TRADE PLAN GBP/USD 🇬🇧 🇺🇸

Continue selling during the short-term uptrend...

-SUMMARY-

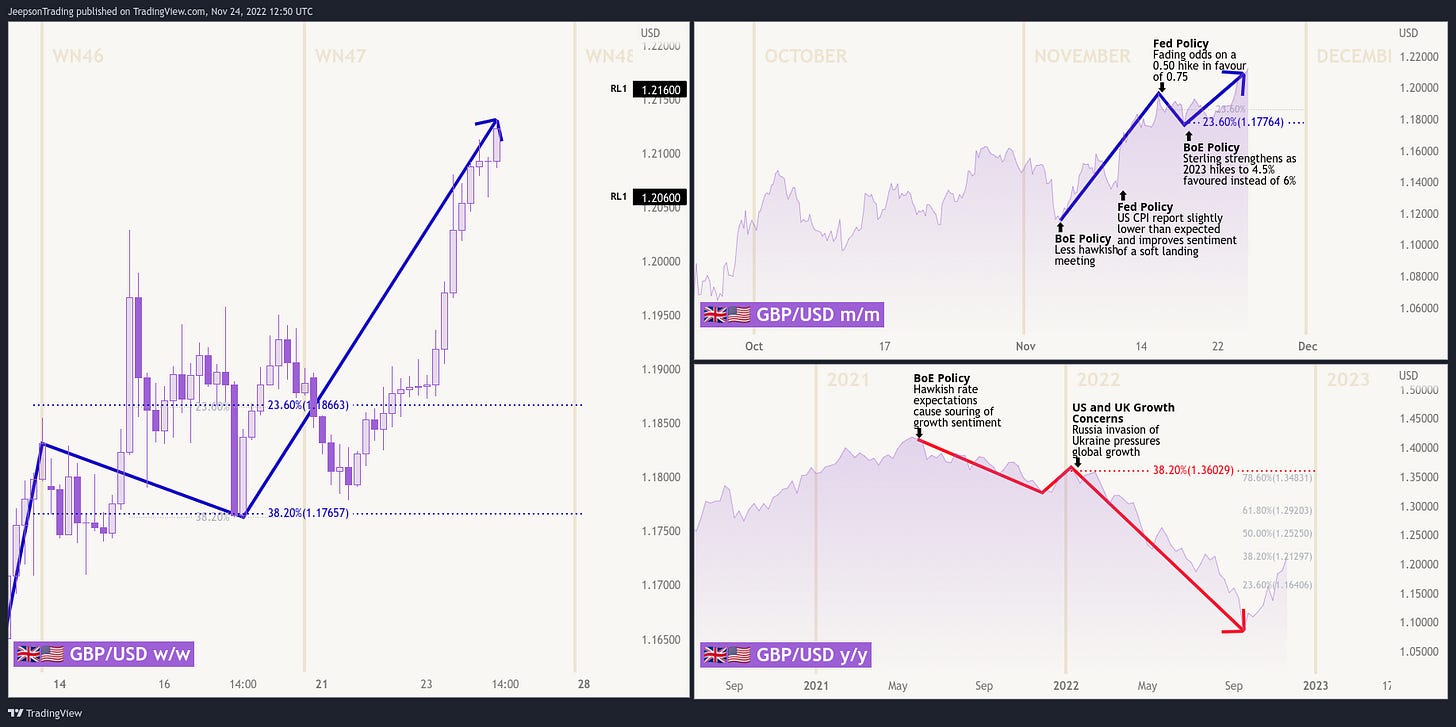

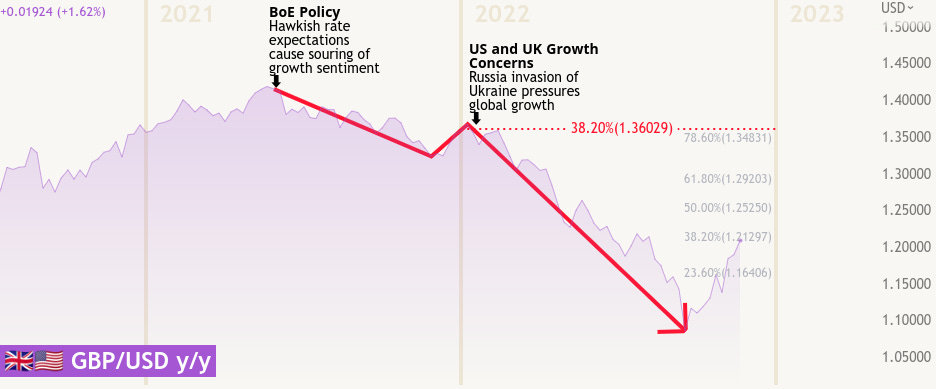

DERBYSHIRE GB / NOV 24 - The long term downtrend of the $GBPUSD that has formed from $1.42 to $1.085 is currently being retraced as it heads towards the previous resistance level at 1.36. This trend is not expected to continue due to an outlook that remains dire but not as worse than had been previously forecasted thanks to the more fiscally responsible Sunak UK government and falling CPI inflation in the US.

The long term downtrend retracement has formed a short term uptrend from $1.116 to $1.208 that is currently pushing to new highs. This trend is expected to break below its previous support at 1.17 once sentiment begins to fade on the optimistic view towards UK interest rates and falling CPI inflation in the US.

The next test for the short term uptrend will be next week on Friday when the latest Non-Farm Payroll data is released. A higher than expected result will give the Fed reason to safely continue hiking whereas a lower than expected result will reinforce the markets view that a dovish pivot is necessary. There is also the US GDP data out on Wednesday that will be of interest as it is the second estimate that may confirm or correct the Q2 contraction of 0.6 percent.

The plan is to continue with the GBP/USD sale whilst price remains below 1.226.

FUNDAMENTALS

-UNITED KINGDOM-

At the beginning of the month on the 3rd of November, the Bank Rate was hiked by 0.75 to 3.00 percent. This matched the market expectations and was higher than the 0.50 percent hike at the September meeting.

This is the eighth consecutive rate hike and the largest since 1989. The MPC remarked that further hikes may be required although at a lower peak than was priced into markets at the time.

The next meeting is next month on Thursday the 15th of December and the long term outlook is for higher rates.

The economic outlook is for pessimistic deterioration and the indicators support this view.

-UNITED STATES-

At the beginning of the month on the 2nd of November (the day before the Bank of England meeting), the Federal Funds Rate was hiked by 75bps to between 3.75 and 4.00 percent. This matched the market expectations as well as the hike at the September meeting.

This is the sixth consecutive rate hike and borrowing costs are now at the highest since 2008. During the press conference, Chair Powell commented that the rates will need to be higher than previously expected.

The next meeting is on Wednesday the 14th of December and the long term outlook is for higher rates.

The CME FedWatch tool is moving towards a more hawkish outlook with falling odds of a 0.50 hike in favour of 0.75 at 64/36 when previously this was 80/20.

The economic outlook is for pessimistic deterioration although the indicators suggest a slightly better outcome is possible.

TECHNICALS

-LONG TERM-

The long term view (year on year) shows that the GBP/USD has been downtrending since the middle of last year in 2021 during a time when the inflation rate began to pick up in the UK and expectations were elevated that the Bank of England would look to raise rates sooner than had been previously expected.

This fall in GBP/USD was pressured further as safe haven flows into the US dollar picked up this year in February 2022 as Russia invaded Ukraine. The subsequent sanctions that followed and lack of supply to the energy markets pushed global inflation higher than had been anticipated and central banks have had to tighten at a record pace. This has lowered global growth which keeps the USD higher and GBP lower.

Recently, the GBP/USD is retracing the fall although the price is far below the confirmed previous retracement at $1.36.

-SHORT TERM-

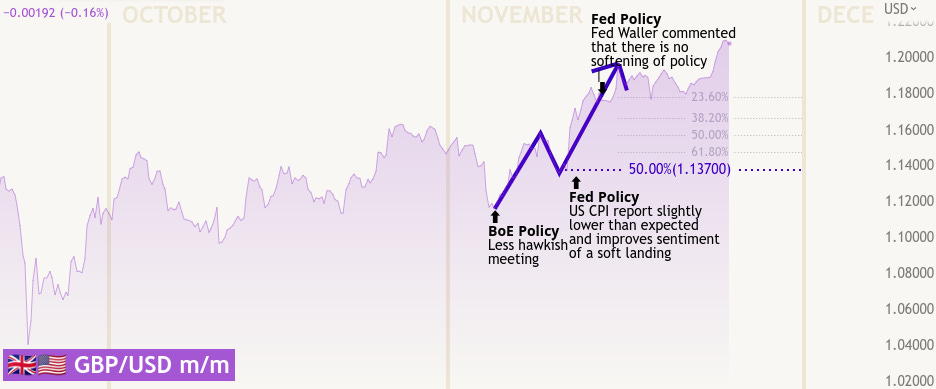

The short term view (month on month) shows that the GBP/USD has been uptrending since the start of the month (November) when the BoE hiked rates but commented that markets had priced in higher rates than may be required.

This uptrend was further supported when the US CPI report came in slightly lower than expected and weakened the US dollar.

The pair has since found a stable level above 1.18 which held as the latest budget announcement was made indicating investor confidence.

SENTIMENT

-BOE RATE SENTIMENT GIVES GBP/USD A LIFT-

Last week on Thursday the 17th of November the UK Chancellor Hunt provided the Autumn Statement which detailed a more fiscally responsible approach to the budget compared to the short-lived mini-budget from the previous Chancellor Kwarteng.

The markets interpreted this as better for inflation and interest rates which resulted in 2023 forecasts being scaled back to 4.5 percent from 6.

It is expected that this sentiment will result in some upside moves on the FTSE 100 as well as downside moves on gilt yields.

-FED RATE SENTIMENT KNOCKS GBP/USD FROM HIGHS-

Last week on Tuesday the 15th of November the odds of a 0.50 percent hike at the Fed meeting next month (Dec 14) in favour of a 0.75 hike began to ease from 80/20 to 64/36.

This caused some strengthening in the USD as higher rates increased the expectations of a hard-landing and has undone some of the moves following the softer than expected US CPI report.

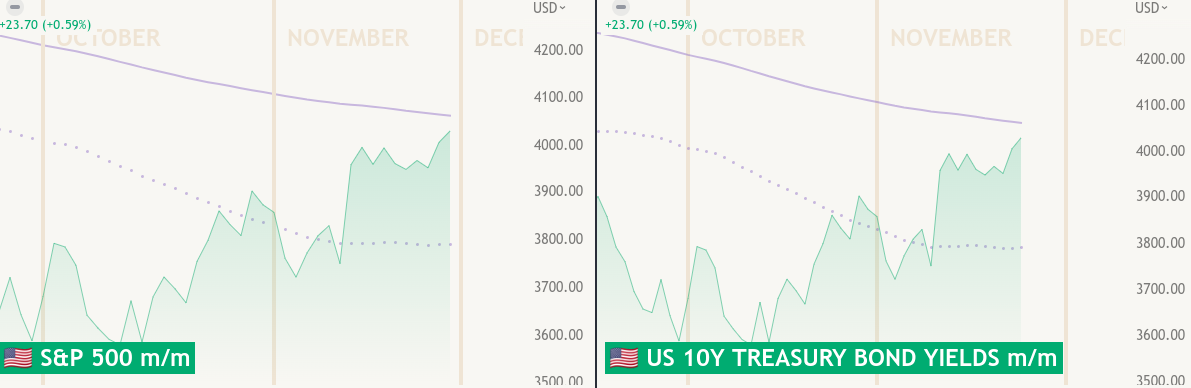

It is expected that this sentiment will result in some downside moves on the S&P 500 as well as upside moves on treasury yields.

-INTERMARKETS-

The FTSE 100 and Gilt Yields are moving to the upside as expected in support of a less hawkish BoE. This is likely to keep GBP/USD moving to the upside.

S&P 500 is holding onto the recent highs, as are the treasury yields which indicates a contradiction but does reflect the indecision regarding rate hikes. This is likely to keep the GBP/USD in a range.

-END DISCLAIMER-

Copy the trade plan with an investment at www.etoro.com/people/jeepsontrading

Detailed analysis over at at www.jeepsontrading.substack.com

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk