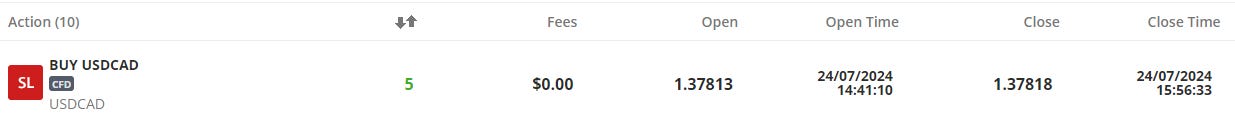

ORDER COMPLETE…

Wednesday, 24 July, Week 31: This report will provide a trade plan for the USD/CAD currency pair in anticipation of the Bank of Canada (BoC) Interest Rate Decision scheduled for release today. The report will cover the context surrounding the event, an analysis of the relevant economic indicators, and a conclusion summarising the findings.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Bank of Canada Interest Rate Decision

The Bank of Canada Interest Rate Decision is a key monetary policy announcement that dictates the target for the overnight rate, the interest rate at which major financial institutions lend and borrow one-day funds among themselves. This decision has a significant impact on short-term interest rates, influencing borrowing costs for businesses and consumers, and ultimately affecting economic activity and inflation.

Associated Economic Indicators:

Inflation Rate: The annual inflation rate in Canada eased to 2.7% in June 2024, down from 2.9% in May, surprising market expectations. This marked a resumption of the disinflation trend in Canadian consumer prices.

Core Inflation Rate: Core consumer prices in Canada increased by 1.90 percent in June 2024 compared to the same month in the previous year, marking the third consecutive month of acceleration and up from 1.8% in May.

Unemployment Rate: The unemployment rate in Canada rose to 6.4% in June 2024 from 6.2% in May, the highest since January 2022, and surpassing market expectations of 6.3%.

Employment Change: Employment in Canada fell by a marginal 1.4K in June 2024, following a 26.7K increase in May and way below forecasts of a 22.5K increase.

GDP Growth Rate: The Canadian economy expanded by 0.3% in the first quarter of 2024, accelerating from a downwardly revised flat reading in the previous period.

Recent Performance:

As outlined above, recent economic data has painted a mixed picture for the Canadian economy. While inflation has shown signs of easing, core inflation remains elevated, and the labour market has softened. GDP growth has been modest, but there are expectations for a pickup in the coming months.

Assessment of Consensus and Forecasts:

The consensus forecast for the BoC Interest Rate Decision is 4.50%, implying a 25bps rate cut. This is in line with the Bank of Canada's recent shift towards a more accommodative monetary policy stance. The central bank cut rates by 25bps in its June meeting, citing easing inflationary pressures and a softening labour market. As stated in the June 5th rate statement, ""With continued evidence that underlying inflation is easing, the Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points. Recent data has increased our confidence that inflation will continue to move towards the 2% target."" The BoC has signalled its willingness to provide further stimulus if needed to support economic growth and ensure inflation returns sustainably to its 2% target.

TRADE THESIS

The Bank of Canada Interest Rate Decision is a high-impact event for the USD/CAD currency pair. The current economic data and market expectations suggest a 25bps rate cut. However, the actual outcome and market reaction are uncertain. Traders should carefully analyse the BoC's statement and the accompanying Monetary Policy Report for clues about the central bank's future policy intentions.

Scenario 1: BoC cuts rates by 25bps, in line with consensus. This scenario is largely priced into the market, and the initial reaction in USD/CAD could be muted. However, the tone of the BoC's statement will be crucial. If the central bank signals a willingness to cut rates further, the CAD could weaken, leading to a rise in USD/CAD. Conversely, if the BoC strikes a more hawkish tone, suggesting that the June rate cut was a "one and done" move, the CAD could strengthen, leading to a decline in USD/CAD.

Scenario 2: BoC surprises by keeping rates unchanged. This scenario would be considered hawkish and could lead to a sharp decline in USD/CAD. The BoC might choose to hold rates steady if it sees signs of stronger-than-expected economic growth or if it is concerned about the potential for inflation to reaccelerate.

Scenario 3: BoC surprises by cutting rates by 50bps. This scenario would be considered dovish and could lead to a sharp rally in USD/CAD. The BoC might choose to deliver a larger rate cut if it sees signs of a significant slowdown in economic growth or if it is concerned about the persistence of weak labour market conditions.

Conclusion

The Bank of Canada Interest Rate Decision is a high-impact event for the USD/CAD currency pair. Traders should be prepared for volatility and carefully analyse the BoC's statement and the accompanying Monetary Policy Report for clues about the central bank's future policy intentions.

References

Bank of Canada:

Statistics Canada:

Trading Economics:

Department of Finance Canada

S&P Global:

Ivey Business School:

Canada Mortgage and Housing Corporation:

Newsquawk:

Stratfor:

Refinitiv:

Bloomberg:

OECD:

IMF: