UNITED KINGDOM, AND GBP

We are at a tipping point for the UK. The economy is stalling, and the central bank is split on how to fix it, leaving the GBP exposed and vulnerable against a stronger USD. The smart money is watchin

Saturday, 14 February 2026

We are at a tipping point for the UK. The economy is stalling, and the central bank is split on how to fix it, leaving the GBP exposed and vulnerable against a stronger USD. The smart money is watching for a rate cut in March to save growth, but sticky inflation could ruin those plans. There are two major events you absolutely must mark on your calendar:

Spring Statement (03 March 2026): Watch for borrowing updates—surprises here could spike Gilt yields.

BoE Interest Rate Decision (19 March 2026): The market expects a cut to 3.50 percent; anything else will cause massive volatility.

MACROECONOMIC AND POLITICAL LANDSCAPE

The UK economy is currently walking through mud. Growth has stalled (0.1 percent in Q4), unemployment is creeping up to 5.1 percent, and the central bank is deeply divided on how to fix it. The sentiment is bearish for the economy but dovish for rates. The key takeaway is that the Bank of England is under immense pressure to cut rates in March to stop the rot, which puts the GBP in a vulnerable position.

Government Leadership, Fiscal Policy, And Mandate

When we look at the political framework driving the United Kingdom right now, we are seeing a government under Prime Minister Keir Starmer and Chancellor Rachel Reeves that is trying to walk a very tight rope. They are balancing a mandate for “sustainable, long-term economic growth” with a desperate need to fix public services and restore fiscal reputation (https://www.gov.uk/government/publications/budget-2025-document/budget-2025-html). The strategy here is clear: supply-side reforms and a massive capital injection to jumpstart investment, while simultaneously deploying a social safety net to stop the “write-off” of workers due to long-term sickness. They have committed to a massive 29 billion GBP real-terms increase in annual day-to-day spending for the NHS through 2029, which is a huge fiscal commitment (https://www.gov.uk/government/publications/spending-review-2025-document/spending-review-2025-html).

Over the last seven months, the fiscal story has been dominated by the fallout and recovery from the Autumn Budget in November 2025. Leading up to it, we saw real fear in the markets about tax hikes, which actually froze hiring. To calm everyone down, Chancellor Reeves shrewdly adjusted her fiscal rules to double the government’s “fiscal headroom” to 22 billion GBP. This was a smart move to create a buffer against shocks (https://www.theguardian.com/politics/2025/dec/22/rachel-reeves-sets-early-march-date-for-spring-statement-as-obr-prepares-forecast). She also froze regulated rail fares and capped bus fares at 3 GBP to help commuters, while raising the National Living Wage to 12.71 GBP. To pay for all this without blowing up the debt, she has ordered “draconian” efficiency savings across Whitehall, aiming to cut administration budgets by 11 percent to save 2.2 billion GBP (https://www.gov.uk/government/publications/spending-review-2025-document/spending-review-2025-html).

As we look ahead to the next seven weeks, everything revolves around the Spring Statement on 03 March 2026. The Treasury is pitching this as a “stability” update, but do not be fooled—the market is watching like a hawk. Traders and businesses are desperate for targeted relief for industrial sectors that are crushing under high costs. This event is the litmus test: can the government hold the line on borrowing while under massive political pressure to help with the cost of living? If they slip, the bond vigilantes might return (https://www.hentons.com/blog/spring-budget-2026-what-to-expect-and-why-it-matters/).

Bank Of England, Monetary Policy, And Inflation Targeting

The Bank of England is currently in a fascinating and somewhat precarious position. Led by Governor Andrew Bailey, the Bank’s nine-member Monetary Policy Committee is structurally independent, but they are fighting a two-front war. Their primary mandate is keeping Consumer Prices Index inflation at 2.0 percent, but they have to balance the risk of inflation getting “stuck” in the system against the risk of crushing the economy so hard they cause a recession (https://www.bankofengland.co.uk/monetary-policy-report/2026/february-2026). It is a classic central banking dilemma, but the split within the committee makes it even more volatile for us as traders.

The last seven months have been a rollercoaster of “will they, won’t they” regarding rate cuts. After rates peaked at 5.25 percent, the Bank managed to cut the rate down to 3.75 percent by December 2025. But here is the kicker: that December decision was a razor-thin 5-to-4 vote (https://tradingeconomics.com/united-kingdom/interest-rate). Then, at the most recent meeting on 05 February 2026, they voted to hold rates at 3.75 percent, again with a 5-to-4 split. Four members were screaming for a cut because unemployment is rising and companies are firing people, but the majority got spooked because inflation popped back up to 3.4 percent in December due to weird spikes in airfares and tobacco duties. At the same time, they are still aggressively shrinking their balance sheet, selling off government bonds to get down to 551 billion GBP (https://commonslibrary.parliament.uk/research-briefings/sn02802/).

Moving into the next seven weeks, all eyes are on the 19 March 2026 meeting. The forward guidance is hinting heavily at a “dovish pivot”—meaning cuts are coming—assuming the inflation data behaves. The market is pricing in a 25 basis point cut to 3.50 percent (https://www.bankofengland.co.uk/monetary-policy/the-interest-rate-bank-rate). But be careful: if the private-sector wage data comes in hot before that meeting, those five members who voted to hold might dig their heels in. If they do not cut in March, we could see a massive repricing in the GBP.

Economic Structure, Industry Dynamics, And Trading Partners

When we analyze the United Kingdom’s economy, we are dealing with a service-heavy giant. With a GDP of 3.69 trillion USD, roughly 80 percent of the output comes from services—think London finance, law, and a booming fintech sector (https://oec.world/en/profile/country/gbr). While manufacturing is a smaller slice of the pie, it is high-value stuff like aerospace and pharmaceuticals. Even post-Brexit, the European Union is still the king of trading partners, taking 41.0 percent of exports and sending 50.2 percent of imports, followed by the United States. Structurally, the UK runs a trade deficit, buying more goods than it sells, but it partly makes up for this by being a global powerhouse in exporting services (https://en.wikipedia.org/wiki/Economy_of_the_United_Kingdom).

The economic performance over the last seven months has been, frankly, underwhelming. Growth for 2025 was just 1.3 percent, and by the fourth quarter, the engine practically stalled out with 0.1 percent growth (https://tradingeconomics.com/united-kingdom/gdp-growth). The services sector flatlined, and construction actually shrank. We also saw how fragile the supply chain is: a cyberattack on Jaguar Land Rover in August/September caused national vehicle production to crash by nearly 29 percent, dragging the whole monthly GDP down with it (https://tradingeconomics.com/united-kingdom/monthly-gdp-mom/news/501636). On top of that, the labor market is cracking. Unemployment hit 5.1 percent late last year, and we are seeing a shift where full-time jobs are disappearing in favor of part-time or secondary jobs as people try to make ends meet (https://tradingeconomics.com/united-kingdom/unemployment-rate).

For the next seven weeks, do not expect a sudden boom. The economy is stuck in neutral waiting for the Spring Statement. Forecasts suggest growth of only 0.2 percent or 0.3 percent for the first quarter of 2026. We need to watch the S&P Global Manufacturing PMI and retail sales data closely. If consumers stop spending because they are worried about their jobs, the service sector could tip into contraction, which would force the Bank of England’s hand on rates (https://tradingeconomics.com/united-kingdom/monthly-gdp-mom).

FINANCIAL MARKETS PERFORMANCE

There is a massive disconnect in the markets: the stock market (GB100) is flying high thanks to global factors, while the domestic indicators—Gilt yields and the GBP—are flashing warning signs about the UK economy. The sentiment is cautious. The GBP is the weak link here; it is highly vulnerable to the interest rate differential widening against the USD. Bond traders are keeping their finger on the sell button ahead of the Spring Statement.

Asset Class Developments And Market Sentiment

The financial markets in the UK have been incredibly volatile over the last seven months, reacting to a mix of fiscal fear and monetary hope. Let’s start with the bond market, which has been on a wild ride. Back in the third quarter of 2025, traders got very nervous about the government’s spending plans. Yields on the 10-year Gilt spiked to 4.8 percent in September because everyone was terrified the Autumn Budget would blow out the deficit (https://www.bankofengland.co.uk/bank-insights/2026/what-were-the-drivers-of-uk-long-term-interest-rates-in-2025). Mortgage rates and corporate borrowing costs jumped. However, once the Budget passed without disaster and the Bank of England finally cut rates in December, calm returned. By mid-February 2026, the 10-year yield had dropped back to 4.42 percent. Why? Because the weak GDP data convinced traders that more rate cuts are inevitable (https://tradingeconomics.com/united-kingdom/government-bond-yield). For the next seven weeks, watch the Spring Statement—if borrowing goes up, yields could spike again.

The stock market has been living in a different reality. The GB100 index has ignored the domestic economic gloom, rallying nearly 20 percent year-on-year to hit 10,446 points by February 13 (https://tradingeconomics.com/united-kingdom/stock-market). This is happening because the biggest companies in the index make their money overseas, so they aren’t hurt by the weak UK consumer. Plus, big global investors have been rotating out of expensive tech stocks and into “boring” defensive sectors like materials and consumer staples—which the UK has in spades (https://uk.investing.com/analysis/materials-and-energy-stocks-take-early-lead-in-2026-200621568). Expect this grind higher to continue, but it is fragile; it needs solid earnings reports to keep going.

In commodities, we witnessed a “super-cycle.” Gold has been absolute rocket fuel, surging 65 percent through the end of 2025 to set record highs. Central banks and nervous investors are buying it as a safe haven (https://www.bullionvault.com/gold-news/infographics/ai-gold-precious-metal-price-forecasts). Energy was a mixed bag: oil prices stayed low due to too much supply (good for inflation), but Natural Gas prices spiked 78 percent in January 2026 due to supply constraints, which is a major risk for UK inflation (https://www.worldbank.org/en/research/commodity-markets).

Finally, the currency market. The GBP has been struggling, hovering near 1.36 against the USD (https://tradingeconomics.com/united-kingdom/currency). It is simple divergence: the US economy looks strong with robust jobs data, while the UK looks weak with rising unemployment. The market is betting the Bank of England will have to cut rates faster than the US Federal Reserve. Over the next seven weeks, if the BoE cuts on March 19 and the Fed holds, we could see the GBP drop toward the low 1.30s as that interest rate advantage disappears.

ECONOMIC INDICATORS AND FORECASTS

The data paints a clear but concerning picture: the economy is slowing down. Unemployment is up (5.10 percent), payrolls are shedding jobs (-43k), and inflation is sticky but expected to fall. The sentiment is decidedly dovish. The numbers strongly support the argument that the Bank of England needs to cut rates to 3.50 percent in March to prevent further damage to the labor market.

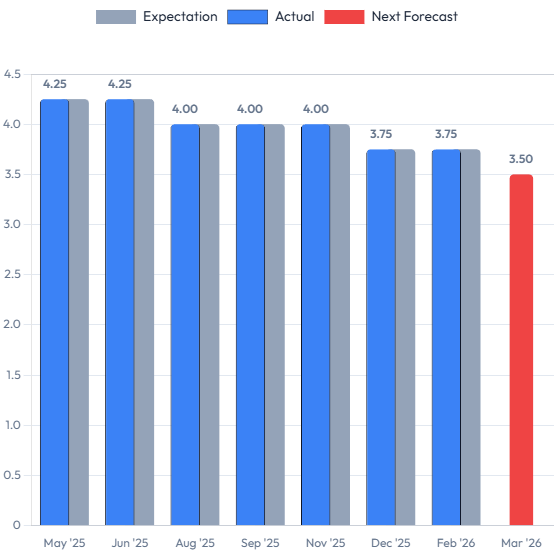

Interest Rate

Next Release & Period: 19 March 2026 (Policy Decision)

Trading Economics Forecast: 3.50 percent (United Kingdom Interest Rate)

Consensus / Long Term Views: The market consensus is largely aligned with the forecast for a 25 basis point cut to 3.50 percent, driven by the need to support the flagging economy. Looking further out, long-term models see the rate trending down toward a “terminal rate” of 3.00 percent by 2027 as policy normalizes.

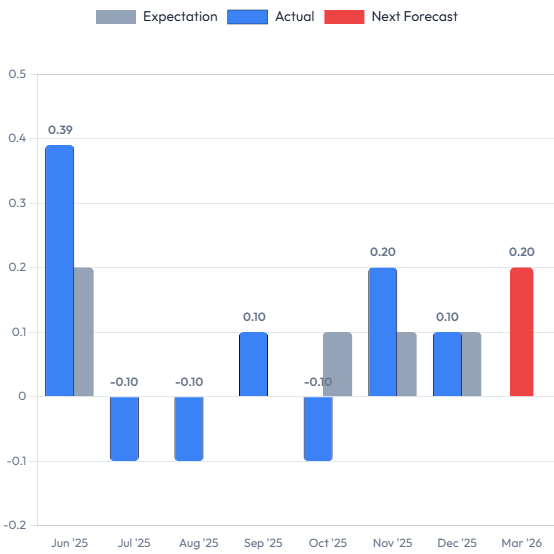

Economic Growth Rate (Monthly GDP)

Next Release & Period: 13 March 2026 (Jan ‘26 Data)

Trading Economics Forecast: 0.10 percent (United Kingdom Monthly GDP MoM)

Consensus / Long Term Views: The broad consensus is that the UK is stuck in a low-growth rut. While no massive recession is priced in, neither is a boom. Long-term projections suggest monthly growth will average a modest 0.40 percent by 2027 as lower interest rates finally start to stimulate business investment.

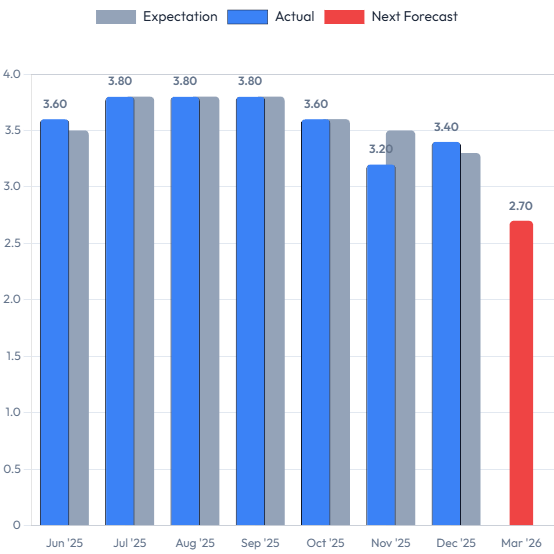

Inflation Rate (CPI)

Next Release & Period: 18 February 2026 (Jan ‘26 Data)

Trading Economics Forecast: 3.00 percent (United Kingdom Inflation Rate)

Consensus / Long Term Views: Most economists believe the spike to 3.40 percent in December was a blip caused by volatile airfares. The consensus view is that inflation will drop back to 3.00 percent in the next print and return to the Bank’s 2.00 percent target by the second quarter of 2026.

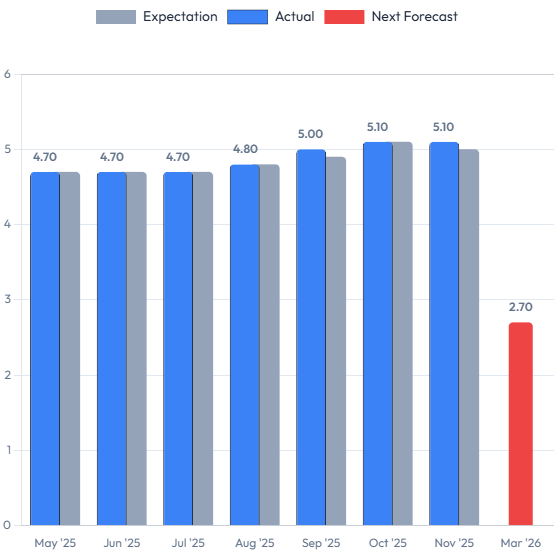

Unemployment Rate

Next Release & Period: 17 February 2026 (Dec ‘25 Data)

Trading Economics Forecast: 5.10 percent (United Kingdom Unemployment Rate)

Consensus / Long Term Views: The labor market is clearly cooling. Consensus expects the rate to hold at 5.10 percent for now, but long-term models see it peaking slightly higher at 5.30 percent in early 2026 before recovering to around 4.50 percent by 2028.