United States Dollar Forex Factbook AUGUST (CPI Update)

DERBYSHIRE GB / AUGUST 16th, 2023 - Updated following CPI report. Next update after the second estimated GDP report on Thursday, August 30th or before if any significant event occurs.

This is the US Dollar Forex Factbook and contains factual information that has been researched from official sources as well as market commentators. It is intended to be used as a guide to aid in your analysis.

ABOUT

The U.S. dollar is the world’s most widely used currency, a safe haven asset, and a key indicator of global economic health. It is not backed by any physical commodity, but its value is based on faith in the U.S. government.

MONETARY POLICY

The Federal Reserve (Fed) Federal Open Market Committee (FOMC)

The Federal Reserve is the central bank of the United States. The Board of Governors, which has seven members, sets discount rates. The Federal Open Market Committee (FOMC), which has 12 members, sets the levels of central bank money and the federal funds rate. The FOMC members include all members of the Board of Governors, the president of the New York Fed, and four presidents from the remaining eleven Reserve Banks on a rotating basis.

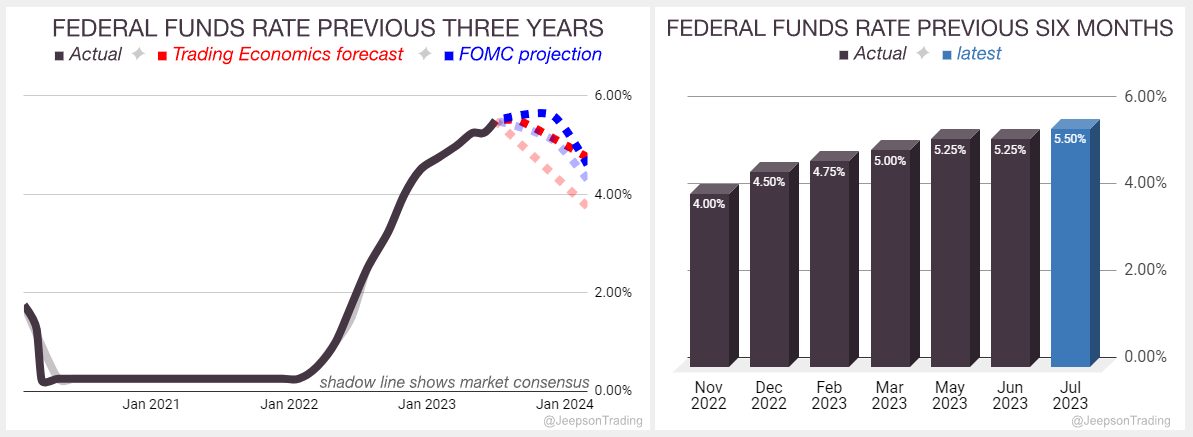

The July meeting matched expectations with a 0.25% hike of the Fed Funds rate setting it at 5.25%-5.50% which is up from 5.00%-5.25% and the pause in June

The latest rate now matches the Trading Economics Q3 ‘23 forecast of 5.50% which they also identify as the peak

Over the previous three years, since the start of 2020, the interest rate has been trending up with a low of 0.25% and a high of 5.50%. Over the previous six months, the rate has climbed at a slower pace.

The next meeting is due on Wednesday, September 20th.

The Federal Open Market Committee‘s July statement summarised:

The economy is expanding at a moderate pace, with strong job gains and low unemployment

Inflation remains elevated.

The banking system is strong, but tighter credit could slow the economy

Rates will remain steady for now but will be adjusted if necessary

Sources: Federal Reserve, Trading Economics, FXStreet

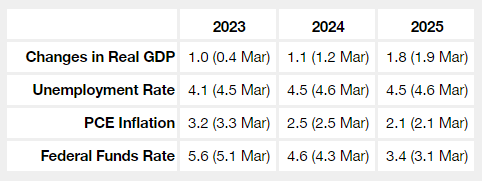

FOMC Projections

The FOMC revised the projections at their June meeting and will update them again at the September meeting.

Projections of change in real gross domestic product (GDP) are percent changes from the fourth quarter of the previous year to the fourth quarter of the year indicated.

ECONOMIC DATA

Gross Domestic Product (GDP)

In the US, GDP Growth Rate measures the yearly change in the price of goods and services purchased by consumers.

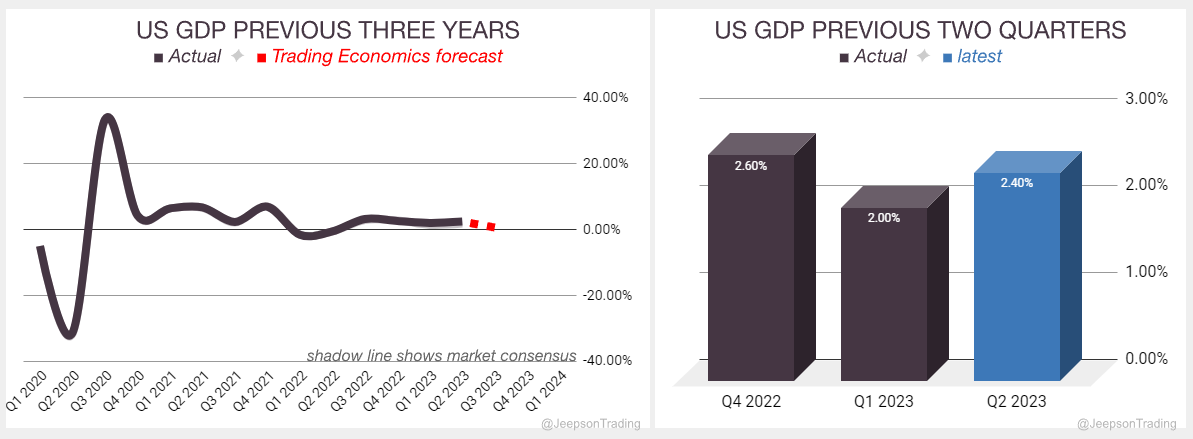

Advance Q2 ‘23 estimate greatly beat expectations coming in at a 2.4% annualised expansion, up from 2.0% in Q1 ‘23.

The latest report is above the FOMC 2023 change in real GDP forecast of 1.0% (revised up from 0.4%) and far above the Trading Economics Q3 ‘23 forecast of 0.6%.

Over the previous three years, since the start of 2020, GDP has been trending up with a low of 3.9% and a high of 7.0%. Over the previous six months, GDP has been steadily improving.

The second estimate Q2 report is due on Thursday, August 30th.

Sources: Bureau of Economic Analysis, Trading Economics, FXStreet

Consumer Price Index (CPI)

Inflation in the US is measured with the Consumer Price Index (CPI) which measures the yearly change in the price of goods and services purchased by consumers.

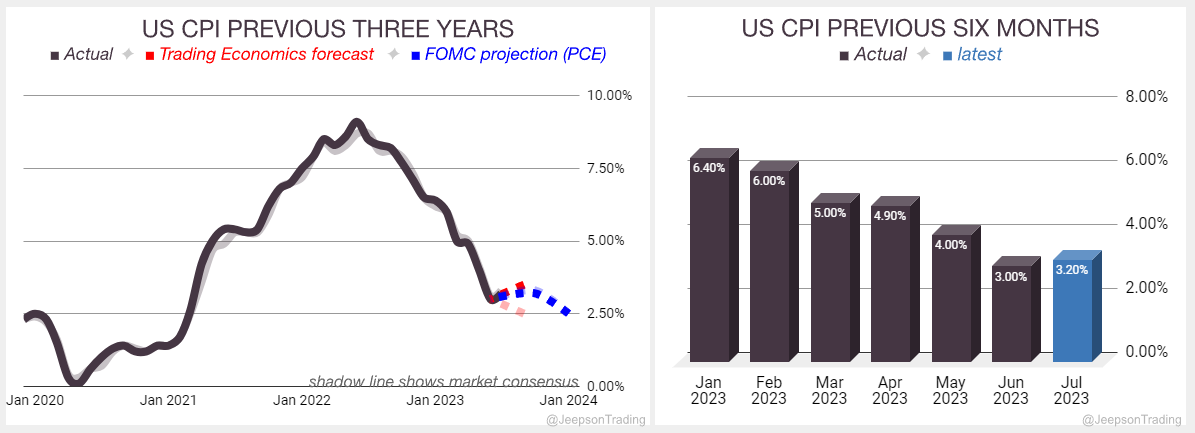

July ‘23 report slightly beat expectations coming in at 3.2% although is higher than the 3.0% in June ‘23.

The latest report now matches the FOMC 2023 PCE forecast of 3.2% although Trading Economics are less optimistic with a Q3 ‘23 forecast of 3.5% (previously 2.5%)

Over the previous three years, since the start of 2020, CPI has been trending up with a low of 0.1% and a high of 9.1%. Over the previous six months, the rate has been falling quickly.

The August report is published on Wednesday, September 13th.

Sources: Bureau of Labor Statistics, Trading Economics, FXStreet

Labour

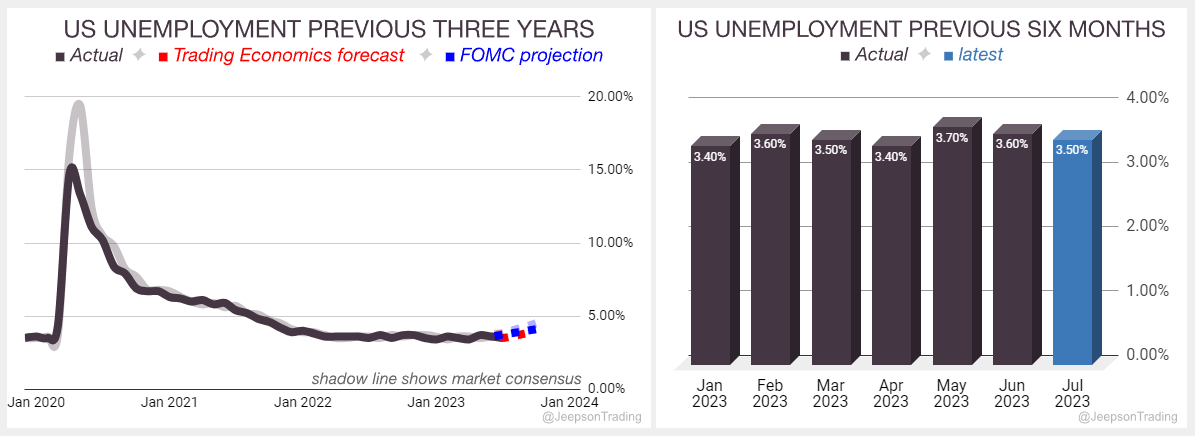

Unemployment in the US is measured as the number of people actively looking for a job as a percentage of the labour force.

July ‘23 report slightly beat expectations coming in at 3.5% which is also slightly better than the 3.6% in June ‘23

Nonfarm payrolls stayed similar at 187K from 185K although that was significantly revised down from 209K

The latest report is below the Trading Economics Q3 ‘23 forecast of 3.8%.

Over the previous three years, since the start of 2020, Unemployment has been trending down with a high of 14.7% and a low of 3.4%. Over the previous six months, unemployment has been steady.

The August report is due on Friday, September 1st.

Sources: Bureau of Labor Statistics, Trading Economics, FXStreet

MARKET NARRATIVES

Monetary Policy Hold

As inflation in the US stabilises, the Fed now intends to hold rates steady. This makes borrowing less risky which will improve the outlook for growth, increase the appetite for stocks, and reduce the demand for the dollar as a safe haven. This is likely to have a negative effect on the value of the dollar.

2023 Debt Ceiling Crisis

The debt ceiling crisis is reducing investor confidence in the dollar and therefore having a negative effect on its value.

The US hit its debt ceiling on the 18th of January 2023 and Secretary Yellen began enacting temporary "extraordinary measures" to pay the bills although this is unlikely to continue beyond the 1st of June. With a split congress (Democrats control the senate and Republicans control the House of Representatives) there is an impasse on getting an agreement to raise the debt limit.

If the ceiling is not raised then the Treasury would begin to default on payments which is expected to result in a global economic meltdown.

A deal was made between President Biden and House speaker Kevin McCarthy on May 27th to increase the debt-ceiling but cap federal spending. The bill titled Fiscal Responsibility Act of 2023 passed the House on May 31 and the Senate on June 1.

2023: Crisis resolved on the 3rd of June when President Biden signed the Fiscal Responsibility Act of 2023 into law which suspends the debt limit until 2025.

GEOPOLITICAL EVENTS

Russian Invasion of Ukraine

The war is having a detrimental effect on the global and US economy by causing higher energy prices, higher food prices, higher inflation and is impacting economic growth.

2021: 92,000 Russian troops are amassed at the Ukraine border and President Putin proposes a prohibition of Ukraine joining NATO which is rejected.

2022: On the 21st of February, President Putin ordered Russian forces to enter the separatist republics in eastern Ukraine and announced recognition of the two pro-Russian breakaway regions (Donetsk People's Republic and Luhansk People's Republic). NATO applied sanctions and scaled them up as the war progressed. Ukraine mounted a counter-offensive which regained lost territory and as winter arrived, a stalemate began.

2023: Russian began a new offensive in January although gained little ground. In early June, Ukraine began its counteroffensive although progress has been slow even as Russia faced mutiny from the short-lived Wagner rebellion.

China-US Trade War

The trade war is having a detrimental effect on the global and US economy by causing higher prices for consumers, increased uncertainty for businesses, disrupted supply chains, job losses and is impacting economic growth.

2018: President Trump imposed tariffs on Chinese goods in an effort to reduce the trade deficit and promote domestic manufacturing. China retaliated with tariffs of its own. Negotiations are ongoing to resolve the trade dispute.

2019: Reports showed that the trade deficit increased to record levels in 2018 and the situation escalated through rhetoric. China was accused of currency devaluation (which would make exports more attractive) although the IMF rejected the claim. Negotiations continued throughout the year and a tentative deal was proposed in Q4 which aimed to improve relations and repair the damage that had been caused to both economies as a result of the trade war.

2020: A deal called Phase One was signed at the beginning of the year although the trade targets appeared unrealistic and were missed by year end.

2021: President Biden takes office and reviews the Phase One deal with ongoing talks throughout the year.

2022: The WTO declared the Steel and Aluminium tariffs to be in breach of rules although the Biden administration disputed this and has maintained the trump era tariffs. The disagreement with the WTO is ongoing.

2023 January: The EU has joined the US in blocking the sale of technology to China that would allow it to produce advanced semiconductor chips.

2023 June: US Secretary of State Blinken visited China and emphasised that the US is diversifying rather than decoupling. The Chinese Foreign Ministry's North American and Oceanian Affairs department rejected this.

2023 July: US Treasury Secretary Yellen criticised China's restrictions during her visit to Beijing and continued to emphasise diversification and not decoupling.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-