US Dollar Forex Reference - APRIL (updated)

DERBYSHIRE GB / APR 14 - This is the US Dollar Forex Reference and contains factual information that has been researched from official sources as well as market commentators. It is intended to be used as a guide to aid in your analysis.

THE FEDERAL RESERVE

POLICY (MARCH)

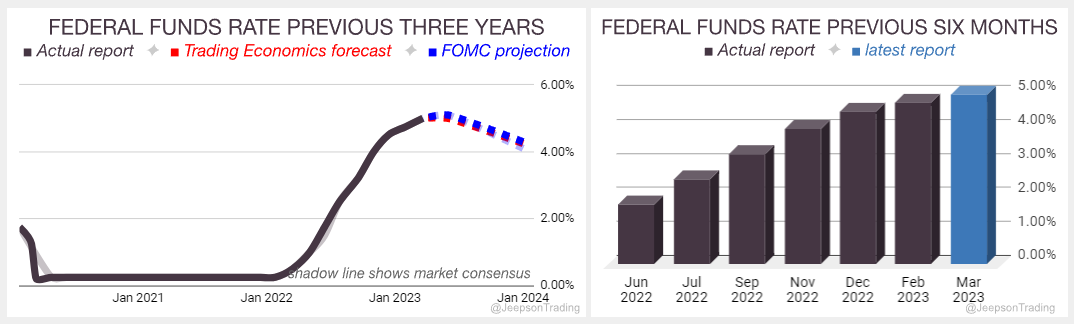

On the 22nd of March, the Federal Funds Rate was hiked by 0.25 to between 4.75 and 5.0 percent

This matched the market expectations as well as the February hike although due to the developing banking crisis there was sentiment anchored towards a pause

This is the ninth consecutive rate hike and borrowing costs are nearing the 2007 high of 5.25 which occurred prior to the financial crash

Policymakers commented that the US banking system is sound and resilient although the recent situation regarding uncertainty and the collapse of SVB is going to see tighter lending as banks take a less risky stance

The next meeting is on Wednesday the 3rd of May

The Federal Reserve is the central banking system in the United States and policy decisions are made by the Board and the Federal Open Market Committee (FOMC). The Board has seven members and they decide on changes in discount rates. The FOMC has twelve members who decide on the levels of central bank money and the federal funds rate. The FOMC members include all members of the board, the president of the New York Fed and four presidents from the remaining eleven Reserve Banks on a rotating basis. Sources: Federal Reserve, Trading Economics

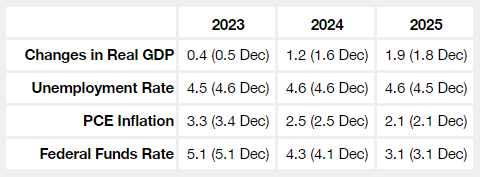

FOMC PROJECTIONS (MARCH)

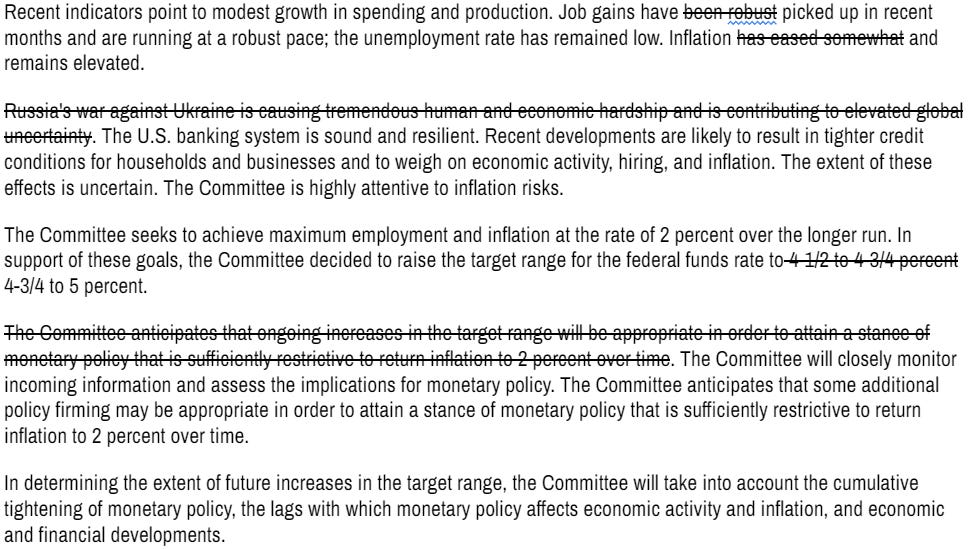

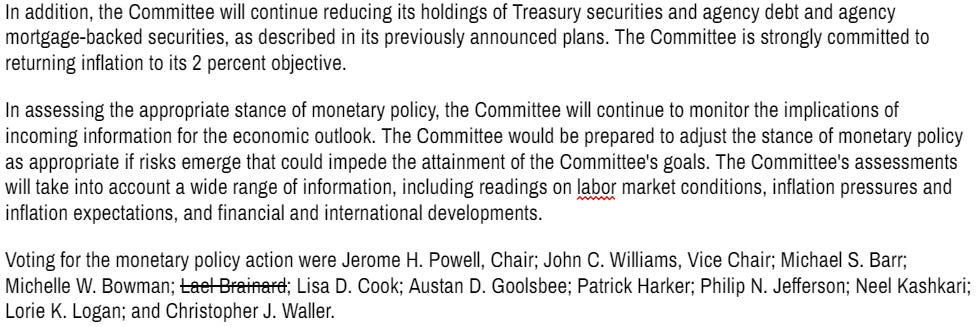

MARCH STATEMENT COMPARED WITH PREVIOUS

US ECONOMIC INDICATORS

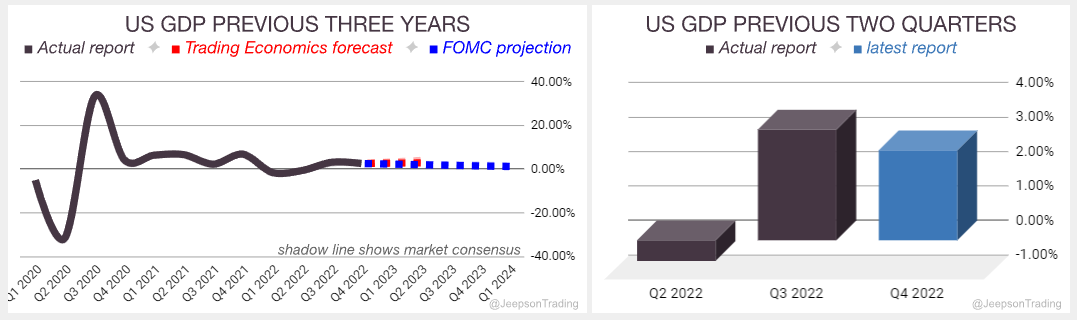

GDP GROWTH RATE

Three Months to December Final (Q4 2022) report came in at an expansion of 2.6 percent (final estimate) which is lower than the 2.7 expected

Lower than the 3.2 percent in Q3

FOMC 2024 projection is for a fall to a 1.2 percent expansion after being lowered from the previous projection of 1.6

Trading Economics Q2 forecast is for a small rise to 2.9 percent which has been maintained from the previous forecast

Q1 2023 Advance report is out on the 27th of April

US GDP Growth Rate measures the yearly change in the price of goods and services purchased by consumers. Sources: Bureau of Labor Statistics, Trading Economics

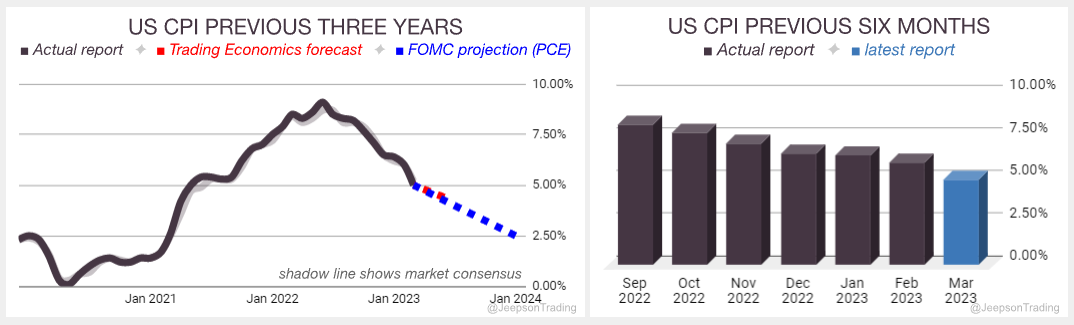

CONSUMER PRICE INDEX

Twelve Months to February report came in at 5.0 percent inflation which is lower than the 5.2 percent expected

Much lower than the 6.0 percent inflation in February

FOMC 2024 projection for PCE (not CPI) is for a fall to 2.5 which is the same as the previous projection

Trading Economics forecast for Q2 has been maintained at a fall to 4.4 percent inflation

The April report is out on the 10th of May

US CPI measures the yearly change in the price of goods and services purchased by consumers. Sources: Bureau of Labor Statistics, Trading Economics

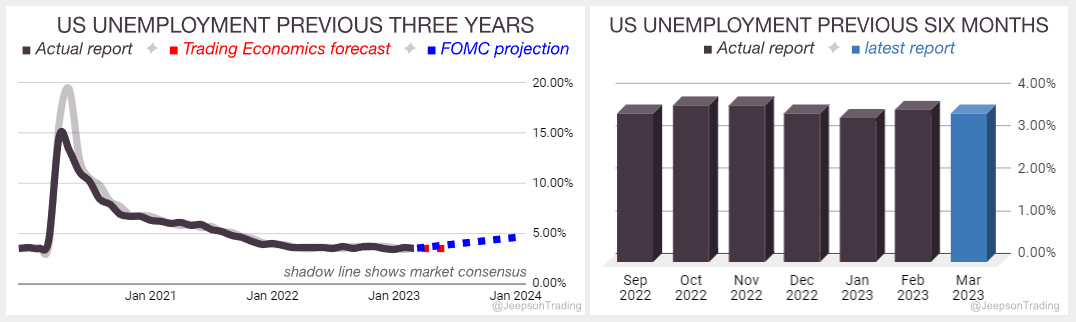

UNEMPLOYMENT RATE

March report came in at 3.5 percent which is slightly lower than the expectations of 3.6

Slightly lower than the 3.6 percent in February

FOMC 2024 projection is for a climb to 4.6 percent which is the same as the previous projection

Trading Economics Q2 forecast is for it to remain at 3.5 percent which has been maintained from the previous forecast

April report is out on the 5th of May

US Unemployment Rate measures the number of people actively looking for a job as a percentage of the labour force. Sources: Bureau of Labor Statistics, Trading Economics

USD MARKET NARRATIVES

FED POLICY

What's Happening: The DXY (US Dollar) has fallen far below the 100 day average as speculators begin to price in the end of the Fed’s tightening cycle which began in March 2022.

Why is it Happening: Due to the safe haven status of the US Dollar, a bearish DXY is indicative of optimistic sentiment. This optimism is born from the sentiment that a less hawkish Fed will benefit the economy due to better credit conditions for borrowing.

Effects on the Market

A more hawkish Fed will result in elevated expectations of a hard-landing and drive flight to safety. This will keep the DXY and Yields to the upside while pressuring S&P 500 to the downside.

A less hawkish Fed will result in reduced expectations of a hard-landing and increase the risk appetite of speculators. This will pressure the DXY and Yields to the downside while supporting the S&P 500 to the upside.

Jeepson Trading is a currency focused fund, managed by Gavin Pearson in the UK - all trading decisions are made at your own risk.

-end-