Pound weakness pressured by stronger dollar and growth pessimism

Pound Sterling Currency Report -October (formatting update)

Derbyshire, UK – October 24th, 2023 - This is the currency report for the Pound Sterling and is intended to be a reference aid for your own analysis and trade planning. The next update will be after the BoE meeting on Thursday, November 2nd.

Decisions to trade are made at your own monetary risk.

Pound weakness pressured by stronger dollar and growth pessimism

The UK economy is facing a number of challenges, including high inflation, rising unemployment, and a cost-of-living crisis. The outlook for growth is pessimistic, and the GBP/USD is in a downtrend. The government and the Bank of England are taking steps to support the economy, but the war in Ukraine and the global economic slowdown pose significant risks.

Monetary Policy

The Bank of England held interest rates at 5.25% in September, aiming to balance the need to curb inflation with the risk of recession. The economy is underperforming against forecasts, with a pessimistic outlook for GDP and unemployment. Inflation is expected to fall significantly in the near term, but services inflation is likely to remain elevated. The MPC is committed to returning inflation to the 2% target sustainably in the medium term.

Interest rates held to avert risk of recession

The nine members of the Bank of England's Monetary Policy Committee (MPC) set monetary policy, including the bank rate (interest rate). The bank rate is the interest rate that banks pay to borrow money from the Bank of England overnight and is secured by Gilt bonds. This rate affects the interest that banks charge their borrowers.

The MPC meets to set monetary policy eight times a year, the latest was September 21st and the next is on November 2nd.

The interest rate of the UK was held at the September meeting after being hiked by 0.25% in August and throughout the previous twelve meetings. This indicates that the Bank of England is hawkish but has become cautious so as to avoid affecting growth. Trading Economics forecast 5.25% to be the peak rate and 2024 to see cuts of 0.75%.

Key points of the Bank of England's MPC September 2023 meeting:

Maintained the Bank Rate at 5.25%.

Reduce the stock of UK government bond purchases by £100 billion over the next twelve months.

Inflation is expected to fall significantly in the near term, services inflation to remain elevated.

Indications of persistent inflationary pressures and resilience in the economy to be monitored.

Monetary policy will need to be restrictive to meet the 2% inflation target.

Steps to bring inflation back to 2% will be balanced with economic growth risks.

The MPC is committed to returning inflation to the 2% target sustainably in the medium term. It will continue to monitor closely indications of persistent inflationary pressures and resilience in the economy as a whole.

Sources: The Bank of England, Trading Economics, FXStreet

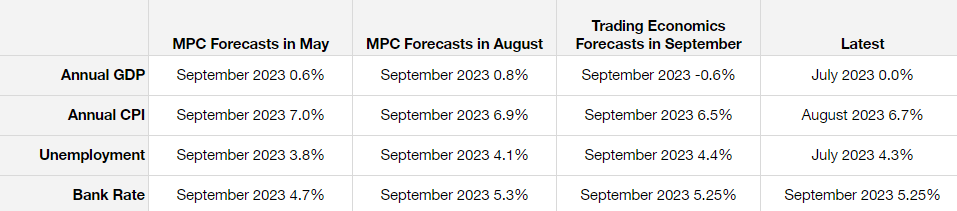

The economy is underperforming against forecasts and has a pessimistic outlook

The Bank of England's Monetary Policy Committee (MPC) makes economic forecasts four times a year. The most recent was at their August meeting and they will be updated in November.

Annual GDP has a pessimistic outlook compared to the MPC’s forecast and may fall into a recession without action which is possibly why the MPC decided to hold rates in September.

Annual CPI has an optimistic outlook compared to the MPC’s forecast and is on track to come in below expectations although the September rate hold may have put that in jeopardy.

Unemployment has a pessimistic outlook compared to the MPC’s forecast and may climb a lot higher than expected.

The Bank Rate is on track to match the MPC forecast and is likely at the peak with cuts beginning to be priced in for 2024.

Market Narratives

US Economic Strength is applying bearish pressure to the GBP/USD

The GBP/USD has gained and lost value in a contrarian correlation with US inflation rates which peaked in late 2022. The GBP/USD is currently in a downtrend which formed in July 2023 when investors began to reposition for the likelihood that the Fed will keep rates higher-for-longer due to the US economy being more resilient than anticipated.

In the previous month, the GBP/USD has reversed this downtrend to form an uptrend as soft US jobs data pushed back on the "Resilient US Economy" narrative.

Upside moves have the potential to test the resistance area around $1.269 while downside retracements could fall to re-test the $1.206 area.

Economic Indicators

The UK economy is on a knife edge, with growth, inflation, and retail sales all showing signs of pressure. Unemployment has been rising slowly, but it is still low and could provide some support to growth. The outlook is uncertain, but there is still hope for the UK economy to avoid a recession.

Slowing economy falls has a slight rebound but signals recessionary risk ahead

The UK GDP monthly rate report measures the change in value of goods and services produced in the UK over a given month compared with the previous. The latest data covers the July period and was published on October 12th by the Office of National Statistics and the next version is out on November 10th.

The latest result of 0.20% matched expectations and signals that the economy is in recovery as it is higher than the previous month's contraction and above the baseline trend.

Trading Economics are forecasting 0.1% for Q4 which would be above the baseline trend of 0.0% and suggest indifference with regards to economic growth.

Sources: Office for National Statistics, Trading Economics, FXStreet

Falling inflation halts and applies indifferent pressure to growth

The UK inflation rate report measures the change in value of a basket of goods and services in the UK over a given month compared with the previous. The latest data covers the September period and was published on October 18th by the Office of National Statistics and the next version is out on November 15th.

The latest result of 6.70% was just above expectations and signals that the falling rate of inflation is reversing as it matches the previous month and is just above the baseline trend. This applies indifferent pressure to the economic outlook as demand stabilises.

Trading Economics are forecasting 4.5% for Q4 which would be far below the baseline trend of 6.1% and suggest optimism with regards to a speedier pace of falling inflation.

Sources: Office for National Statistics, Trading Economics, FXStreet

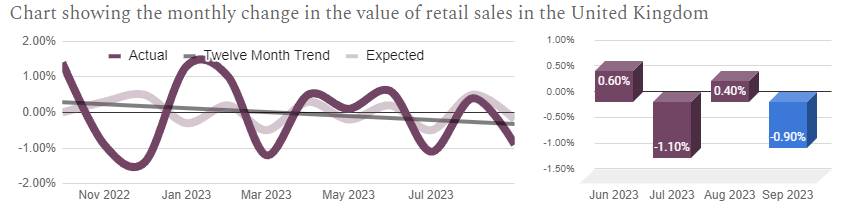

Falling retail sales quickens and applies significant bearish pressure to growth

The UK retail sales report measures the change in value of aggregated retail goods and services sales over a given month compared with the previous. The latest data covers the September period and was published on October 20th by the Office of National Statistics and the next version is out on November 17th.

The latest result of -0.90% was far below expectations and signals that the falling rate of retail sales is picking up pace as it is a very sharp fall from the previous month and far below the baseline trend. This applies bearish pressure to the economic outlook as consumers spend less.

Trading Economics are forecasting -2.0% for Q4 which would be below the baseline trend of -0.3% and suggest a lot of pessimism with regards to a rebound of falling sales.

Sources: Office for National Statistics, Trading Economics, FXStreet

Stable unemployment remains steady and applies indifferent pressure to growth

The UK unemployment rate report measures the number of people actively looking for a job as a percentage of the labour force over a given month. The latest data covers the August period and was published on October 24th by the Office of National Statistics and the next version is out on November 14th.

The latest result of 4.20% was just below expectations and signals that the stable rate of unemployment continues as it is similar to the previous month and the same as the baseline trend. This applies indifference to the economic outlook as businesses maintain employment levels.

Trading Economics are forecasting 4.4% for Q4 which would be just above the baseline trend of 4.3% and optimism with regards to a stable labour market.

Sources: Office for National Statistics, Trading Economics, FXStreet

Geopolitical Events

The cost-of-living crisis is putting pressure on consumers' spending power in the UK. The rising cost of essential goods and services is outpacing household incomes, leading to a fall in real incomes. The war in Ukraine is exacerbating the situation by causing energy prices to soar and disrupting supply chains. This is putting upward pressure on inflation and weighing on the UK economy. As a result, the value of the pound is falling.

Cost-of-Living crisis pressures consumers spending power

Since late 2021, the prices for many essential goods in the United Kingdom have been increasing faster than household incomes, resulting in a fall in real incomes. This is caused by a combination of factors, including rising inflation, the COVID-19 pandemic, the Russia-Ukraine war, and Brexit.

Recent Key Events

April-May 2022: 77% of UK adults report feeling worried about the rising cost of living, and 50% say they worry "nearly every day". 52% of respondents to an ONS survey say they have cut back on their energy use.

June 2022: Inflation rises sharply, affecting a wide range of goods and services, including transport, food, furniture, household items, electricity and clothing. Consumer confidence falls to its lowest level since 1974.

November 2022: Nurses and other NHS medical personnel vote to strike over failing wages, inflation, overwork and underfunding. Business investment falls and GDP declines.

December 2022: The Joseph Rowntree Foundation reports that over 3 million low-income UK households cannot afford to heat their homes. Shoplifting increases by 22%.

September 2023: Birmingham City Council, the largest local authority in Europe, declares itself effectively bankrupt.

The cost of living crisis is putting downward pressure on the value of the pound. This is because the crisis is leading to higher inflation, which makes the pound less attractive to foreign investors. Additionally, the crisis is reducing economic growth, which also makes the pound less attractive.

Russian invasion of Ukraine adds uncertainty

On February 24, 2022, Russia invaded Ukraine in an escalation of the Russo-Ukrainian War which began in 2014. The invasion is the largest military conflict in Europe since World War II and has resulted in tens of thousands of casualties on both sides. The invasion has also caused a humanitarian crisis, with millions of Ukrainians displaced from their homes. The international community has condemned the invasion and imposed sanctions on Russia. The International Criminal Court is investigating possible war crimes and crimes against humanity committed by Russian forces.

Recent Key Events

June 2023: The Ukrainian counteroffensive in June 2023 made significant progress, with Ukraine liberating villages and reclaiming territory in the eastern Donbas region. The Wagner Group's rebellion against the Russian government was a major setback for Russia.

August 2023: Ukraine counteroffensive slowed by millions of mines laid by Russia. Ukrainian drones damage the Russian landing ship Olenegorsky Gornyak.

September: An attack on Russian naval targets in Sevastopol damages the Black Sea fleet. Several oil and gas drilling platforms on the Black Sea held by Russia since 2015 have been retaken.

The war in Ukraine is having a negative impact on the global economy, including the value of the pound. The war has caused energy prices to soar and disrupted supply chains, which are putting upward pressure on inflation and weighing on the UK economy.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-