Trade details…

Monday, 26 August, Week 35

This trade plan provides a comprehensive analysis of the Australia Monthly CPI Indicator and its potential impact on the AUD/USD currency pair. It explores the economic fundamentals, central bank policies, geopolitical developments, technical analysis, and market sentiment surrounding the Aussie dollar.

The plan delves into the recent trends and historical prices of the AUD/USD, examining the factors that have contributed to its recent strength and the risks that could weigh on its performance in the coming weeks. It also provides a detailed analysis of the upcoming Australian CPI release, outlining the potential market reactions to different scenarios.

The plan offers specific trading strategies for both pre- and post-CPI release scenarios, providing entry levels, stop-loss levels, and potential profit targets based on historical support and resistance levels. It also includes a discussion of the conviction levels associated with each trade, based on a thorough analysis of all available data.

The near term is defined as a five-day outlook, the short term is defined as a six-week outlook, the mid-term is defined as a six-month outlook, and the long term is defined as a five-year outlook.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Australia Monthly CPI Indicator

When the Australia Monthly CPI Indicator is released, forex traders typically focus on the headline inflation rate, seeking to gauge the trajectory of inflation and its potential impact on the Reserve Bank of Australia's (RBA) monetary policy. Traders will also scrutinise the underlying components of the CPI, such as trimmed mean inflation, to assess the breadth and persistence of inflationary pressures. The market reaction to the CPI release will depend on the deviation from consensus forecasts and the implications for future RBA policy decisions.

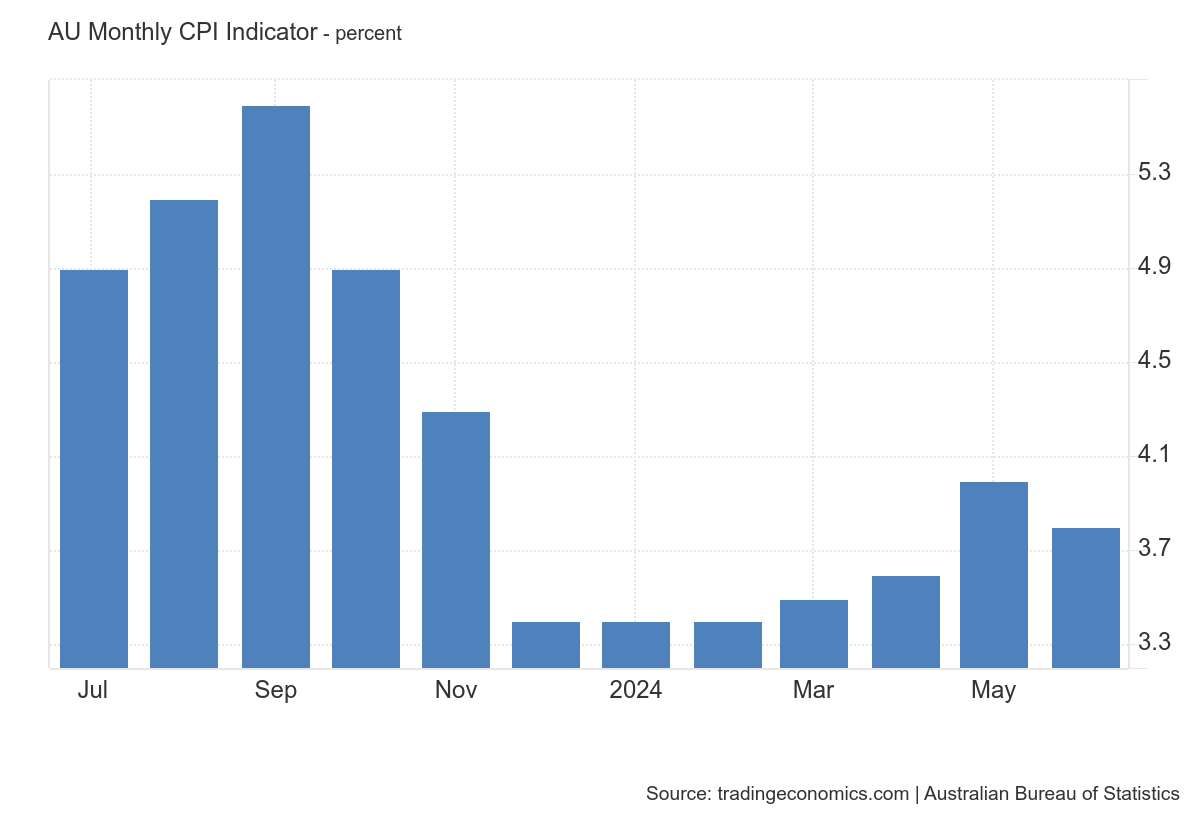

The most recent changes to the economic indicators associated with the Australia Monthly CPI Indicator paint a mixed picture. The headline CPI inflation rate for June came in at 3.8%, down from a six-month high of 4% in May and in line with market expectations. This slowdown was mainly attributed to easing prices for transport, driven by a deceleration in automotive fuel costs. Additionally, inflation moderated for health, recreation and culture, and education. On the other hand, prices accelerated for housing, particularly for electricity, while inflation remained unchanged for food and non-alcoholic beverages. The monthly CPI excluding volatile items and travel stood at 4% in June.

Over the past six months, the economic indicators associated with the Australia Monthly CPI Indicator have shown signs of easing inflationary pressures, but inflation remains above the RBA's target range of 2-3%. The headline CPI inflation rate peaked at 4% in May before easing to 3.8% in June. The trimmed mean measure of underlying inflation has also shown a gradual decline, falling from 4% in the first quarter of 2024 to 3.9% in the second quarter. However, persistent services inflation and a sharp rise in shipping costs pose upside risks to the inflation outlook.

Looking ahead, the economic indicators associated with the Australia Monthly CPI Indicator are expected to show a continued gradual easing of inflation, but the pace of disinflation remains uncertain. The RBA expects inflation to return to its target range by late 2025, but the path to achieving this goal is likely to be bumpy. The upcoming release of the Australian CPI for July on Wednesday, July 31st, will be a key event to watch. A weaker-than-expected CPI print could trigger a sell-off in the Aussie, as it could raise expectations of an RBA rate cut. Conversely, a stronger-than-expected CPI print could support the Aussie, as it would reinforce the RBA's hawkish stance.

Riding the Commodity Wave

The Australia Monthly CPI Indicator is highly relevant to the market themes that are currently influencing the AUD/USD. The pair has been trending upwards in recent weeks, supported by the weakening US dollar and the RBA's hawkish stance. The upcoming CPI release will be closely watched by market participants for clues about the future direction of RBA monetary policy and its potential impact on the Aussie.

If the Australia Monthly CPI Indicator comes in as expected, at 3.8%, it is likely to have a neutral impact on the AUD/USD. The market has already priced in a moderate slowdown in inflation, and a print in line with expectations would reinforce the RBA's current stance. However, the pair could experience some volatility in the immediate aftermath of the release, as traders digest the details of the report and assess its implications for future RBA policy decisions.

In the near term, the AUD/USD is likely to be influenced by several other events, including the release of the US PCE for July on Friday, August 30th, and the US Non-Farm Payrolls report on Friday, September 6th. A higher-than-expected US PCE print could support the US dollar and weigh on the AUD/USD pair, as it would suggest that inflation in the US is proving more persistent than expected. Conversely, a weaker-than-expected US Non-Farm Payrolls print could weigh on the US dollar and support the AUD/USD pair, as it would suggest that the US labour market is softening.

Upcoming Pivotal Events (AUD/USD)

Wednesday, July 31st, Week 31: Australian CPI (Jul): A weaker-than-expected CPI print could trigger a sell-off in the Aussie, as it could raise expectations of an RBA rate cut. Conversely, a stronger-than-expected CPI print could support the Aussie, as it would reinforce the RBA's hawkish stance.

Friday, August 30th, Week 35: US PCE (Jul): A higher-than-expected PCE print could support the US dollar and weigh on the AUD/USD pair, as it would suggest that inflation in the US is proving more persistent than expected. Conversely, a lower-than-expected PCE print could weigh on the US dollar and support the AUD/USD pair, as it would suggest that inflation in the US is easing.

Friday, September 6th, Week 36: US Non-Farm Payrolls (Aug): A stronger-than-expected NFP print could support the US dollar and weigh on the AUD/USD pair, as it would suggest that the US labour market remains robust. Conversely, a weaker-than-expected NFP print could weigh on the US dollar and support the AUD/USD pair, as it would suggest that the US labour market is softening.

Trading the Aussie Inflation Story

Riding the Downward Wave: Trading a Below-Consensus CPI

If the Australia Monthly CPI Indicator comes in below the consensus forecast of 3.8%, it could trigger a sell-off in the AUD/USD. A weaker-than-expected CPI print would raise expectations of an RBA rate cut, potentially leading to a decline in the Aussie.

Conviction Level: High

Catching the Upside Momentum: Trading an Above-Consensus CPI

If the Australia Monthly CPI Indicator comes in above the consensus forecast of 3.8%, it could trigger a rally in the AUD/USD. A stronger-than-expected CPI print would reinforce the RBA's hawkish stance, potentially leading to an increase in the Aussie.

Conviction Level: Moderate

Conclusion

This trade plan has provided a comprehensive analysis of the Australia Monthly CPI Indicator and its potential impact on the AUD/USD currency pair. The key takeaways for forex traders are:

The upcoming release of the Australian CPI for July on Wednesday, July 31st, will be a key event to watch for traders looking to trade the AUD/USD.

A weaker-than-expected CPI print could trigger a sell-off in the Aussie, while a stronger-than-expected CPI print could support the Aussie.

The AUD/USD pair is likely to remain volatile in the near term, influenced by a range of factors, including economic data releases, central bank policy announcements, and geopolitical developments.

Sources

Australian Bureau of Statistics

Reserve Bank of Australia

Trading Economics

Bloomberg

Reuters