Navigating the Week Ahead in Forex

Strength of Currencies for Week 24 2025

The US Dollar is set for a week of scrutiny as markets continue to process recent robust labour data and await critical inflation figures, all against the backdrop of ongoing US-China trade discussions. Commodity-linked currencies such as the Australian and New Zealand Dollars will also command attention, reacting to trade sentiment and important economic data from China.

Okay, here's a quick rundown of what's happening with major currencies:

US Dollar: Pretty solid right now and might tick up a bit. Looking further out, it could ease off in June, then get a bit choppy in July.

New Zealand Dollar: Fairly steady, might see a bit of a boost short-term. For June, it could weaken, then possibly pick up again in July.

Australian Dollar: Holding its own and could also get a bit stronger soon. Expect it to be fairly balanced in June and then potentially strengthen in July.

Japanese Yen: A bit on the weaker side and could dip further. June might see it stabilise a bit, but July could bring more downward pressure.

Swiss Franc: Stable for now. It might get a bit stronger in June before weakening slightly in July, but generally staying neutral.

Euro: Looking a bit weak and likely to face some headwinds. This trend could continue through June and into July, though July might see a bit more stability.

British Pound: Hanging in there but could face some downward pressure. Expect it to weaken a bit in June and then level out in July.

Canadian Dollar: Quite weak at the moment and likely to head lower. It's looking to be even weaker in June before seeing some slight improvement in July, but still generally under pressure.

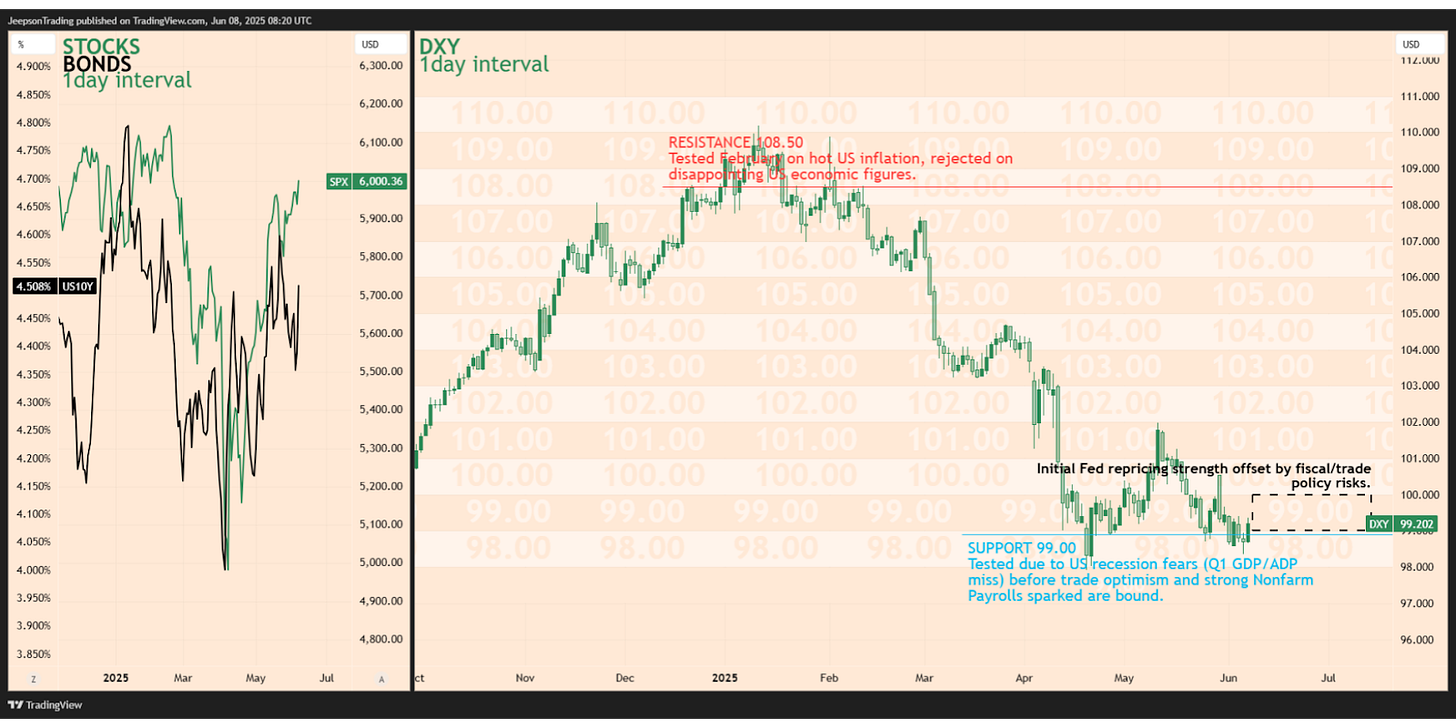

United States Dollar (USD)

The US Dollar's been on a bumpy ride, reacting to US-China trade, Fed shifts, and debt ceiling worries. These are still the main drivers, plus key US inflation data this week. The Dollar seems pretty solid now, maybe edging up short-term. Longer out, it's more uncertain. It could weaken or get choppy due to government money worries and trade being so unpredictable, even if the US economy does well. So, watch the inflation data and trade news.

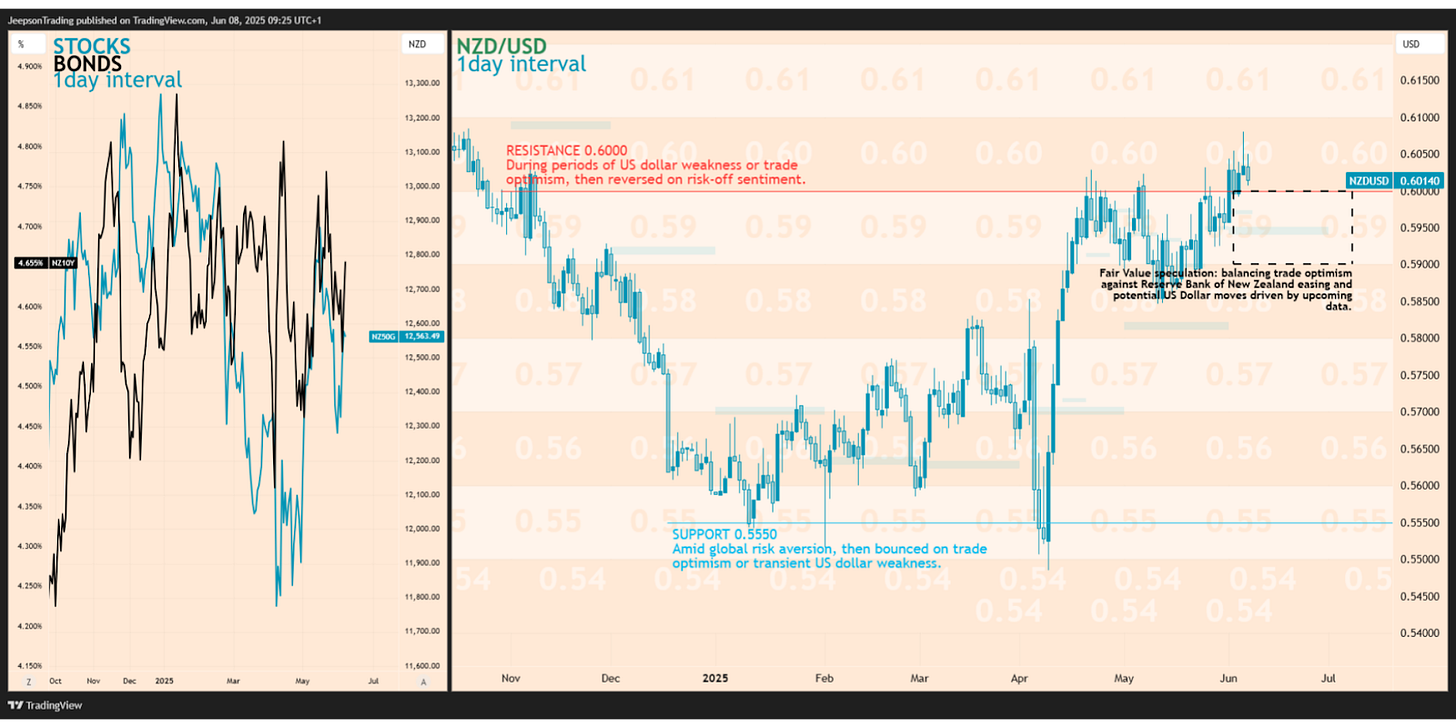

New Zealand Dollar (NZD)

The Kiwi dollar's been swayed by US-China trade, talk of NZ rate cuts, and dairy prices. It’s held up well on recent trade optimism, even though a rate cut here is still widely expected. Looking ahead, trade deals, dairy trends, and our central bank's moves (especially July 8th) will be key, along with local economic data. This week, trade news is front and centre, plus a local business survey. Fundamentally, the Kiwi's pretty neutral. It might see a small lift short-term if trade hopes continue. Further out, it's a mixed picture – depends on investor risk appetite and central bank signals versus their inclination to cut rates. Watch Thursday’s business report and any trade updates.

Australian Dollar (AUD)

The Aussie dollar's recent ups and downs have been all about US-China trade news, what our Reserve Bank's doing (they cut rates and might again), mixed local economic numbers, and China's demand for our iron ore. Lately, the Aussie got a bit of a lift from hopes around US-China trade talks and better iron ore prices, despite the central bank still leaning towards more cuts.

Looking ahead, the Aussie's path will really depend on how those trade talks go, China's economic health, and future RBA moves. Iron ore prices are still a biggie. This week, China's economic data on Monday is key, as is any trade talk news.

Right now, the Aussie dollar's fundamentals are pretty balanced. It might get a slight boost this week if we see good Chinese data and positive trade talk vibes. Longer out, it's a mixed bag—could be okay or even a bit stronger, but it really hinges on whether good news from overseas can offset the RBA's inclination to cut rates here. Keep an eye on Monday's China data, Tuesday's local confidence numbers, and any hints from the RBA on Thursday. And, as always, US-China trade news will be a major factor.

Japanese Yen (JPY)

The Yen often gets a boost when markets are jumpy, but higher US rates and a cautious Bank of Japan (BoJ) tend to pull it down. It lost some ground recently with better US-China trade vibes and the Fed sounding firmer than the BoJ. Key drivers ahead are global risk, especially US-China trade and Fed moves, along with the BoJ's June meeting and Japan's economy. This week, watch Japan’s final Q1 GDP and trade talk news. The Yen seems a bit weak now and could dip short-term. Longer-term, expect choppiness or weakness due to differing central bank policies and Japan’s softer economy, though it might pop on market scares. So, that GDP and trade news are the main things to watch.

Swiss Franc (CHF)

The Swiss Franc usually gets stronger when markets are nervous, but the central bank (SNB) is always working to keep it from climbing too high because of deflation worries—they've even cut rates and might do more. So, global risk, especially around trade, is a big driver. That SNB meeting on June 19th will be important too. For this week, Tuesday's consumer confidence numbers are worth watching. Overall, the Franc looks pretty stable, as the SNB’s cautious stance will likely limit any big jumps, even if investors are looking for safety. Still, major trade news could always shake things up.

Euro (EUR)

The Euro's been influenced by changing ideas about what the European Central Bank (ECB) might do, mixed economic news from Europe, and how investors feel about US trade actions. It dipped a bit lately against a stronger US dollar, even though the ECB did cut rates as expected, because ECB President Lagarde hinted they might hold off on more cuts for now.

Coming up, US-EU trade (especially that July 9th tariff deadline), what the ECB says next about its plans, and how Europe's economy stacks up against the US will be really important for the Euro. This week, the main thing is how ECB policy compares to the US, plus we'll get industrial production numbers on Friday. Keep an ear out for any ECB officials speaking.

The Euro seems a bit weak fundamentally right now and might struggle a bit this week and in the weeks ahead. This is mostly because its interest rate policy is different from the US, and there's a real worry about possible US tariffs on European goods. Watch Friday's industrial figures and any comments from the ECB. Also, if US-China trade optimism really takes off, that could make the US dollar even stronger, which wouldn't help the Euro.

British Pound (GBP)

The Pound's been moving based on how risky investors are feeling, economic data, and expectations the Bank of England (BoE) might cut rates. It lost a bit of ground recently as the US dollar got stronger and everyone started looking towards the UK's Spending Review and upcoming economic numbers.

Looking ahead, that Spending Review on June 11th is huge, along with inflation and growth figures that'll feed into the BoE's meeting on June 19th. Global trade, especially anything happening with US-EU tariffs, will matter too. This week, the Spending Review is the big domestic event, but we've also got key UK jobs, wages, and GDP data coming out.

Fundamentally, the Pound's in a neutral spot right now. It could feel a bit of downward pressure, or just stay flat, this week and in the coming weeks. That's because the BoE is dealing with slow growth and inflation, and the Spending Review or trade issues could add more headwinds.

So, key things to watch: Tuesday's retail sales, jobs, and wage data. Wednesday is the big Spending Review, and the BoE Governor speaks. Then Thursday, we get April GDP numbers. Weak figures anywhere there could push the Pound lower.

Canadian Dollar (CAD)

The Canadian Dollar (CAD) has really struggled lately. The economy shrank in the first quarter, and job numbers have been worryingly weak. Oil prices have been up and down, and US trade policies haven't helped. The Bank of Canada (BoC) already cut rates and is under pressure to do more. Just last week, the CAD weakened again after a really bad May jobs report, making more BoC rate cuts look likely, even though oil prices firmed up a bit.

Looking ahead, what the BoC does next will be key – and they'll be watching inflation and growth numbers closely. Oil prices and US-Canada trade will also be big factors. That awful May jobs report makes it very likely the BoC will signal more easing soon. This week, the market will still be reacting to those bad job numbers, and people will be expecting the BoC to act. This will probably matter more than what oil prices are doing.

Right now, the CAD is looking pretty weak. It's likely to feel some downward pressure this week and in the weeks ahead. That's mainly because everyone expects the BoC to ease policy due to the fragile economy, especially when you compare it to what's happening in the US.

So, the main thing this week is just watching how the market continues to react to last week's terrible job news. There isn't much Canadian data out, but any other bad news would just confirm that the BoC will probably ease. Oil price swings are always a risk, but for now, it's really all about what the BoC might do.

Key Takeaways and Concluding Thoughts

The foreign exchange market in the week ahead will likely be principally driven by the ongoing reassessment of Federal Reserve monetary policy expectations, developments stemming from US-China trade negotiations, and crucial US inflation data. Diverging monetary policy outlooks among other major central banks will persist in creating both opportunities and risks. Traders should remain vigilant for any unexpected economic data releases and shifts in geopolitical sentiment, as these factors can rapidly alter currency valuations. Maintaining a clear comprehension of each currency's fundamental drivers and associated risk factors will be indispensable for making informed trading decisions.

Top Five Events for the Upcoming Week (June 09 - June 13, 2025):

Monday, June 09: China May CPI, PPI, and Trade Balance. These are important indicators for gauging the economic health and demand from the world's second-largest economy, which will significantly impact commodity-linked currencies like the AUD and NZD, as well as broader global risk sentiment.

Wednesday, June 11: US May Consumer Price Index (CPI). This is a critical inflation measure that will heavily influence expectations for Federal Reserve policy and the direction of the US Dollar.

Wednesday, June 11: UK Government Spending Review. This event has the potential to be a major domestic driver for the British Pound, affecting the UK's fiscal outlook and overall sentiment towards its assets.

Thursday, June 12: US May Producer Price Index (PPI). This release will provide further insight into US inflation trends, complementing the CPI data and impacting the outlook for Fed policy and the US Dollar.

Thursday, June 12: UK April GDP figures. A key indicator of the UK's economic health that will influence Bank of England policy expectations and the value of the GBP.