UNITED KINGDOM: Economic stagnation amid falling inflation, but political and geopolitical risks are increasing

Saturday, 29 June 2024, Week 26: The UK economy is at a crossroads. Inflation has fallen more quickly than anticipated, but economic growth remains subdued. The upcoming general election and geopolitical tensions in the Middle East are adding to uncertainty. This report analyses the key economic and political developments of the past five months and looks ahead to the potential opportunities and risks for the next five weeks.

Fiscal Policy

The UK government's fiscal policy has been a significant influence on the economy over the past five months. The Autumn Statement in November 2023 saw the Chancellor announce a package of tax cuts and spending increases aimed at supporting growth and easing the cost of living crisis. These measures included a 2 percentage point cut to the main rate of employee National Insurance contributions and a freeze on fuel duty. The Spring Budget in March 2024 saw the Chancellor announce a further 2 percentage point cut to the main rate of employee and self-employed National Insurance contributions, as well as a number of other tax cuts and spending increases.

The Office for Budget Responsibility (OBR) estimates that the combined effect of these measures will be to increase borrowing by an average of £8.8 billion a year (0.3 per cent of GDP). The OBR also estimates that the measures will provide a small, temporary boost to demand in the near term and a similar, but permanent, boost to supply over the medium term.

The government's fiscal loosening has provided some support to the economy. The Bank of England has raised the Bank Rate five times since December 2022, from 0.1% to 5.25%.

Looking ahead to the next five weeks, the UK's fiscal policy is likely to remain a key focus for markets. The general election on July 4th will determine the direction of fiscal policy for the next five years. A Labour victory would likely lead to a more expansionary fiscal policy, while a Conservative victory would likely see a continuation of the current government's focus on fiscal consolidation.

Economics

The UK economy has been stagnating in recent months, with GDP growth weak and business investment subdued. The labour market remains tight, but there are signs that it is beginning to loosen. Inflation has fallen more quickly than anticipated, but it is expected to rise again in the second half of the year. The UK's trade deficit has widened in recent months, reflecting weak export growth and strong import growth.

The economic outlook for the UK is uncertain, with a number of headwinds facing the economy. These include the ongoing war in Ukraine, high energy prices, rising interest rates, and the risk of a global recession. The UK is also facing a number of structural challenges, including low productivity growth and an ageing population.

Despite these challenges, there are also some tailwinds supporting the UK economy. These include a strong labour market, a recovery in consumer spending, and the government's fiscal support.

Economic Growth

The UK economy grew by just 0.1% in 2023, the weakest growth since the 2008-09 financial crisis. While growth was weak in the second half of the year, the UK did not enter a technical recession. The OBR forecasts that GDP growth will pick up to 0.8% in 2024, but this is still well below the UK's long-term average growth rate.

The weakness in economic growth is being driven by a number of factors, including high inflation, rising interest rates, and the uncertainty created by the war in Ukraine. Consumer spending has been weak, as households have been squeezed by the rising cost of living. Business investment has also been subdued, as firms have been reluctant to invest in the face of uncertainty.

Labour

The UK labour market remains tight, with the unemployment rate at a historically low level of 3.8%. However, there are signs that the labour market is beginning to loosen. The number of vacancies has been falling in recent months, and the employment rate has also started to decline.

Wage growth remains strong, but it is expected to moderate in the coming months as inflation falls and the labour market loosens. The OBR forecasts that nominal average pay growth will slow from 6.8% in 2023 to 3.6% in 2024.

Price Changes

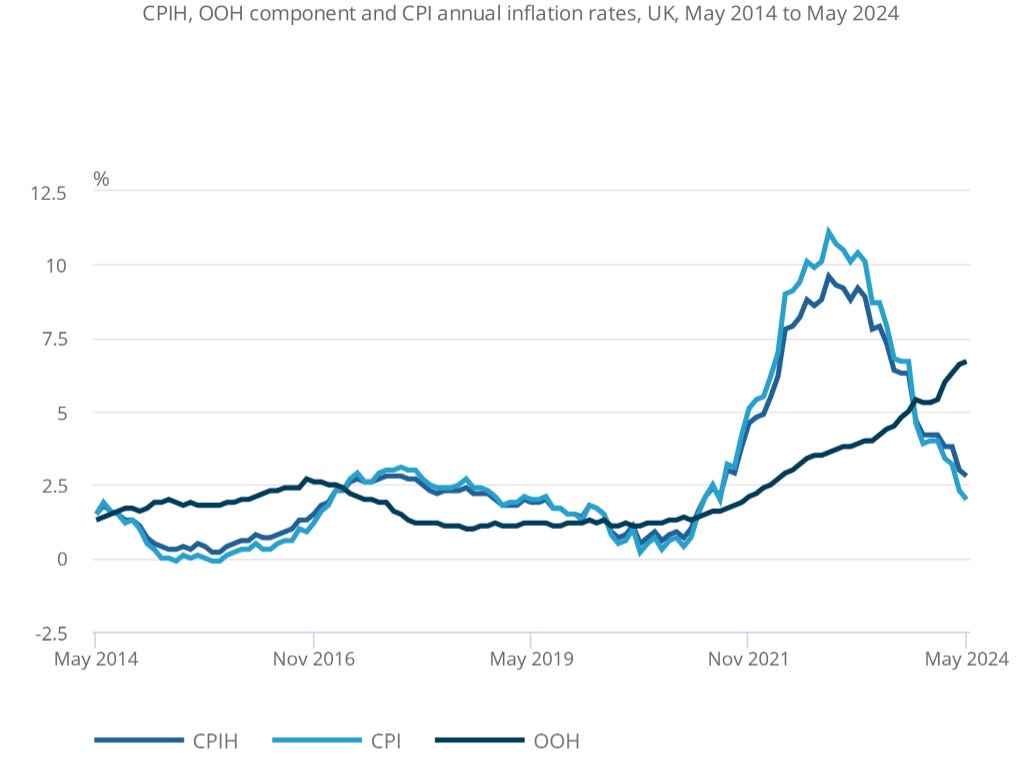

CPIH inflation fell to 2.8% in May 2024, down from a peak of 9.6% in October 2022. The fall in inflation has been driven by a number of factors, including lower energy prices, easing supply chain disruptions, and the Bank of England's interest rate rises.

The OBR forecasts that CPIH inflation will fall to an average of 2.2% in 2024 and 1.5% in 2025. However, the OBR also warns that there are a number of risks to the inflation outlook, including the possibility of further energy price rises and the persistence of strong wage growth.

The CPIH all goods index fell by 1.3% in the 12 months to May 2024, compared with a fall of 0.8% in the 12 months to April. This is the largest annual fall since December 2000. The downward effects came from non-energy industrial goods (particularly housing goods, clothing and footwear goods, and vehicles), and food, alcohol and tobacco. The only large, partially offsetting upward contribution was from energy, principally from motor fuels.

Trade

The UK's trade deficit widened to £6.75 billion in April 2024, the largest deficit in almost two years. The widening of the deficit was driven by a fall in exports and a rise in imports.

The weakness in exports is being driven by a number of factors, including the slowdown in the global economy, the strength of the pound, and the ongoing impact of Brexit. The rise in imports is being driven by the UK's strong domestic demand and the high price of imported energy.

The OBR forecasts that the UK's trade deficit will remain large in the coming years.

Monetary Policy

The Bank of England's Monetary Policy Committee (MPC) has raised the Bank Rate five times since December 2022, from 0.1% to 5.25%. The MPC has raised rates in response to the surge in inflation, which has been driven by a number of factors, including the war in Ukraine, high energy prices, and strong domestic demand.

The MPC's most recent decision, in June 2024, was to maintain the Bank Rate at 5.25%. The decision was made by a majority of 7-2, with two members preferring to reduce Bank Rate by 0.25 percentage points, to 5%.

The MPC's decision to maintain Bank Rate at 5.25% reflects its concerns about the persistence of inflationary pressures. The MPC noted that CPI inflation had fallen back to the 2% target in May, but it also noted that the restrictive stance of monetary policy was weighing on activity in the real economy, was leading to a looser labour market and was bearing down on inflationary pressures.

The MPC said that it would continue to monitor closely indications of persistent inflationary pressures and resilience in the economy as a whole, including a range of measures of the underlying tightness of labour market conditions, wage growth and services price inflation. The MPC also said that it remained prepared to adjust monetary policy as warranted by economic data to return inflation to the 2% target sustainably.

Looking ahead to the next five weeks, the MPC is likely to remain in a wait-and-see mode. The MPC will be monitoring closely the impact of its previous rate rises on the economy, as well as the evolution of inflation and wage growth. The MPC is likely to keep Bank Rate at its current level until it is confident that inflation is on a sustainable path back to the 2% target.

The MPC's June 2024 Monetary Policy Summary stated: "Headline CPI inflation has fallen back to the 2% target. The restrictive stance of monetary policy is weighing on activity in the real economy, is leading to a looser labour market and is bearing down on inflationary pressures. Key indicators of inflation persistence have continued to moderate, although they remain elevated. Monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term in line with the MPC’s remit. The Committee has judged since last autumn that monetary policy needs to be restrictive for an extended period of time until the risk of inflation becoming embedded above the 2% target dissipates."

Geopolitics and Market Themes

War in Ukraine

Russia's invasion of Ukraine in February 2022 has had a significant impact on the global economy, including the UK. The war has led to higher energy prices, disrupted supply chains, and increased uncertainty.

The UK government has imposed a number of sanctions on Russia in response to the invasion. These sanctions have had a negative impact on the UK economy, but the government has argued that they are necessary to put pressure on Russia to end the war.

The war in Ukraine is likely to continue to weigh on the UK economy in the coming months. The war is creating uncertainty, which is deterring investment and weighing on consumer confidence. The war is also leading to higher energy prices, which is pushing up inflation and squeezing household incomes.

Conflict in the Middle East

The conflict in the Middle East has escalated in recent months, with increased tensions between Israel and Hezbollah. The conflict has led to some disruptions to shipping in the Red Sea, which is a key trade route for the UK.

The conflict in the Middle East is a risk to the UK economy. The conflict is creating uncertainty, which is deterring investment and weighing on consumer confidence. The conflict is also leading to higher energy prices, which is pushing up inflation and squeezing household incomes.

UK General Election

The UK will hold a general election on July 4th. The election is expected to be close, with the Labour Party currently ahead in the polls.

The outcome of the election will have a significant impact on the UK economy. A Labour victory would likely lead to a more expansionary fiscal policy, while a Conservative victory would likely see a continuation of the current government's focus on fiscal consolidation.

The election is also likely to have an impact on the pound. A Labour victory would likely lead to a weaker pound, while a Conservative victory would likely lead to a stronger pound.

Conclusion

The UK economy is facing a number of challenges, including high inflation, rising interest rates, and the uncertainty created by the war in Ukraine and the conflict in the Middle East. The upcoming general election is also adding to uncertainty.

Despite these challenges, there are also some tailwinds supporting the UK economy. These include a strong labour market, a recovery in consumer spending, and the government's fiscal support.

The outlook for the UK economy is uncertain, but the next five weeks will be crucial in determining the direction of the economy in the coming months.

References

Office for Budget Responsibility, Economic and fiscal outlook, March 2024

Office for National Statistics, GDP quarterly national accounts, UK: January to March 2024

Office for National Statistics, Labour market overview, UK: June 2024

Bank of England, Monetary Policy Report, May 2024

Bank of England, Monetary Policy Summary and minutes of the Monetary Policy Committee meeting ending on 19 June 2024

Office for National Statistics, Retail sales, Great Britain: May 2024

Office for National Statistics, UK trade: April 2024

Office for National Statistics, Consumer price inflation, UK: May 2024

Stratfor

The Daily Upside

Bloomberg

Reuters

Newsquawk

Trading Economics

Financial Juice