🇬🇧 Sterling Forex Handbook (November)

Bank of England turns dovish although outlook is still very much uncertain

STERLING

Sterling is the currency of the United Kingdom and nine of its associated territories. The pound is the main unit of sterling,[4] and the word "pound" is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling.

Sterling is the world's oldest currency that is still in use and that has been in continuous use since its inception. It is currently the fourth most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and Renminbi, it forms the basket of currencies which calculate the value of IMF special drawing rights. As of mid-2021, sterling is also the fourth most-held reserve currency in global reserves.

The Bank of England is the central bank for sterling, issuing its own banknotes, and regulating issuance of banknotes by private banks in Scotland and Northern Ireland. Sterling banknotes issued by other jurisdictions are not regulated by the Bank of England; their governments guarantee convertibility at par. Historically, sterling was also used to varying degrees by the colonies and territories of the British Empire.

BANK OF ENGLAND

BANK RATE

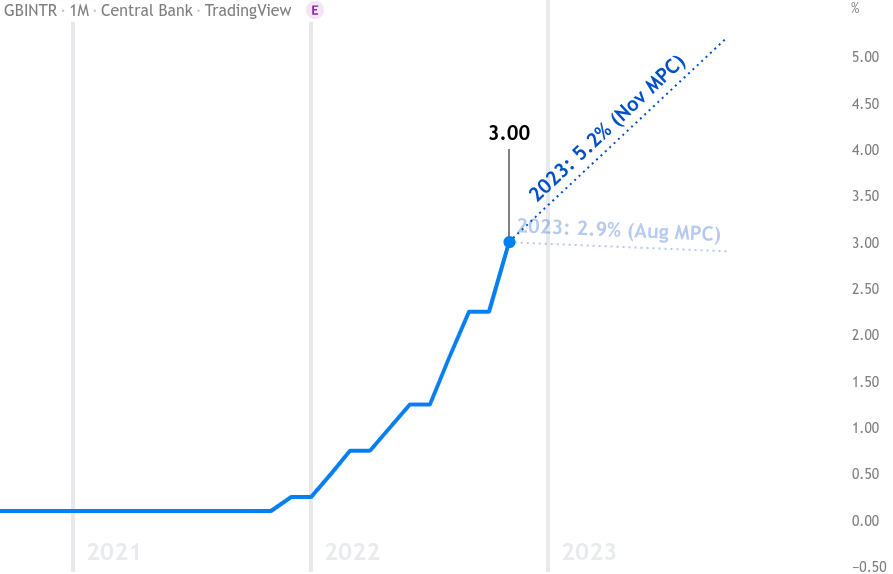

source: Bank of England

On the 3rd of November, the Bank Rate was hiked by 75bps to 3.00 percent. This matched the market expectations and was higher than the 50bps hike at the September meeting.

This is the eighth consecutive rate hike and the largest hike since 1989. The MPC remarked that further hikes may be required although at a lower peak than currently priced into markets.

The next meeting is on Thursday the 15th of December and the long term outlook is for higher rates although it is likely that rates will be less hawkish than expected.

The Bank of England is the Central Bank of the United Kingdom and monetary policy decisions are made by the nine members of the Monetary Policy Committee.

Monetary Policy Summary Highlights (November)

2% inflation target to sustain growth and employment.

voted 7-2 to increase Bank Rate by 0.75 points to 3.00%.

One member voted for 0.25 points, the other for 0.50 points

Significant developments to fiscal policy since previous forecast

Uncertainty around the outlook for UK retail energy prices has fallen to some extent following further government interventions.

…working assumption is that some fiscal support continues beyond the current six-month period of the Energy Price Guarantee (EPG)

The MPC’s forecast does not incorporate any further measures that may be announced in the Autumn Statement scheduled for 17 November.

There have been large moves in UK asset prices since the August Report. These partly reflect global developments, although UK-specific factors have played a very significant role during this period.

The MPC’s projections are conditioned on the path of Bank Rate implied by financial markets in the seven working days leading up to 25 October.

That path rose to a peak of around 5¼% in 2023 Q3, before falling back. Overall, the path is around 2¼ percentage points higher over the next three years than in the August projection.

The higher market yield curve has pushed new mortgage rates up sharply. Financial conditions have tightened materially, pushing down on activity over the forecast period.

GDP is expected to decline by around ¾% during 2022 H2

The labour market remains tight, although there are signs that labour demand has begun to ease.

CPI inflation was 10.1% in September and is projected to pick up to around 11% in 2022 Q4, lower than was expected in August, reflecting the impact of the EPG.

In the MPC’s November central projection that is conditioned on the elevated path of market interest rates, GDP is projected to continue to fall throughout 2023 and 2024 H1, as high energy prices and materially tighter financial conditions weigh on spending.

In the MPC’s central projection, CPI inflation starts to fall back from early next year as previous increases in energy prices drop out of the annual comparison. Domestic inflationary pressures remain strong in coming quarters and then subside. CPI inflation is projected to fall sharply to some way below the 2% target in two years’ time, and further below the target in three years’ time.

MPC Projection Highlights (November)

The BoE publishes the Monetary Policy report every quarter.

Bank Rate - November MPC Projection

Implied by forward market interest rates

Q4 2022 at 3.0% (Q3 2022 2.4%)

Q4 2023 at 5.2% (Q3 2023 2.9%)

Q4 2024 at 4.7% (Q3 2024 2.4%)