US-China Verdict & US CPI to Steer Global Markets

Strength of Currencies for Forex Traders for Week 19 2025

Welcome to your weekly forex update. By looking at recent history and what’s coming up, I hope to help you spot potential trading chances and better handle any wild market swings. It looks like the next seven days could be pretty active, with the US-China trade talks and some important US inflation figures likely to be big news, potentially shaking up a few currency pairs.

STRENGTH OF CURRENCIES

US Dollar (USD): This week, it’s looking moderately strong. But, interestingly, its influence could swing quite a bit, anywhere from very bearish (meaning it could go down a lot) to very bullish (meaning it could go up a lot). Looking further out, the vibe is more neutral to moderately bullish, and its fundamental strength is rated as moderately strong.

Japanese Yen (JPY): For Week 20, the Yen seems pretty neutral. We might see it move moderately bearish to moderately bullish. Longer-term, though, the outlook is more bearish, as its underlying strength is considered weak.

Swiss Franc (CHF): It's also looking neutral this coming week, and like the Yen, could sway moderately bearish to moderately bullish. For May, it’s shaping up to be neutral to moderately bearish, with its fundamental strength also in that neutral to moderately weak kind of area.

Euro (EUR): It’s neutral for Week 20 too, and could potentially shift moderately bearish to moderately bullish. Looking ahead, it’s leaning moderately bearish, even though its basic strength is actually seen as moderately strong.

British Pound (GBP): This week, the Pound is looking moderately weak. It could also see some pretty big moves, from very bearish all the way to moderately bullish. For May 2025, the general feeling is bearish, and its fundamental strength is very weak.

Australian Dollar (AUD): The Aussie dollar is also starting off moderately weak this week. Its influence could span from very bearish to moderately bullish. Looking further out, we're expecting it to be moderately bearish, and its fundamental strength is weak.

New Zealand Dollar (NZD): The Kiwi dollar is another one looking moderately weak in Week 20. We could see it go anywhere from very bearish to neutral. And for the longer run, it's pointing towards moderately bearish, with its basic strength being moderately weak.

Canadian Dollar (CAD): The Loonie is also on the moderately weak side for this upcoming week. Its influence might range from moderately bearish to neutral. Longer term, it’s also looking moderately bearish, and its fundamental strength is considered moderately weak.

USD – PIVOTAL WEEK AHEAD WITH TRADE AND INFLATION IN FOCUS

The US Dollar is kicking off Week 20 looking pretty solid, but honestly, its impact could swing wildly either way short-term. While the immediate picture is fuzzy, things look a bit steadier further out, possibly even leaning positive, mainly because the Fed seems more hesitant to cut rates than other big central banks. The Dollar Index even had a three-week winning streak before Week 19, signaling the Fed wasn't rushing to lower rates.

Over the last seven weeks, the Dollar's value has really been swayed by two main things: new US trade tariffs and how the market's reaction to US economic news. For example, early April saw the Dollar dip when Q1 growth surprisingly shrank (mostly due to tariffs skewing import figures) and a key jobs report disappointed. This fueled bets the Fed would have to cut rates. But the Dollar showed some fight, bouncing back, especially with any optimism on US-China trade talks or when big economic numbers, like the April jobs report, beat expectations, calming immediate recession fears. It’s really been a tug-of-war: will the Fed ease, or will the Dollar remain a safe haven amid trade worries?

This coming week is huge for the Dollar. Its direction will really hinge on two events: what happens with US-China trade talks (due to wrap up around May 12th) and the April inflation (CPI) data out on May 13th. Good news on trade might actually push the Dollar down initially if global risk appetite surges. However, if inflation comes in hotter than expected (Trading Economics forecasts +0.3% month-on-month, +2.6% year-on-year), that would likely reinforce the Fed's caution on rate cuts. That scenario would be very bullish for the Dollar and could make global markets jittery. On the flip side, soft inflation, especially if paired with weak retail sales on May 15th (Trading Economics predicts a 0.8% monthly drop), would revive talk of Fed easing and could be very bearish for the currency. Plus, several Fed officials are speaking this week, so everyone will be listening closely for any policy hints. For what it's worth, Trading Economics thinks the DXY (Dollar Index) will be around 100.29 by the end of this quarter.

JPY – NAVIGATING SAFE-HAVEN DEMAND AND DOMESTIC HEADWINDS

Going into Week 20, the Japanese Yen is looking pretty neutral, but its influence could swing either way, from a bit bearish to a bit bullish. That’s a little different from the longer view for May 2025, which had the Yen pegged as fundamentally weak and likely to fall. That more downbeat long-term outlook was mostly because the Bank of Japan (BoJ) is keeping its policy loose and has lowered its forecasts for growth and inflation, blaming uncertainties from US tariffs.

Over the last seven weeks, the Yen has definitely played its part as a safe haven, getting stronger whenever global markets got jittery. We saw this clearly in early and mid-April when US trade policy news shook things up. But these strength spurts often faded, with the Yen losing ground anytime there was renewed optimism about US-China or US-Japan trade talks. The BoJ’s very cautious and accommodative stance, keeping rates as they are and cutting growth forecasts due to trade risks, has been a steady drag on the currency. Mixed economic news from Japan in March, like falling real wages, also added to the downward pressure, though a rise in foreign exchange reserves in April was a small positive.

This coming week, what happens with the Yen will largely depend on the US-China trade talks. If those talks break down, expect a big rush into the Yen, pushing its value up. But if they sort things out and global tensions ease, the Yen could weaken as investors get more confident. On the home front, the Bank of Japan's Summary of Opinions on May 13th will be key. People will be looking for any change in how policymakers see inflation and future policy, especially after Governor Ueda recently stressed they’re watching the data. The biggest piece of Japanese data will be the first look at Q1 GDP figures on May 16th. If the economy shrank, as Trading Economics predicts (-0.1% for the quarter), especially if the BoJ sounds dovish and US-China talks go well, the Yen could weaken further. March's current account data on May 12th will also be on traders' radars. Trading Economics is forecasting the USD/JPY exchange rate to be around 145.57 by the end of this quarter.

CHF – SAFE-HAVEN STATUS IN THE SPOTLIGHT AMIDST TRADE TALKS

The Swiss Franc starts Week 20 looking neutral, meaning its impact could go moderately bearish or bullish. For May 2025, the view was more neutral to slightly weak, with a generally neutral to moderately bearish influence, mostly due to the SNB's surprise rate cut in March and bad April consumer confidence. Gold, which often tracks the Franc, also ended last week (May 9th) weaker.

In the past seven weeks, the Franc has been a go-to safe haven during global jitters, especially with US trade policy shifts in April. It rose against the US Dollar when recession fears spiked but usually fell back if trade optimism reappeared. Domestically, a sharp drop in April consumer confidence (a 14-month low) and extremely low inflation (0.0% year-on-year in April) are big worries, backing the SNB's easier money policy.

This week, the Franc’s direction will almost entirely depend on its safe-haven role tied to the US-China trade talks outcome (happening in Switzerland, by the way). A breakdown there would likely send the Franc much higher as money seeks safety. A positive resolution calming global markets would probably weaken it. The key domestic data is Q1 Industrial Production on May 16th. A weak figure there, after recent poor PMI and consumer confidence, would just highlight domestic economic weakness. Trading Economics sees USD/CHF at 0.84 by quarter-end, with the SNB rate staying at 0.25%.

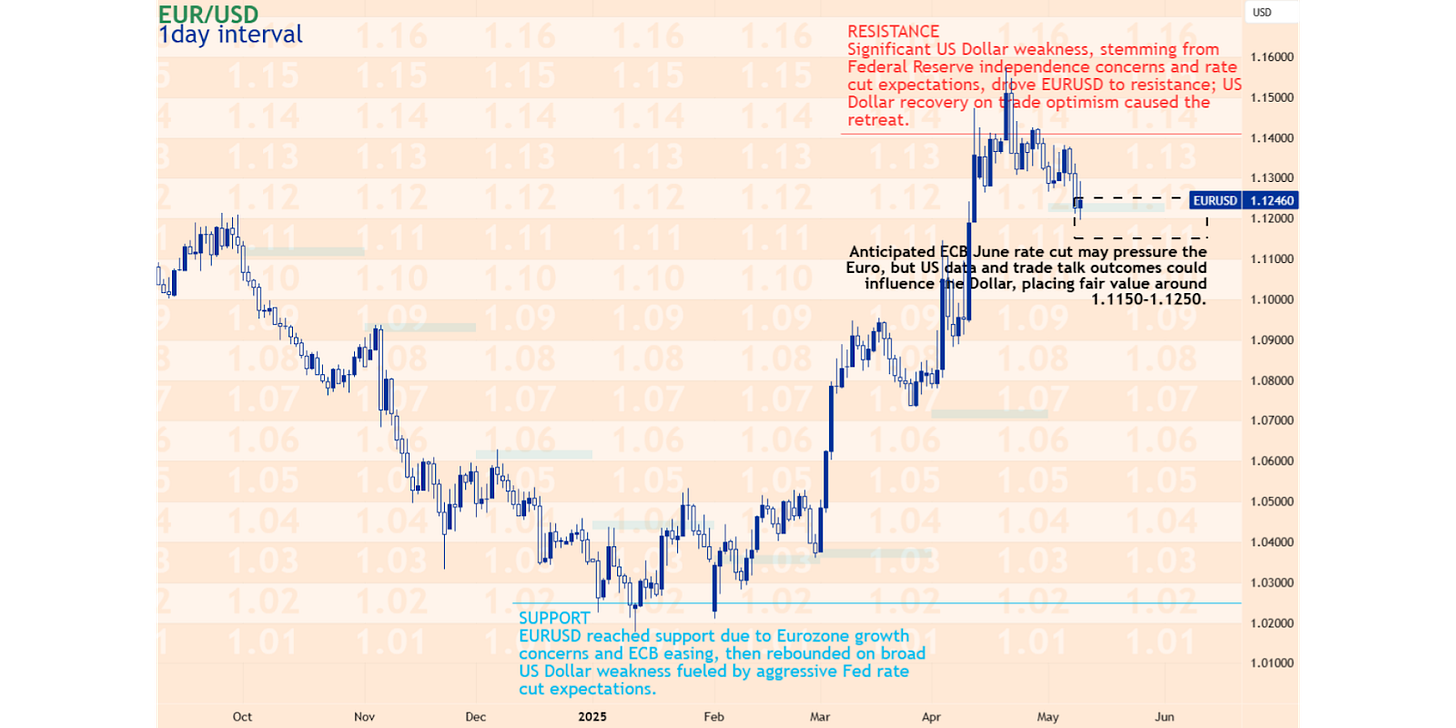

EUR – BALANCING REGIONAL DATA AGAINST EXTERNAL SHOCKS

The Euro's heading into Week 20 with a neutral feel, meaning it could swing moderately bearish or bullish. For May overall, the Euro actually looked moderately strong, thanks to better-than-expected Q1 growth and April's core inflation sticking around. Despite this, the bigger picture for May leaned bearish, mainly because almost everyone expects the European Central Bank (ECB) to cut rates in June.

Over the last seven weeks, the Euro's performance has been a story of pretty decent news at home versus big outside pressures, mostly from US trade policy. The Euro gained some ground against the US Dollar in April, especially when US economic data disappointed and tariff worries were high. The ECB did cut rates in April, which wasn't a huge surprise, but their cautious tone and the still-present core inflation offered some support. Even so, early PMI data for April hinted the economy might be stalling again, and general economic sentiment took a knock.

This week, the Euro's direction will likely come down to how the US-China trade talks affect overall market mood and how ECB policy stacks up against the US Fed's, particularly after the US inflation (CPI) data. Key numbers from the Eurozone to watch include Germany's May ZEW Economic Sentiment on the 13th, and then on the 15th, the second look at Eurozone Q1 GDP and March industrial production. There are also Eurogroup and ECOFIN meetings on the 12th and 13th covering longer-term topics like the Banking Union and digital euro. Weaker ZEW figures or a lower GDP reading could pull the Euro down, while more good news could give it a boost. The European Commission's Spring 2025 Economic Forecast, due mid-May, will also be important for sentiment. Trading Economics sees the EUR/USD at 1.13 by quarter-end and the ECB rate at 1.90%.

GBP – CRUCIAL DOMESTIC DATA TO TEST BOE'S CAUTIOUS STANCE

The British Pound is starting Week 20 looking fundamentally a bit weak, and its influence could really go anywhere from very bearish to moderately bullish. This comes after May overall was seen as very weak for the Pound, with a generally bearish feel, mostly because the Bank of England (BoE) cut rates early in the month and everyone's worried about how global trade spats could hit the UK.

Over the last seven weeks, the Pound's value has been pushed around by changing guesses about what the BoE will do with interest rates, and by the effects of what's happening with global trade. The BoE’s decision to cut rates on May 8th, even though the vote was a close 5-4 (which kind of cooled expectations for more quick cuts), really showed the bank is nervous about the economy. The UK economic news has been a mixed bag: April PMIs were weak, but March retail sales were strong, and Q4 GDP held up. A US-UK trade framework announced in early May was a small plus, but bigger trade worries are still a major drag.

Week 20 is a big one for the Pound, with a ton of UK data coming out. The preliminary Q1 GDP figures on Thursday, May 15th (everyone’s expecting around 0.6% growth for the quarter), along with March's monthly GDP, industrial, and manufacturing numbers, will be super important. If growth is stronger than expected, that could help the Pound by backing up the BoE's go-slow approach on more rate cuts. But weak data would likely bring back talk of easier policy and push the Pound down. Job market data on Tuesday, May 13th, including unemployment (expected at 4.4%) and wage growth (expected at +5.3% with bonuses), will also be crucial. If wages are still rising fast, it might make people question the idea that rates will fall much further. And, of course, how the US-China trade talks pan out will also heavily influence the Pound. Trading Economics thinks the GBP/USD will be around 1.32 by the end of this quarter.

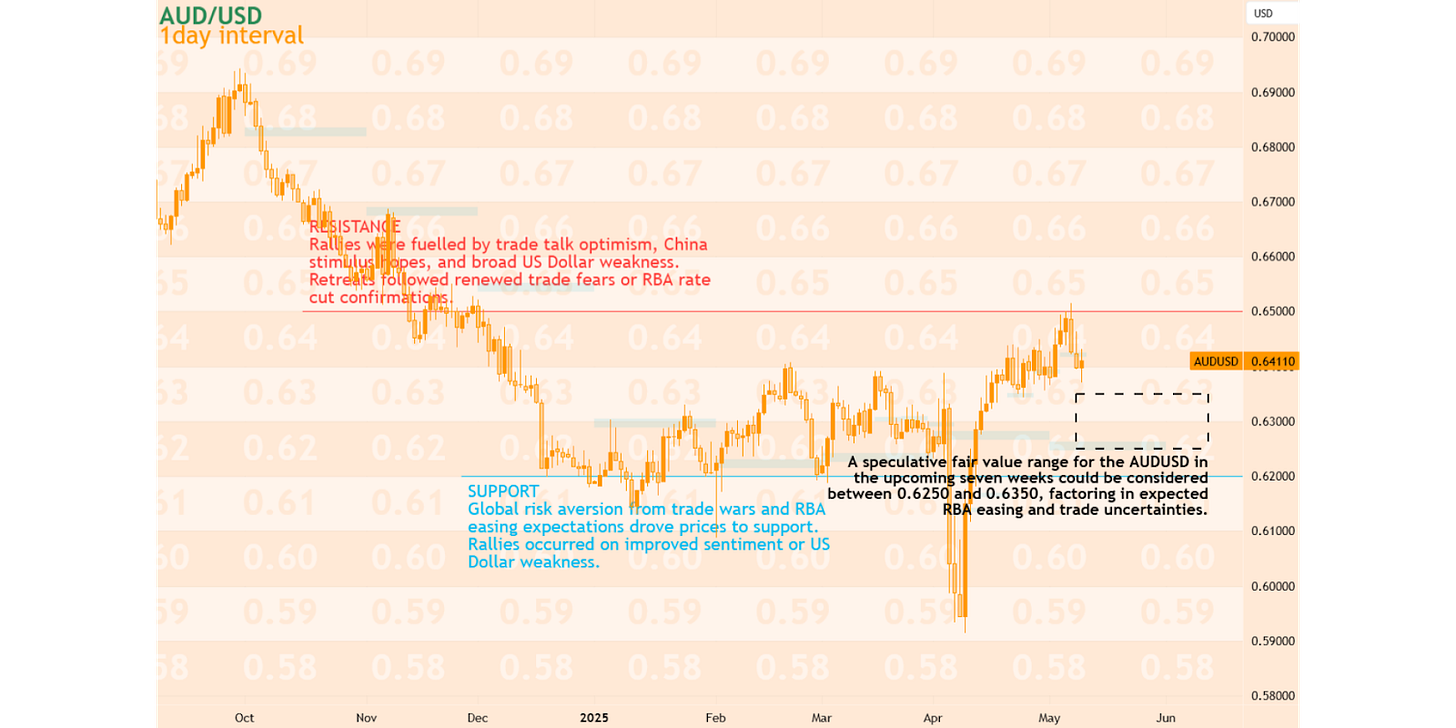

AUD – TRADE TALKS AND DOMESTIC JOBS DATA TO DRIVE DIRECTION

The Aussie Dollar is starting Week 20 fundamentally a bit weak, and its impact could range from very bearish to moderately bullish. For May overall, the AUD was seen as weak with a generally bearish outlook. This was mainly because many expect the Reserve Bank of Australia (RBA) to cut rates at its May 20th meeting, and commodity markets have been sending mixed messages.

Over the past seven weeks, the AUD has really reacted to global risk appetite, especially to US-China trade news, given Australia's strong trade ties with China. The currency often gained when trade optimism rose but fell when tensions flared or when Aussie data, like weaker-than-expected Q1 core inflation, pointed to an RBA rate cut. Economic news from China has also been a big factor; strong Chinese exports in April offered some support, though concerns about iron ore demand lingered due to falling prices and a drop in a key shipping index.

This next week is a big one for the AUD. The outcome of the US-China trade talks will be key; a good result could give the currency a real lift. On the Australian front, we'll see May Westpac Consumer Confidence and April NAB Business Confidence figures on May 13th, which will give us a sense of the mood. But the main event is Thursday's April jobs report. The unemployment rate is expected to stay at 4.1 percent with around 20,000 new jobs. Any big surprise here could really shift expectations for the RBA's May 20th meeting. Disappointing local data that firms up bets on an RBA cut, or a breakdown in trade talks, would likely be very bearish for the AUD. Trading Economics expects the AUD/USD to be around 0.63 by the end of this quarter.

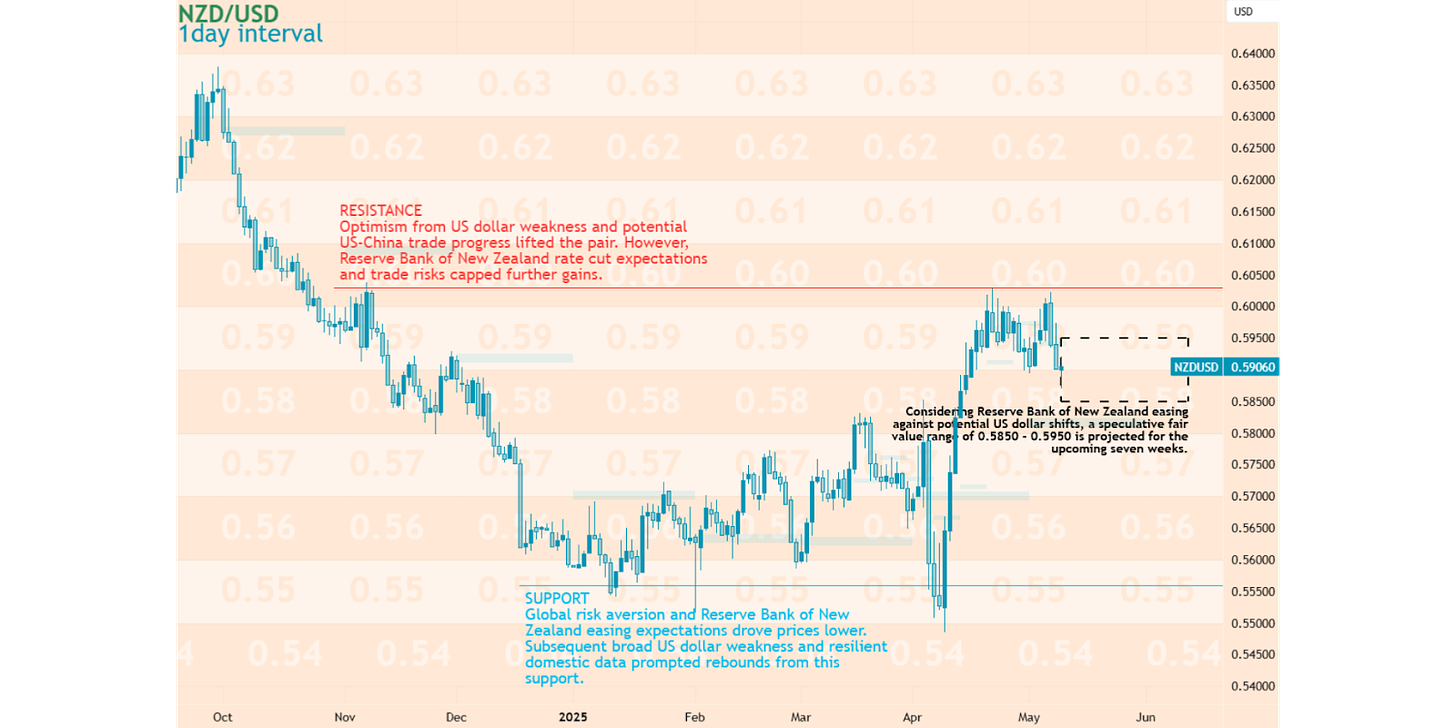

NZD – NAVIGATING TRADE SENTIMENT AND DOVISH RBNZ EXPECTATIONS

The New Zealand Dollar (Kiwi) is starting Week 20 looking moderately weak, and its impact could range from very bearish to neutral. This lines up with the outlook for May 2025, which also pointed to moderate weakness and a generally bearish influence, mostly because of an expected Reserve Bank of New Zealand (RBNZ) rate cut and worries about US tariffs. The Kiwi actually ended Week 19 near a three-week low against the US Dollar.

Over the last seven weeks, the NZD has really been pushed around by US Dollar movements, changes in how risky the world feels (especially with US-China trade stuff), and a growing belief the RBNZ will ease its policy. The RBNZ already cut rates back in April. Bad news from New Zealand, like a sharp drop in April's ANZ Business Confidence which blamed US tariff worries, added to the downward pressure on the currency, even though March's building permit numbers did look okay. And while the NZX 50 stock market rallied on general trade optimism, the currency itself lagged behind.

Week 20 looks like it could be a bit volatile for the NZD, and a lot depends on what happens with the US-China trade talks. Good news there might offer the Kiwi some temporary relief, but a negative outcome would likely lead to more losses. Domestically, RBNZ Governor Hawkesby's speech on May 15th will be watched closely for any clues about monetary policy ahead of the May 28th interest rate decision, where another rate cut is widely expected. The April Business NZ PMI, also due on May 15th (with a forecast of 53), will give us a look at how the manufacturing sector is doing. Trading Economics expects the NZD/USD to be around 0.59 by the end of this quarter.

CAD – OIL, RISK SENTIMENT, AND DOMESTIC CONCERNS IN PLAY

The Canadian Dollar is starting Week 20 looking a bit weak fundamentally, and its impact could swing from moderately bearish to neutral. That’s pretty much in line with the bigger picture for May 2025, which also saw it as a bit weak and leaning bearish, mostly because people expect the Bank of Canada (BoC) to cut rates in June and there are worries about US import tariffs. The CAD actually slipped in Week 19, even though there was a good headline jobs number, because the unemployment rate went up a bit.

Over the last seven weeks, the Canadian Dollar's value has mostly been swayed by oil price movements, how risky the world feels (especially with US-China trade stuff), and Canadian economic news that shapes what people think the BoC will do. The April jobs report was a mixed bag, and we heard that some manufacturing jobs were lost because of US tariffs. Oil prices (WTI was around $61 a barrel) had a good run the week before. And folks are still pretty much banking on the BoC cutting rates in June.

Looking ahead this week, the CAD will mainly move based on oil prices and how the US-China trade talks affect global market mood. Good news from the trade talks that pushes oil prices up could give the CAD a boost. But, ongoing worries about Canada’s economy and the BoC seeming like it might ease policy will probably keep the CAD from rising too much. There’s not a whole lot on the Canadian economic calendar, just March Building Permits on the 14th and Final Manufacturing Sales for March on the 15th. Trading Economics sees the USD/CAD at 1.40 by the end of this quarter, and they expect the BoC interest rate to be 2.75% then too.

CONCLUSION

This week is shaping up to be all about the outcome of the US-China trade talks and some critical US inflation data. These two will likely set the mood for global markets and steer the major currencies. If you're trading forex, it's a good reminder to keep a close watch on both world events and economic numbers.

Currencies with strong ties to global trade, like the Aussie and Kiwi dollars, along with safe-haven currencies such as the Japanese Yen and Swiss Franc, are probably going to see some big moves depending on the trade news. The US Dollar itself could go either way, based on that CPI inflation data and how the trade talks pan out. On top of that, comments from central bankers, especially RBNZ Governor Hawkesby, and key economic releases from Australia (jobs) and the UK (GDP, job market) will add more to the mix, creating potential trading spots. Staying nimble and keeping a close eye on risk management will be vital with the expected market swings.

So, what are the main events to watch for Week 20 (May 12 - May 16, 2025)?

US-China Trade Talks Outcome (concluding around May 12th, Geneva): This is the big one. A positive result could really cheer markets, boosting commodity currencies and stocks, while safe havens might take a hit. A breakdown, however, would likely cause a sharp sell-off. This affects pretty much everything: all currency pairs, global stocks, commodities (especially oil and industrial metals), and bonds.

US Consumer Price Index (CPI) for April (May 13th): This is crucial for what the Federal Reserve might do next. Hotter-than-expected inflation would likely make the Fed more cautious about rate cuts, boosting the US Dollar and potentially unsettling riskier assets. Softer numbers could bring back talk of rate cuts, weakening the Dollar. Watch USD pairs, global stocks, bonds, and gold.

UK Labour Market Statistics for March (May 13th): This will heavily influence what people think the Bank of England will do. If wage pressures stick around, it could limit bets on further rate cuts, supporting the Pound. Signs of a weaker job market would do the opposite. Key for GBP pairs, UK stocks (FTSE 100), and UK government bonds (Gilts).

Australia Employment Data for April (May 15th): A really important piece of the puzzle for the Reserve Bank of Australia's May 20th policy decision. If the numbers (consensus expects unemployment at 4.1% and +20k jobs) are significantly different, it could shift expectations for an RBA rate cut. Impacts AUD pairs and Australian stocks.

UK Q1 GDP (Preliminary) (May 15th): Along with the job numbers, this will help shape the Bank of England's views. Stronger growth could reduce expectations for more rate cuts for the Pound. Affects GBP pairs, UK stocks, and Gilts.