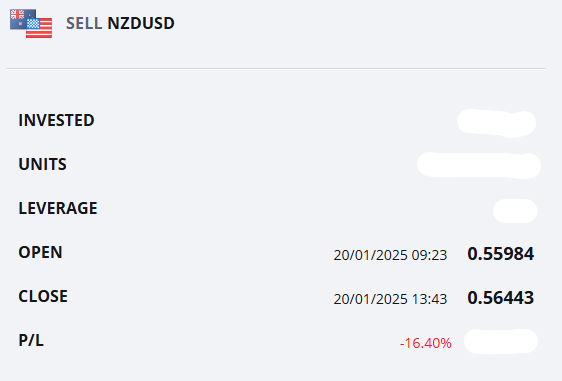

UPDATE: The WSJ issues a story regarding how tariffs are to be reviewed, not implemented on day one. Dollar sinks as fundamentals develop, thus trade to be closed with a loss of 46 pips.

Monday, January 20, 2025, Week 4

The NZD/USD begins the week on shaky ground, with the NZD reeling from a confirmed recession and the USD basking in the glow of a hawkish Fed. The stark divergence in monetary policy between the two central banks, with the RBNZ expected to ease further while the Fed signals a slower pace of rate cuts, is a key driver of the pair's weakness. Recent economic data from New Zealand paints a dismal picture: Q3 GDP contracted sharply, and business confidence has plummeted. Meanwhile, the US economy shows signs of resilience, though concerns about inflation and the impact of the incoming Trump administration's policies linger. Geopolitical factors, including Trump's inauguration and his stance on trade, add to the uncertainty. Crucial data releases this week, such as inflation figures from both countries and the Federal Reserve's interest rate decision, will be pivotal in shaping market expectations and influencing the NZD/USD's trajectory.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

NZD/USD: A Very Bearish Kiwi Meets a Very Bullish Greenback

The NZD/USD has been under pressure over the past ten days, reflecting the diverging economic realities of the two countries. The NZD has been hit hard by the confirmation of a technical recession, with Q3 GDP contracting by a worse-than-expected 1%, fuelling expectations of aggressive easing by the RBNZ and further weighing on the currency. Conversely, the USD has benefited from the Fed's hawkish tilt, robust economic data, and safe-haven demand amid global uncertainties surrounding Trump's inauguration and his trade policies.

In the currency market, the NZD/USD tumbled to a two-year low of 0.558 on January 17th. The Commitment of Traders (COT) report as of January 14, 2025, revealed a bearish bias towards the NZD, with asset managers and leveraged funds holding substantial net short positions.

Dealers: 62,179 long positions, 2,542 short positions

Asset Managers: 12,140 long positions, 52,919 short positions

Leveraged Funds: 10,519 long positions, 24,626 short positions

The COT report for the USD showed mixed positioning: dealers and asset managers net long, while leveraged funds were net short.

Upcoming Economic Data and Potential Market Reactions

Jan 21: NZ Inflation Rate QoQ (Q4, Forecast: 0.50%). A weaker-than-expected reading could reinforce the RBNZ's dovish stance, weighing on the NZD.

Jan 24: US Existing Home Sales (DEC, Forecast: 4.1M). Stronger-than-expected data could boost housing market confidence, supporting the USD.

Jan 28: US Durable Goods Orders MoM (DEC, Forecast: 1.20%). A positive figure would signal manufacturing strength, potentially supporting the USD.

Jan 29:

NZ Balance of Trade (DEC, Forecast: NZ$ -0.34B). A wider-than-expected trade deficit could further weaken the NZD.

US Fed Interest Rate Decision. A hawkish stance or signals of fewer rate cuts than anticipated could strengthen the USD.

US Fed Press Conference. Powell's comments will be closely watched for policy clues.

Jan 30:

NZ ANZ Business Confidence (JAN). Weaker business confidence could add to the bearish sentiment surrounding the NZD.

US GDP Growth Rate QoQ Adv (Q4, Forecast: 2.70%). Stronger-than-expected growth would support the USD.

Jan 31:

US Core PCE Price Index MoM (DEC, Forecast: 0.30%). A higher reading could raise inflation concerns, supporting the USD.

US Personal Income MoM (DEC, Forecast: 0.10%). Stronger income growth could boost spending and the USD.

US Personal Spending MoM (DEC, Forecast: 0.50%). Robust spending reinforces a strong economy, supporting the USD.

The NZD/USD is a sell candidate. The combination of diverging monetary policies, the confirmed recession in New Zealand, and robust US economic data points towards further weakness.

NZD/USD Trade Plan: Shorting the Kiwi

The NZD/USD appears poised for further decline. The struggling New Zealand economy, marked by a confirmed recession and weak domestic demand, contrasts with the relatively robust US economy. The RBNZ's dovish stance, with anticipated further easing, diverges from the Fed's hawkish tilt. This monetary policy divergence is a key driver of the pair's weakness. President-elect Trump's inauguration and potential trade policies, particularly tariffs, add further uncertainty to the global economic outlook, potentially bolstering the USD. The technical picture supports a bearish view, with the NZD/USD at two-year lows.

Entry: 0.5600 (current market price)

Stop-Loss: 0.5800 (200 pips)

Profit Target: 0.5510

Monitoring upcoming economic indicators is crucial. On January 21st, the NZ Q4 inflation data will be key. Weaker-than-expected figures could reinforce the RBNZ's dovish stance, weighing on the NZD. Stronger-than-anticipated US Existing Home Sales data on January 24th could further support the USD. The NZ Balance of Trade (Jan 29) and US Durable Goods Orders (Jan 28) will offer insights into trade performance. The US Fed's interest rate decision and press conference (Jan 29) are critical. A hawkish stance could strengthen the USD. The NZ ANZ Business Confidence (Jan 30) and US GDP Growth Rate QoQ Adv (Jan 30) will provide further clues about the economic outlook. Finally, the US Core PCE Price Index MoM, Personal Income MoM, and Personal Spending MoM (Jan 31) will shed light on US inflation and consumer spending. Deviations from forecasts could warrant an early exit.

The Bearish Outlook for the Kiwi Continues

The NZD/USD remains under significant pressure, and the outlook is decidedly bearish. The combination of a struggling New Zealand economy, a dovish RBNZ, a robust US economy, and a hawkish Fed creates a compelling case for further NZD/USD weakness. Geopolitical uncertainties, particularly surrounding Trump's trade policies, add another layer of complexity. Traders should diligently monitor upcoming economic data and central bank communications.

Sources

Bloomberg, Reuters, Trading Economics, ForexLive, Federal Reserve, European Central Bank, Bank of Japan, Bank of England, Reserve Bank of Australia, Reserve Bank of New Zealand, Swiss National Bank, Bank of Canada, US Bureau of Labor Statistics, Eurostat, Statistics Canada, Australian Bureau of Statistics, Statistics New Zealand, Swiss Federal Statistical Office, Office for National Statistics, Cabinet Office Japan, Ministry of Internal Affairs and Communications, Ministry of Finance Japan.