United Kingdom Macroeconomics

UK Pound exhibits resilience amid fiscal consolidation and persistent inflation.

Indifferent fundamental strength, while market sentiment remains bullish.

UK navigates modest growth amid persistent inflation while pound defies economic headwinds

The UK economy has 1.4% growth (2024), 3% inflation and tax increases. The pound is trading at 1.29-1.30 against the dollar due to monetary policy.

Labour's tax-driven fiscal consolidation and aggressive defence commitments reshape UK outlook

The UK narrowly avoided a recession with 0.1% Q4 2024 growth. Despite this, the Bank of England's monetary policy is complicated by high inflation and low manufacturing and construction PMIs.

Looming Spring Statement and planned tax changes will test market confidence

Key economic events in the coming weeks include UK inflation figures (18 March), Bank of England's rate decision (20 March), and the Spring Statement (26 March), which may adjust upcoming National Insurance hikes. Inflation could reach 3.7% by Q3 2025, while GDP growth is projected at 1.7% for 2025, potentially supporting sterling

Current Situation and Outlook

The UK economy currently sits at a critical juncture. GDP expanded by a modest 0.1% in Q4 2024, narrowly avoiding a technical recession, while year-on-year growth reached 1.4%, exceeding expectations. However, recent business surveys paint a concerning picture, with the S&P Global Manufacturing PMI falling to 46.9 in February and construction PMI slumping to 44.6, its lowest level since May 2020. Despite these headwinds, the pound has gained approximately 3% in the first week of March alone, reflecting market confidence in the UK's monetary policy framework and macroeconomic stability, even as domestic growth prospects remain uncertain.

Looking ahead, several pivotal events loom on the horizon. The Bank of England's monetary policy meeting on March 20 will be closely scrutinised for signals about future rate cuts, particularly given the recent uptick in inflation. Just days before, February's inflation data (released March 18) will provide crucial context for the MPC's deliberations. Perhaps most significantly, Chancellor Reeves' Spring Statement on March 26 comes just 11 days before the scheduled April 6 implementation of the employers' National Insurance increase, with markets watching closely for any potential adjustments to these planned tax measures.

Labour's Fiscal Consolidation and BoE's Cautious Easing Defined the Economic Landscape

The UK's economic and political landscape has undergone substantial transformation since Labour's landslide victory in July 2024. The new government wasted no time implementing significant policy changes, beginning with the cancellation of the controversial Rwanda asylum plan and the establishment of a Border Security Command. Chancellor Rachel Reeves' late-July spending review included controversial cuts to winter fuel payments for around 10 million pensioners, justified by citing a substantial £21.9 billion overspend inherited from the previous administration.

The defining economic event of Labour's first months in power was undoubtedly Reeves' October 2024 budget. The £40 billion tax increase package represented the largest fiscal consolidation since 1993 and included measures that will push the UK tax burden to its highest recorded level in history. Key measures included increasing employers' National Insurance to 15% on salaries above £5,000 from April 2025, changes to farm inheritance tax from April 2026, and income tax thresholds to rise with inflation only after 2028. Rather than focusing on immediate spending cuts, the government opted for revenue-raising measures aimed at providing long-term fiscal stability.

January 2025 saw Reeves announce plans for a new Heathrow runway as part of a broader growth strategy, along with directives to regulators to "tear down regulatory barriers" to promote economic expansion. This pivot toward growth-oriented policies followed criticism that the government's fiscal consolidation approach might hamper economic recovery. The following month, Prime Minister Starmer announced a significant increase in the defence budget to 2.5% of GDP by 2027, funded partly by reducing international aid to 0.3% of GDP.

Throughout this period, the Bank of England continued its cautious easing cycle, delivering its third 25 basis point cut in February 2025, bringing the Bank Rate to 4.5%. The decision revealed an increasingly dovish tilt within the Monetary Policy Committee, as Catherine Mann—previously one of the committee's most hawkish members—joined another colleague in voting for a larger 50 basis point reduction.

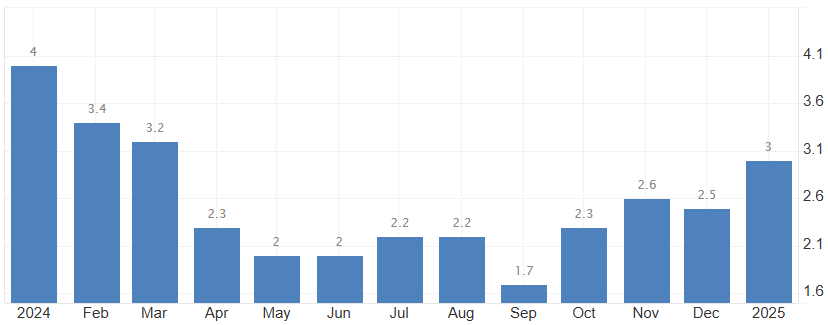

In the past seven weeks, economic data has presented a mixed picture. While the UK avoided a technical recession with modest 0.1% growth in Q4 2024, business surveys suggest continuing challenges. The most concerning development has been the uptick in inflation to 3.0% in January 2025, significantly above the Bank's 2% target and higher than market expectations of 2.8%. Services inflation rose to 5.0%, highlighting ongoing pricing pressures in labour-intensive sectors.

Despite these economic headwinds, the pound has shown remarkable resilience in early 2025. GBP/USD has recovered to over 1.29, reaching levels last seen in November 2024. Meanwhile, the FTSE 100 reached an all-time high above 8900 in March 2025, though UK-focused funds saw significant outflows of £1.22 billion in February alone. This divergence between strong currency performance and domestic asset outflows reflects a nuanced market view—confidence in the UK's monetary policy and macroeconomic stability, but concerns about domestic growth prospects.

The most significant global development affecting markets has been the escalation of trade tensions, with President Trump implementing 25% tariffs on Canadian and Mexican imports and increasing tariffs on Chinese goods to 20% on March 4th. This has triggered a risk-off sentiment across global markets, though sterling has remained relatively resilient amid this turbulence.

Rate Decisions and Spring Statement to Influence Pound Trajectory Amid Global Uncertainties

The next seven weeks represent a crucial period for the pound sterling, with several pivotal events that could significantly impact its trajectory. The most immediate focus is on the Bank of England's monetary policy meeting on March 20, where markets expect rates to hold at 4.5%. The decision and accompanying statement will be closely scrutinised for signals about the future path of rate cuts, particularly given the recent uptick in inflation. Just a few days prior, on March 18, the release of February's inflation data will provide crucial context for the MPC's deliberations. Any continuation of January's inflationary trend could further complicate the Bank's plans for monetary easing.

Perhaps the most significant event on the horizon is Chancellor Reeves' Spring Statement on March 26, which comes just 11 days before the scheduled April 6 implementation of the employers' National Insurance increase. Market participants will be watching closely for any adjustments to the planned tax measures, particularly potential relief for employers via an increased Employment Allowance or higher threshold before employers' NICs become payable. The charity sector, which faces major funding challenges from the NIC rise, may also receive targeted support. There's also speculation about potential relief for businesses and farmers from the April 2026 inheritance tax changes.

Looking beyond these immediate events, the pound's medium-term outlook will be shaped by several key factors. The divergence between central bank policies will be particularly important, as the ECB is expected to continue cutting rates while the BoE takes a more cautious approach due to high inflation. This could support GBP/EUR in the near term, though Germany's €500 billion infrastructure plan may complicate this dynamic. Against the dollar, the pound may face headwinds if the Federal Reserve delays its easing cycle due to persistent US inflation, potentially strengthening the greenback against most major currencies.

The most significant external threat to the UK economy and the pound is the implementation of US tariffs. As the UK's largest export partner, any substantial tariffs from the US could significantly impact the British economy, hindering growth and potentially increasing inflation. This risk highlights the delicate geopolitical balancing act facing the Starmer government, as it must maintain the "special relationship" with the US under President Trump while pursuing its own economic and diplomatic objectives.

On the domestic front, the UK's economic prospects appear mixed. KPMG forecasts 1.7% GDP growth in 2025, driven by household consumption and government spending. Consumer spending is projected to increase by 1.8% due to robust wage growth, though this may moderate to 1.4% in 2026 as structural challenges persist. The Bank of England remains more pessimistic, having halved its growth forecast for 2025 to just 0.75%.

Inflation is projected to rise further in the near term, reaching 3.7% by Q3 2025 due to higher global energy costs and regulated price changes, potentially not returning to the 2% target until Q4 2027. This outlook suggests a very gradual normalisation of monetary policy, with markets now pricing in a 77% chance of a rate cut in May and a 55.6% chance in August, but no further cuts anticipated until at least February 2026.

Looking further ahead to the second half of 2025, several important developments will shape the UK's economic and geopolitical landscape. The publication of the Strategic Defence Review and National Security Strategy before June's NATO summit will outline the UK's defence priorities and approach to global security challenges. The UK-EU relationship will continue to evolve amid European support for Ukraine, potentially creating opportunities for deeper security cooperation. The UK's trade strategy will progress with ongoing negotiations with India and potential new agreements with Southeast Asian nations.

For the pound specifically, market forecasts suggest modest movements in the coming months. Trading Economics projects GBP/USD will trade at 1.29 by the end of Q1 2025 before dipping slightly to 1.28 over the next 12 months. Currencies Direct forecasts that the pound will fluctuate in the first half of 2025 before gaining ground in the second half, with GBP/EUR rising overall but GBP/USD potentially weakening due to US dollar strength. Goldman Sachs projects UK gilt yields will fall to around 4% by year-end as the BoE continues its gradual cutting cycle, forecasting 100 basis points of further cuts in 2025.

The ultimate performance of sterling will depend on the UK's ability to avoid the trap of stagflation—high interest rates, high prices, and sluggish growth. The effectiveness of the Labour government's economic policies in stimulating investment and productivity will be crucial for sustained currency appreciation. As we move further into 2025, traders should closely monitor the evolution of inflation, the pace of monetary policy normalisation, and the impact of fiscal changes on economic growth.

Sources

Bank of England, Office for National Statistics, Office for Budget Responsibility, HM Treasury, KPMG, Trading Economics, Morningstar, S&P Global, UK Parliament, House of Commons Library, TradingView, Ernst & Young, Trustnet, Goldman Sachs, Currencies Direct, Corpay, JeepsonTrading, Calastone, AHDB, Tradingster, Foreign Commonwealth and Development Office, Ministry of Defence, Royal United Services Institute, FX Street, DW, Telegraph, UK Defence Journal, GIS Reports.