NFP Pivotal to the Direction of the Dollar

Dollar Forex Playbook for JULY (Updated post FOMC)

INTENDED USE: Trade planning guidance for the US Dollar.

DERBYSHIRE GB / July 31st, 2023 - Updated following the July 26th FOMC meeting and hike. Next update is expected after the NFP data on Friday the 4th of August or before if any significant event occurs.

Macroeconomic Snapshot

The macroeconomics situation of the US has improved more than anticipated and is likely to improve further. This is expected to reduce upward support on the dollar’s value.

Federal Reserve’s (Fed), Federal Open Market Committee (FOMC)

The FOMC hiked interest rates by 0.25%, as expected. This is the highest level since 2001 and the Fed could raise rates again although the base case is to hold. The next meeting is on September 20th.

The interest rate situation is likely to lead to stabilised bond yields which may dissuade investors and may limit upward support on the value of the dollar.

Gross Domestic Product (GDP) Growth Rate

Over four years, GDP has been volatile with a low of 3.9% in Q4 ‘20 to a high of 7% in Q2 ‘21 but has been steady for the past six months. Q2 first estimate came in strong at 2.4% annualised expansion from 2.0% in Q1 2023 and beat expectations. The FOMC has a 2023 change in real GDP at 1.0% although Trading Economics are less optimistic with a Q3 2023 annualised growth forecast of 0.60%. The second estimate Q2 report is due on Thursday the 30th of August

GDP is anticipated to slow and see less investor confidence in US stocks which may limit downward pressure on the value of the dollar.

Consumer Price Index (CPI)

Over four years, CPI has been volatile with a low of 0.1% in May ‘20 to a high of 9.1% in June ‘22 but has been falling quickly for the past six months. June slowed to 3.0% annual inflation from 4.0% in May, slightly better than expectations. The FOMC has a 2023 PCE projection (PCE is not CPI) at 3.2% although Trading Economics are more optimistic with a Q3 2023 CPI forecast of 2.5%. The July report is due on Thursday the 10th of August.

CPI is anticipated to stabilise, leading to a less tight monetary policy and potentially support growth which may limit upward support the value of the dollar.

Labour

Over four years, unemployment has fallen from a high of 14.7% in Apr ‘20 to a low 3.4% in Apr ‘23 but has stabilised in the past six months. June fell to 3.6% unemployment from 3.7% in May as expected. The FOMC has a ‘23 unemployment rate projection at 4.1% although Trading Economics are more optimistic with a Q3 ‘23 forecast of 3.8%. The July report is due on Friday the 4th of August.

Unemployment is anticipated to climb slightly, potentially leading to reduced economic growth and US stocks which may limit downward pressure on the value of the dollar.

Russian Invasion of Ukraine

The war is having a detrimental effect on the global and US economy by causing higher energy prices, higher food prices, higher inflation and is impacting economic growth. This is expected to limit the downward pressure on the dollar’s value.

China-US Trade War

The trade war is having a detrimental effect on the global and US economy by causing higher prices for consumers, increased uncertainty for businesses, disrupted supply chains, job losses and is impacting economic growth. This is expected to limit the downward pressure on the dollar’s value.

DXY Longer Term (Four Months)

The US Dollar Index (DXY) has formed a downtrend since the start of June when investors began to price a lower peak interest rate which weakened the dollar. This dovish sentiment has been retraced three times as the Fed has not yet shown any signs that they will look to begin lowering rates in the near future. The DXY is currently retracing from the lows below 100.00 and testing the 38.20% fib. The downtrend will be broken on moves beyond the 78.60% level.

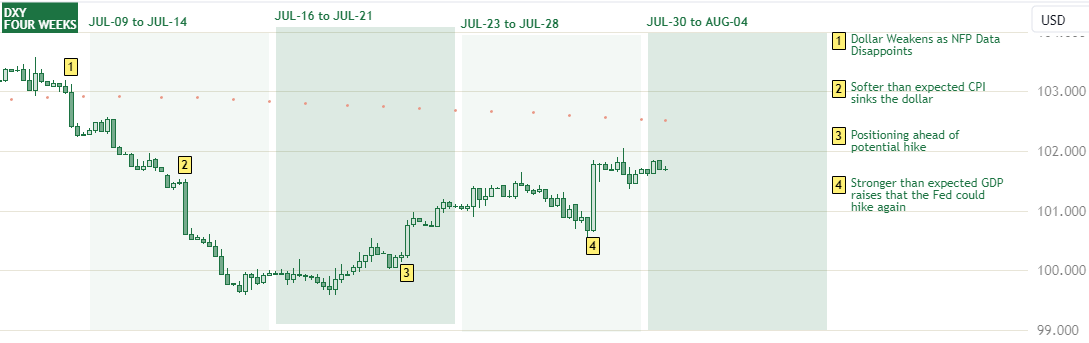

DXY (Four Weeks)

The US Dollar Index (DXY) has lost value over the previous three weeks, pressured by a cooling CPI although a stronger than expected economy raises the prospect of another hike.

Outlook

The events to keep an eye on:

Tuesday the 1st of August

JOLTS Job Openings improvement to 9.6M exp. from 9.8M prev.

Wednesday the 2nd of August

ADP Non-Farm Employment Change Big fall to 195K exp. from 497K prev.

Friday the 4th of August

Average Hourly Earnings slight fall to 0.3% exp. from 0.4% prev.

Non Farm Payrolls fall to 200K exp. from 209K prev.

Unemployment Rate remain at 3.6% exp.

CME Group 30-Day Fed Fund futures

September: rising sentiment of a hold, 78% in favour, 22% for a 0.25 hike

November: rising sentiment of a hold, 67% in favour, 30% for a 0.25 hike

Six Month Bond Yields

Treasuries: slightly rising at 5.55% from 5.50% last week

Long Term Value of the US Dollar to Stabilise: As the Federal Reserve appears to plan on keeping rates at a high level for a lengthy period, growth may be limited which could see investors move hold onto some dollar safe havens. The US Dollar Index (DXY) over the long term is expected to retain its four month downtrend and remain below the 103.5 retracement unless NFP significantly beats its forecast.

Short Term Value of the US Dollar to Stabilise: The stronger than expected GDP data supported the dollar higher as investors look to caution themselves against a potential further hike although that is not the base-case. The US Dollar Index (DXY) over the short term is expected to remain above 100.00 unless NFP comes in below its forecast.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-