Macroeconomics of the United States

Essential insights for USD traders...

Friday, February 14, 2025, Week 7

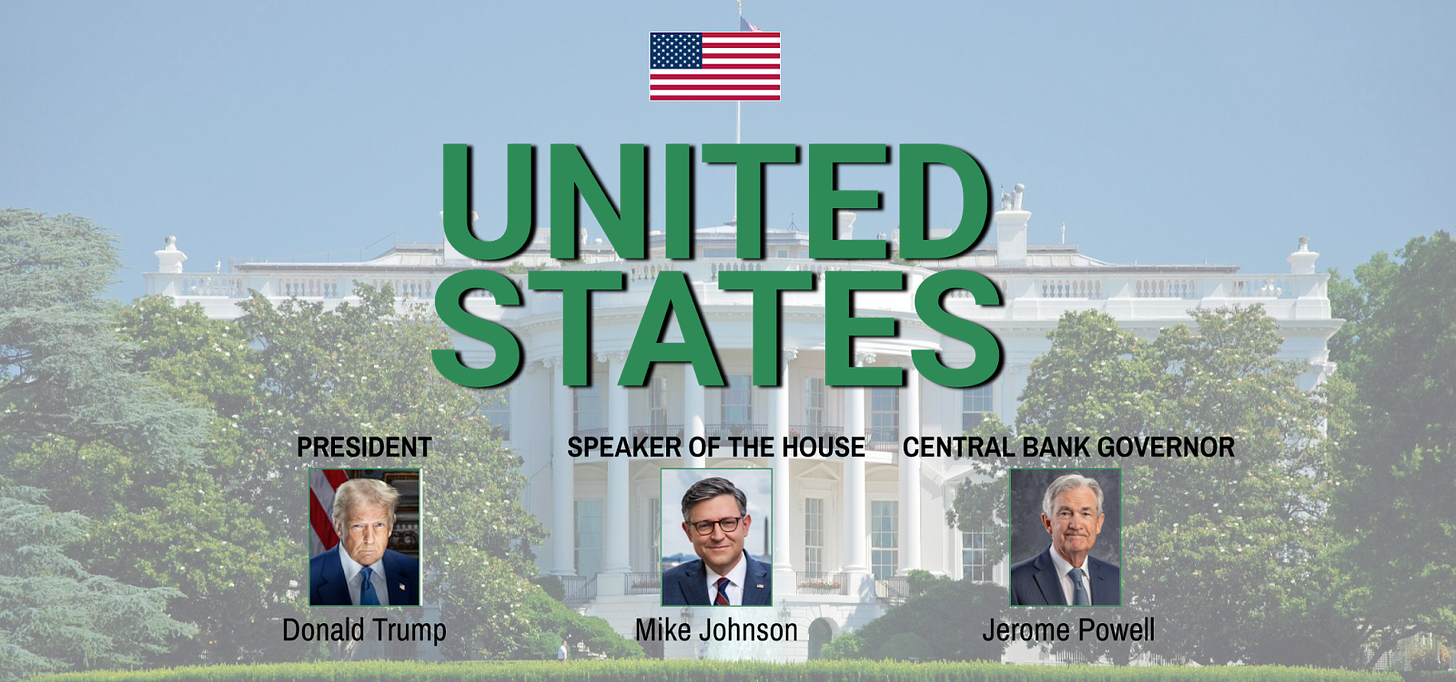

The USD, as always, is a focal point, and right now, the political landscape is adding an extra layer of complexity. We're in a second Trump administration, inaugurated just a few weeks ago on January 20th, 2025. As any seasoned forex trader knows, Trump's "America First" agenda and unpredictable policy moves can inject serious volatility into the markets. His administration's focus on protectionist trade and deregulation adds another dimension to the trading environment.

Let's break it down. Trump wields considerable executive power, shaping both domestic and foreign policy. Congress, the 119th, is under Republican control. In theory, this should smooth the way for his agenda, but the reality is far more nuanced. The political climate is intensely polarized, suggesting potential gridlock and ongoing uncertainty – never a good sign for currency stability. The Judicial branch, led by Chief Justice John Roberts, will likely play a crucial role in adjudicating challenges to the administration's actions, adding another layer of complexity.

The last seven weeks have been a masterclass in Trump-induced market swings. His February 1st tariff announcement – 25% on steel and aluminium from Canada and Mexico, 10% on China – immediately sent shockwaves through global markets. Exemptions for Canada and Mexico, secured on February 3rd after a deal on drug trafficking, offered a temporary reprieve, but the broader trade war narrative remains very much alive. The market is on edge, anticipating reciprocal tariffs on an even wider range of goods, including vital sectors like oil and gas, pharmaceuticals, and semiconductors.

CBP One is a mobile application used by Customs and Border Protection (CBP) to manage appointments for asylum seekers and other individuals seeking entry into the United States.

Domestically, Trump's infrastructure spending and tax cut proposals are under the microscope. Will they boost growth, or simply ignite inflation? The jury's still out, and this uncertainty is feeding market volatility. His attempt to impound $3 trillion, currently tied up in court, adds another wrinkle to the fiscal outlook. Beyond the headline-grabbing moves, numerous executive orders have been flying – impacting immigration (from ending CBP One to deploying troops and declaring a national emergency), LGBTQ+ rights, and DEI initiatives across federal agencies. Even the resumption of federal executions and a shift in focus at the Justice Department are adding to the sense of unpredictability. Traders need to stay nimble, as the next seven weeks could bring further policy shifts with significant market implications.

Sizing Up the US Economy: Strengths, Weaknesses, and Key Players

The US economy, the world's largest, remains a dominant force, but it's not invincible. Its 2024 nominal GDP of $29.167 trillion and projected 2.8% growth are impressive, but the Q4 slowdown to an annualized 2.3% raises eyebrows. Consumer spending, surging 4.2% in Q4, is clearly the engine of growth, but this reliance on consumption makes the economy vulnerable to shocks, especially if trade disputes escalate and dent consumer confidence.

The service sector, at 80.2% of GDP, remains the backbone, with tech, finance, and healthcare leading the way. Keep an eye on the usual suspects – Apple, Microsoft, Amazon, Alphabet, ExxonMobil, Meta, Tesla, Nvidia, and Broadcom – they're not just market movers, they're global influencers. Their earnings and performance can trigger ripple effects across international markets.

The US export landscape is diverse – aircraft, pharmaceuticals, semiconductors, you name it. And with trading partners spanning from Canada and Mexico to China, Japan, and the EU, there's a degree of diversification. However, the trade war drums are beating louder, particularly with China, and that poses a real threat to exports and overall growth.

Market Narratives: Decoding the USD's Story

The USD's story over the past seven weeks has been a complex one. The Fed's January 29th decision to hold rates steady at 4.25-4.50%, coupled with their cautious tone in the FOMC minutes released February 8th, initially provided support. The market interpreted this as a hawkish tilt, especially after three rate cuts totalling a full percentage point in 2024. However, Trump's pronouncements – calling for lower rates and sending mixed signals on tariffs – have injected significant volatility.

The trade war narrative, with its tariff threats and retaliatory measures, has been another key driver. Risk-off sentiment has periodically boosted the USD's safe-haven appeal, but concerns about global growth and the potential for a recession are never far from the surface. The tech sector, rattled by DeepSeek's disruptive AI model and facing regulatory scrutiny, has also weighed on market sentiment.

Looking ahead, these narratives will continue to shape the USD's trajectory. Upcoming economic data – inflation, GDP, employment – will be crucial for gauging the Fed's next move and the health of the US economy. The trade war's evolution, especially with China, will remain a major factor. And the tech sector's performance, amidst rising competition and regulatory headwinds, will continue to influence investor confidence.

Geopolitical Chessboard: Navigating the Risks

Geopolitics are always a wildcard, and right now, the board is particularly complex. The US-China relationship, fraught with trade tensions and a tech race fuelled by DeepSeek and US chip export restrictions, remains a major source of uncertainty. The January 17th Trump-Xi phone call offered a brief moment of calm, but the underlying tensions haven't disappeared. The war in Ukraine, with its global implications and the recent US-Russia talks, continues to fuel risk aversion. The collapse of the Syrian government and the broader Middle East instability add to the geopolitical risk premium. And then there's Trump himself – his "America First" approach and unpredictable foreign policy create constant uncertainty about the US's role on the world stage.

For USD traders, this means staying vigilant. The US-China dynamic, the Ukraine situation, and any flare-ups in the Middle East will be key drivers of risk sentiment. Trump's foreign policy decisions, especially regarding Russia and other potential hotspots, warrant close monitoring.

The Fed's Balancing Act: Monetary Policy in Uncertain Times

The Federal Reserve, under Jerome Powell (whose term is up in May 2026), is navigating a tricky landscape. Their dual mandate – maximum employment and price stability (2% inflation) – is being tested by the current environment. After three rate cuts in 2024, they held steady at 4.25-4.50% in their January 29th meeting, signalling a pause to assess the impact of past easing and the unfolding Trump agenda. The FOMC minutes from that meeting (released Feb 8th) reinforced this cautious, data-dependent approach. The removal of the "ongoing progress" language on inflation from their statement, while acknowledging that inflation remains "somewhat elevated," added a layer of intrigue.

The market's now betting on a slower pace of easing, with perhaps just one more cut in 2025, likely in the second half. But there are dissenting voices – Governor Waller, for instance, hinted at a possible first-half cut if inflation behaves. The Fed's December SEP projected a median rate of 3.9% by end-2025 and 3.4% by end-2026. The ongoing QT program is another factor in the mix, influencing longer-term rates and the USD. Traders will be parsing every word from Powell and other FOMC members for clues about the Fed's next move.

USD: A Murky Fundamental Outlook

The USD's current strength is built on safe-haven flows and the Fed's relatively hawkish stance. But the underlying fundamentals are a mixed bag. The US economy is still growing, but the pace is slowing. Q4 2024 GDP growth came in at a soft 2.3% annualized. Recent data has been all over the map – strong December job growth followed by weaker January figures, easing inflation followed by a concerning uptick. This creates a murky picture, making it tough to call the USD's direction with confidence.

The outlook hinges on a few key factors:

Inflation's Path: Will it continue its upward trajectory, forcing the Fed's hand, or will it cool down, allowing for more easing? The January CPI print was hotter than expected, adding to the uncertainty.

Trade War Fallout: Trump's trade policies are a wildcard. Will they spark a global slowdown, boosting the USD's safe-haven appeal, or will cooler heads prevail, allowing for a trade truce and potentially weighing on the greenback?

Tech's Resilience: Can the tech sector weather the storm of Chinese competition and increased regulation, or will the sell-off deepen, impacting overall market sentiment and the USD?

The Consumer's Mood: Will consumer confidence and spending hold up amid the uncertainty, or will we see a pullback, impacting growth and potentially forcing the Fed to act?

Geopolitical Wildcards: The US-China rivalry, the war in Ukraine, and Middle East instability are all potential triggers for risk aversion and USD strength.

Forecasts and Projections: A Reality Check

Let's look at the projections, but with a healthy dose of scepticism. In this environment, forecasts are more like educated guesses.

GDP Growth: Trading Economics sees 2.0% for 2026. Achievability: Low. Trade wars, geopolitical risks, and policy missteps could easily derail these projections.

Fed Funds Rate: The market's betting on 4.50% through Q1 2025. The Fed's December SEP has it lower, at 3.9% (end-2025) and 3.4% (end-2026). Achievability: Very low. Inflation and growth are too unpredictable to make these forecasts reliable.

10-Year Treasury Yield: 4.50% (end of Q1 2025), 4.34% (12 months). Achievability: Moderate. Aligned with current trends, but subject to significant volatility.

USD Index (DXY): 109.45 (end of Q1 2025), 111.17 (12 months). Achievability: Moderate. Dependent on the Fed staying relatively hawkish and continued safe-haven demand. Trade policy could throw a wrench in the works.

US500: 5957.17 (Q1 2025), 5713.73 (12 months). Achievability: Low. Tech sell-off, trade war fears, and earnings risks make this a tough target.

Unemployment Rate: 4.40% (end of Q1 2025), 4.30% (2026). Achievability: Moderate. Possible, but vulnerable to economic shocks.

The USD's path is far from clear. The US economy has its strengths, but the risks are real and substantial. Trade wars, geopolitical uncertainty, and the unpredictable Trump factor are all in play. A flexible, data-driven trading strategy is essential for navigating this environment.