Trade Plan for the EUR/USD 🇪🇺 🇺🇸 (WN36)

Detail on the orders placed by Jeepson Trading at eToro and 5ers.

FUNDAMENTAL AND SENTIMENT SUMMARY

The most recent significant event was last Wednesday when the EU HCIP report showed inflation at 9.1%, slightly higher than what was expected and thus pressuring the ECB into higher rates. Energy costs continue to be elevated at 38.3 percent although this is slightly down on the previous reports 39.6 percent.

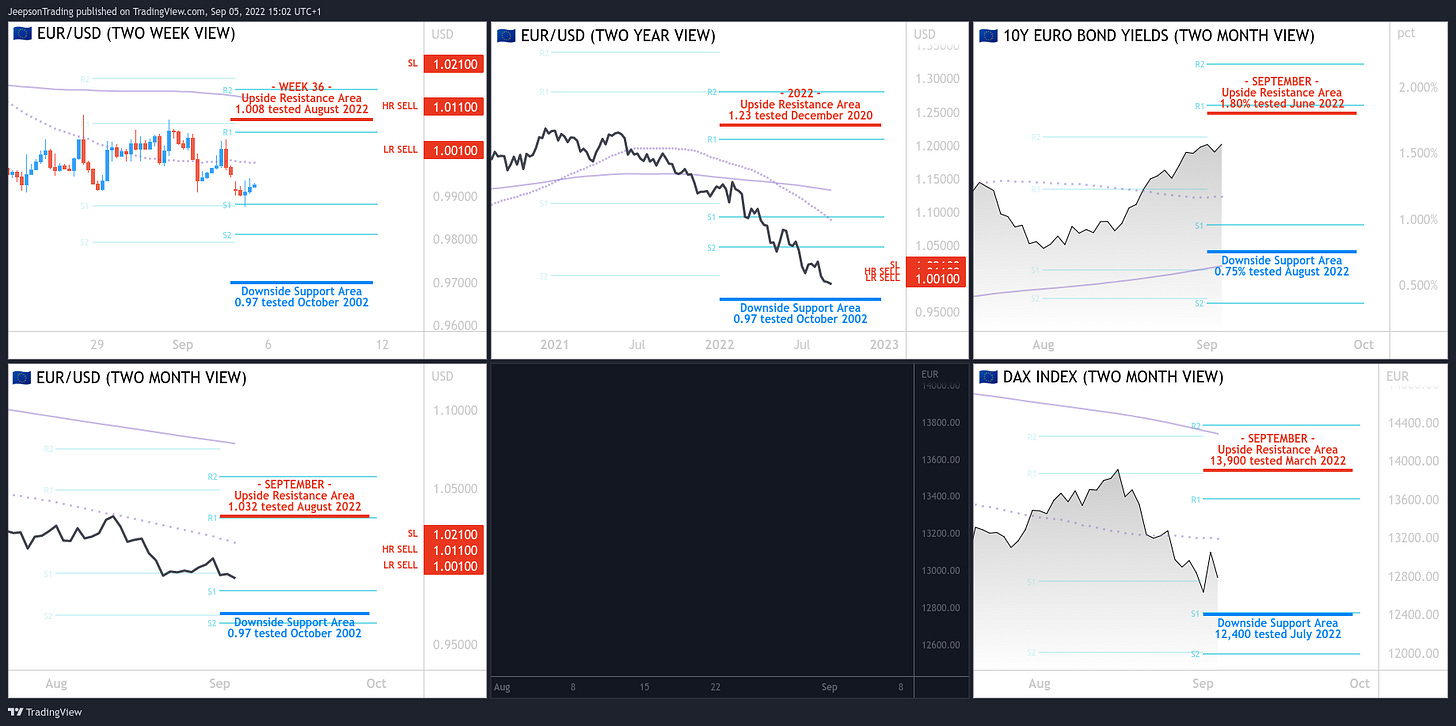

The next ECB meeting is on Thursday and odds have raised on a 75bps hike that would follow its 50 bps hike in July. The rising 10Y yields are a clear indication of how rapidly this has been re-priced as last month they moved from 0.78% to 1.57%.

Attention is locked on Wednesday's ECB meeting and the rate decision of the governing council.

ORDERS

The momentum on the $EURUSD is expected to remain bearish in light of a strong US Dollar and the pessimistic outlook to the rising energy costs narrative as it begins to slide towards $0.97. A higher interest rate on Wednesday will worsen the economic outlook of the eurozone and thus any rallies can be faded.

An order to SELL the $EURUSD has been placed:

Stop Loss 1.021

High Risk Sell 1.011

Low Risk Sell 1.001.

-END-

DISCLAIMER: The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk.