Inflation Icicles: Can the Dollar Thaw Out?

Market Analysis for Week Number 02 2024

DERBYSHIRE UK, Jan 10, 2024, Week 2. Hello and welcome. This week's market narratives are pivotal on the outcome of tomorrow’s US inflation rate, a critical factor for future Fed monetary policy. Fed speeches by Barkin and Williams may also offer valuable clues about their stance.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

UNITED-STATES: Despite mixed signals, headwinds are currently dominating the narrative, impacting the US Dollar. While the economy expanded strongly in Q3 2023, recent indicators point to a slowdown, with job growth moderating and consumer spending easing. Inflation, though declining, remains concerning, and the Fed's projected 75 bps rate cuts in 2024 create uncertainty. This cautious outlook weakens the Dollar's appeal, pushing it down against most major currencies. However, Trading Economics forecasts predicting higher GDP and lower inflation in 2024 could shift the narrative towards optimism, potentially strengthening the Dollar if the Fed slows down its rate cuts or even holds its ground. Overall, the US Dollar stands at a crossroads, with its direction hinging on the interplay of evolving economic data and the Fed's eventual policy response.

Thursday, January 11, 2024: Core Inflation Rate MoM/YoY DEC: This release will be the most pivotal event of the week, directly impacting expectations for future Fed monetary policy actions. A lower-than-expected reading could bolster hopes of a slower pace of rate hikes, potentially weakening the Dollar. Conversely, higher inflation figures could reinforce hawkish Fed stances and strengthen the Dollar.

Thursday, January 11, 2024: Fed Speeches by Barkin and Williams: While not as high-impact as the inflation data, these speeches can offer crucial insights into individual FOMC members' economic assessments and policy preferences. Any hawkish or dovish language could sway market sentiment and influence the Dollar’s trajectory.

Wednesday, January 17, 2024: Retail Sales MoM DEC: This indicator gauges consumer spending, a key driver of economic growth. A strong retail sales figure could signal resilience in the face of inflation and interest rate hikes, potentially supporting the Dollar. On the other hand, a weak reading could raise concerns about economic slowdown and put downward pressure on the Dollar.

EURO-AREA: Despite maintaining hawkish rhetoric and raising rates for the second meeting in a row, the Eurozone's narrative remains precarious, caught between a weakening economy and stubbornly high inflation. Headwinds abound, with a surprise GDP contraction in Q3 highlighting concerns about the energy crisis and recessionary risks. Yet, tailwinds like rising household consumption and a stabilising core inflation rate offer glimmers of hope. This volatility has translated into a choppy performance for the Euro, buffeted by fluctuating inflation data and shifting expectations for ECB and Fed policy paths. While Trading Economics forecasts a slight GDP uptick and gradual inflation decline, these hinge on factors like ongoing geopolitical uncertainties and winter energy consumption. Should these forecasts materialise, the ECB might loosen its hawkish grip, potentially weakening the Euro against a hawkish Fed-backed dollar. However, further economic deterioration or inflationary surprises could prompt even more aggressive tightening, bolstering the Euro's appeal relative to other currencies. Ultimately, the Euro's trajectory remains in flux, intricately woven into the complex tapestry of regional economic data, central bank pronouncements, and the broader global economic landscape.

Wednesday, January 10, 2024: ECB Guindos Speech: While not a direct policy announcement, speeches by key ECB officials like Guindos can offer crucial hints about the governing council's economic assessments and potential future policy direction. Hawkish or dovish comments could significantly influence market expectations for rate hikes and impact the Euro's sentiment.

Tuesday, January 16, 2024: ZEW Economic Sentiment Index JAN: This forward-looking survey gauges business confidence in the Eurozone economy. Strong confidence readings could signal optimism and potential economic resilience, potentially bolstering the Euro. Conversely, a weak ZEW index could raise concerns about a broader slowdown and put downward pressure on the currency.

Wednesday, January 17, 2024: Inflation Rate YoY Final DEC: While not the first release of inflation data, the final December figure may differ slightly from preliminary estimates. Any significant deviation could alter market perceptions of inflationary pressures and influence expectations for future ECB policy actions, impacting the Euro's trajectory.

UNITED-KINGDOM: Despite the Bank of England's hawkish stance on interest rates to combat inflation, the UK economy has shown mixed signals, offering both headwinds and tailwinds. Housing market data suggests resilience, with retail sales unexpectedly surging in November thanks to Black Friday discounts. However, services sector contraction and a revised GDP decline in Q3 paint a concerning picture. The pound's recent strength partly reflects this mixed bag, buoyed by hopes of an interest rate pivot due to recession fears. However, Trading Economics forecasts of continued, albeit slower, GDP growth and inflation on a gradual descent could challenge this narrative, potentially putting downward pressure on the pound if it reinforces the Bank of England's commitment to tighter monetary policy. Geopolitical uncertainties, particularly regarding the war in Ukraine, add another layer of complexity, making the pound's trajectory highly sensitive to data releases and central bank pronouncements in the coming months.

Wednesday, January 10, 2024: BoE Governor Bailey Speech. Bailey's comments on the economic outlook, monetary policy intentions, and assessment of inflation and rate resilience could shift the narrative. Strong hawkish signals could solidify a pro-rate hike narrative, while dovish stances could weaken it.

Friday, January 12, 2024: Event: GDP data (MoM, 3-month avg., NOV) Potential Impact: Above-expectations growth could bolster the pound, while underperformance could weaken it.

Wednesday, January 17, 2024: Inflation data (YoY, Core YoY, MoM, DEC). Falling inflation could boost the pound, especially if paired with dovish Bailey speech, while persistently high inflation could dampen it.

JAPAN: The Bank of Japan's unwavering commitment to ultra-loose monetary policy, despite a surprise contraction in Q3 GDP, continues to drive the narrative around the yen. While headwinds like declining private consumption and capital expenditures, alongside mounting global uncertainties, paint a concerning picture, the BoJ's dovish stance, reinforced by recent wage increases, keeps hopes of inflation reaching its 2% target alive. This has maintained a downward pressure on the yen, furthered by the dollar's recent strength fueled by global central bank hawkishness. However, Trading Economics' forecasts of a slight GDP rebound and gradual inflation decline could challenge this narrative. If realised, they might prompt the BoJ to reconsider its ultra-loose policy, potentially triggering speculation about a policy shift and causing the yen to appreciate against the dollar. External factors like the recent earthquake and airport collision add uncertainty, but ultimately, the interplay between the BoJ's stance and global economic developments will dictate the yen's trajectory in the coming months.

Wednesday, January 10, 2024: JP10-Year JGB Auction: High demand or low demand for the auction could indicate investor sentiment towards the BOJ's monetary policy and potentially influence speculation about the end of negative interest rates.

Friday, January 12, 2024: JPEco Watchers Survey Current & Outlook (DEC): If this survey reveals significant changes in business sentiment or economic forecasts, it could impact the narrative regarding Japan's economic recovery and potentially influence the BOJ's policy outlook.

Thursday, January 18, 2024: Reuters Tankan Index (JAN): This influential survey measures business confidence and provides insights into future investment plans. Positive results could bolster the narrative of economic resilience and potentially signal stronger yen.

USD/JPY: Since January 4th, the USD/JPY has slightly appreciated, driven by a rebound in the US dollar and Treasury yields. This is due to revised expectations of less aggressive interest rate cuts by the US Federal Reserve, following strong US economic data including a better-than-expected jobs report. This indicates a resilient US labour market, possibly delaying the Fed's easing cycle. The dollar's rise is also supported by higher Treasury yields and cautiousness about the Fed's policy changes. Conversely, since November 29th, the USD/JPY has depreciated over the long term. This reflects uncertainties around the Federal Reserve's monetary policy adjustments in response to economic conditions, especially inflation and labour market trends, causing variable expectations of interest rate changes and the dollar's depreciation against the yen. The Japanese Yen's value has been influenced by speculation around the Bank of Japan's monetary policy, external factors like recent natural disasters, and the BoJ's continued dovish stance with its ultra-loose monetary policy. These factors collectively shape the long-term USD/JPY exchange rate trend.

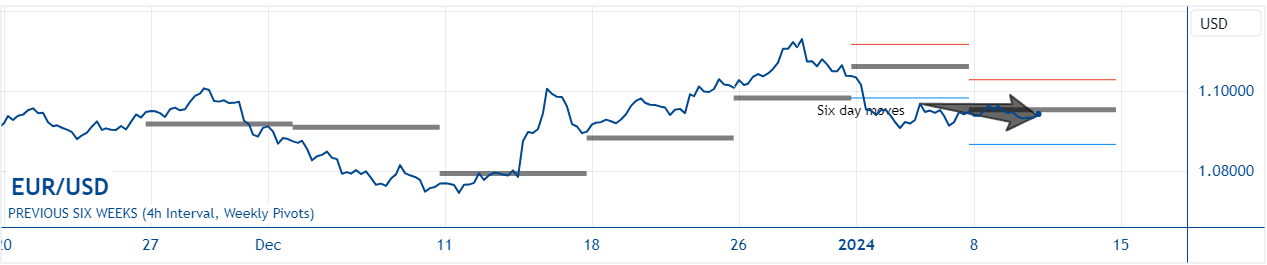

EUR/USD: Since January 4th, the EUR/USD exchange rate has stabilised, influenced by various factors affecting both the Euro and the US Dollar. The Euro's value is impacted by fluctuating Eurozone inflation rates and the European Central Bank's monetary policy. Despite aggressive rhetoric and rate hikes, the Eurozone faces challenges like GDP contraction and high inflation, creating an uncertain outlook for the Euro. Conversely, the US Dollar is influenced by the Federal Reserve's monetary policy adjustments in response to US economic indicators. The US showed strong growth in Q3 2023, but recent data indicates a slowdown with slower job growth and reduced consumer spending. However, less aggressive expectations of Fed rate cuts in 2024, delayed by strong labour market data, have moderated the Dollar's movement. Over the long term, since November 29th, the EUR/USD has also been stable. This reflects ongoing uncertainty and mixed economic signals from both the Eurozone and the US. The Euro's trajectory is affected by regional economic data and ECB policies, while the Dollar's direction is shaped by US economic trends and the Fed's responses. The interaction of regional inflation, PMI figures, and changing interest rate expectations in both regions has resulted in a generally steady EUR/USD exchange rate during this time.

GBP/USD: Since January 4th, the GBP/USD exchange rate has been stable, influenced by various factors affecting both the Pound Sterling and the US Dollar. The Pound has been resilient to high-interest rates, evidenced by strong consumer borrowing, positive housing market trends, and service sector growth in the UK. These factors present a mixed economic outlook, balancing the Bank of England's hawkish interest rate stance with possible adjustments due to recession concerns. On the other hand, the US Dollar's movement is influenced by changing economic indicators, particularly inflation and labour market data, affecting expectations of the Federal Reserve's monetary policy. Since November 29th, the GBP/USD has seen a slight increase. This change reflects the mixed signals in the UK economy, suggesting a potential slowdown in the Bank of England's rate hikes. Meanwhile, the US Dollar has been impacted by anticipated Federal Reserve rate cuts and a cautious economic outlook, despite stronger growth in Q3 2023. The overall slight appreciation of the GBP/USD in this period is due to the interplay between the monetary policy decisions of the Bank of England and the Federal Reserve, against the background of global economic indicators.

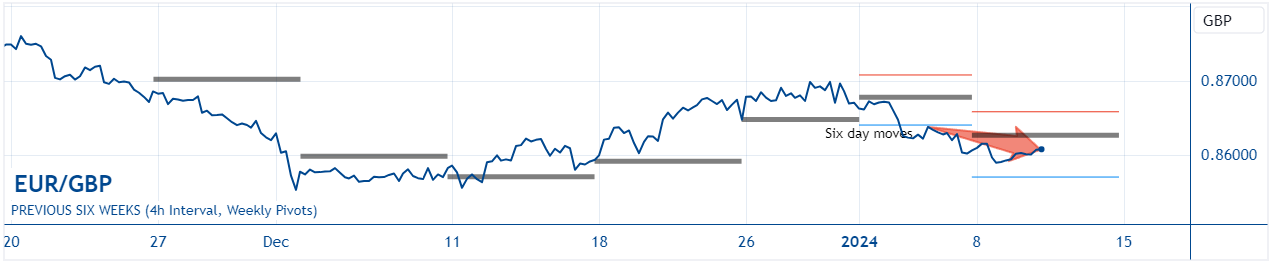

EUR/GBP: Since January 4th, the EUR/GBP exchange rate has decreased, influenced by different economic conditions and monetary policy expectations in the Eurozone and the UK. The Euro's value has been affected by varying inflation rates in the Eurozone and expectations surrounding the European Central Bank (ECB) and the Federal Reserve's monetary policies. Key factors include regional inflation, PMI figures, and changing market expectations for interest rate adjustments. In contrast, the Pound Sterling has been strengthened by the UK's economic resilience to high-interest rates, as indicated by recent data on consumer borrowing, housing market trends, and service sector growth. Since November 29th, the EUR/GBP has also lost value. This trend is due to the Eurozone's challenges, such as a weakening economy and high inflation, compared with the UK's relative economic stability and the Bank of England's (BoE) hawkish stance on interest rates. The Pound has gained strength against the Euro, as the ECB faces uncertainty in its policy direction amid economic fluctuations, while the BoE has been more decisive in responding to economic indicators.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from th e5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-