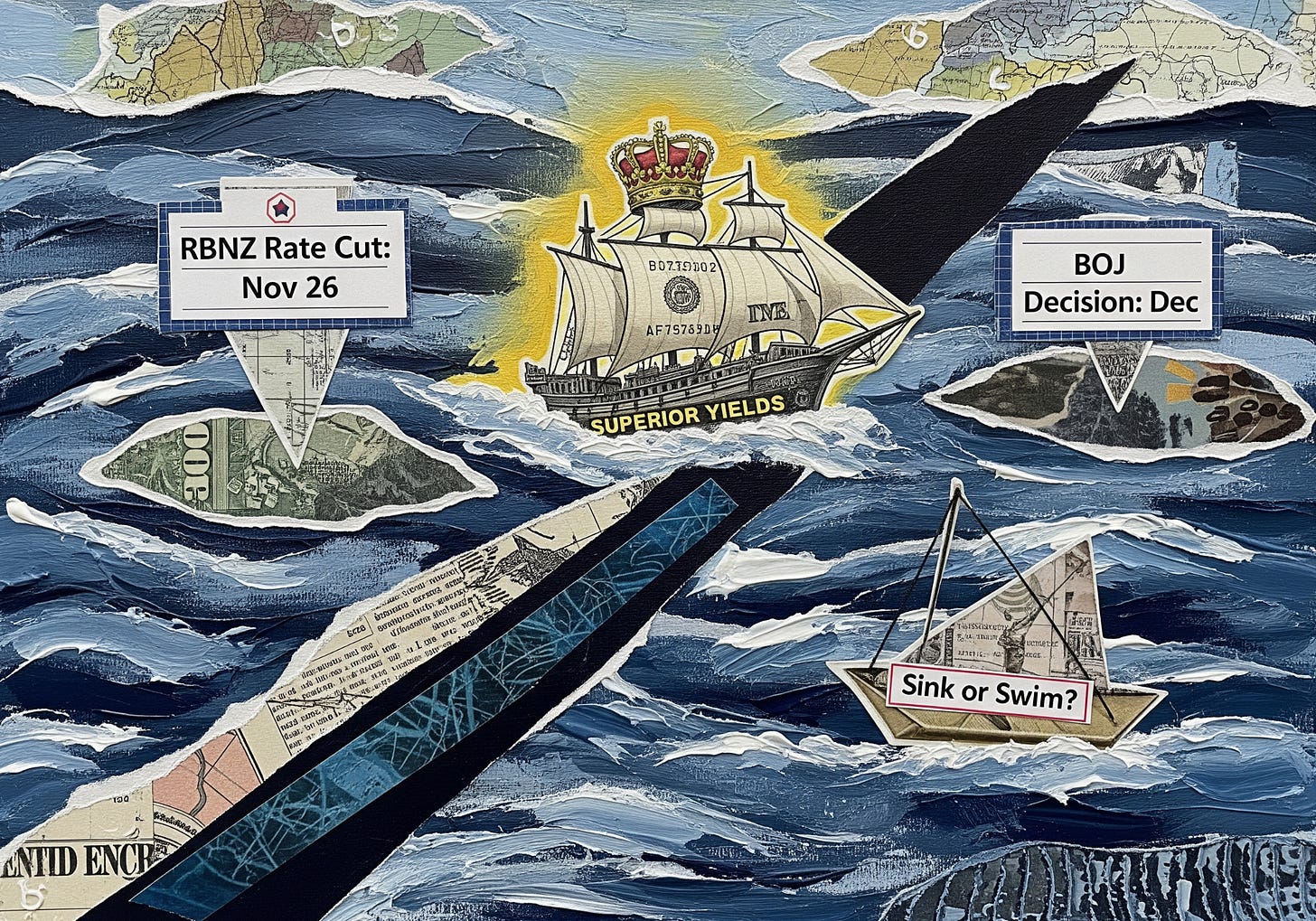

Navigating the Great Divergence

RBNZ DECISION AND INFLATION DATA TO DRIVE VOLATILITY

We are currently navigating the treacherous currents of the Great Divergence, where central bank policies are drifting apart. Our focus centers on the US Dollar, New Zealand Dollar, Australian Dollar, and Japanese Yen because they represent the opposing poles of this monetary divide. The Greenback is surging on economic exceptionalism, while the Kiwi and Yen are taking on water from dovish policies and fiscal anxieties. Meanwhile, the Aussie remains anchored by stubborn inflation, resisting the prevailing tides.

FROM STIMULUS FEARS TO DATA CONFIRMATION

Since October, we have weathered a violent shift in the tides, driven by a fracturing of global central bank consensus. The Reserve Bank of New Zealand’s “jumbo” 50 basis point cut on Wednesday, October 08, signaled a desperate pivot to support growth, effectively capsizing the Kiwi’s yield advantage. Conversely, the US Dollar found structural buoyancy as “US Exceptionalism” and the “Trump Trade” outweighed political dysfunction, with Q2 GDP hitting a stunning 3.8 percent despite the 43-day government shutdown. In Japan, the rise of Prime Minister Takaichi in October unleashed fiscal stimulus fears of a 25 trillion Yen package, sending 10-year JGB yields surging to 1.75 percent by mid-November while crushing the Yen as markets priced in debt monetization.

Looking ahead to the end of December, we are sailing into a dense data fog. The US Federal Reserve’s “Data Dump” in mid-December is expected to reveal the economy weathered the shutdown, confirming sticky inflation and scuttling bets for early 2026 rate cuts. The horizon holds a critical turning point for the Yen; the Bank of Japan meeting on Friday, December 19, could see a forced rate hike to 0.75 percent. Meanwhile, the Kiwi will struggle until the Half Year Economic and Fiscal Update on Tuesday, December 16, reveals the true extent of domestic damage.

NAVIGATING THE CENTRAL BANK STORM

Navigating the choppy waters since Week 47, the Australian Dollar initially found wind in its sails following a blockbuster jobs report but hit a squall on Tuesday, November 18. On that day, the RBA minutes confirmed a hawkish bias, yet commodity weakness weighed on sentiment. Simultaneously, the Global Dairy Trade auction saw prices plunge 3.0 percent, dragging the Kiwi toward the rocks near 0.5650 USD. The Yen faced a mutiny, plummeting until Friday, November 21, when verbal intervention regarding the 157.00 level momentarily steadied the ship against the Greenback.

Charting our course through Week 49, the RBNZ decision on Wednesday, November 26, is the imminent storm. A 25 basis point cut is fully priced, but dovish guidance regarding a terminal rate below 2.0 percent could break the hull at 0.5600 USD. Simultaneously, the Australian Monthly CPI indicator on the same day determines if the RBA maintains its hawkish heading; a print above 3.4 percent forces a repricing. For the US Dollar, the PCE inflation release on Thursday, November 27, is the sextant reading we need. A hot print confirms the “higher for longer” tack, likely pushing the Dollar Index through resistance before we hit the calm of the holiday liquidity drought in early December.

FINAL THOUGHTS

We are navigating a volatile sea of policy divergence. The US Dollar remains the undisputed king of the high seas, powered by superior yields. Watch the RBNZ’s rate cut on November 26 and the Bank of Japan’s critical decision in December; these coordinates will determine if we sink or swim.