Pound Sterling Forex Reference - JUNE (BoE Update)

DERBYSHIRE GB / JUNE 22nd, 2023 - Bank of England hikes 50bps due to high and sticky inflation. Next update after the final Q1 GDP report on Friday the 30th of June, or before if any significant event occurs.

This is the Pound Sterling Forex Reference and contains factual information that has been researched from official sources as well as market commentators. It is intended to be used as a guide to aid in your analysis.

ABOUT

The pound sterling, or GBP, is the official currency of the United Kingdom. It is the oldest currency in continuous use and is the fourth most traded currency in the world.

MONETARY POLICY

The Bank of England

The Bank of England is the Central Bank of the United Kingdom and monetary policy decisions are made by the nine members of the Monetary Policy Committee (MPC).

June Meeting of the Bank of England’s, Monetary Policy Committee (MPC)

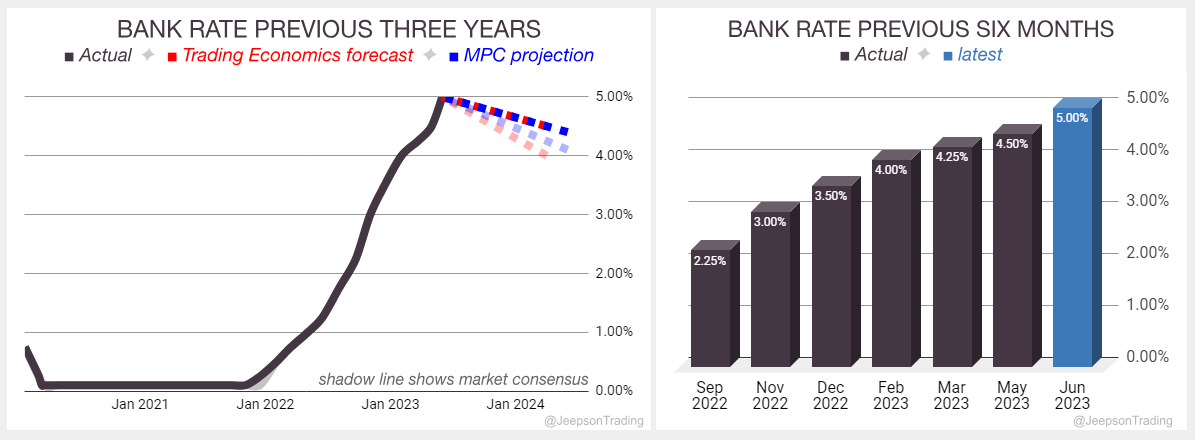

The Bank Rate was hiked by 0.50% in June to 5.00%, higher than the 0.25% hike in May

This was higher than the 0.25% hike expected by analysts

This was the twelfth consecutive rate hike since the tightening cycle began in December 2021

The Monetary Policy Report (printed in May) projection for the Bank Rate in Q2 2023 was slightly raised to a peak of 4.4% from the 4.3% which was projected in February

Trading Economics have retained their Q2 2023 Bank Rate forecast at 4.75%

The next meeting is on Thursday the 3rd of August

The Monetary Policy Committee‘s statement contained cautiously optimistic sentiments and a forward-looking data-dependant approach to monetary policy:

7/9 voted to increase Bank Rate by 0.50 percentage points to 5.0%

Concerned about the persistence of inflationary pressures in the economy

Will monitor indications of persistent inflationary pressures and tighten further if required

Will adjust Bank Rate as necessary to return inflation to the 2% target sustainably in the medium term, in line with its remit.

Sources: The Bank of England, Trading Economics, FXStreet

May 2023 Monetary Policy Report

The Bank of England's Monetary Policy Committee (MPC) revised its economic forecast for the UK at their May meeting. They will update them again in August.

Increased the Bank Rate by 0.25 percentage points, to 4.5%

Expects CPI inflation to fall sharply from April, but to remain above the 2% target in the medium term

Continuing to address the risk of more persistent strength in domestic price and wage setting

Continuing to closely monitor indications of persistent inflationary pressures

Will adjust Bank Rate as necessary to return inflation to the 2% target sustainably in the medium term

Inflation has been rising sharply in recent months, driven by

the war in Ukraine

rising energy prices

supply chain disruptions

The MPC is concerned that inflation could become entrenched if it is not brought under control

The raising of the Bank Rate is to slow the pace of economic growth and bring inflation back down to the 2% target

ECONOMIC DATA

Gross Domestic Product (GDP)

Measures the quarter on quarter change of the inflation-adjusted value of produced goods and services.

GDP Growth Rate Preliminary Estimate for Q1 2023

GDP in the UK for Q1 remained steady at a 0.1% quarterly expansion from 0.1% in Q4 2022

This also matched the 0.1% expansion expected by analysts

Driven by construction and manufacturing. Services and household consumption were flat

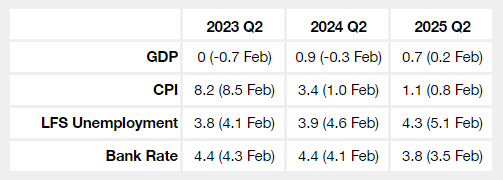

The May Monetary Policy Report projection for the Q2 2023 Real GDP was significantly raised to 0.00% growth from a contraction of -0.7% which was projected in February

Trading Economics have raised their Q2 2023 growth forecast to 0.3% from 0.2%

The final Q1 report is due on Friday the 30th of June

Sources: Office for National Statistics, Trading Economics, FXStreet

CONSUMER PRICE INDEX

Measures the yearly change in the price of goods and services purchased by consumers.

CPI Report for May

CPI in the UK for May remained at 8.7% annual inflation from 8.7% in April

This was a lot higher than the 8.4% expected by analysts

Inflation driven by rising prices for air travel, recreational and cultural goods and services, and second-hand cars. Core CPI is 7.1%, a new 30-year high

The May Monetary Policy Report projection for the Q2 2023 CPI was lowered to 8.2% inflation from 8.5% inflation which was projected in February

Trading Economics have lowered their Q2 2023 CPI forecast to 7.5% from 8.0%

The June report is due on Wednesday the 19th of July

Sources: Office for National Statistics, Trading Economics, FXStreet

LABOUR

Unemployment rate measures the number of people actively looking for a job as a percentage of the labour force.

Labour Report for April

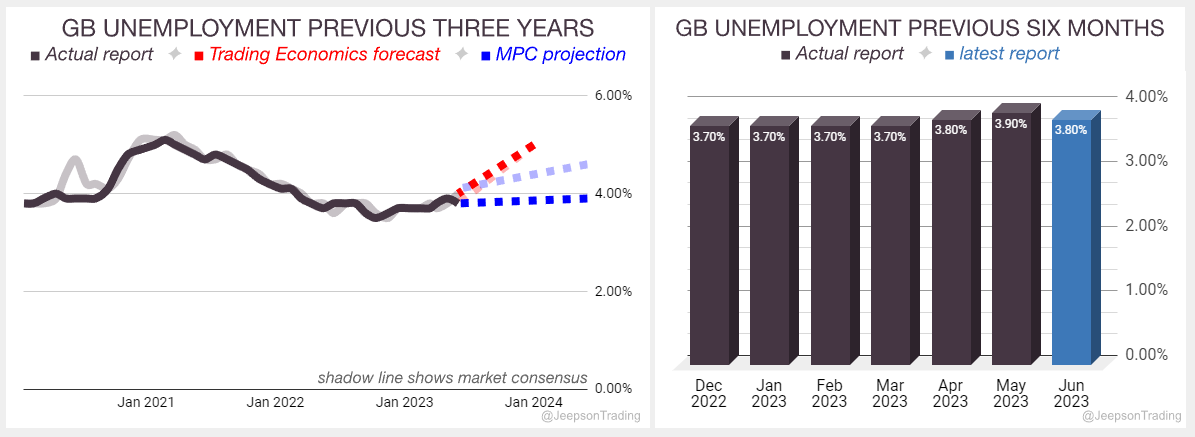

Unemployment in the UK for April fell slightly to 3.8% from 3.9% in March

Lower than the 4.0% expected by analysts

Employment improved to 76% from 75.8%

The May Monetary Policy Report projection for Q2 2023 unemployment was lowered to 3.8% from 4.1% which was projected in February

Trading Economics have retained their Q2 2023 unemployment rate forecast at 4.0%

The May report is due on Tuesday the 11th of July

Sources: Office for National Statistics, Trading Economics, FXStreet

MARKET NARRATIVES

Cost-of-Living Crisis

The cost-of-living crisis has reduced the spending power of consumers and resulted in slower economic growth. This is likely to lead to reduced foreign investment in the stock market and is expected to apply downward pressure on the pound’s value.

Since late 2021, the prices of essential goods have been rising faster than incomes. This has caused a fall in real income which means people now have less money to buy the things they need.

There are a number of factors that have contributed to this rise in prices, including inflation, the COVID-19 pandemic, Russia's invasion of Ukraine, and Brexit.

2023: Strikes continue and further sectors join in such as education.

2022: Government assistance provided with energy bill cap and a minimum wage increase fails to solve the crisis and employees strike from several sectors such as transport, health and services. Some strikes are resolved but the majority are ongoing.

GEOPOLITICAL EVENTS

Russian Invasion of Ukraine

The war is having a detrimental effect on the global and UK economy by causing higher energy prices, supply chain disruptions, financial market volatility, refugee crisis and geopolitical uncertainty.

2021: 92,000 Russian troops are amassed at the Ukraine border and President Putin proposes a prohibition of Ukraine joining NATO which is rejected.

2022: On the 21st of February, President Putin ordered Russian forces to enter the separatist republics in eastern Ukraine and announced recognition of the two pro-Russian breakaway regions (Donetsk People's Republic and Luhansk People's Republic). NATO applied sanctions and scaled them up as the war progressed. Ukraine mounted a counter-offensive which regained lost territory and as winter arrived, a stalemate began.

2023: Russian began a new offensive in January although gained little ground. In early June, Ukraine began its counteroffensive.

Brexit

The UK's decision to leave the European Union (EU) has created a great deal of uncertainty about the future of the UK economy. This uncertainty has made investors less willing to take risks, which has led to a sell-off in risky assets, such as stocks and currencies.

2014-2015: The euro-sceptic party UKIP garners support and scores the most seats in the EU parliament election. The Conservatives win the 2015 general election and as promised in the manifesto, PM Cameron arranges a referendum on the UK's membership of the EU.

2016: On the 23rd of June, 52% voted for the UK to leave the EU. PM Cameron who is pro-EU resigns and Theresa May takes the helm. In October, Article 50 is triggered and the two-year process of the UK's withdrawal from the EU begins.

2017-2018: PM May calls a snap general election and loses the majority but retains power by sharing with the Democratic Unionist Party (DUP). Withdrawal agreements fail to pass parliament, an extension is made but further revisions to the agreement continue to be rejected by parliament.

2019: PM May resigns and Boris Johnson takes power who gains another extension from the EU to enable further negotiations. The deadline is now the 31st of January, 2020. Another general election is called and the Conservatives regain the majority.

2020: With negotiations strained and the deadline having passed, the UK is forced to leave the EU without a deal. Negotiations continue and a deal is eventually agreed which comes into effect on the 1st of January 2021. The EU-UK Trade and Cooperation Agreement (TCA) is a comprehensive trade deal that covers goods, services, fisheries, and much more.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 8.6% in 2023 Q1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-