Markets to be Subdued Until NFP

Market Analysis for Week Number 40 2023

Derbyshire, UK – October 1st, 2023: Study the Economic Events of Interest section below for hints on how to trade the upcoming week. The focus event of the week will be US NFP on Friday which is expected to beat the previous result although still to be far lower than the recent trend and indicative of a slowdown.

Decisions to trade are made at your own monetary risk.

US Dollar Strength Signals Bullish Outlook

US Dollar Outlook Bullish as US Economy Slows, Inflation Remains High: The Fed kept interest rates at 5.50% in September, but said it is still committed to bringing inflation back to 2%. The US economy is growing at a slower rate but remains strong. Macroeconomic signals suggest a bullish outlook for the US dollar, as inflation remains above target which will require rates to remain higher for longer. Geopolitical events, such as the war in Ukraine and the US-China trade war, are also adding uncertainty and putting upward support on the value of the dollar.

Technical: The DXY has had a volatile run during the past nine months but it has been on a bullish tear since early summer as global economic uncertainty and sticky inflation strengthened the dollar. The near-term outlook under current conditions for the DXY are bullish and so are likely to remain above the $1.03 area.

Intermarkets are also reflective of the pessimistic outlook.

The S&P 500 looks bearish as price has fallen and is now below the 100-day moving average and indicates a lack of investor confidence.

The yield on six-month Treasury bonds looks stable and indicates investors positioning for rates being higher for longer. The price is around 5.5% while the Fed Funds rate was held at 5.50%.

CME Group 30-Day Fed Fund futures

November favours a hold and odds have climbed to 80% from 75% last week. A 0.25 hike chance has fallen to 18% from 25%.

December favours a hold at 65%. A 0.25 hike chance is at 30%.

EUR/USD Mixed

Euro Outlook Mixed as EA Economy Slows but Interest Rates Rise: The European Central Bank raised interest rates to 4.50% in September, signalling its commitment to bringing inflation back to 2%, even if it means slowing economic growth. The euro area economy has slowed but still has a cautiously optimistic outlook, with recent GDP contractions expected to recover and unemployment expected to remain steady. Macroeconomic signals suggest a mixed outlook for the euro, as the economy is slower than before and although inflation has fallen it still remains high. Geopolitical events, such as the gas dispute with Russia and the war in Ukraine, are also adding uncertainty and putting downward pressure on the value of the euro.

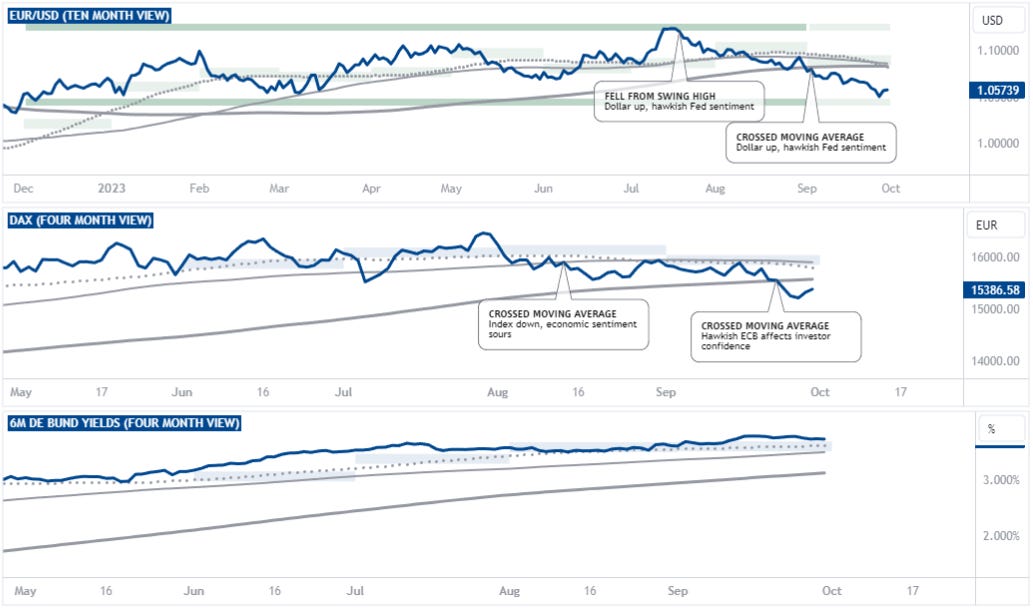

Technical: The EUR/USD has had a bullish run during the past nine months but it has been in retreat since early summer as economic uncertainty weakened the euro and strengthened the dollar. The near-term outlook under current conditions for the EUR/USD are mixed and so are likely to remain above the $1.04 area and below the $1.12 area.

Intermarkets are also reflective of the mixed outlook.

The DAX looks bearish as price has fallen and is now below the 200-day moving average and indicates a lack of investor confidence although it is climbing from the recent lows.

The yield on six-month German Bunds looks stable and indicates investors positioning for higher rates. The price is around 3.7% while the Main Refinancing Operations rate was hiked this month to 4.50%.

GBP/USD at Risk as UK Economic Outlook Darkens

Pound Outlook Bearish as UK Economy Slows, Inflation Remains High: The Bank of England kept interest rates at 5.25% in September, but said it is still committed to bringing inflation back to 2%. The UK economy is underperforming and has a gloomy outlook, with GDP growth expected to stagnate and unemployment expected to rise. Macroeconomic signals suggest a bearish outlook for the pound, as the economy slows and inflation remains high. Geopolitical events, such as the cost-of-living crisis and the war in Ukraine, are also adding uncertainty and putting downward pressure on the value of the pound.

Technical: The GBP/USD has been bullish over the past nine months, but is now in retreat being driven by the economic uncertainty along with a stronger dollar. The near-term outlook under current conditions for the GBP/USD suggests that it will see downside pressure that is likely to keep value under the four-month high of $1.31.

Intermarkets are moving in agreement with the UK’s pessimistic outlook.

The FTSE 100 looks bearish as price has fallen and is now below the 200-day moving average and indicates a lack of investor confidence.

The yield on six-month Gilt bonds looks bearish has fallen below its 50-day moving average and indicates investors moving out of equities and into the safety of bonds. The price is around 5.4% while the Bank rate was held this month at 5.25% which may be the terminal rate.

Economic Events of Interest

Monday, October 2nd

0700 (GMT +1) UK Nationwide House Prices: -0.4% expected vs -0.8% previously.

1000 (GMT +1) EA Unemployment Rate: 6.4% expected vs 6.7% previously.

1500 (GMT +1) US ISM Manufacturing PMI: 47.7 expected vs 47.6 previously. USD reaction likely to be minimal.

Tuesday, October 3rd

1500 (GMT +1) US JOLTS Job Openings: 8.83M expected vs 8.6M previously. USD reaction likely to be minimal.

Wednesday October, 4th

1000 (GMT +1) EA Retail Sales: -0.3% expected vs -0.2% previously. EUR reaction is likely to be weaker unless there is a high beat to the upside.

1500 (GMT +1) US ISM Services PMI: 53.6 expected vs 53.7 previously. USD reaction is likely to be minimal.

Friday, October 6th

1330 (GMT +1) US Non Farm Payrolls: 163K expected vs 150K previously. USD reaction likely to be mixed. A large downside miss would likely weaken the USD as may lead to slower growth and a less hawkish fed.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-