Trade-Plan for the GBP/USD 🇬🇧 🇺🇸

Continue selling for now

SUMMARY

Risk Level Two orders are in progress that were sold below the Stop Loss of $1.182. This was to capitalise on the short term uptrend following the transition of power from PM Truss to PM Sunak who is regarded as more fiscally responsible.

This plan is to be maintained until next Thursday when the US CPI data for October is released. The report is expected at 8.2 percent and reinforces that peak inflation has passed. Any upside surprise to this data will be dollar positive and likely resist the GBP/USD against moves higher.

SENTIMENT

The narrative that is presently influencing the valuation on the GBP/USD is the improved mood in the UK following the change of government to PM Sunak and Chancellor Hunt from the turbulent but short tenure of PM Truss and Chancellor Kwarteng’s fiscally irresponsible policies.

The near-term attention of speculators is focused on next Thursday when the US CPI print for October which is expected at 8.2 percent and reinforces that the peak has passed. Any upside surprise to this data will be dollar positive and likely resist the GBP/USD against moves higher.

Following this, on Friday the UK preliminary GDP data for Q3 is out which is expected to show an expansion of 2.1 percent.

FUNDAMENTALS

UNITED KINGDOM

The Monetary Policy Committee of the Bank of England (BoE) met yesterday on the 3rd of November and a decision was made to hike the Bank Rate (Interest Rate) by 75bps to 3.00 percent which was as expected and fully priced in. The policy outlook is less hawkish as the Governor Andrew Bailey commented that it is likely that rates will not rise as much as markets are pricing in. The meeting was accompanied by a fresh monetary policy report which projects a recession for the next two years. The MPC will meet again next month on Thursday the 15th of December.

The outlook for:

UK GDP is pessimistic deterioration (pr. )

UK CPI is indifferent improvement (pr. )

UK Unemployment is pessimistic deterioration (pr. )

UNITED STATES

The Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) met earlier this week on the 2nd of November and a decision was made to hike the Federal Funds Rate (Interest Rate) by 75bps to 3.75-4.00 percent which was as expected and fully priced in. The policy outlook is hawkish as Chairman Powell commented that hikes will go higher than previously projected (4.6 percent in Sep). The FOMC will meet again next month on Wednesday the 14th of December and the CME FedWatch tool indicates 50/50 percent odds of either a 25bps or 50bps hike.

The outlook for:

US GDP is pessimistic deterioration (pr. )

US CPI is optimistic improvement (pr. )

US Unemployment is pessimistic deterioration (pr. )

TECHNICALS

MICRO TERM

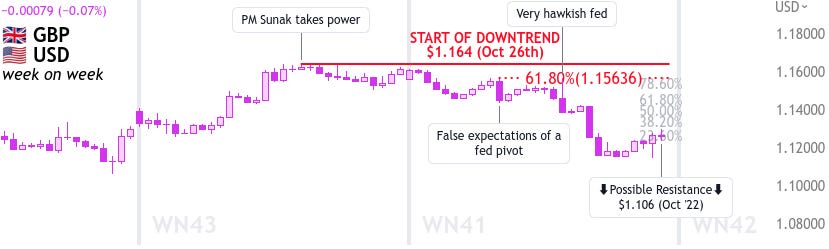

The micro term view (week on week) shows that the GBP/USD is downtrending from last week’s high of $1.164 when PM Sunak took power and the high value was fully priced in.

The downtrend fell to 1.143 before retracing higher as speculators falsely priced in a Fed pivot from their hawkish policy.

Price has since fallen as the Fed struck a hawkish tone.

The next potential support is at $1.106 which was last tested earlier last month in October.

SHORT TERM

The short term view (month on month) shows that the GBP/USD has been downtrending from the September high of $1.174 when the sentiment towards Fed rate hikes moved hawkish.

The downtrend fell to $1.038 following an unfunded tax cut announcement by the-then chancellor Kwarteng where it then steadily retraced higher as the policies were reversed and the new chancellor Hunt appointed.

Price has been steady since as the Fed struck an overly-hawkish whole the BOE tapered its 2023 projections although it still sees an extended two-year recession.

The next potential support is at $1.036 which was last tested in September 2022.

LONG TERM

The long term view (year on year) shows that the GBP/USD has been downtrending from 1.425 since May last year (2021) when the Delta variant took hold and sentiment towards COVID-19 worsened.

The downtrend fell to 1.33 where it then retraced higher before falling again as political uncertainty towards the-then PM Johnson and mounting political scandals.

Price has continued to fall ever since as the sentiment on UK growth soured as well as an ever-increasing value on USD aided by safe haven flows due to Russia’s invasion of Ukraine and persistently high global inflation.

The next potential support is at $1.035 which was last tested lsat month in September 2022.

END DISCLAIMER

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk.