Selling the EUR/USD 🇪🇺🇺🇸

EUR/USD higher while speculators don't believe the Fed

SUMMARY

The sentiment supports the EUR/USD against moves lower until the US CPI data comes out on Thursday. The market is pricing in an annual inflation of 8.0 percent for October which would be a fall from 8.2 percent for September.

The US Dollar is expected to be resistant to higher moves until the report comes out.

The EUR/USD will be:

Bullish if US CPI is lower than expected

Bearish if US CPI is higher than expected

The on-going Risk Level Two orders to sell EUR/USD will be maintained as the Stop Loss level at 1.014 is not expected to be broken.

After Thursday's US CPI data the market attention will move towards the following week’s EA GDP Growth Rate data and US Retail Sales.

SENTIMENT

FED POLICY DISBELIEF SUPPORTS THE EUR/USD AGAINST MOVES LOWER

On Wednesday the 2nd of November the Federal Reserve hiked rates by 0.75 percent and commented that it would be better to raise too-high rather than too-low. This was initially interpreted as a hawkish move, however speculators have since re-considered and are positioning for a pivot.

The disbelief in the Fed is expected to have a bullish effect on the DAX, S&P 500 and EUR/USD.

FUNDAMENTALS

EURO-AREA

The Governing Council of the European Central Bank (ECB) met last month on the 27th of October and a decision was made to hike the Main Refinancing Operations Rate (Interest Rate) by 0.75 points to 2.00 percent which was as expected. The policy outlook is hawkish as Trading Economics are forecasting it to rise to 3.50 percent next year in 2023 (prev. 2.00). The next scheduled meeting for the Governing Council is next month on Thursday the 15th of December.

The outlook for:

- EA GDP is pessimistic deterioration (pr. )

- EA CPI is pessimistic improvement (pr. )

- EA Unemployment is indifference (pr. )

UNITED-STATES

The Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) met earlier this week on the 2nd of November and a decision was made to hike the Federal Funds Rate (Interest Rate) by 0.75 points to 3.75-4.00 percent which was as expected and fully priced in. The policy outlook is hawkish as Chairman Powell commented that hikes will go higher than previously projected (4.6 percent in Sep). The FOMC will meet again next month on Wednesday the 14th of December and the CME FedWatch tool indicates 60 percent odds of a 0.50 hike and 40 percent of a 0.75 hike.

The outlook for:

US GDP is pessimistic deterioration (pr. )

US CPI is optimistic improvement (pr. )

US Unemployment is pessimistic deterioration (pr. )

TECHNICALS

SHORT TERM

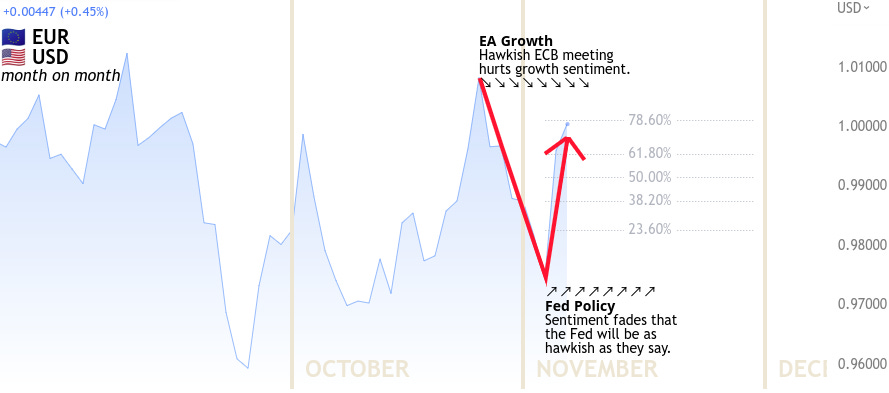

The short term view (month on month) shows that the EUR/USD has been downtrending since last month that began in late-October when a hawkish ECB meeting soured the sentiment towards growth.

This pessimism remains but the EUR/USD has retraced some of the fall due to a weaker US Dollar. This is as a result of positioning against the Fed’s hawkish rhetoric. The market does not appear to believe that the Fed will over-tighten in the face of a contracting economy and job losses.

LONG TERM

The long term view (year on year) shows that the EUR/USD has been downtrending since last year, which began in mid-2021 when the Federal Reserve began to comment on tapering off its stimulus plan.

This fall was pressured further as safe haven flows into the USD picked up this year in February 2022 as Russia invaded Ukraine. The subsequent sanctions that followed and lack of supply to the energy markets pushed global inflation higher than had been anticipated and central banks have had to tighten at a record pace. This has lowered global growth which keeps the US Dollar higher and Euro lower.

END DISCLAIMER

Copy the trade plan with an investment at http://www.etoro.com/people/jeepsontrading

More at www.jeepsontrading.substack.com

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk