US Dollar Forex Handbook | April (Updated)

DERBYSHIRE GB / APR 10 - This report provides a concise breakdown of the latest US Dollar research and is intended to be used as a reference guide when trading the markets.

The value of the DXY which values the US Dollar (in US Dollars) is expected to remain below $104.00, re-evaluate after US CPI on the 12th of April.

This article provides details on the analysis that was used to create this short-term forecast.

FEDERAL FUNDS RATE

POLICY (MARCH)

On the 22nd of March, the Federal Funds Rate was hiked by 0.25 to between 4.75 and 5.0 percent

This matched the market expectations as well as the February hike although due to the developing banking crisis there was sentiment anchored towards a pause

This is the ninth consecutive rate hike and borrowing costs are nearing the 2007 high of 5.25 which occurred prior to the financial crash

Policymakers commented that the US banking system is sound and resilient although the recent situation regarding uncertainty and the collapse of SVB is going to see tighter lending as banks take a less risky stance

The next meeting is on Wednesday the 3rd of May and the Fed projection is for a peak rate of 5.1 before falling in 2024.

The Federal Reserve is the central banking system in the United States and policy decisions are made by the Board and the Federal Open Market Committee (FOMC). The Board has seven members and they decide on changes in discount rates. The FOMC has twelve members who decide on the levels of central bank money and the federal funds rate. The FOMC members include all members of the board, the president of the New York Fed and four presidents from the remaining eleven Reserve Banks on a rotating basis. Sources: Federal Reserve, Trading Economics

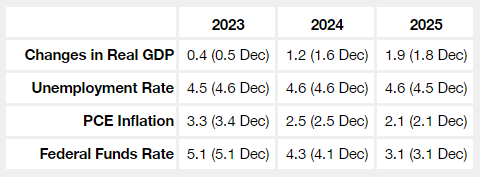

FOMC PROJECTIONS (MARCH)

FEBRUARY AND MARCH STATEMENT ANALYSIS

“Recent indicators point to modest growth in spending and production. Job gains have been robust picked up in recent months and are running at a robust pace; the unemployment rate has remained low. Inflation has eased somewhat and remains elevated.”

-this suggests that the Fed is concerned about inflation and intends to remain hawkish on bringing it down.

-

“Russia's war against Ukraine is causing tremendous human and economic hardship and is contributing to elevated global uncertainty. The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee is highly attentive to inflation risks.”

-indicates that the banking system is not in crisis although the wider economy may see a slowdown due to reduced borrowing / lending.

-

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-1/2 to 4-3/4 percent 4-3/4 to 5 percent.”

-again, remains hawkish on inflation and interest rates.

-

“The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. The Committee will closely monitor incoming information and assess the implications for monetary policy. The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

-FOMC potentially highlighting that they are not planning to cut in the immediate future.

-

“In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

-no suggestion of a dovish tilt.

-

“In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.”

Tightening of conditions to continue.

-

“In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

Keeping their options open with regards to changes when necessary.

-

“Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lael Brainard; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Lorie K. Logan; and Christopher J. Waller.”

Lael Brainard has resigned.

ECONOMIC INDICATORS

GDP GROWTH RATE

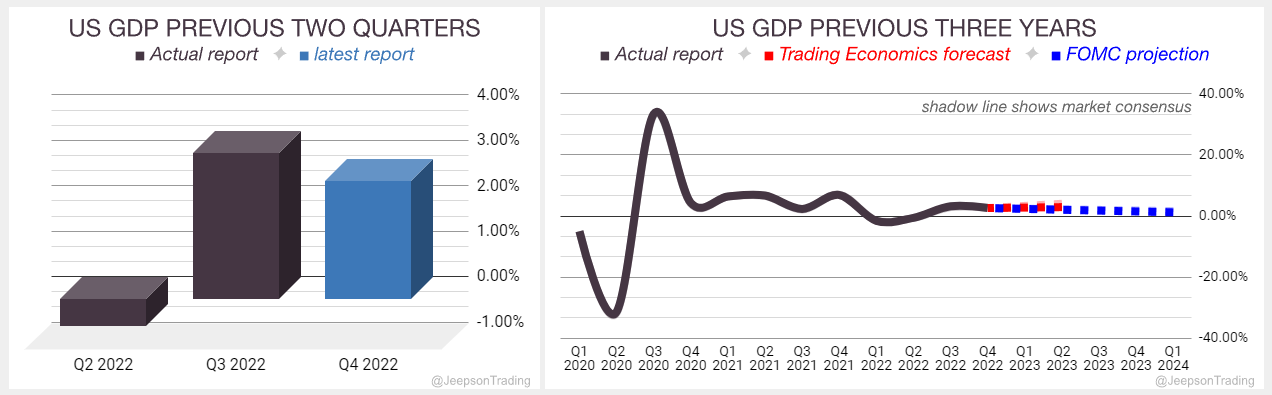

Three Months to December Final (Q4 2022) report came in at 2.6 percent (final estimate) which is lower than the expectations of 2.7

Lower than the 3.2 percent in Q3

FOMC 2024 projection is for a fall to 1.2 percent after being lowered from the previous projection of 1.6

Trading Economics Q2 forecast is for a small rise to 2.9 percent which has been maintained from the previous forecast

Previously, the outlook for GDP was classified as ‘pessimistic deterioration’ and following the latest report for Q4 February, it remains the same

Q1 2023 Advance report is out on the 27th of April

US GDP Growth Rate measures the yearly change in the price of goods and services purchased by consumers. Sources: Bureau of Labor Statistics, Trading Economics

CONSUMER PRICE INDEX

Twelve Months to February report matched expectations coming in at 6.0 percent inflation

Much better than the 6.4 percent inflation in January

FOMC 2024 projection for PCE (not CPI) is for a fall to 2.5 which is the same as the previous projection

Trading Economics forecast for Q2 has been maintained at a fall to 4.4 percent inflation

Previously, the outlook for CPI was classified as ‘indifferent improvement’ and following the latest report for February, it remains the same

The March report is out on the 12th of April

US CPI measures the yearly change in the price of goods and services purchased by consumers. Sources: Bureau of Labor Statistics, Trading Economics

UNEMPLOYMENT RATE

March report came in at 3.5 percent which is slightly lower than the expectations of 3.6

Slightly lower than the 3.6 percent in February

FOMC 2024 projection is for a climb to 4.6 percent which is the same as the previous projection

Trading Economics Q2 forecast is for it to remain at 3.5 percent which has been maintained from the previous forecast

Previously, the outlook for Unemployment was classified as ‘indifferent deterioration’ and following the latest report for March, it has become a little less pessimistic

April report is out on the 5th of May

US Unemployment Rate measures the number of people actively looking for a job as a percentage of the labour force. Sources: Bureau of Labor Statistics, Trading Economics

FED POLICY NARRATIVE

WHAT’S HAPPENING: The DXY (US Dollar) has fallen far below the 100 day average as speculators begin to price in the end of the Fed’s tightening cycle which began in March 2022.

WHY IS IT HAPPENING: Due to the safe haven status of the US Dollar, a bearish DXY is indicative of optimistic sentiment. This optimism is born from the sentiment that a less hawkish Fed will benefit the economy due to better credit conditions for borrowing.

EFFECTS ON THE MARKET: A more hawkish Fed will result in elevated expectations of a hard-landing and drive flight to safety. This will keep the DXY and Yields to the upside while pressuring S&P 500 to the downside.

A less hawkish Fed will result in reduced expectations of a hard-landing and increase the risk appetite of speculators. This will pressure the DXY and Yields to the downside while supporting the S&P 500 to the upside.

LATEST: The Fed hike of 0.25 in March and the updated projections suggest that the Fed are not considering cuts in the near future as the peak 2023 rate suggested is 5.1 although will fall to 4.3 in 2024, however this is more hawkish than the 4.1 that was projected in December. The banking crisis following the collapse of SVB appears to have stabilised for now. Inflation is cooling quickly and unemployment is rising slowly suggesting that the hard landing is avoidable. The moving averages indicate that the stock market and 10Y yields are more optimistic. Sentiment is tilted towards a less hawkish Fed.

Jeepson Trading is a currency focused fund, managed by Gavin Pearson in the UK - all trading decisions are made at your own risk.

-end-