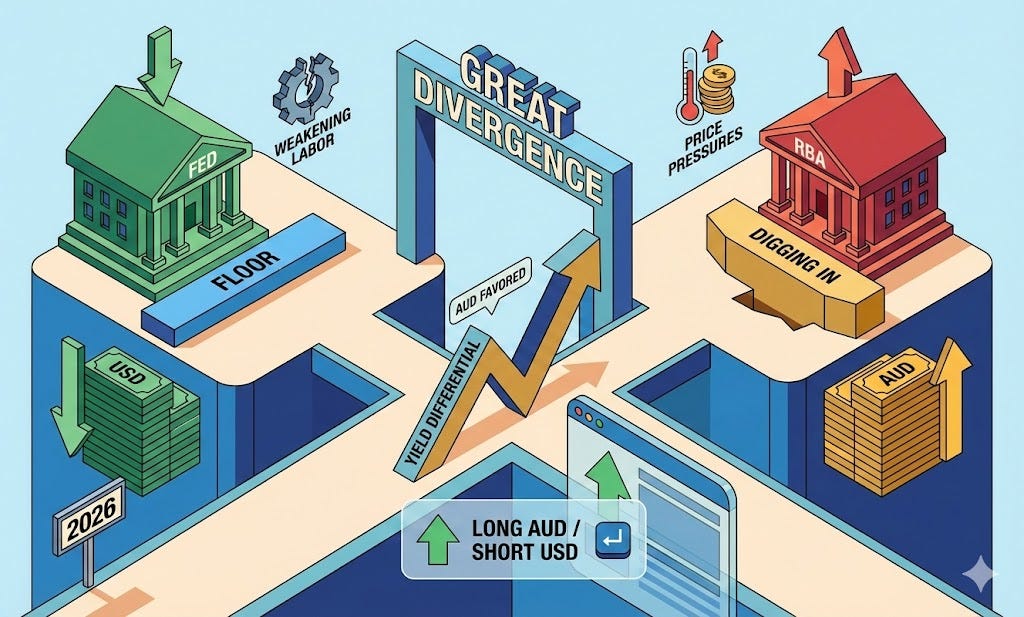

Weekly Forex Briefing (WN2 2026): THE GREAT DIVERGENCE OF 2026

As we turn the corner into 2026, I’m spotting an opportunity in the foreign currency markets, and that would be the “Great Divergence” that is emerging between the Aus

THE TALE OF TWO CENTRAL BANKS

As we turn the corner into 2026, I’m spotting an opportunity in the foreign currency markets, and that would be the “Great Divergence” that is emerging between the Aussie and the Greenback. As the Fed battles to provide a floor to a weakening labor market, the RBA is digging its heels in as the “last hawk standing,” struggling with persistent price pressures. This collision course presents the perfect opportunity for a traditional long AUD, short USD trade. The yield differential has blown out further in the AUD’s favor, and this is clearly going to be the trade of the coming weeks.

STRUCTURAL SHIFTS: DECEMBER WEAKNESS TO FEBRUARY VOLATILITY

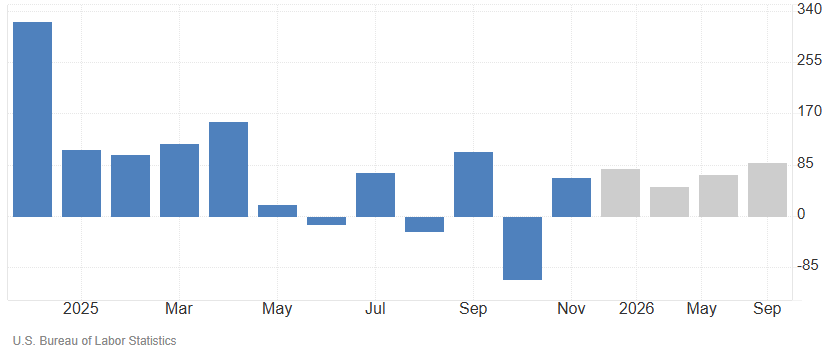

Scanning the horizon from mid-December 2025 to now, the defining story hasn’t just been dollar weakness—it’s been the unraveling of King Dollar’s reign. While the Federal Reserve slashing rates to 3.75% set the stage, the real shock came from Chair Powell unveiling a $40 billion monthly T-bill buying spree. That move rattled the bulls to their core. Traders didn’t hesitate to read between the lines, labeling it “stealth QE.” Suddenly, the system was awash with liquidity right as the labor market began to buckle, with unemployment creeping up to 4.6%. That sparked an exodus from the Greenback—a shift that feels like we’re only seeing the tip of the iceberg.

As we peer toward the end of February 2026, I expect this narrative to gain serious traction. The spotlight is now fixed on January 28, the next Fed gathering. If the “Sahm Rule“ recession indicator keeps flashing red, I’d wager the Fed will signal more dovishness—likely trimming rates again or opening the liquidity taps even wider.

It’s a completely different beast Down Under. I’m keeping a hawk’s eye on the Reserve Bank of Australia; their February 3 meeting is shaping up to be a genuine nail-biter. With inflation stubbornly stuck at 3.8%, policymakers might have their hands forced to hike rates to 3.85%. Should Q4 data confirm those heating price pressures, the Aussie dollar could part ways entirely with the global easing cycle. That widening yield gap? It’s the fuel for this entire trade.

But here’s the fly in the ointment: the January 13 US CPI release is a massive wildcard. If inflation stages a surprise comeback above 3.0%, the Fed would have to slam the brakes on cuts. That scenario could spark a vicious short squeeze, catching the bears flat-footed.

IMMEDIATE OUTLOOK: NAVIGATING THE POST-HOLIDAY DATA WAVE

Trading over the holiday window—from December 22 through today—was predictably jagged. Thin liquidity made for a bumpy ride, yet the broader market trends held their ground.

This sluggishness was made worse by month-end rebalancing flows and a lukewarm US S&P Manufacturing PMI of 51.8 on Friday, January 2. Sure, it’s technically growth, but it wasn’t convincing enough to shake off worries about an industrial slowdown, leaving the USD exposed. Meanwhile, the Aussie Dollar seized the moment. It edged higher as traders bet on domestic yields staying “higher for longer,” largely turning a blind eye to the silence on stimulus out of China.

As we gear up for the full trading week ending Sunday, January 11, 2026, expect volatility to roar back. I’m laser-focused on Monday’s ISM Manufacturing PMI. If that figure slips into contraction territory below 50, it would add fuel to the recessionary fire in the US industrial sector and likely weigh heavily on the Dollar right out of the gate.

Then, the spotlight swings to Australia on Wednesday, January 7, for the monthly CPI reading. This is a heavy hitter; a result near the forecast of 3.5 percent could practically seal the deal for an RBA rate hike, giving the AUD another leg up against the struggling Buck.

We wrap up the week with the main event: US Non-Farm Payrolls on Friday, January 9. Markets are already bracing for a cool-down. My take is that anything coming in under 100,000 jobs added would pretty much nail down expectations for a January Fed cut. If that plays out, the floor could fall out from under the USD as yield support evaporates. Frankly, a stellar jobs report is about the only thing that could throw the Greenback a lifeline at this point.

CONCLUSION: THE YIELD DIFFERENTIAL PLAY

As we head into early 2026, the landscape is being shaped by one dominant theme: the “Divergence Trade.” I’m bullish on the Aussie and bearish on the Greenback. It boils down to a stark contrast in priorities: the Federal Reserve is shifting gears to rescue the labor market, while the RBA is still in the trenches, battling to crush inflation. This gap in policy cycles sets the stage for further gains in AUD/USD. That said, keep your eyes peeled for the January 13 CPI print; it’s the one wildcard that could throw a wrench in the works near-term.

Remember to include Fundamental Analysis into all your trade plans.

DISCLAIMER: The information printed here is informational only, NOT advice. Trading involves risk, and you could lose money.