Order details…

Thursday, 25th July, Week 30: This report analyses the recent performance of CAD/JPY and provides a five-week outlook for the pair. It examines the factors that have influenced the pair's price movements over the past five months and identifies potential catalysts for future price action. The report concludes with actionable insights for forex traders, including key economic events to monitor in the coming weeks and trade theses.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Yen's Resurgence Meets Loonie's Weakness: A Five-Month Tug-of-War

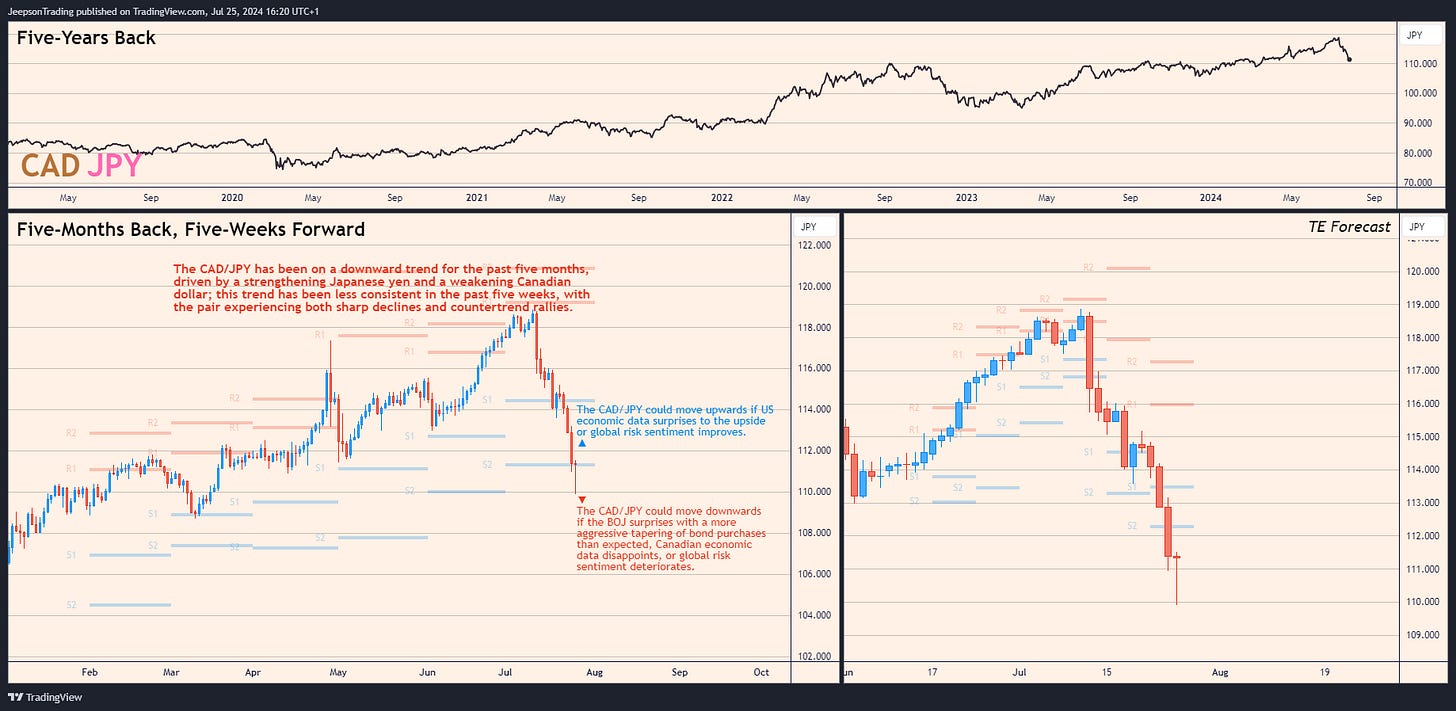

The CAD/JPY has experienced a significant decline over the past five months, reflecting a strengthening Japanese yen and a weakening Canadian dollar. The most notable move occurred in late April, when the pair plunged from 115.8 to 111.1. This move was likely triggered by a combination of factors, including a broad strengthening of the yen amid speculation of government intervention to curb its weakness, a shift in Bank of Japan (BOJ) rhetoric towards policy normalisation, and safe-haven flows into the yen amid a global risk-off sentiment sparked by disappointing US tech earnings and escalating geopolitical tensions. Concurrently, the Canadian dollar weakened due to disappointing economic data, concerns about the impact of the Bank of Canada's (BoC) aggressive rate-hiking cycle on the housing market, and a decline in oil prices.

The previous five weeks have seen a continuation of volatility in CAD/JPY, with the pair breaking below key support levels but also experiencing countertrend rallies. This recent price action differs from the broader five-month period, which saw a more consistent depreciation of the Canadian dollar against the Japanese yen. Other details that forex traders should be aware of include the BoC's recent pivot towards rate cuts, aimed at stimulating a slowing economy, and the ongoing wildfires in Canada, which have disrupted oil production and raised concerns about supply disruptions.

Summary: The CAD/JPY has been on a downward trend for the past five months, driven by a strengthening Japanese yen and a weakening Canadian dollar; this trend has been less consistent in the past five weeks, with the pair experiencing both sharp declines and countertrend rallies.

Five-Week Outlook: A Battle of Monetary Policy and Risk Sentiment

Looking ahead, the CAD/JPY could face further volatility in the next five weeks as investors digest key economic data releases and assess the outlook for both Canadian and Japanese monetary policy. The pair could move upwards if upcoming US economic data, such as Q2 GDP and PCE inflation, surprises to the upside, reinforcing expectations for a less dovish Federal Reserve and potentially boosting risk sentiment, which could weigh on the safe-haven yen. Additionally, an improvement in global risk sentiment, potentially driven by a resolution of geopolitical risks or positive economic surprises, could further reduce safe-haven demand for the yen.

Conversely, the pair could move downwards if the BOJ surprises with a hawkish move at its meeting in the week commencing 31st July, potentially in the form of a more aggressive tapering of its bond purchases than the market expects. Weaker-than-expected Canadian economic data, particularly the July Labour Force Survey due in week 32, could also weigh on the Canadian dollar and support the Japanese yen. Additionally, a continuation of the global risk-off sentiment, potentially triggered by escalating geopolitical tensions or disappointing corporate earnings, could further boost the yen's safe-haven appeal.

Upside: The CAD/JPY could move upwards if US economic data surprises to the upside or global risk sentiment improves.

Downside: The CAD/JPY could move downwards if the BOJ surprises with a more aggressive tapering of bond purchases than expected, Canadian economic data disappoints, or global risk sentiment deteriorates.

Action Points: Navigating the CAD/JPY Maze

Monitor the release of key economic data from Canada and Japan, paying close attention to indicators of growth, inflation, and labour market conditions.

Follow central bank communications, particularly from the BoC and the BOJ, for clues about the future direction of monetary policy.

Assess the impact of geopolitical developments, including the Russia-Ukraine war, tensions in the Middle East, and the US-China trade dispute, on market sentiment and currency valuations.

Key Economic Events to Monitor:

Week 31:

Tuesday, 30th July: Japan Unemployment Rate JUN

Wednesday, 31st July: BOJ Interest Rate Decision, BOJ Quarterly Outlook Report, Canada GDP MoM MAY, Canada GDP MoM Prel JUN

Thursday, 1st August: Japan Jibun Bank Manufacturing PMI Final JUL

TRADE THESIS

Short CAD/JPY:

The current macroeconomic backdrop favours a short position on CAD/JPY. The BoC's recent pivot towards rate cuts, while aimed at stimulating a slowing economy, is likely to exacerbate the downward pressure on the Canadian dollar. The ongoing wildfires in Canada have also disrupted oil production, raising concerns about supply disruptions and further weighing on the loonie. Conversely, the Japanese yen is benefiting from safe-haven flows amid a global risk-off sentiment and expectations for a potential hawkish shift from the BOJ. The divergence in monetary policy between the BoC and the BOJ, coupled with the yen's safe-haven appeal, suggests that CAD/JPY is likely to experience further downward pressure in the coming weeks.

Conclusion

The CAD/JPY is poised for further volatility in the coming weeks as investors assess the outlook for Canadian and Japanese monetary policy and global risk sentiment. The pair's recent price action reflects a strengthening Japanese yen and a weakening Canadian dollar, driven by a divergence in monetary policy and safe-haven flows. Forex traders should closely monitor key economic data releases, central bank communications, and geopolitical developments to navigate the uncertainty surrounding CAD/JPY and identify potential trading opportunities.

Sources

Bank of Canada

Bank of Japan

Statistics Canada

Ministry of Finance, Japan

Cabinet Office, Japan

Ministry of Internal Affairs & Communications, Japan

Ministry of Economy Trade & Industry (METI), Japan

Trading Economics

Reuters

S&P Global

IMF

OECD

Newsquawk

Stratfor