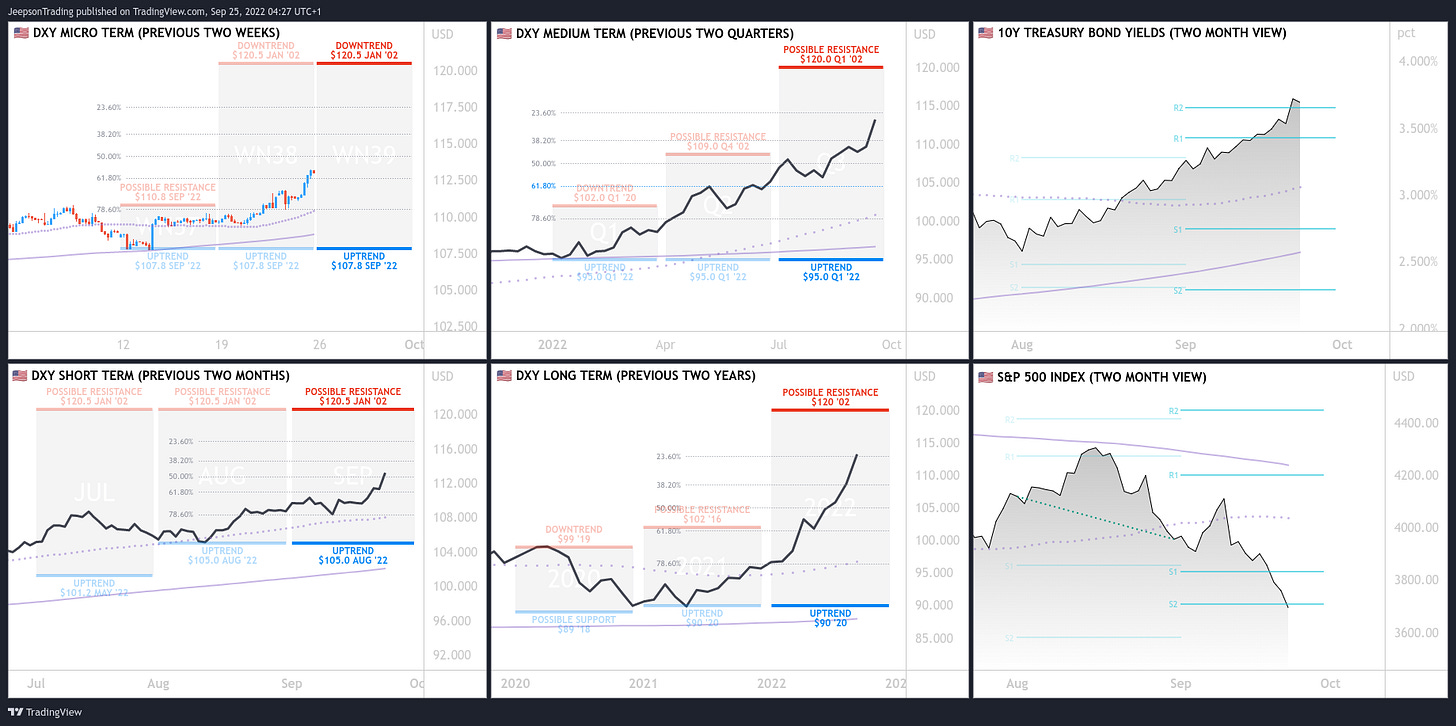

Trade Plan for the DXY 🇺🇸 (WN39)

Detail on the orders placed by Jeepson Trading at eToro and 5ers

FUNDAMENTAL SUMMARY

The Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) met last week on the 21st of September and a decision was made to hike the Federal Funds Rate (Interest Rate) by 75bps from 2.25-2.50 percent to 3.00-3.25 percent which was as expected. The policy outlook is hawkish as the FOMC also provided a projection of 4.6 percent for next year in 2023 which is up nearly a percent from the 3.8 which they projected in June. The next scheduled meeting for the FOMC is this Wednesday the 2nd of November and the CME FedWatch tool indicates 73 percent odds of a 75bps hike (up from X).

More recently, with regards to economic indicators other than the FOMC meeting, the CPI rate for the twelve months to August was reported a couple of weeks ago at 8.3 pecent which was above expectations of 8.1 percent but still a fall from the previous 8.5 percent and continuation of the fall since the peak inflation period in June of 9.1 percent.

The sentiment that is presently influencing the valuations on the US Dollar is the narrative regarding the economic slowdown. The aggressive interest rate hikes this year have quickly raised the cost of borrowing and along with high inflation have reduced the purchasing power of consumers who consist 68 percent of GDP. The outlook could turn more pessimistic if the second revision of Q2 GDP which is out this week has a lower reading than a 0.6 percent contraction.

The focus of market speculators is on Tuesday's release of the Durable Good Orders report which if comes in at the expected 0.5 percent contraction will see a continuation of the micro-term uptrend. However, any signs of expansion would resist moves higher and cause a retracement.

Trading Economics has climbing forecasts for a higher value:

Q3: $112.3 (pr. 110.9)

Q3 '23: $116.0 (pr. 114.7)

ORDERS

The momentum on the $USDOLLAR over the micro-term indicates higher moves towawrds it target of $120.5 but may weaken throughout the week if economic indicators point to an improving economic situation (or at least not as bad as expected). The short-term uptrend has no retracement created and so any fall could slip back towards the 105.0 area.

-END DISCLAIMER-

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk.