NEW ZEALAND, AND THE NZD: A FUNDAMENTAL ANALYSIS

New Zealand’s coalition governance emphasizes fiscal discipline with annual operating allowances set at NZD 2.4 billion to 2028, navigating deficit reduction and targeted infrastructure investments over the medium term.

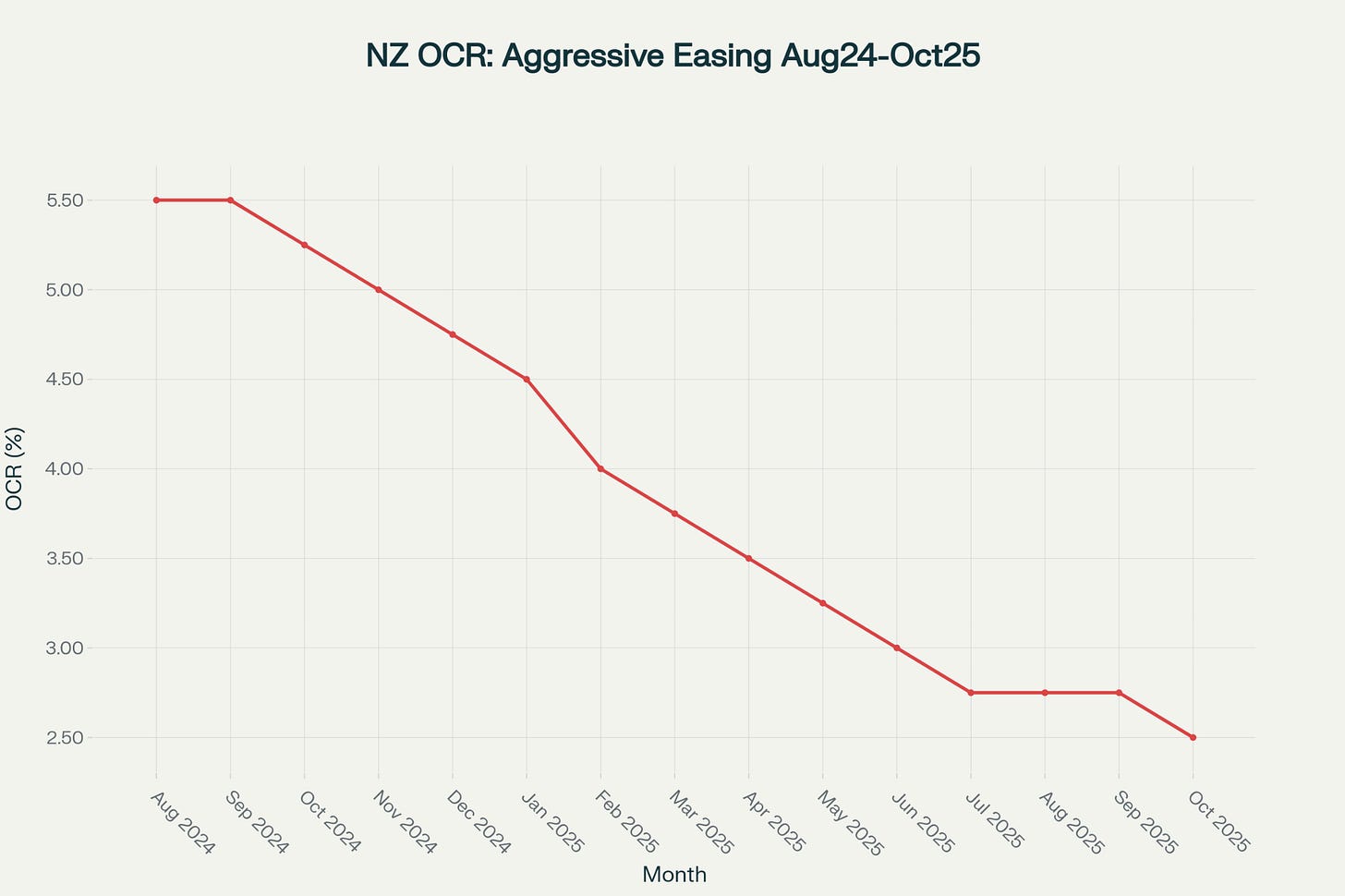

The Reserve Bank aggressively eased monetary policy, cutting the Official Cash Rate by 300 basis points to 2.50 percent from August 2024 to October 2025, aiming inflation toward the 2.0 percent midpoint.

Export sector, led by dairy, delivered a nineteen percent surge in September 2025 despite annual GDP contraction amid recovering global demand, particularly in China and Australia.

Political debate on Treaty Principles, moves toward a four-year parliamentary term referendum, and a new central bank Governor shape the governance agenda.

Budget 2025 tightens spending and reforms KiwiSaver, while the central bank prepares further rate cuts and regulatory shifts under newly appointed Governor Anna Breman.

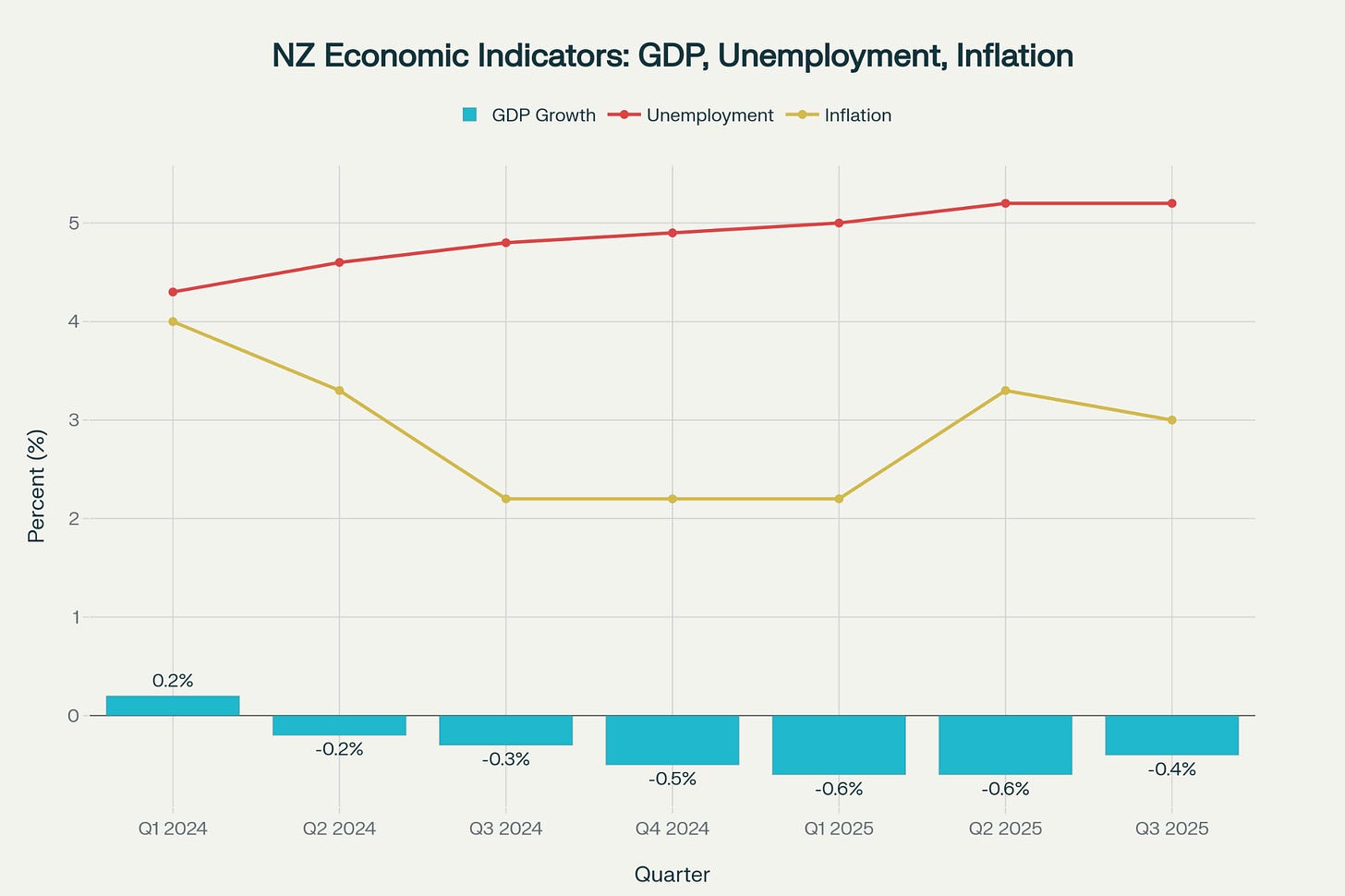

Unemployment rose to 5.2 percent in Q2 2025, inflation held at 3.0 percent in Q3 2025, and per capita GDP remains below pre-crisis highs.

The economy’s recovery is dependent on export strength, cautious fiscal policy, and effective monetary transmission, with headwinds from global volatility and weak domestic demand.

GOVERNMENT PRIORITIES AND FISCAL STRATEGY IN CONTEXT

NEW ZEALAND’S POLITICAL STRUCTURE: NAVIGATING COALITION GOVERNANCE

New Zealand adopted its current parliamentary structure under a constitutional monarchy in 1852, now led by Prime Minister Christopher Luxon’s coalition government formed post-October 2023 elections. The governing team unites National Party, ACT New Zealand, and New Zealand First, reflecting a conservative pivot in domestic politics. A Cabinet system holds ministers across key portfolios, including Finance (Nicola Willis), Regulation (David Seymour), and Foreign Affairs (Winston Peters), balancing party priorities in public sector, law-and-order, and social investment.

Mandates since November 2023 center on economic repair, cost-of-living relief, and bureaucratic reform. The government’s “100-day Plan” fast-tracked legislation to streamline water management, restore landlord tax deductibility, focus monetary policy on inflation only, and scale back previous social programs. National targets for outcome-based progress by 2030 span health, education, and employment, demonstrating the coalition’s intent to reshape long-term performance review.

DEFICIT MANAGEMENT AND FISCAL CONSOLIDATION: RECENT EVOLUTION

Over seven months to October 2025, fiscal policy shifted toward consolidation following years of rising core expenses and expanding deficits. Budget 2025, presented 22 May, signaled stricter allowances; the main operating allocation for 2025 fell to NZD 1.3 billion, with subsequent years set for NZD 2.4 billion. The capital allowance was increased to NZD 4.0 billion. Treasury forecasts projected a deficit of NZD 12.1 billion for 2025/26, with the government targeting a return to a marginal surplus by 2028/29.

Major policy directions included the Investment Boost (accelerating capital deduction for businesses), KiwiSaver contribution and eligibility reforms, and NZD 1.7 billion invested across hospitals and schools. Public sector performance plans required ministries to operate within stricter baselines, with Wellington being notably affected by workforce reduction. Net core Crown debt remained near 42 percent of GDP in 2024; forecasts aim for a gradual decline toward 40 percent and lower over the medium term.

DEFICIT REDUCTION PATHWAY: FORWARD-LOOKING POLICY

The next seven weeks pivot around the Half Year Economic and Fiscal Update (16 December 2025), which will reflect Q2 economic weakness and recalibrate deficit, debt, and revenue forecasts. Parliament expects challenging revisions, as Budget 2025 projections may prove optimistic. However, the government maintains commitment to spending restraint and deficit reduction without abrupt service cuts, drawing lessons from historical consolidation periods targeting gradual savings via expenditure and revenue mix.

Infrastructure and health allocations remain protected, but benefit and debt servicing costs present risks for the fiscal balance. Treasury’s long-term warning on aging demographics and rising superannuation costs underscores the need for continued discipline. Genuine recovery will hinge on meeting these fiscal goals without stalling domestic demand or damaging essential service delivery.

CENTRAL BANK TRANSITIONS AND MONETARY POLICY IN NEW ZEALAND

RBNZ LEADERSHIP AND STRUCTURE: STEERING THE BANK INTO 2026

The Reserve Bank of New Zealand (RBNZ), with statutory independence, underwent marked leadership transition in 2025. Governor Adrian Orr resigned in March after friction over budget and strategic direction. Acting Governor Christian Hawkesby remained incumbent until September when Dr. Anna Breman, former First Deputy Governor at Sweden’s Riksbank, was named successor (effective from December 1). Board restructuring reduced director-level roles to streamline oversight and ensure agility amid budget constraints. The government renewed RBNZ’s primary mandate to price stability, dropping dual employment targets for a narrower inflation focus.

A newly created Financial Policy Committee will launch in early 2026, strengthening prudential oversight and bank lending ratios. Chair transitions and board independence reforms target more robust checks and balances for monetary decision-making, aligning with international best practices.

MONETARY EASING IN A FRAGILE ECONOMY: RECENT POLICY ACTIONS

Over seven months to October, the RBNZ delivered 300 basis points of rate cuts (Official Cash Rate to 2.50 percent as of October 8), supporting economic recovery after annual GDP contraction. The February 2025 Statement saw a 50 basis point cut, and the October move delivered a larger-than-expected reduction amid persistent slack and consumer caution.

Inflation stayed at the upper bound (3.0 percent Q3), yet forward-looking indicators (2-year expectations at 2.28 percent) show anchoring near target. Business confidence faded, characterized by hiring reduction and muted investment intentions. Loan-to-value ratios for housing will be eased from December, to aid credit flow and support the residential market. Mortgage rates have trended down, providing relief to indebted households.

MONETARY OUTLOOK: LATE 2025 AND BEYOND

November’s Monetary Policy Statement points to an additional 25 basis point cut; economists are split on the outlook for 2026 but most expect rates will bottom near 2.00-2.25 percent. New Governor Anna Breman’s entry may bring enhanced transparency and communication strategy. Her first policy meeting in February 2026 will set the tone for future central bank direction.

Risks persist: inflation remains at ceiling, while excessive rate cuts could reignite price growth. The RBNZ signals willingness to pause should forward-looking measures stabilize; wholesale interest markets mostly price in one further cut.

NEW ZEALAND’S ECONOMIC STRUCTURE AND INTERNATIONAL LINKS

ECONOMIC FOUNDATIONS, INDUSTRIAL STRENGTHS, AND TRADE PARTNERS

New Zealand’s economy is strongly weighted to primary industry, especially dairy, meat, horticulture, and forestry. Dairy remains the largest export earner (over one-third of goods export earnings), with leading firms including Fonterra, The a2 Milk Company, and robust horticulture and wine export sectors. Services (notably tourism and international education) form the bulk of GDP, with recent years highlighting tourism’s slow recovery post-pandemic.

China is the largest export destination (29 percent, primarily dairy and horticulture), followed by Australia (15 percent), USA, Japan and South Korea. September 2025 marked a nineteen percent export surge (NZD 5.8 billion), narrowing the annual trade deficit to near balance due to rising dairy and kiwifruit sales. Imports remain China-heavy, with smaller volumes from Australia, USA, and Japan.

Market structure shows pronounced volatility, with commodity cycles and global risk conditions exerting powerful influence over GDP, inflation, and employment.

RECENT ECONOMIC PERFORMANCE: SEVEN-MONTH REVIEW

Annual GDP contracted 0.6 percent in Q2 2025, with per capita GDP down 4.6 percent since 2022. Unemployment rose to 5.2 percent in Q2, while inflation held at 3.0 percent in Q3. Dairy export values expanded twenty-seven percent year-on-year in September; broader business and consumer sentiment remained cautious despite monetary stimulus. Retail activity and construction lagged, while provincial centers like Waikato and Southland benefited directly from farm income.

PRIMARY SECTOR MOMENTUM AND SERVICES DRAG: EXPORTS LEAD RECOVERY

Strong export results offset domestic weakness, with Fonterra projecting NZD 10.00-11.76 per kilogram for farmgate milk solids in 2025/26. Infrastructure investment—NZD 6 billion in government-funded projects for second-half 2025—aims to support growth and employment, notably in hospitals and schools.

Forecasts through end-2025 anticipate slowly returning growth: Treasury and banks project one to two percent GDP expansion, with Budget 2025 expecting 2.9 percent average growth for 2025/26. Headwinds persist as property, employment, and consumption remain subdued.

NOTABLE NEWS AND FUTURE EVENTS: SOCIAL, POLITICAL, AND ECONOMIC CONTEXT

POLITICAL CONTROVERSIES AND POLICY EVENTS: PAST SEVEN MONTHS

April’s defeat of the Treaty Principles Bill (10 April, 112-11 vote) quieted one of New Zealand’s most contentious debates in recent history, following mass November 2024 protests. New Zealand First and ACT continue to push Treaty reform, with Māori and opposition leaders speaking against perceived government overreach.

Adrian Orr’s resignation triggered a global search for new RBNZ leadership, culminating in Anna Breman’s appointment (announced 23 September). May’s Budget 2025 formalized consolidation, while September marked the passage of regional infrastructure funding and key health investments.

Parliamentary reforms saw movement toward a four-year term bill, with select committee reviews highlighting bipartisan support and constitutional complexity. Wellington endured large-scale public sector job losses, affecting economic performance in regional hubs.

Agricultural sector shifted as Fonterra announced a NZD 4.22 billion consumer business sale to Lactalis, planning a NZD 2 per share return to farmer-shareholders early 2026.

UPCOMING EVENTS AND POLICY SHIFTS: SEVEN-MONTH OUTLOOK

The next seven months will bring decisive banking, fiscal reporting, and governance changes. November’s RBNZ review, December’s HYEFU, and February’s first Breman-chaired monetary policy meeting will clarify the recovery path. The infrastructure program is set to ramp up, providing a critical test for employment and regional growth.

The four-year term referendum awaits further clarification and alignment with local government cycles; likely timing is 2026, possibly concurrent with general elections. Continued debate around Treaty clauses and Māori rights is expected, influencing social and legal reform agendas.

New Zealand’s export performance will hinge on China’s demand and global commodity prices. Dairy sector continuation and planned Fonterra returns may provide a rural boon. Budget 2026 development in mid-2026 will challenge the government’s ability to maintain strict fiscal discipline amid pressure on public services.

International events—Australian and Chinese economic shifts, global trade tensions—will weigh directly on New Zealand, with risks and opportunities concentrated in early 2026.

CONCLUSION AND TAKEAWAYS

New Zealand’s economy is like a ship threading cautiously through treacherous coastal waters—tailwinds from monetary easing fill the sails of exports, yet sluggish domestic winds leave the decks quiet. The coalition government, at the helm, must steady the rudder of inflation with fiscal discipline as a new captain prepares to take command at the central bank. In the coming seven months, the nation will learn if it can steer toward sheltered harbors or must trim its sails for a fresh heading beneath overcast skies. Smooth sailing will rely on keeping the crew of policies in sync, riding the tides of global change, and ensuring every part of the ship weathers the journey.