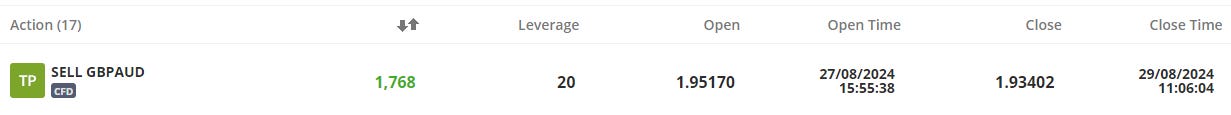

Trade details…

Tuesday, 27 August, Week 35

This trade plan provides an in-depth analysis of the GBPAUD forex pair, focusing on a potential short-selling opportunity. It examines economic indicators, central bank policies, market sentiment, and price patterns to help forex traders make informed decisions. The GBPAUD cross is affected by macroeconomic data releases, central bank announcements, global risk sentiment, and commodity prices. It has a positive correlation with Australian exports and an inverse relationship with the US dollar.

Currently, market sentiment surrounding the GBPAUD is cautiously bullish, driven by the Bank of England's (BoE) recent rate cut and expectations of further easing, contrasting with the Reserve Bank of Australia's (RBA) hawkish stance. However, this bullish sentiment may be short-lived, as underlying economic fundamentals and upcoming pivotal events suggest potential for a reversal.

For clarity, this trade plan utilises specific timeframes for analysis: near-term (five-day outlook), short-term (six-week outlook), mid-term (six-month outlook), and long-term (five-year outlook).

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Navigating the GBPAUD Landscape

Over the past six weeks, the GBPAUD has been on an uptrend. However, in the previous five days, the pair has shown signs of slowing momentum.

In the near-term, the Australian dollar could strengthen against the British pound due to the upcoming release of the Australian CPI for July. If the data shows a higher-than-expected inflation figure, it could reinforce the RBA's hawkish stance and potentially lead to a rate hike, boosting the AUD. Conviction level: Moderate, as the RBA has signalled a preference for maintaining the current rate for an extended period, but unexpected inflationary pressures could prompt a shift in policy.

Conversely, the GBPAUD could weaken in the near-term if the UK's economic data continues to disappoint. Weak GDP figures or a further decline in consumer confidence could fuel expectations of more aggressive easing by the BoE, putting downward pressure on the GBP. Conviction level: High, as recent UK economic indicators have been mixed, with some showing signs of weakness, and the BoE has already indicated a willingness to cut rates further if necessary.

Upcoming Pivotal Events

Australian CPI for July (Wednesday, 28 August, Week 35): A higher-than-expected inflation figure could bolster the AUD, as it would support the RBA's hawkish stance and potentially lead to a rate hike. Conversely, a lower-than-expected figure could weaken the AUD, as it would suggest that inflationary pressures are easing, reducing the need for further rate hikes.

UK GDP Growth Rate QoQ Final Q2 (Monday, 30 September, Week 39): A confirmation of the preliminary estimate of 0.60% growth could provide some support to the GBP, as it would indicate that the UK economy is not slowing as sharply as some fear. However, a downward revision to the growth figure could weaken the GBP, as it would suggest that the UK economy is more vulnerable to the headwinds from high inflation and rising interest rates.

UK Inflation Rate YoY AUG (Wednesday, 18 September, Week 38): A higher-than-expected inflation figure could strengthen the GBP, as it would increase the likelihood of further rate hikes by the BoE. Conversely, a lower-than-expected figure could weaken the GBP, as it would suggest that inflationary pressures are easing, reducing the need for further rate hikes.

Trade Thesis: Shorting the GBPAUD

A potential short-selling opportunity in the GBPAUD has arisen at its current level around 1.95. The Stop-Loss is to be placed 200 pips above this entry and a profit target is at 1.947 which can potentially be extended to 1.93.

This trade plan presents a compelling short-selling opportunity in the GBPAUD, based on the divergence in monetary policy between the BoE and the RBA, the potential for further weakness in UK economic data. The high conviction level stems from the confluence of these factors, suggesting a high probability of a downward move in the pair.

Sources

Bank of England

Office for National Statistics

Trading Economics

BRC - British Retail Consortium

Confederation of British Industry

GfK Group

S&P Global

Nationwide Building Society

Office for Budget Responsibility

Eurostat

US Bureau of Labor Statistics

Australian Bureau of Statistics

Reserve Bank of Australia

Australian Government

Westpac Banking Corporation

Melbourne Institute

National Australia Bank

CoreLogic