Trade Plan for the GBP/USD 🇬🇧 🇺🇸 (WN39)

Detail on the orders placed by Jeepson Trading at eToro and 5ers

FUNDAMENTAL AND SENTIMENT SUMMARY

The Monetary Policy Committee (MPC) of the Bank of England (BoE) met last week on the 22nd of September and a decision was made to hike the Bank Rate (Interest Rate) by 50bps from 1.75 percent to 2.25 percent which was as expected. The policy outlook is slightly hawkish as Trading Economics are forecasting it to remain at 2.25 percent this quarter whilst in August, the MPC projected 3.00 percent by Q3 next year in 2023. The next scheduled meeting for the Monetary Policy Committee is next month on Thursday the 3rd of November.

More recently, with regards to economic indicators other than the BoE meeting,the CPI rate for the twelve months to August was reported a couple of weeks ago at 9.9 pecent which was below expectations of 10.2 percent and the first inflation easing in eleven months and was led by the fall in motor fuel (32.1 vs 43.7).

The sentiment that is presently influencing the valuations on the Pound Sterling is the narrative regarding the economic slowdown and how fast it progresses. The recent indicators suggest that the situation is worsening faster than expected, especially with the retail sales contraction at more than a percent below expectation. However - last Friday the new Chanceller, Kwasi Kwarteng announced an income tax reduction and removal of red tape with the goal of stimulating growth. The immediate market reaction was overwhelmingly pessimistic as funding through borrowing will burden the economy for decades if this gamble does not work out.

The focus of market speculators will be on Friday's release of the final GDP growth rate data for Q2 which if comes in at the expected 0.1 percent contraction will see a continuation of the micro-term downtrend. However, any bigger than expected result would resist moves lower and possibly retrace.

Trading Economics has falling forecasts for a lower GBP/USD: Q3: $1.07 (pr. $1.13), in twelve months: 1.02.

ORDERS

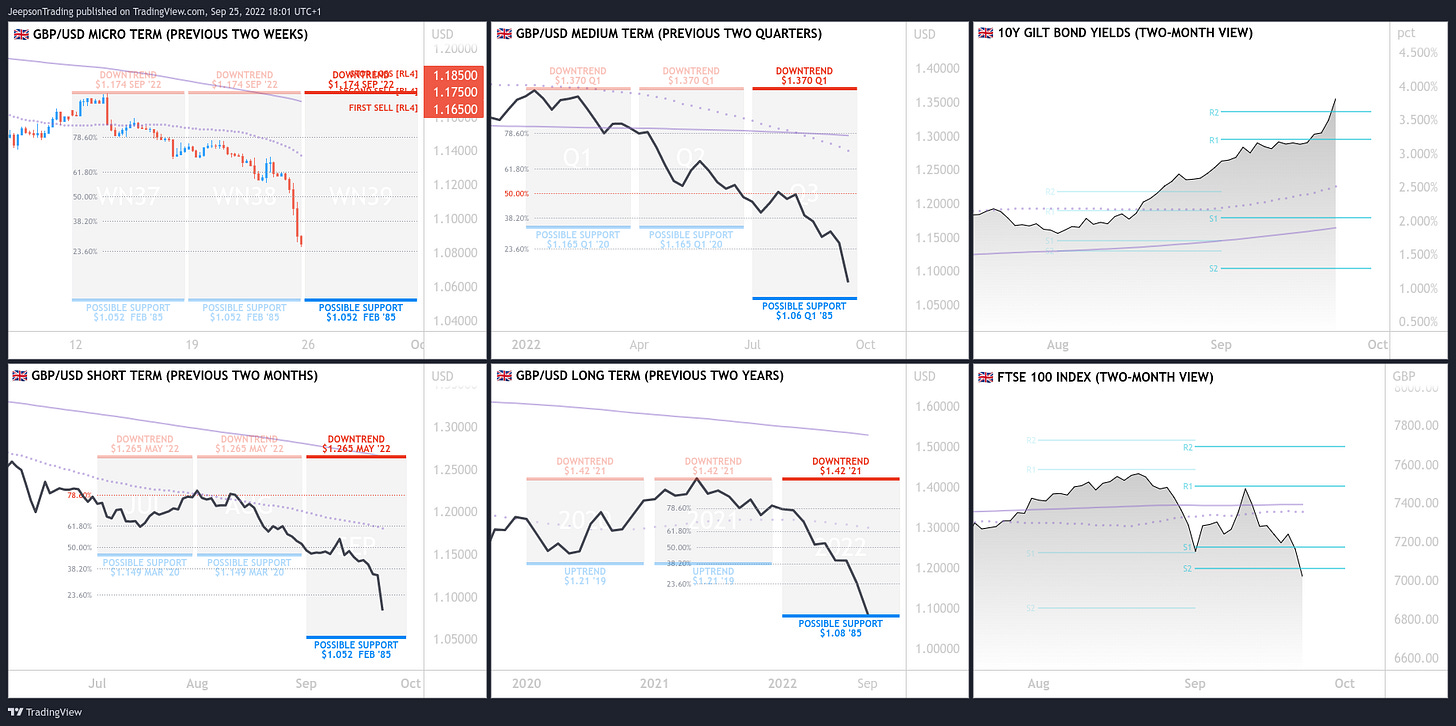

The momentum on the $GBPUSD over the micro-term is bearish and the downtrend is strong from the 1.174 level. The short-term downtrend is falling from its 78.6 percent retracement level and has a possible support area at $1.052. An order to SELL the $GBPUSD has been placed from a much higher level but will be revised once a retracement level is created.

Stop Loss 1.185

First Sell 1.165

Second Sell 1.175

-END DISCLAIMER-

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk.