US Dollar Forex Reference - MAY (CPI update)

The debt ceiling crisis needs to be resolved

DERBYSHIRE GB / MAY 14 - This is the US Dollar Forex Reference and contains factual information that has been researched from official sources as well as market commentators. It is intended to be used as a guide to aid in your analysis.

MONETARY POLICY

The Federal Reserve

The Federal Reserve is the central bank of the United States. The Board of Governors, which has seven members, sets discount rates. The Federal Open Market Committee (FOMC), which has 12 members, sets the levels of central bank money and the federal funds rate. The FOMC members include all members of the Board of Governors, the president of the New York Fed, and four presidents from the remaining eleven Reserve Banks on a rotating basis.

The FOMC raised the federal funds rate by 0.25% on the 3rd of May 2023, to a range of 5.00% to 5.25%. This was the tenth consecutive rate hike, and borrowing costs now match the 2007 high of 5.25%. The Fed signalled a potential pause in the tightening cycle. The central bank also noted that tighter credit conditions could weigh on economic activity.

The next meeting is on Wednesday the 26th of July 2023.

The Federal Open Market Committee‘s May statement contained mixed sentiment and a cautious approach to monetary policy:

The economy grew slowly in the first quarter, but job growth was strong and unemployment was low. Inflation remains high.

The US banking system is strong, but higher interest rates could slow economic growth and hiring. The Fed is watching inflation closely.

The Fed raised interest rates to 5-5/4 percent to combat inflation. The Fed will continue to monitor economic data and adjust policy as needed to achieve its 2 percent inflation target.

The Fed will continue to monitor economic data and adjust interest rates as needed to achieve its goals of maximum employment and 2 percent inflation.

Sources: Federal Reserve, Trading Economics

FOMC Projections

The FOMC revised the projections at their March 22nd meeting and will update them again at the July meeting.

ECONOMIC DATA

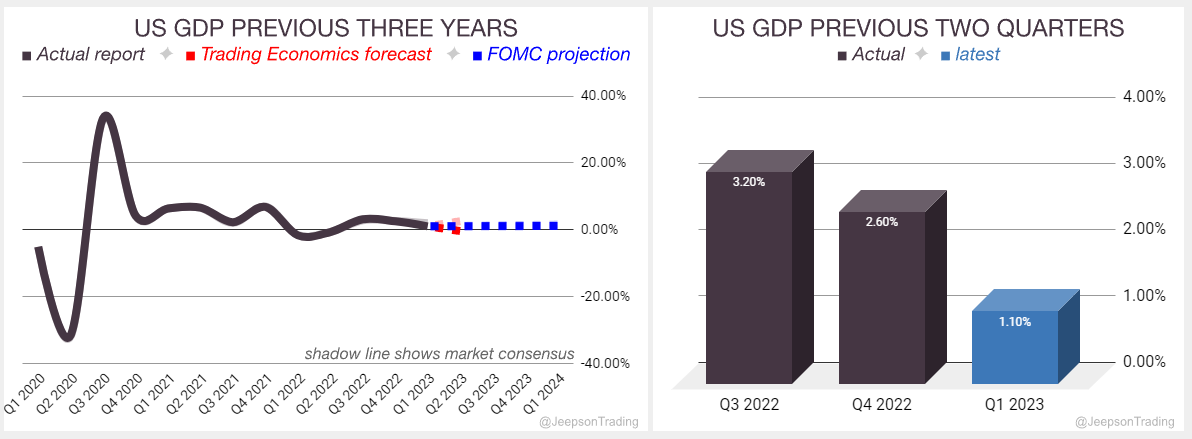

Gross Domestic Product (GDP)

In the US, GDP Growth Rate measures the yearly change in the price of goods and services purchased by consumers.

The US GDP growth rate in Q1 2023 was 1.1 percent, far lower than the 2.0 percent expected and the 2.6 percent in Q4 2022. The FOMC projects a slowing economy with a growth rate of 1.2 percent in 2024, which is down from the previous projection of 1.6 percent. Trading Economics forecasts a contraction by 0.3 percent in Q2 which is far lower than the previous forecast of 2.9 percent. The second estimate of the Q1 2023 report is due on Thursday the 25th of May.

Sources: Bureau of Labor Statistics, Trading Economics

Inflation

In the US, inflation is measured with the Consumer Price Index (CPI) which measures the yearly change in the price of goods and services purchased by consumers.

US CPI in the 12 months to April was 4.9 percent inflation, lower than the 5.0 percent expected and a little lower than the 5.0 percent in February. The FOMC projects a 2.5 percent inflation rate in 2024, the same as the previous projection. Trading Economics forecasts a 4.4 percent inflation rate in Q2, unchanged from the previous forecast. The May report is due on Tuesday the 13th of June.

Sources: Bureau of Labor Statistics, Trading Economics

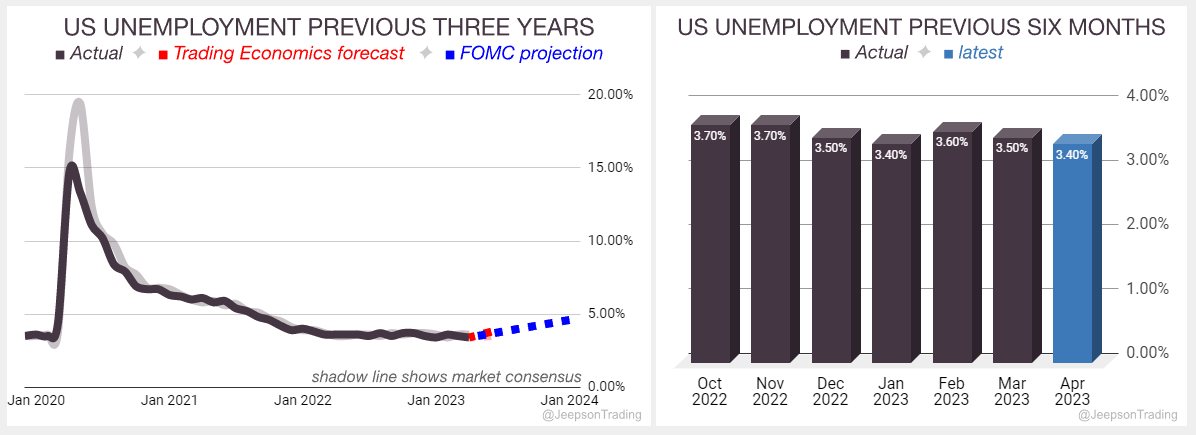

Unemployment

In the US, unemployment is measured as the number of people actively looking for a job as a percentage of the labour force.

US unemployment in April 2023 was 3.4%, lower than the 3.6% expected and the 3.5% in March. The FOMC projects 4.6% unemployment in 2024, the same as the previous projection. Trading Economics forecasts a 3.8% unemployment rate in Q2, up from 3.5% in the previous forecast. The May report is due on Friday the 2nd of June.

Sources: Bureau of Labor Statistics, Trading Economics

GEOPOLITICAL EVENTS

The War in Ukraine

The war is having a detrimental effect on the global and US economy by causing:

Higher energy prices

Supply chain disruptions

Financial market volatility

A refugee crisis

Geopolitical uncertainty

2021: 92,000 Russian troops are amassed at the Ukraine border and President Putin proposes a prohibition of Ukraine joining NATO which is rejected.

2022: On the 21st of February, President Putin ordered Russian forces to enter the separatist republics in eastern Ukraine and announced recognition of the two pro-Russian breakaway regions (Donetsk People's Republic and Luhansk People's Republic). Further economic sanctions from NATO were applied as the war raged on although by the second half of the year, Ukraine successfully mounted a counter-offensive to regain some of the lost territory and as winter arrived, a stalemate began.

2023: Russian began a new offensive in January although gained little ground. Ukraine is reported to be preparing for a new counteroffensive during Spring 2023.

China-US Trade War

The trade war is having a detrimental effect on the global and US economy by causing:

Higher prices for consumers

Reduced economic growth

Increased uncertainty for businesses

Disrupted supply chains

Job losses

2018: President Trump imposed tariffs on Chinese goods in an effort to reduce the trade deficit and promote domestic manufacturing. China retaliated with tariffs of its own. Negotiations are ongoing to resolve the trade dispute.

2019: Reports showed that the trade deficit increased to record levels in 2018 and the situation escalated through rhetoric. China was accused of currency devaluation (which would make exports more attractive) although the IMF rejected the claim. Negotiations continued throughout the year and a tentative deal was proposed in Q4 which aimed to improve relations and repair the damage that had been caused to both economies as a result of the trade war.

2020: A deal called Phase One was signed at the beginning of the year although the trade targets appeared unrealistic and were missed by year end.

2021: President Biden takes office and reviews the Phase One deal with ongoing talks throughout the year.

2022: The WTO declared the Steel and Aluminium tariffs to be in breach of rules although the Biden administration disputed this and has maintained the trump era tariffs. The disagreement with the WTO is ongoing.

2023: The EU has joined the US in blocking the sale of technology to China that would allow it to produce advanced semiconductor chips.

MARKET NARRATIVES

Debt Ceiling

The Us hit its debt ceiling on the 18th of January 2023 and Secretary Yellen began enacting temporary "extraordinary measures" to pay the bills although this is unlikely to continue beyond the 1st of June. With a split congress (Democrats control the senate and Republicans control the House of Representatives) there is an impasse on getting an agreement to raise the debt limit.

If the ceiling is not raised then the Treasury would begin to default on payments which is expected to result in a global economic meltdown.

Monetary Policy

The Federal Reserve has been raising interest rates to combat inflation, which reached a peak of 9.10% in June 2022. Some investors believe the Fed is being too aggressive, while others believe it is necessary to cool inflation.

Hawkish Fed actions support the dollar and Treasury yields, but pressure the stock market.

Dovish Fed actions support the stock market, but pressure the dollar and Treasury yields.

2023 Market Events

May 12th: Biden’s Debt Ceiling Meeting With McCarthy Postponed

No agreement caused a safe-haven rally. Potentially progress is being made behind the scenes as aides continue discussions.

May 1st: First Republic Bank rescue deal failed, further increasing dovish sentiment

Bank bailout by major U.S. banks failed to stabilise the bank, stock price plummeted and Federal Deposit Insurance Corporation (FDIC) closed the bank and sold it to JPMorgan Chase.

March 17th: First Republic Bank Rescue Deal further increases dovish sentiment

Bank bailout by major U.S. banks on March 16, 2023, improves confidence, leads to Fed dovishness and a weaker US dollar.

March 10th: Silicon Valley Bank Collapse suggests dovish fed required

Bank collapse due to poor risk management and investor panic considered to induce Fed dovishness and a weaker US dollar.

February 3rd: NFP Higher than expected leads to a more hawkish fed

Stronger-than-expected job growth in January adds to inflation pressure, leading to a hawkish Fed and a stronger US dollar.

January 6th: Low Wage Growth suggests a less hawkish fed

Below-expectations report eases inflation pressure, leading to a decline in the US dollar as investors move into riskier assets.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 8.6% in 2023 Q1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-