate by 25 basis points, but Chair Jerome Powell’s commentary was unexpectedly hawkish. His statement that a December rate cut was “not a foregone conclusion” was a thunderclap that echoed across global markets. The probability of another cut plummeted from around 90 percent to below 70 percent, triggering a violent repricing. The US Dollar surged, with the DXY hitting a 12-week high by Thursday, October 30. Currencies like the Euro, Japanese Yen, and New Zealand Dollar were immediately punished. The hawkish pivot sent US Treasury yields stabilizing near their recent highs and weighed on gold prices, which are sensitive to a stronger dollar and higher yields.

The week’s final act was a tragic one for the Canadian Dollar. On Friday, October 31, just two days after its hawkish moment in the sun, it was crushed by a dismal domestic GDP report. Data showed the economy had unexpectedly contracted by 0.3 percent in August, completely reversing the Bank of Canada’s narrative and sending the currency plunging past the 1.40 per USD level. The week ended as it began, with a single, powerful theme—central bank policy—dictating all market movement, but the leadership had changed from trade optimism to the undisputed dominance of a hawkish Fed.

The Road Ahead: Central Banks in the Dark

The next two weeks are defined by a profound and unusual uncertainty, as a US government shutdown has caused an “economic data blackout.” With official reports like Non-Farm Payrolls and the Consumer Price Index indefinitely postponed, the market and central banks are flying blind, forced to navigate using the faint signals from private-sector data. This makes the upcoming US ISM surveys and the ADP employment report on Wednesday, November 5, disproportionately important. A weak number from ADP (consensus +25,000) could revive Fed easing bets and hit the dollar, while a strong number could solidify the Fed’s hawkish pause and extend the dollar’s rally.

This week, two major central banks must make policy decisions in this data vacuum. The Reserve Bank of Australia decides on Tuesday, November 4. After a stunningly hot Q3 inflation report, the RBA is expected to hold its rate at 3.6 percent. The key will be whether their statement acknowledges the persistent inflation, which would be hawkish and support the Aussie, or expresses concern over the global uncertainty and weak Chinese data, which would be dovish. On the same day, the new Canadian government tables its first budget, a critical confidence vote that will set the fiscal tone. A larger-than-expected stimulus could offer support to an economy reeling from last week’s terrible GDP print and buoy the Canadian Dollar.

Then, on Thursday, November 6, the Bank of England will announce its policy. With the UK economy showing signs of stagnation (September Composite PMI at 50.1) and inflation remaining stubbornly high (3.8 percent), the BoE is in a difficult position. A hold at 4.0 percent is the consensus, but the vote split will be scrutinized for any shift in the committee’s dovish or hawkish leanings. On Friday, November 7, Canada’s October labor report will be released, a high-stakes event after the recent GDP shock. Looking to the following week (Week 46), the UK releases its Q3 GDP on Thursday, November 13, and Japan follows with its Q3 GDP on Sunday, November 16, which is forecast to show a contraction of 0.5 percent. The US shutdown remains the Sword of Damocles hanging over the market; any news of a resolution could trigger a sharp “risk-on” rally and a sell-off in the US Dollar.

The primary themes are central bank divergence and data scarcity. The hawkish Fed pivot has strengthened the US Dollar, creating headwinds for other currencies. The upcoming RBA and BoE meetings, alongside crucial private US data and the Canadian budget, are the key pivotal events that will shape market direction in the coming weeks. The absence of official US data makes every private release a potential market-mover, increasing the risk of sharp, sentiment-driven volatility.