Markets on Edge: Fed Cut Expected, But BOJ’s Move Could Surprise

Weekly Forex Briefing (WN44)

This report provides a concise briefing on the pivotal market drivers from the past week and a forward-looking analysis of the critical events that will shape the market narrative in the weeks ahead.

The previous week was defined by a soft US inflation report that cemented expectations for a Federal Reserve rate cut, fueling a global equity rally to record highs.

Crude oil prices surged on new US sanctions against Russia, while US-Canada trade tensions escalated sharply, punishing the Canadian dollar.

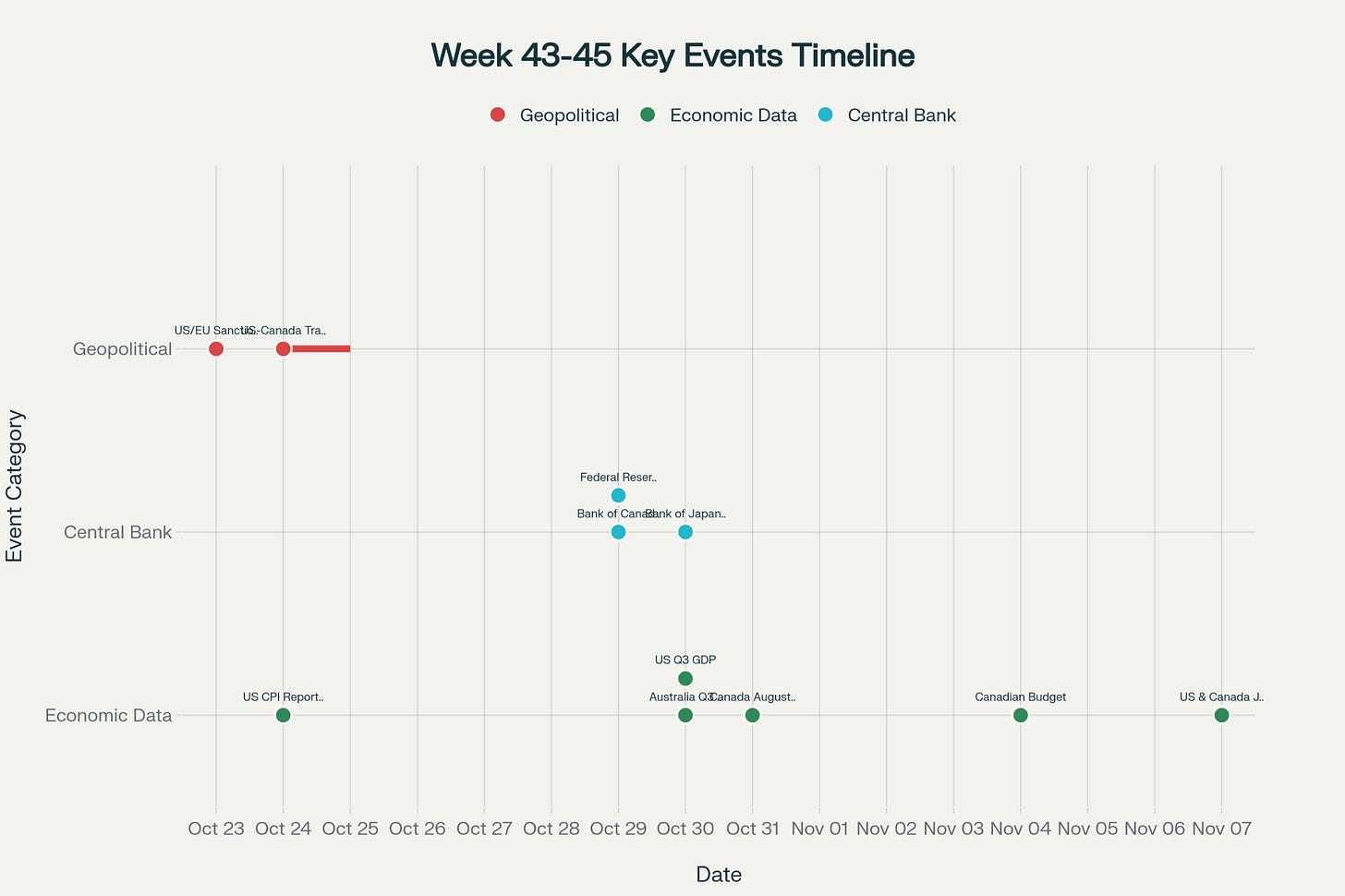

The upcoming two weeks are dominated by a gauntlet of central bank decisions from the US, Canada, and Japan, as well as critical GDP and inflation data.

The Canadian federal budget and key US/Canada labour reports in early November will set the policy and economic trajectory for the remainder of the year.

The Rearview Mirror: How a Soft Inflation Print Ignited a Global Rally

The market action during Week 43 was overwhelmingly defined by the market’s reaction to the September US Consumer Price Index report on Friday, October 24. The data came in cooler than market expectations, with both headline and core inflation rising less than forecast. This was the catalyst that solidified investor expectations that the Federal Reserve will cut interest rates at its upcoming meeting on October 29. The probability of a 25-basis-point rate cut, which was already high, moved to nearly 99 percent priced in by the markets.

This dovish repricing triggered a powerful and broad-based “risk-on” rally across global financial markets. The US dollar weakened, while global stock markets surged to new all-time highs. The S&P 500 rose 0.8 percent to a record 6785.00, and Europe’s STOXX 600 also closed at a new peak. The rally was led by the technology sector, with chipmaker Intel surging more than 6 percent. This positive sentiment was powerful enough to overshadow other significant geopolitical developments.

Key events and their impacts during the week included:

US/EU Sanctions on Russia (Thursday, Oct 23): The imposition of new sanctions on Russian energy giants Rosneft and Lukoil caused crude oil prices to surge by over five percent, injecting a significant geopolitical risk premium into the energy market and stoking supply disruption fears.

US-Canada Trade Tensions (Friday, Oct 24 - Saturday, Oct 25): The abrupt termination of trade talks by President Trump, followed by a threat of new tariffs over the weekend, created a severe and specific headwind for the Canadian dollar, causing it to plunge to six-month lows.

“Takaichi Trade” Intensifies (Throughout the week): In Japan, the speculative rally in stocks and sell-off in the yen continued as markets positioned for a large fiscal stimulus package from new Prime Minister Sanae Takaichi. The Nikkei 225 hit new records, while the yen weakened past 152 per US dollar.

The Path Forward: Navigating a Week of Pivotal Policy Decisions

The upcoming seven days, and extending into the following week, represent one of the most concentrated periods of event risk for the entire year. The trajectory of global markets will be set by the outcomes of three major central bank meetings and a slate of top-tier economic data.

The week is dominated Wednesday, October 29, featuring decisions from both the Bank of Canada and the US Federal Reserve.

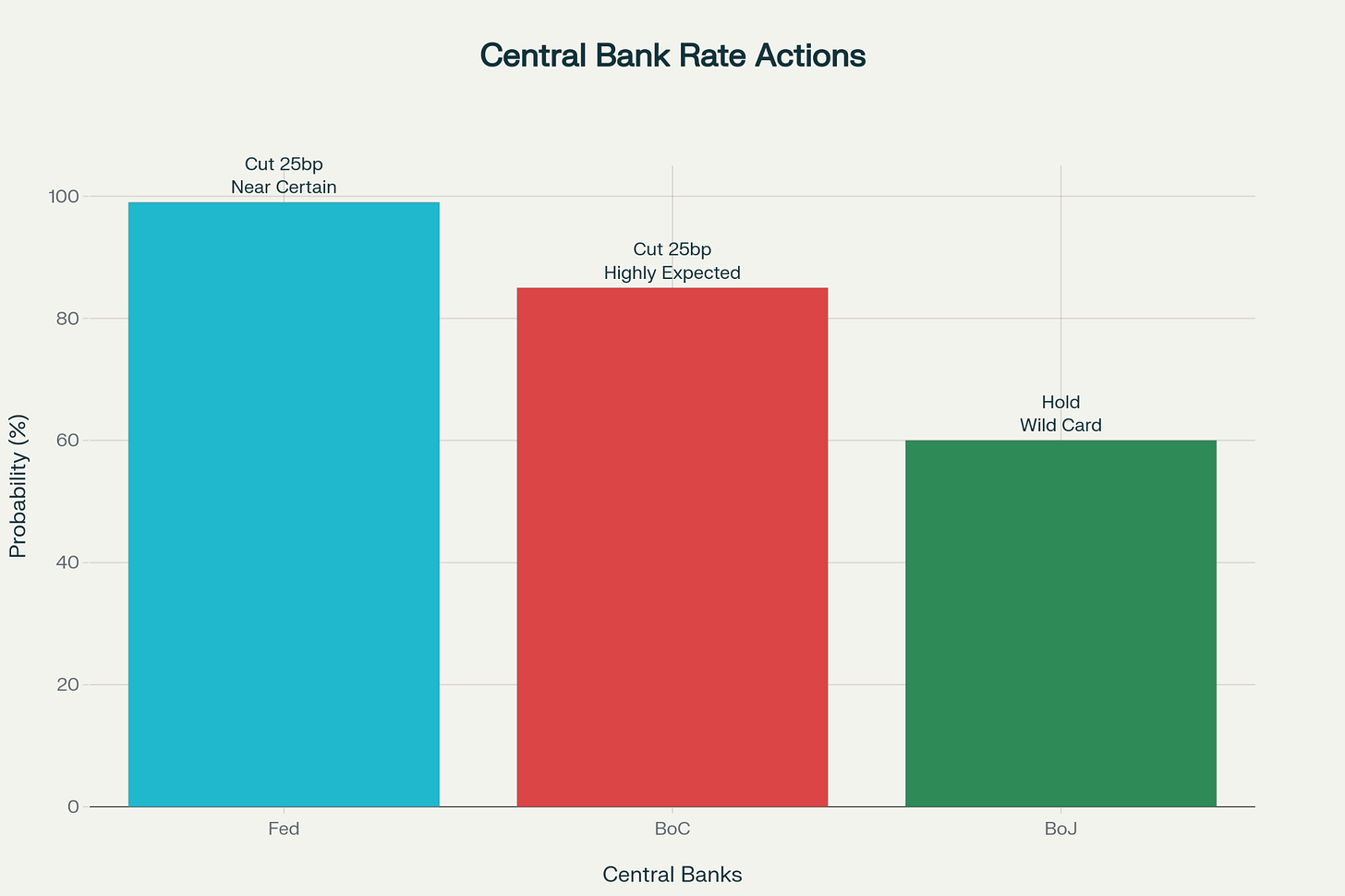

Bank of Canada (Oct 29): A 25-basis-point rate cut is overwhelmingly expected following Canada’s Q2 economic contraction and the recent escalation in US trade tensions. The market’s focus will be on the dovishness of the forward guidance in the accompanying Monetary Policy Report. A signal of more cuts to come would pressure the Canadian dollar further.

US Federal Reserve (Oct 29): A 25-basis-point cut is a near certainty. The market reaction will depend entirely on Chair Jerome Powell’s press conference and whether he signals a readiness for another cut in December or a more cautious “wait-and-see” approach.

Bank of Japan (Oct 30): This is the biggest wild card. The market expects a dovish hold, in line with the “Takaichi trade” narrative. However, with inflation remaining well above target, the risk of a hawkish surprise is significant and could trigger a violent reversal in the yen and Japanese stocks.

This central bank gauntlet is accompanied by a dense economic calendar that could alter policy expectations:

Australia Q3 CPI (Oct 29/30): This is a binary event for the Australian dollar. A soft print will lock in a November rate cut and send the currency lower. A hot print would validate the RBA’s recent caution and likely trigger a sharp relief rally.

US & Canada Q3 GDP (Oct 30 & 31): The advance US Q3 GDP report is forecast to show a sharp slowdown to 1.0 percent annualized growth. A weaker number would validate the Fed’s dovish pivot. Canada’s August GDP report will be closely watched for signs of a rebound after a weak Q2.

Canadian Budget & Labor Reports (Nov 4 & 7): The following week, the Canadian government’s first budget will be a major fiscal event, while the October jobs reports from both the US and Canada will provide the first crucial data points for their respective central banks’ December decisions.

A PIVOTAL PERIOD FOR POLICY AND MARKETS

The upcoming period is defined by pivotal policy decisions and critical data releases that will set the market’s direction for the remainder of the year.

Central bank communication is everything this week.

The Bank of Japan meeting is the biggest source of risk.

Australian inflation data is a key binary event for the Aussie dollar.

US GDP and jobs data will determine the Fed’s path into December.

The Canadian budget could provide a crucial fiscal offset to monetary easing.