Trade Plan for the EUR/USD 🇪🇺 🇺🇸 (WN39)

Detail on the orders placed by Jeepson Trading at eToro and 5ers

FUNDAMENTAL AND SENTIMENT SUMMARY

The Governing Council of the European Central Bank (ECB) met a few of weeks ago on the 8th of September and a decision was made to hike the Main Refinancing Operations Rate (Interest Rate) by 75bps from 0.50 percent to 1.25 percent which was as expected. The policy outlook is hawkish as Trading Economics are forecasting it to rise to 2.00 percent next year in 2023. The next scheduled meeting for the Governing Council is next month on Thursday the 27th of October.

More recently, with regards to economic indicators other than the ECB meeting, the CPI rate for the twelve months to August (final) was reported a couple of weeks ago at 9.1 pecent which was as expected and mostly driven by energy which was up 38.6 percent.

The sentiment that is presently influencing the valuations on the Euro is the narrative regarding rising energy costs and how fast they inflate. The recent indicators suggest that the situation is not improving and may worsen as the war in Ukraine has been escalated by the on-going referendums in several regions which raises risk due to the increased nuclear threat.

The focus of market speculators is on Friday's release of the Flash CPI report for September which if comes in at the expected 9.7 percent inflation will see a continuation of the micro-term downtrend. However, any smaller than expected result would resist moves lower, a retracement likely if the result is lower than previous (9.1).

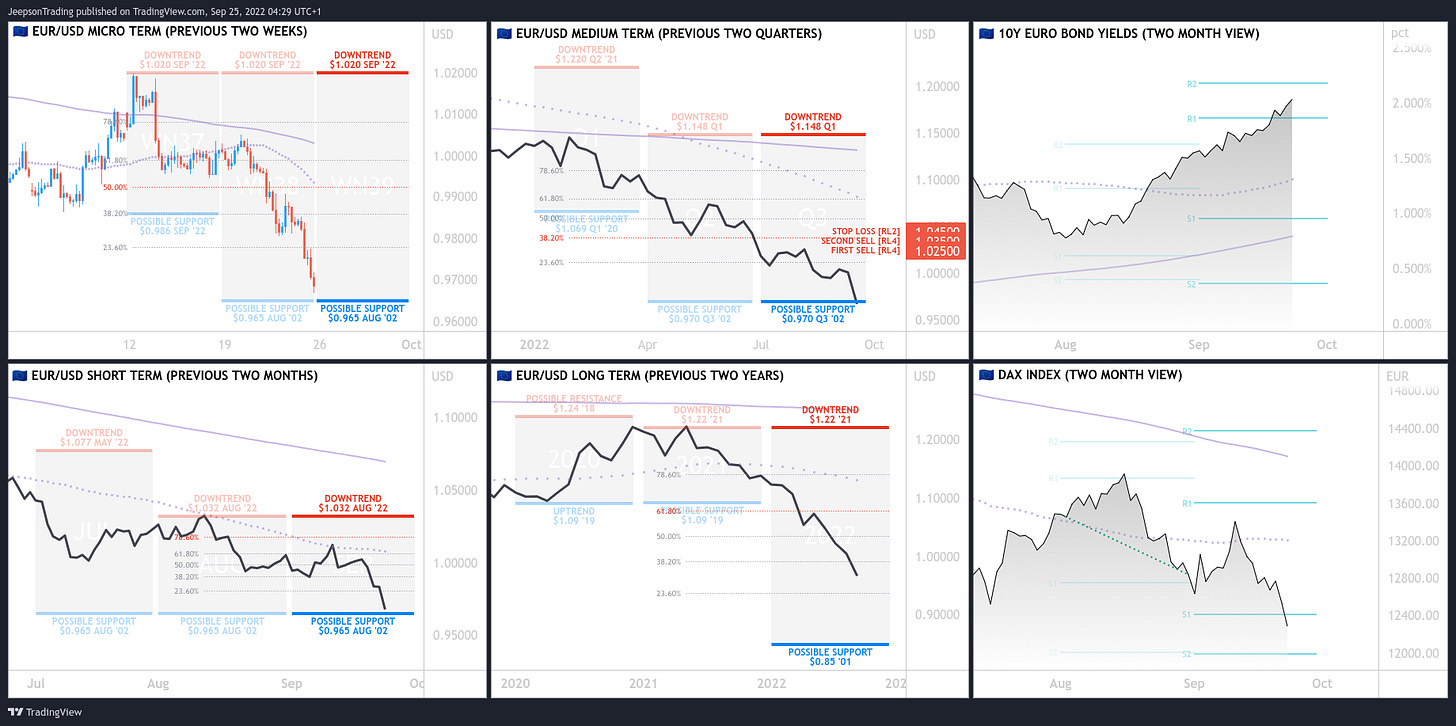

Trading Economics has climbing forecasts for a lower EUR/USD:

Q3: $0.97 (pr. $0.99)

Q4: 0.96 (pr. 0.98)

Q1: 0.95 (pr. 0.96)

ORDERS

The momentum on the $EURUSD over the micro-term is bearish although the value is close to the medium-term support level at 0.970. The short-term downtrend is falling from its 78.6 percent retracement level and targeting the $0.965 level. An order to SELL the $EURUSD has been placed based on the Medium-Term chart. An order to buy may be considered on Friday if the CPI data comes in lower than expected.

Stop Loss 1.045

First Sell 1.025

Second Sell 1.035

-END DISCLAIMER-

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk.