UNITED STATES, AND USD FUNDAMENTAL RESEARCH & ANALYSIS

The Hollow Boom And The Dollar’s Decline

Thursday, 01 January 2026

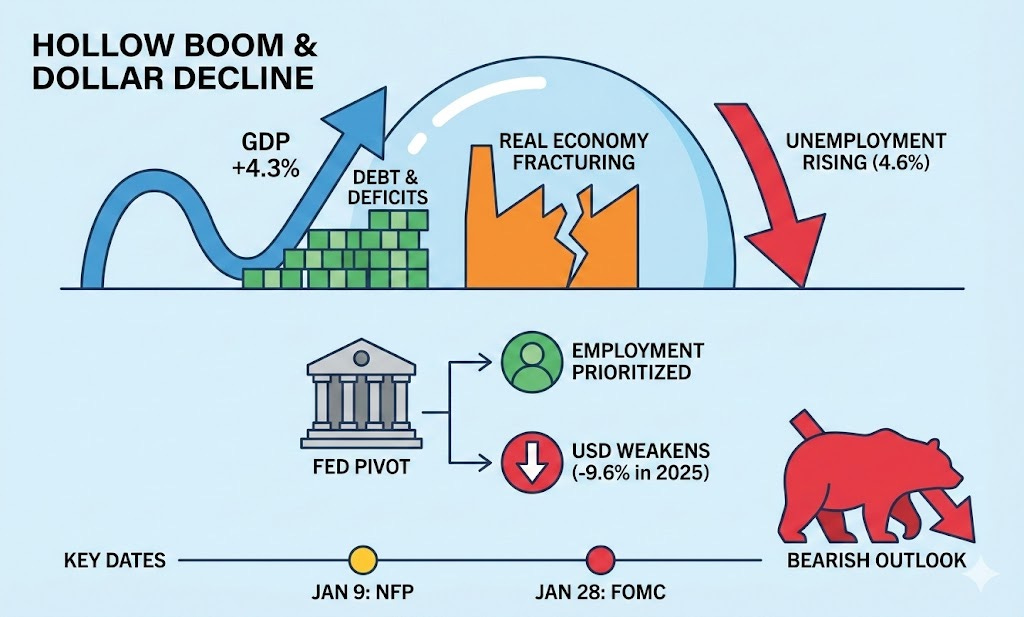

The United States enters 2026 in a state of “Hollow Boom”—GDP is robust at 4.3 percent, driven by government deficits and debt, while the real economy of labor is fracturing with unemployment rising to 4.6 percent. The Federal Reserve is pivoting to ease, prioritizing employment over its 2 percent inflation target, which has weakened the USD (-9.6 percent in 2025). The combination of fiscal dominance, political pressure on the Fed, and a cooling labor market favors a bearish structural outlook for the Dollar. Key Dates: Non-Farm Payrolls (January 9) and FOMC Rate Decision (January 28).

CURRENCY DIRECTION SPECULATION

Bearish Structural Shift Driven By Dovish Fed And Labor Cracks

We have witnessed a fundamental decoupling of the USD from its traditional growth narrative over the previous seven weeks. Despite the United States posting a robust third-quarter GDP of 4.3 percent, the Greenback has succumbed to a “fiscal dominance” theme. The Federal Reserve’s decision to cut rates to 3.50-3.75 percent in December, combined with Chair Powell’s reveal of a 40 billion USD monthly T-bill buying program, was widely interpreted by traders as “stealth QE” designed to fund widening deficits. When you pair this with November’s unemployment spike to 4.6 percent, it is clear why capital has rotated out of the USD and into hard assets like Gold (https://www.federalreserve.gov/newsevents/pressreleases/monetary20251210a.htm).

Year End Flows And Dovish Minutes Cement Weakness

During the previous seven days, the USD Index (DXY) languished near 12-week lows around 97.7. This weakness was largely driven by thin holiday liquidity and the release of the December FOMC minutes. These minutes revealed a divided committee but ultimately confirmed a bias toward further easing in 2026 to support the labor market. This dovish signal acted as a green light for month-end portfolio rebalancing, where we saw asset managers selling USD to buy undervalued foreign equities, keeping the currency heavy despite a lack of tier-one data releases during the holiday week (https://tradingeconomics.com/united-states/currency).

Data Vacuum Likely To Prompt Consolidation Before NFP

Looking at the upcoming seven days, I expect the USD to trade in a tight consolidation range with a bearish bias as traders return from the holidays. Liquidity will normalize, but conviction will likely remain low until we see the Non-Farm Payrolls release on January 9. The ISM Manufacturing PMI due January 5 will be a critical watch; if we see a continued contraction (below 50), it would reinforce the recessionary industrial narrative and pressure the USD further. However, be aware that geopolitical headline risk from the Middle East or Ukraine could provide fleeting safe-haven bids, potentially capping excessive downside in the immediate term (https://tradingeconomics.com/united-states/calendar).

Policy Divergence And Fiscal Drag Suggest Continued Downside

Over the upcoming seven weeks, the path of least resistance for the USD remains to the downside. The January 28 FOMC meeting looms large; if the Fed signals a pause while the economy cools, the yield curve may steepen further, which would likely hurt the currency. Additionally, the expiration of the Continuing Resolution in mid-February introduces fiscal cliff risks that could spike volatility. Unless inflation unexpectedly re-accelerates above 3.0 percent, the “Twin Deficit” structural drag—specifically the trade and budget deficits—combined with falling yields suggests the USD will continue to underperform against the Euro and Gold (https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm).

GOVERNMENTAL FRAMEWORK & FISCAL POLICY

Executive Power Expands Amidst Deficit Concerns

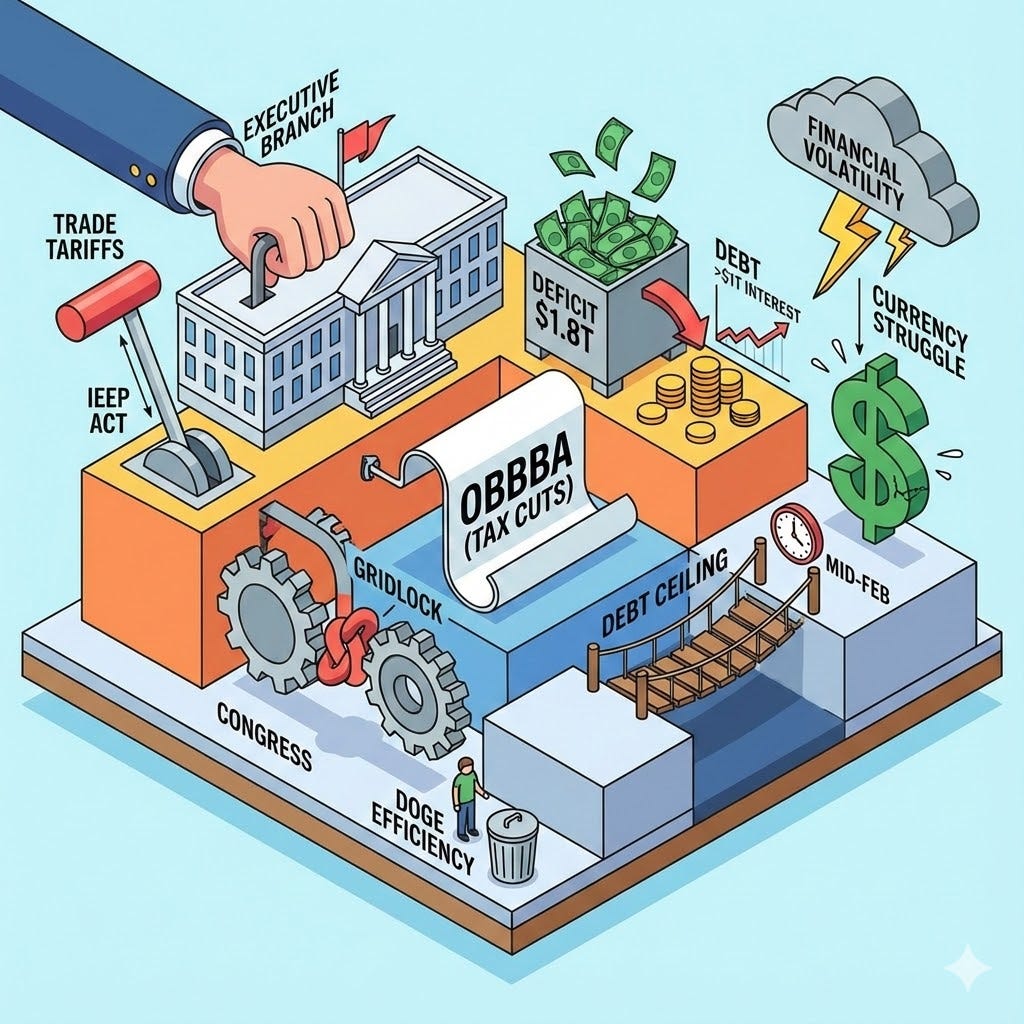

The United States government operates as a federal constitutional republic, currently under the second term of President Donald J. Trump. What we are seeing in this administration is a significant consolidation of influence over economic levers, particularly regarding trade. The Executive Branch has been utilizing the International Emergency Economic Powers Act to bypass traditional congressional gridlock, allowing for the swift implementation of tariffs. The cabinet, featuring Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, is actively pursuing an “America First” agenda that centers on re-industrialization and deregulation. However, this executive agility is constantly facing friction from a divided Congress, where slim majorities necessitate complex reconciliation tactics to pass any significant spending bills. The administration has also tasked the new Department of Government Efficiency, led by Elon Musk, with slashing federal bloat, though the actual legislative impact of these proposals remains bogged down in committee debates (https://en.wikipedia.org/wiki/Cabinet_of_Donald_Trump).

Fiscal policy over the previous seven months has been defined by what looks like pro-cyclical expansion. The landmark passage of the “One Big Beautiful Bill Act” (OBBBA) in July 2025 was a watershed moment. It permanently extended the 2017 tax cuts, eliminated federal taxes on tips and overtime pay, and introduced full expensing for corporate R&D. While this stimulus certainly boosted consumption and corporate earnings in Q3, it has also exacerbated debt service costs. Net interest payments on the national debt have now exceeded 1 trillion USD annually. Consequently, the deficit widened to 1.8 trillion USD for the fiscal year 2025, a figure that is worrying bond vigilantes and foreign holders of US debt. The government shutdown we experienced in October 2025 highlighted the fragility of the appropriations process, temporarily halting data collection and shaking investor confidence in US governance. This fiscal looseness is a key reason why the currency is struggling despite reasonable growth; the market is essentially pricing in a higher risk premium for US fiscal sustainability (https://waysandmeans.house.gov/2025/05/12/the-one-big-beautiful-bill-delivers-on-president-trumps-priorities-to-restore-and-expa).

Looking ahead to the upcoming seven weeks, the fiscal risks are quite acute. The current Continuing Resolution that is funding the government expires in mid-February, raising the specter of yet another shutdown. Political grandstanding is expected to peak as the debt ceiling suspension comes up for a mid-term review. Furthermore, the administration’s aggressive use of tariffs is expected to face renewed scrutiny as inflation persists near 2.7 percent; any move to increase duties further could spook markets. The Treasury’s reliance on short-term T-bill issuance to mask long-term borrowing costs creates a refinancing wall that could inject volatility into bond markets. If demand for US debt wavers during the Q1 refunding announcements, we could see a spike in yields that tightens financial conditions regardless of what the Fed does (https://home.treasury.gov/system/files/131/General-Explanations-FY2025.pdf).

CENTRAL BANK MONETARY POLICY

The Federal Reserve Pivots To Protect Labor Over Prices

The Federal Reserve System, led by Chair Jerome Powell, theoretically operates with a dual mandate of maximum employment and stable prices. However, if you look at their recent actions, the current landscape has effectively forced a third unofficial mandate: financial stability amidst massive sovereign debt issuance. The central bank’s leadership is currently in a state of high tension. With Chair Powell’s term expiring in May 2026, the politicization of the Fed has intensified. The administration is openly favoring loyalist candidates like Kevin Hassett over institutionalists, a dynamic that has eroded the market’s perception of the Fed’s independence and introduced a political risk premium into USD assets. We are seeing a Fed that is increasingly sensitive to political pressure to keep financing costs manageable for the Treasury (https://www.federalreserve.gov/aboutthefed/bios/board/powell.htm).

Over the previous seven months, we have watched the Fed execute a dramatic pivot. The Fed held rates at the restrictive peak of 5.25-5.50 percent throughout the first half of 2024, finally initiating the first cut in September 2024. Entering 2025, the policy rate stood at 4.25-4.50 percent. For the first half of 2025—specifically the March, May, June, and July meetings—the FOMC held rates steady, adopting a “wait and see” approach as inflation seemed sticky. However, as labor market cracks widened in late Q3 2025, the Fed resumed easing. They delivered a 25 basis point cut in September 2025, followed by cuts in October and December, bringing the target range down to the current 3.50-3.75 percent. The December meeting was truly historic for its dissent; a 9-3 vote split revealed a fractured committee. We saw Governor Stephen Miran advocating for a deeper 50 basis point cut, while regional presidents Schmid and Goolsbee voted to hold. This discord highlights the extreme difficulty of managing policy when inflation (2.7 percent) remains above target while unemployment (4.6 percent) signals recessionary cracks (https://www.federalreserve.gov/newsevents/pressreleases/monetary20251210a.htm).

Crucially, the Fed has engaged in what many of us are calling “stealth easing.” While headline rates were cut, Chair Powell announced a mechanism in December to purchase 40 billion USD of Treasury bills monthly to manage balance sheet runoff issues. Markets have interpreted this as a return to Quantitative Easing (QE) in all but name, which is actively diluting the USD’s value. The balance sheet reduction (QT) continues in the background for longer-dated assets, but this new liquidity injection at the short end effectively neutralizes the tightening effect. This contradictory policy mix—cutting rates while inflation is sticky, and buying bonds while claiming to tighten—is creating significant confusion and volatility in the forex markets. It suggests a central bank that is prioritizing liquidity provision to the Treasury market over strict inflation targeting.

For the upcoming seven weeks, all eyes are on the January 27-28 FOMC meeting. Markets are currently pricing a 60 percent probability of a pause, betting the Fed will want to assess the cumulative impact of recent cuts. However, if the January 9 jobs report confirms the unemployment rate rising toward 4.7 percent, the political and economic pressure to cut again will be immense. The interplay between the Fed’s balance sheet reduction and its T-bill buying program will be critical for liquidity conditions. Any sign that the Overnight Reverse Repo facility is draining too fast could trigger a repo spike similar to 2019, potentially forcing the Fed’s hand to intervene even more aggressively. Traders should also watch for any speeches from the dissenting governors, as their public comments will signal whether the internal fracture is widening (https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm).

ECONOMY STRUCTURE & DEVELOPMENT

A Hollow Boom: High Growth Masks Structural Decay

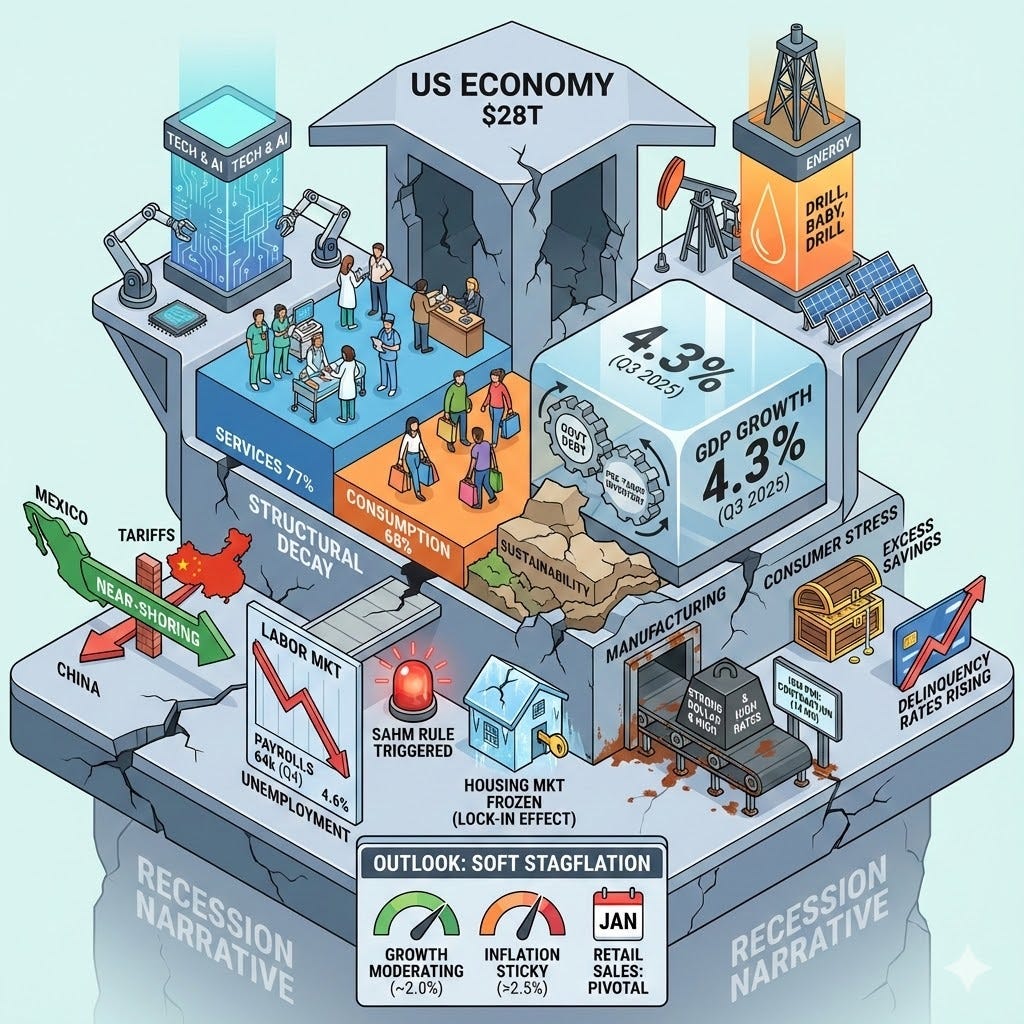

The US economy remains the global hegemon, valued at over 28 trillion USD. Its structure is heavily weighted toward services (77 percent) and consumption (68 percent), which makes the consumer the ultimate arbiter of economic health. The technology sector, led by the “Magnificent Seven” and the broader AI ecosystem, along with the energy sector bolstered by “Drill, Baby, Drill” policies, are the primary engines of output right now. Interestingly, key trading partners have shifted, with Mexico surpassing China as the top partner due to “near-shoring” trends and the aggressive tariff regimes implemented over the last year. This shift has altered supply chain dynamics, keeping input costs somewhat elevated as companies pay a premium for supply security over efficiency. The manufacturing sector remains a weak spot, struggling with the strong dollar of 2024 and high interest rates, evidenced by the ISM Manufacturing PMI remaining in contraction territory for 14 consecutive months (https://www.bea.gov/data/gdp/gross-domestic-product).

Over the previous seven months, the economy has displayed what I call a “hollow boom.” Headline GDP growth accelerated to 4.3 percent annualized in Q3 2025, which on the surface looks fantastic. However, when you dig deeper, this growth was largely driven by government deficit spending and pre-tariff inventory building by corporations fearing future import costs—neither of which is sustainable organic growth. Beneath this shiny surface, the labor market has deteriorated significantly. Non-farm payrolls averaged a weak 64,000 in Q4 2025, down from over 200,000 earlier in the year, and the unemployment rate rose to 4.6 percent. This divergence suggests growth is being fueled by debt and productivity gains (AI) rather than broad-based labor participation. The private sector is not hiring at a rate sufficient to absorb new entrants to the workforce, and the “Sahm Rule” recession indicator has been triggered, signaling that a downturn is likely already underway despite the positive GDP prints (https://www.bls.gov/news.release/archives/empsit_01102025.pdf).

The housing market has also shown signs of strain. While prices have remained sticky due to low inventory, transaction volumes have plummeted as mortgage rates remain volatile. The “lock-in” effect, where homeowners refuse to sell and lose their low legacy rates, has frozen the market, reducing labor mobility. Meanwhile, the service sector has been the lone bright spot, particularly in healthcare and hospitality, but even there, we are seeing signs of fatigue as consumers exhaust the last of their pandemic-era excess savings. Credit card delinquency rates have ticked up to levels not seen since 2011, signaling that the lower-income consumer is under significant stress and relying on credit to maintain living standards.

For the upcoming seven weeks, the outlook is precarious. The “sugar high” of fiscal stimulus is fading, and the lagged effects of tariffs are beginning to bite consumer wallets. Retail sales are expected to soften as those excess savings are finally depleted. The economy faces a “soft stagflation” scenario where growth moderates to near 2.0 percent while inflation remains sticky above 2.5 percent due to supply chain frictions and wage pressures in the service sector. The resilience of the US consumer will be tested by the cooling labor market, making the January retail sales data a pivotal release to watch. If the consumer capitulates, the recession narrative will return with a vengeance, forcing the Fed to abandon its inflation fight entirely in favor of growth support (https://tradingeconomics.com/united-states/gdp-growth).

FINANCIAL MARKETS OVERVIEW

Equities Rally On Liquidity While Currency Suffers

The US stock market, represented by the S&P 500, gained nearly 17 percent in 2025, closing the year near 6,850. The rally over the previous seven months was largely driven by the “Trump Trade” (deregulation) and the “Fed Put” (rate cuts). However, it is crucial to note that market breadth is incredibly narrow, concentrated almost entirely in AI and energy stocks. The equal-weighted S&P 500 has significantly underperformed the cap-weighted index, indicating that the average stock is not performing nearly as well as the headline figures suggest. The recent divergence between rising stock prices and a falling USD is a classic signal of asset inflation driven by currency debasement rather than pure organic growth. Investors are essentially treating stocks as a “real asset” hedge against the loss of purchasing power in the currency, piling into equities even as earnings estimates flatten out (https://tradingeconomics.com/united-states/stock-market).

In the commodities market, Gold has been the ultimate barometer of US fiscal health. XAU/USD surged over 60 percent in 2025 to close near 4,320 USD/oz. This disconnect from real rates—Gold rallied even when bond yields rose—is a massive red flag. It signals that global central banks, particularly in the BRICS bloc, are diversifying reserves away from the USD in response to US fiscal profligacy and sanctions risk. Oil (WTI) has remained rangebound between 68 USD and 75 USD, capped by record US production but supported by geopolitical risk premiums in the Middle East. For the USD, lower oil is usually supportive as it acts as a tax cut for consumers, but the correlation has weakened as the US becomes a net energy exporter. A spike in oil prices now poses a stagflationary risk that could hurt both bonds and stocks (https://tradingeconomics.com/commodity/gold).

The bond market is the epicenter of stress and volatility. The 10-year Treasury yield experienced extreme swings, spiking to 4.52 percent in November on fiscal fears before retreating to 4.17 percent in late December as recession bets took hold. The yield curve (2s10s) is steepening, a classic signal of an impending economic slowdown. The “Term Premium” is rising as investors demand more compensation to hold long-duration US debt amidst 2 trillion USD annual deficits. This bond market volatility is tightening financial conditions even as the Fed tries to ease them, creating a policy headache. If the 10-year yield breaks back above 4.50 percent, it could trigger a liquidation event in risk assets as the cost of capital becomes prohibitive for the broader economy (https://tradingeconomics.com/united-states/government-bond-yield).

The currency market saw the USD Index (DXY) peak mid-year before collapsing nearly 10 percent to trade around 98.3 by year-end 2025. The Greenback is suffering from the narrowing interest rate differential with peers and the erosion of institutional credibility. While still high-yielding relative to the Yen or Franc, the trend of lower highs and lower lows indicates a structural bear market has begun. The market is effectively voting that the US twin deficits (fiscal and trade) are unsustainable without a cheaper currency.

Over the upcoming seven weeks, we should expect continued volatility in the bond market as the Treasury announces its refunding needs. If auctions are weak or demand soft, yields could spike, putting pressure on equities. In the stock market, earnings season will be critical; investors need to see if AI spending is actually translating into profits to justify these valuations. For the currency, the direction will likely be dictated by the bond market. If yields fall further on weak data, the USD will likely continue its slide. Conversely, if inflation data surprises to the upside, we could see a sharp reversal and a short squeeze in the Dollar as rate cut bets are priced out (https://tradingeconomics.com/united-states/currency).