Making the Case for a Weaker Pound Sterling

The Forex and Fixed Income markets have opposing views

DERBYSHIRE GB / APR 13 - This is the Pound Sterling Forex Playbook by Jeepson Trading and it is intended to be used as a guide to formulate your trade plans. It contains analysis based on the Pound Sterling Forex Reference.

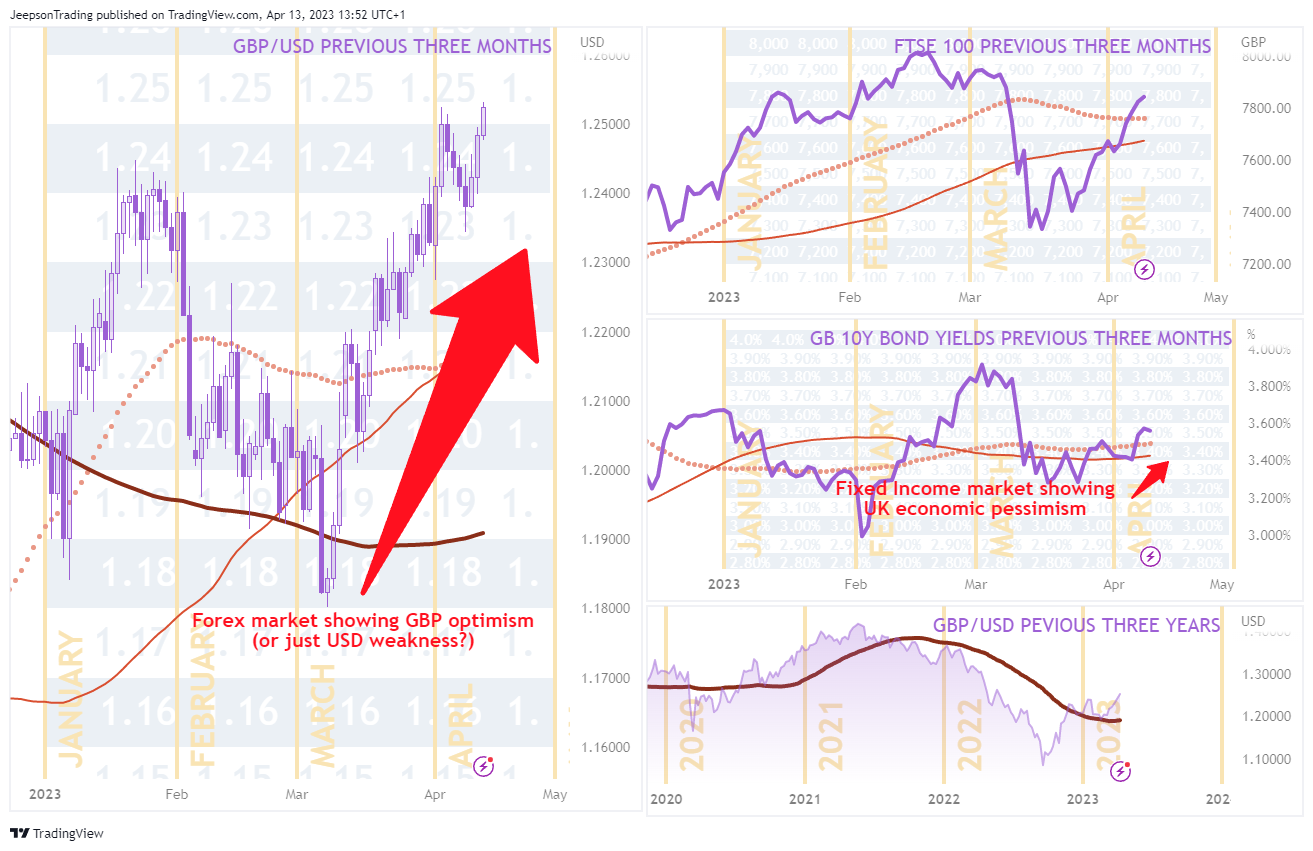

The outlook of the UK is debated as just this week, the IMF forecast a contraction in 2023 while the Bank of England suggest this can be avoided and markets are in agreement with them as the Pound Sterling has appreciated over 700 pips since the start of last month. Some of this can be attributed to a weaker dollar but optimism towards the UK economy is clear as the FTSE 100 also gained, moving more than 400 points from the 7,300 area to 7,800 also since just last month.

Next week will see fresh inflation data and the initial consensus is for it to be slightly lower than the already 10.4 although still likely to remain above 10 percent. There will also be the UK retail sales report which has an early expectation of a half point contraction over the previous month.

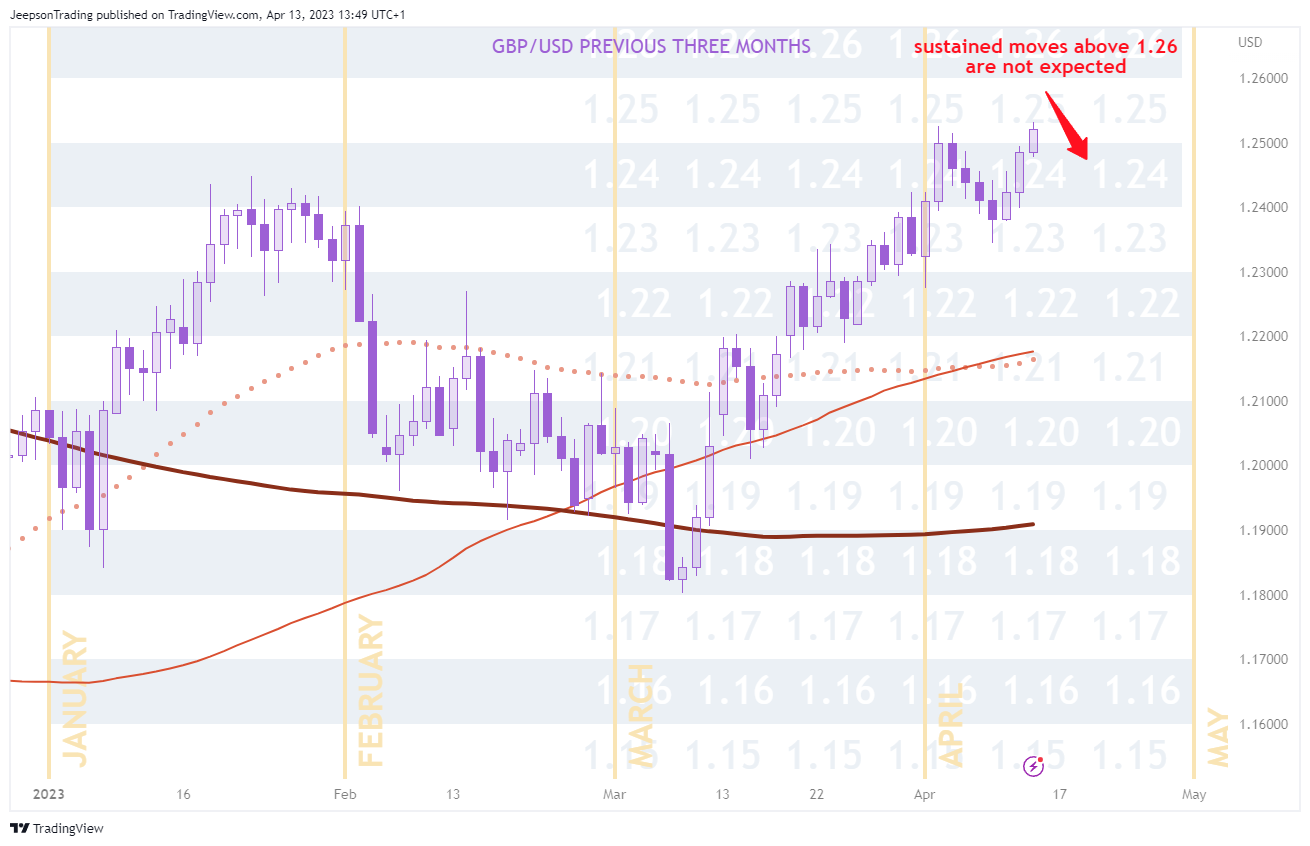

Based on the research and analysis detailed in this report, the value of the Pound Sterling in US Dollars over the short term is not expected to move into the $1.26 area. Re-evaluate after UK CPI data on Wednesday the 19th of April.

FUNDAMENTAL ANALYSIS

THE BANK OF ENGLAND

On March the 23rd, the Bank of England made the eleventh consecutive hike and set the Bank Rate to 4.25 percent from previously 4.00.

Following the meeting they provided a ‘Monetary Policy Summary’ which provided amendments and updated views to the full economic assessment that was provided in February. It began with comments that there is no significant impact expected for the UK banking sector following the collapse of the Silicon Valley Bank and the bailout of Credit Suisse by UBS. With regards to GDP, fresh data indicates that the projected contraction in 2023 could now show a small expansion which has been helped by the Energy Price Guarantee providing more disposable income for households. Unemployment is also expected to be better than the projected 4.4 percent in 2024. The bank acknowledged that inflation unexpectedly spiked in February to 10.4 percent, however they suggest that this was caused by volatile pricing such as clothing and footwear so is unlikely to be persistent. To reinforce this view, they are projecting that CPI will fall further than previously projected (9.7% in 2023, 3.0% in 2024).

In the closing comments they mention its commitment to returning inflation towards its 2 percent target.

The bank will meet again on Thursday the 11th of May to decide on bank rate changes as well as updating the ‘Monetary Policy Report’ which will include a full economic assessment and projections.

THE UK ECONOMY

QUARTERLY GDP GROWTH RATE: The latest data is for Q4 2022 which at a 0.1 percent expansion is better than expected and a contraction this year in 2023 may be avoided. Previously, the outlook for GDP was classified as ‘optimistic deterioration’ but has since been upgraded to ‘optimistic stagnation’.

ANNUAL CPI RATE: The latest data is for February which at 10.4 percent inflation is higher than expected although the Bank of England are still projecting it to come down quickly. Previously, the outlook for CPI was classified as ‘optimistic improvement’ and this can be maintained for now.

UNEMPLOYMENT RATE: The latest data is for January which at 3.7 percent is slightly better than expected and the Bank of England are projecting it to rise although not as high as the previously forecasted 4.4 percent for next year 2024. Previously, the outlook for unemployment was classified as ‘optimistic deterioration’ and this can be maintained for now.

SENTIMENT ANALYSIS

ECONOMIC GROWTH NARRATIVE

Conversations regarding the outlook of UK growth (or lack thereof) is in the minds of speculators who may be looking to capitalise on a potentially weaker pound although it has been on a tear since early March moving from the $1.18 area to $1.25 in April at the start of this month. These moves can be attributed to a weaker US Dollar which saw a period of selling in the wake of the developing banking crisis which was considered to tip the hand of the Fed into a dovish pivot which is yet to be seen.

The upside moves on Gilt Yields in April suggest that the fixed income market is expecting the Bank of England to stick to its hawkish policy and this in time will pressure Sterling and the FTSE 100 to the downside. However, if the bond sellers are incorrect and the Bank does soften its policy then yields will be seen to fall, matching the optimistic sentiment seen in the Forex and equity markets.