TRADE PLAN GBP/USD 🇬🇧 🇺🇸

Monitor markets, waiting on fresh data...

-SUMMARY-

DERBYSHIRE GB / NOV 24 - The $GBPUSD is attempting to break above $1.230 as it continues to retrace the long term downtrend from $1.420 which had fallen as low as $1.085.

The resistance level at $1.37 is a difficult task for the bulls in the face of UK forecasts that the economy is heading (and may already be in) for a multi-year recession, however the bears are not putting up much of a fight as USD safe-haven moves continue to unwind.

The key data this week that could cause a change in the bullish $GBPUSD sentiment may not happen until next week when we get the latest US and UK CPI reports as well as rate decisions from both Central Banks.

The CME FedWatch Tool has a 0.50 hike forecasted at 80 percent which indicates there is still some room left in the USD shorts although there is more of a risk to the upside if any news gives way to an increased chance of a 0.75 hike.

On Friday there will be US PPI data which if comes in significantly above expectations and the odds of a 0.50 hike are still elevated then there may be room to take a market entry short on the $GBPUSD.

Until then, the plan is to monitor the market but avoid placing any entries.

FUNDAMENTALS

-UNITED KINGDOM-

At the beginning of last month on the 3rd of November, the Bank Rate was hiked by 0.75 to 3.00 percent. This matched the market expectations and was higher than the 0.50 percent hike at the September meeting.

This is the eighth consecutive rate hike and the largest since 1989. The MPC remarked that further hikes may be required although at a lower peak than was priced into markets at the time.

The next meeting is next week on Thursday the 15th of December and the long term outlook is for higher rates.

The economic outlook for the upcoming quarter is for pessimistic deterioration and the indicators support this view.

_

-UNITED STATES-

At the beginning of last month on the 2nd of November (the day before the Bank of England meeting), the Federal Funds Rate was hiked by 75bps to between 3.75 and 4.00 percent. This matched the market expectations as well as the hike at the September meeting.

This is the sixth consecutive rate hike and borrowing costs are now at the highest since 2008. During the press conference, Chair Powell commented that the rates will need to be higher than previously expected.

The next meeting is next week on Wednesday the 14th of December and the long term outlook is for higher rates.

The CME FedWatch tool is moving towards a less hawkish outlook with climbing odds of a 0.50 hike in favour of 0.75 at 80/20 when previously this was 65/35.

The economic outlook for the upcoming quarter is for pessimistic deterioration although the indicators suggest a slightly better outcome is possible.

_

TECHNICALS

-TWO YEAR VIEW-

Over a two year view with weekly intervals, the GBP/USD has fallen from $1.42 to $1.08. Price is now retracing but is expected to remain below the 1.37 area which was previously tested in January prior to the war in Ukraine.

_

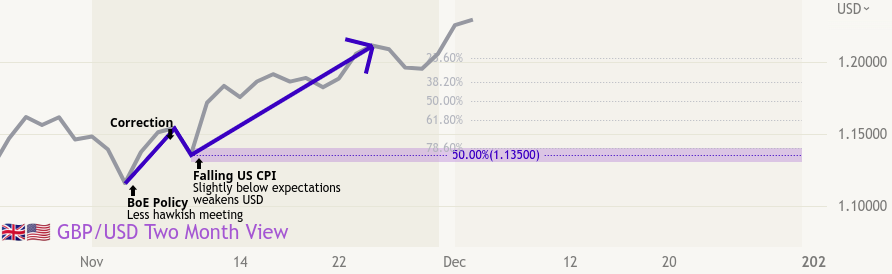

-TWO MONTH VIEW-

Over a two month view with daily intervals, the GBP/USD has climbed from $1.080 to $1.225. Price is now steady near the highs and is expected to remain above the $1.135 area which was previously tested early in November prior to the lower than expected release of US CPI.

The fundamental analysis suggests that the USD will outperform the GBP during the next quarter which will result in continued downside moves on the USD. It is therefore expected that the GBP/USD will remain on the upside above the $1.135 area.

_

SENTIMENT

-NOV 10 | FALLING US CPI GIVES GBP/USD A LIFT -

On November the 10th, annual US CPI for October was reported at 7.7 percent inflation and crucially, this is below the market expectation of 8.0 percent. This resulted in increased odds that the Fed will hike at 0.50 percent instead of the previously expected 0.75. Speculators are also now considering that a soft landing (recession aversion) is achievable and USD safe haven longs are being unwound.

It is expected that this narrative will result in optimism and see upside moves on the S&P 500 and downside moves on 10Y bond yields. This will likely cause a weaker USD.

_

-NOV 03 | LESS HAWKISH BANK OF ENGLAND CREATES AN UPTREND ON GBP/USD -

On November the 3rd, the Bank of England hiked the Bank Rate by 0.75 to 3.00 percent and then held a press conference where the governor tempered previous hawkishness and mentioned that rates will not be required to be as high as markets had priced in.

This is due to the change of government from Truss to Sunak who has been seen to be taking a much more fiscally responsible approach to budgets.

It is expected that this narrative will result in optimism and see upside moves on the FTSE 100 and downside moves on 10Y bond yields. This will likely cause a stronger GBP.

_

-INTERMARKETS-

The FTSE 100 and UK Gilt yields are moving as expected by the sentiment narrative regarding a less hawkish Bank of England and are continuing to price in the recent optimism.

The S&P 500 and US Treasury yields are also moving as is expected although that is based on the sentiment narrative regarding a cooling CPI, soft landing and less hawkish Federal Reserve.

_

-𝗘𝗡𝗗 𝗗𝗜𝗦𝗖𝗟𝗔𝗜𝗠𝗘𝗥-

- Copy the trade plan with an investment at www.etoro.com/people/jeepsontrading

- The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk