🇺🇸 United States Dollar Forex Handbook (October)

UNITED STATES DOLLAR

The United States dollar was introduced on the 2nd of April 1792 and is the official currency of the United States and several other countries. The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank.

The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, its equivalence to gold was revised to $35 per troy ounce. Since 1971 all links to gold have been repealed.

The U.S. dollar became an important international reserve currency after the First World War, and displaced the pound sterling as the world's primary reserve currency by the Bretton Woods Agreement towards the end of the Second World War.

The dollar is the most widely used currency in international transactions, and a free-floating currency.

THE FEDERAL RESERVE

FEDERAL FUNDS RATE

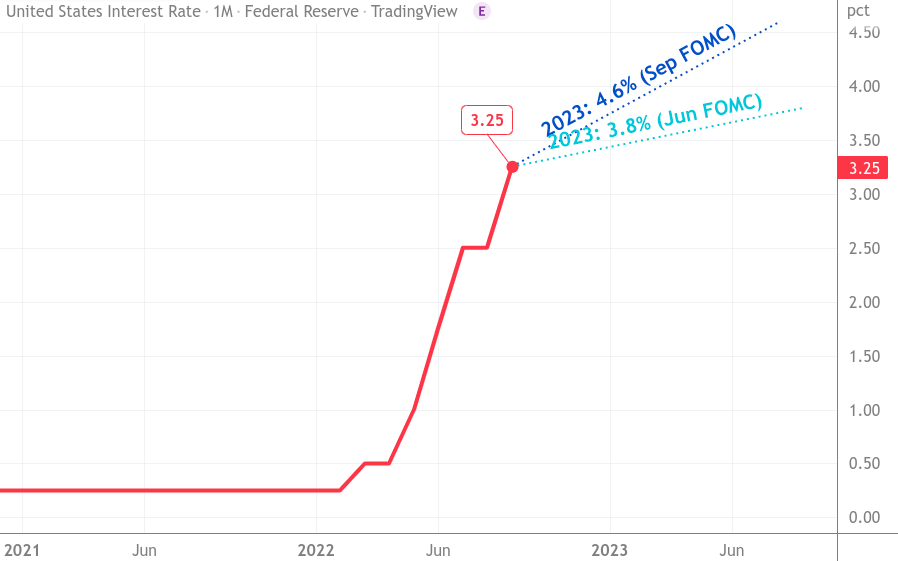

The Federal Funds Rate was hiked by 75bps on the 21st of September to between 3.00 and 3.25 percent. The next meeting is on Wednesday the 2nd of November and the long term outlook is for hawkish hikes.

75bps hike expected

Fed chair Powell had previously said that 2.25-2.50 was the neutral rate and so this is now intended to tighten the economy, ie. slow the rate of inflation by slowing the rate of growth through more expensive borrowing.

Previously 75bps hike to between 2.25% and 2.50%

Source, The Federal Reserve

The Federal Reserve is the central banking system in the United States and policy decisions are made by the Board and the Federal Open Market Committee (FOMC). The Board has seven members and they decide on changes in discount rates. The FOMC has twelve members who decide on the levels of central bank money and the federal funds rate. The FOMC members include all members of the board, the president of the New York Fed and four presidents from the remaining eleven Reserve Banks on a rotating basis.

FOMC STATEMENT HIGHLIGHTS (Sep)

Recent indicators point to modest growth in spending and production.

Job gains have been robust in recent months, and the unemployment rate has remained low.

Inflation remains elevated.

The war in Ukraine and related events are creating additional upward pressure on inflation and are weighing on global economic activity.

The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.

Decided to raise the target range for the federal funds rate to 3 to 3-1/4 percent and anticipates that ongoing increases in the target range will be appropriate.

Will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities.

Committed to returning inflation to its 2 percent objective.

Would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals.