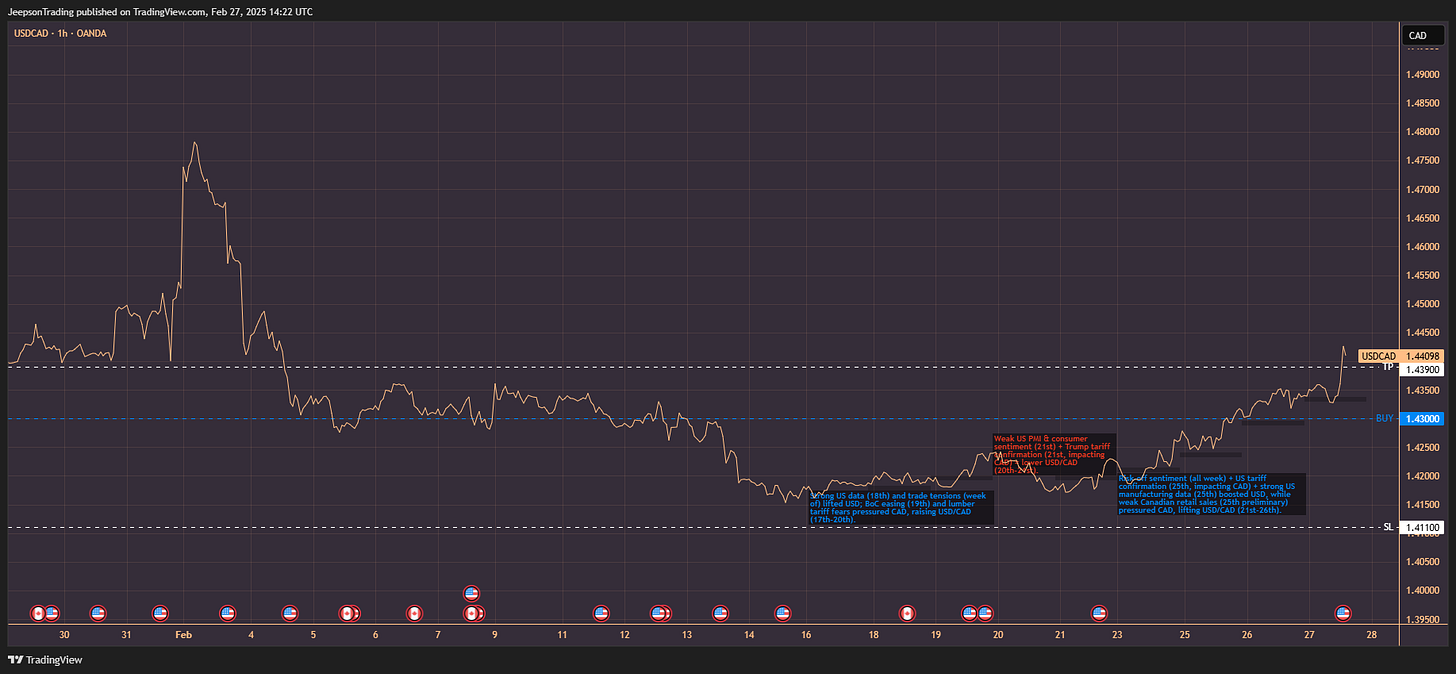

[Complete +81 pips] How to Trade the US CPI: USD/CAD Trade Plan

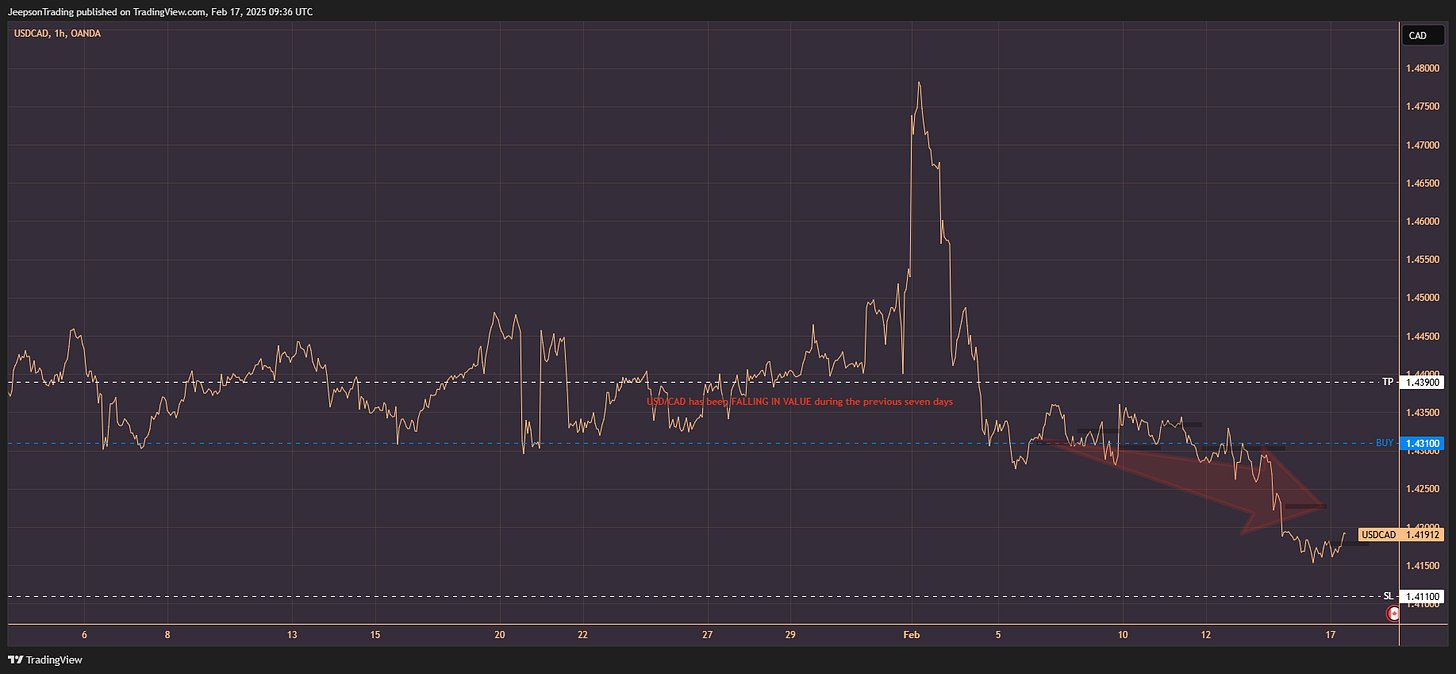

UPDATED: Monday February 17th 2025

Thursday, February 27, 2025, Week 09

The pair has been rallying all week as risk sentiment soured and eventually reached the take profit level.

Monday, February 17, 2025, Week 08

The US CPI data came in at 3% which was above expectations and so the USD/CAD buy has been left to run. The pair did lose value last week as the market mood shifted to a risk on sentiment as peace talks surrounding Ukraine came into the spotlight. Price remains above the Stop Loss and is expected to continue climbing throughout the week as the fundamental strength of the USD and weakness of the CAD drift back into view.

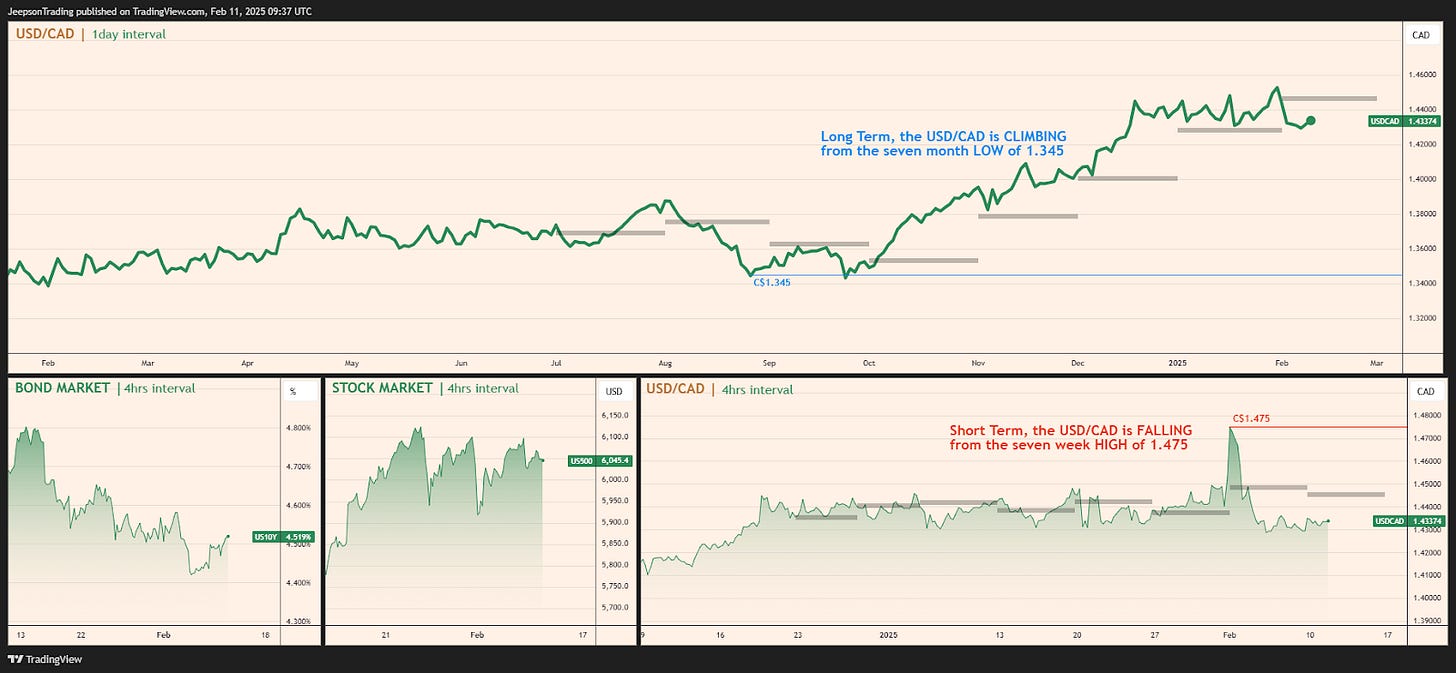

Tuesday, February 11, 2025, Week 7

The upcoming US CPI release on Wednesday presents a compelling trading opportunity. Over the past six weeks, the USD has been strengthening, driven by safe-haven demand amid escalating US-China trade tensions and a relatively hawkish Fed. However, recent mixed economic data from the US, including weaker-than-expected January jobs figures and softer service sector activity, has injected some uncertainty into the USD's outlook. Meanwhile, the Canadian dollar has been under significant pressure from US tariff threats, a dovish Bank of Canada, and the persistent weakness in oil prices. Trudeau's resignation adds another layer of political risk to the Loonie. The upcoming CPI report will be crucial for gauging the strength of the US economy and the potential trajectory of Fed policy, which will directly impact the USD/CAD pair.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

USD/CAD: Bearish CAD, Cautiously Bullish USD

The dominant theme influencing USD/CAD over the past several weeks has been USD strength fuelled by safe-haven flows and a relatively hawkish Fed. Trump's tariff announcements, particularly the confirmation of tariffs on Canada, have exacerbated risk aversion, benefiting the USD. The Fed, while acknowledging moderating US growth and easing inflation, has signalled a cautious approach to future rate cuts, supporting the USD. Conversely, the dominant theme for the CAD has been broad weakness driven by the tariff threats, the BoC's dovish monetary policy (rate cuts and asset purchase resumption), and weak oil prices. Trudeau's resignation adds to the CAD's woes.

Over the past several days, the narrative for the USD has been dominated by Trump's trade policies and their potential impact on the US economy. The actual implementation of tariffs has solidified the USD's safe-haven appeal. The narrative for the CAD has centred around the BoC's dovish stance and the increasing likelihood of further easing. The weaker-than-expected January jobs data from both the US and Canada has added to the uncertainty.

In the upcoming days, several factors could influence USD/CAD. For the USD, Fed Chair Powell's testimony, the FOMC minutes, and the CPI and PPI reports for January will be key. Hawkish signals from the Fed or higher-than-expected inflation could further strengthen the USD. Conversely, dovish comments or softer inflation data could pressure the greenback. For the CAD, the focus will be on US-Canada trade relations, oil prices, and the upcoming BoC interest rate decision. Any escalation in trade tensions or further weakness in oil could weigh on the CAD.

Fundamentally, the outlook for USD/CAD remains bullish, albeit with some caution warranted due to the unpredictable nature of Trump's trade policies. The USD is supported by safe-haven demand and a relatively hawkish Fed, while the CAD faces multiple headwinds. The COT report shows significant net short positions in CAD, suggesting limited room for further CAD weakness based solely on positioning, but the overall fundamental and sentiment backdrop favors further USD/CAD upside.

Upcoming Economic Indicators

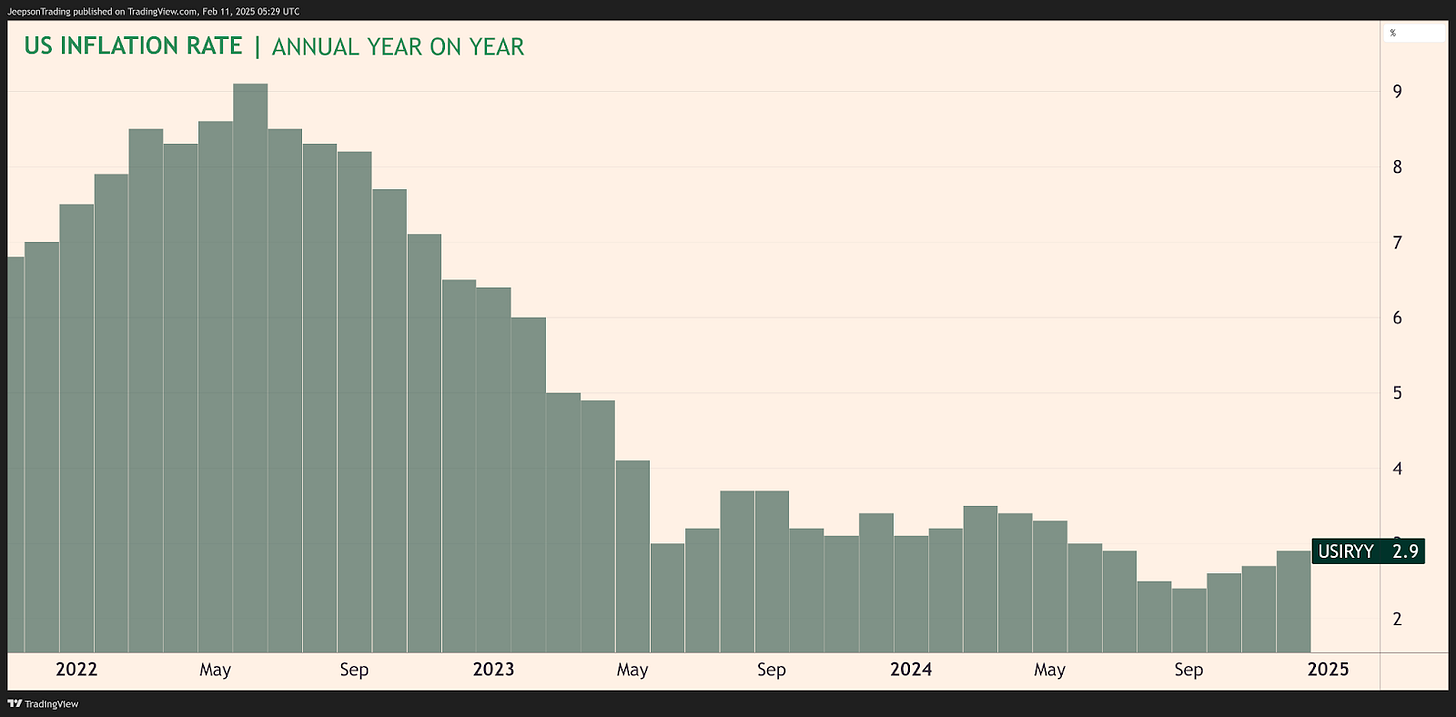

Feb 12: US Inflation Rate YoY (JAN) (CPI). Forecast: 2.9%. A higher-than-expected reading could strengthen the USD on expectations of a more hawkish Fed, potentially leading to a breakout in USD/CAD. A lower-than-expected reading could trigger a CAD relief rally, although the broader USD strength might limit the extent of the CAD's gains.

Feb 12: US Core Inflation Rate YoY (JAN). Forecast: 3.1%. A similar impact to headline CPI, with a higher-than-expected reading supporting the USD and a lower-than-expected reading potentially weakening it.

Feb 13: US PPI MoM (JAN). Forecast: 0.2%. A higher reading could add to inflation concerns, potentially supporting the USD, while a lower reading might ease those concerns and pressure the greenback.

Feb 14: US Retail Sales MoM (JAN). Forecast: 0.3%. Stronger retail sales could boost the USD on an improved economic outlook; weaker sales could add to slowdown fears and pressure the USD.

Feb 18: CA Inflation Rate YoY (JAN). Forecast data not available. Higher-than-expected inflation could limit the BoC's ability to ease further, potentially providing some support to the CAD. However, given the dominant risk-off sentiment and the focus on US tariffs, the impact on USD/CAD might be limited.

Feb 19: US Building Permits Prel (JAN). Forecast data not provided. Stronger building permits could signal a positive outlook for the housing sector and lend some support to the USD, while weaker data could add to economic concerns.

Feb 19: US Housing Starts (JAN). Forecast data not provided. Similar impact to building permits.

Feb 19: FOMC Minutes (from Jan 29 meeting). Could provide further insights into the Fed's policy outlook. Hawkish commentary could boost the USD, while dovish signals could weaken it.

Feb 21: US Existing Home Sales (JAN). Forecast data not provided. Stronger sales could be seen as a positive sign for the housing market and the broader economy, potentially supporting the USD.

US CPI: Recent Rise, Uncertain Outlook

The US Consumer Price Index (CPI), released by the Bureau of Labor Statistics (BLS), is a key measure of inflation, tracking the average change in prices paid by urban consumers for a basket of goods and services. Over recent months, US inflation has been rising, reaching 2.9% year-on-year in December 2024. This was in line with market expectations, but it followed a trend of increasing inflation from 2.6% in October to 2.7% in November. Core inflation, which excludes volatile food and energy prices, has been easing slightly, falling to 3.2% in December from 3.3% in the previous three months.

The market's reaction to the upcoming January CPI report will depend largely on whether the actual reading meets, exceeds, or falls short of expectations. An in-line print of 2.9% could have a limited direct impact, reinforcing the Fed's current cautious stance. However, in the current environment of heightened trade tensions and market volatility, even a small deviation from the forecast could trigger significant moves.

USD/CAD Trade Plan

This trade plan outlines two approaches for trading USD/CAD around the US CPI release: one with entry before the data and one after.

Entry Before CPI Release

This strategy aims to capitalize on potential CAD weakness ahead of the CPI release, even if the actual data comes in line with expectations.

Entry: 1.431

Stop-Loss: 1.411 (200 pips).

Take-Profit: 1.439. This target represents a previous resistance level and offers a reasonable profit potential before the data release. Closing the trade before the actual CPI announcement limits exposure to potential whipsaw movements.

Entry After CPI Release

This strategy involves waiting for the CPI release and then entering a trade based on the market's reaction.

CPI Above Expectations (Above 2.9%):

Impact: A higher-than-expected CPI print could strengthen the USD on increased inflation concerns and reduced rate cut expectations. This would likely exacerbate CAD weakness, creating a favourable environment for a long USD/CAD trade.

Entry: A break above 1.4400 (previous resistance). This confirms the bullish momentum.

Stop-Loss: 1.430 (100 pips).

Take-Profit: 1.449, Extended TP: 1.459 (longer-term resistance).

CPI Below Expectations (Below 2.9%):

Impact: A lower-than-expected CPI print could initially weaken the USD on reduced inflation concerns and increased rate cut expectations. This could trigger a CAD relief rally. However, if the miss is modest, the USD could find support from safe-haven demand, and the CAD downtrend could resume. A larger miss could signal further Fed easing and weigh heavily on the USD, making a long USD/CAD trade less appealing.

Trade: Do not enter a long USD/CAD position if the CPI significantly misses expectations. Consider a short-term long CAD trade if the USD weakens substantially. If the miss is modest and the USD holds support, look for a pullback to enter long USD/CAD.

Conviction and Conclusion

This USD/CAD trade plan offers a balanced approach, allowing for entry before or after the CPI release. The fundamental and sentiment backdrop favors USD/CAD upside, with the USD benefiting from safe-haven flows and a relatively hawkish Fed, while the CAD is weighed down by tariff threats, BoC dovishness, and political uncertainty. The pre-CPI entry strategy offers a favorable risk-reward profile, with a defined take-profit level to limit exposure to event risk. The post-CPI entry strategies allow for a more data-driven approach, but require careful monitoring of the market's reaction and quick execution.

Conviction: Moderately High. The confluence of factors supporting USD strength and CAD weakness creates a compelling setup. However, the uncertainty surrounding Trump's trade policies and the potential for unexpected economic data warrants caution. Position sizing should reflect the inherent risks.

Sources

Trading Economics, Financial Juice, CFTC, Bank of Canada, Bureau of Labor Statistics, Federal Reserve.