US dollar outlook sees upward momentum, supported by the Fed, market narratives, and geopolitics

US Dollar Currency Report October (Retail Sales update)

Derbyshire, UK – October 18th, 2023 - This is the currency report for the US Dollar and is intended to be a reference aid for your own analysis and trade planning. This edition has the latest retail sals data which came in higher than expected putting some pressure on inflation and the need for interest rates being higher for longer. The next update will be after the early Q3 US GDP report on Thursday, October 26th which has high expectations of more than 4%.

Decisions to trade are made at your own monetary risk.

US dollar outlook sees upward momentum, supported by the Fed, market narratives, and geopolitics

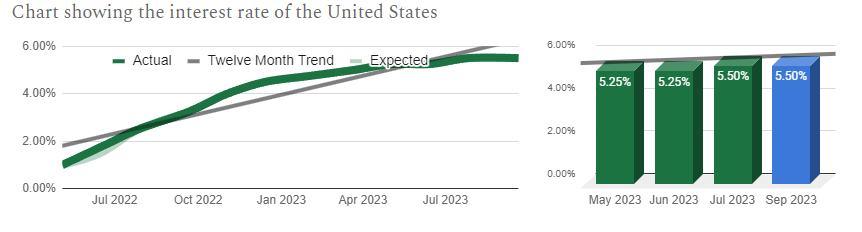

Monetary Policy provides upside momentum for USD: The Fed has raised rates to 5.50% in September and is maintaining its hawkish policies which involve rates being higher for longer.

Market narratives provide upside momentum for USD: The US economy remains resilient.

Macroeconomics provides upside momentum for USD: The economy is slowing but is strong enough to avoid a recession, inflation is stabilising, retail sales are increasing, and non-farm payrolls are growing. The unemployment rate is historically low and stable.

Geopolitics provides upside momentum for USD: The ongoing conflicts have an uncertain outlook and investors are averse to risky holdings in favour of safe-havens.

Monetary Policy

Interest rates held but no cuts in sight

The seven members of the Federal Reserve’s (Fed) Federal Open Market Committee (FOMC) set monetary policy, including the Federal Funds rate (interest rate). The Federal Funds rate is the interest rate that banks pay to borrow money from other banks. This rate affects the interest that banks charge their borrowers.

The FOMC meets to set monetary policy eight times a year, the latest was September 20th and the next is on November 1st.

The interest rate of the US was held at the September meeting after being hiked by 0.25% in July and throughout most of the previous twelve meetings. This indicates that the Federal Reserve is hawkish but has become cautious as inflation has been falling quickly and they want to avoid affecting growth. Trading Economics forecast 5.50% to be the peak rate and 2024 to see cuts of 0.25%.

Key points of the Federal Reserve’s FOMC September 2023 meeting:

The economy is expanding at a solid pace, but job growth has slowed in recent months.

Inflation remains elevated.

The Fed is committed to returning inflation to its 2% objective.

The Fed decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.

The Fed will continue to monitor incoming information and adjust the stance of monetary policy as appropriate.

The Fed is keeping interest rates high in an effort to bring down inflation and is aware that this could slow economic growth, but it believes that it is necessary to bring inflation under control.

Sources: The Federal Reserve, Trading Economics, FXStreet

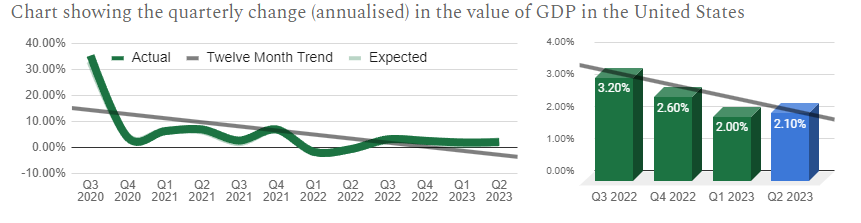

The economy is performing slightly better than forecasted

The Federal Reserve’s Federal Open Market Committee (FOMC) makes economic forecasts four times a year. The most recent was at their September meeting and they will be updated in December.

Changes in Real GDP (annualised) has an optimistic outlook compared to the FOMC’s forecast and recession risks appear minimal.

Annual PCE has an indifferent outlook compared to the FOMC’s forecast and is on track to come in as expected.

Unemployment has an indifferent outlook compared to the FOMC’s forecast although it could climb a little higher than expected.

The Federal Funds Rate is on track to match the FOMCs’ forecast and is likely at the peak with small cuts beginning to be priced in for 2024.

Market Narratives

US Economic Strength is applying bullish pressure to the USD

Late July 2023: in late July, the Fed remained on their hawkish path with the Fed fund rate being hiked by 0.25% to 5.5%. The next day saw a significant upside surprise in GDP for Q2 at 2.4% which indicated that the US economy is resilient to recent hikes and a wave of dollar buying began as the ‘higher-for-longer’ narrative took hold. There have been no retracements since.

Economic Indicators

Outlook for growth shows that the cooling economy could remain strong

The US GDP quarterly rate report measures the change in value of goods and services produced in the US over a given quarter compared with the previous and then annualised. The latest data covers the Q2 period and was published on September 28th by the Bureau of Economic Analysis and the next version is out on October 26th.

The quarterly rate of GDP in the US has been falling over the past four months, although recently stabilised but is a continuation of the general decline seen over the previous year. This indicates that the economy is slowing but is strong enough to avoid a recession.

The Q2 growth rate of 2.10% was a little higher than Q1’s 2.00%, and bucked the recent downtrend. The trend-following forecast model predicts Q3 at 2.20% growth during Q3, which would be above the recent downtrend and suggests an optimistic outlook. Trading Economics are far more optimistic, with a forecast of 5.9% in Q3.

Sources: Bureau of Economic Analysis, Trading Economics, FXStreet

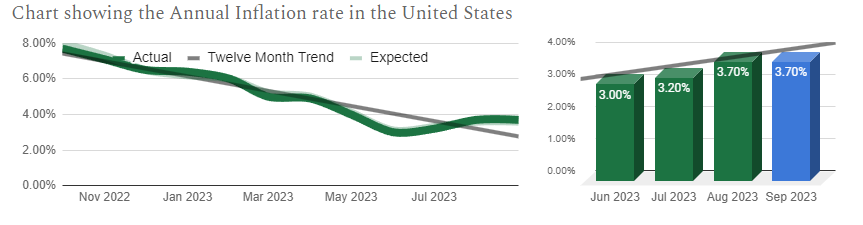

Outlook for inflation signals a light headwind for growth

The US inflation rate report measures the change in value of a basket of goods and services in the US over a given month compared with the previous. The latest data covers the August period and was published on October 12th by the Bureau of Labour Statistics and the next version is out on November 14th.

US prices have risen over the past four months, after falling rapidly during the previous year. This suggests that the economy is heating up, as demand increases and businesses raise prices.

September's inflation rate of 3.70% matched the rate in August’s. The trend-following forecasting model correctly predicted inflation of 3.7% for September and 3.7% again for October. This would see a stabilisation of prices, suggesting that the rate of inflation is steady. Trading Economics are far more optimistic, with a forecast of 3.0% by the end of Q4.

Sources: Bureau of Labour Statistics, Trading Economics, FXStreet

Outlook for retail sales signals a light headwind to growth

The US retail sales report measures the change in value of aggregated retail goods and services sales over a given month compared with the previous. The latest data covers the September period and was published on October 17th by the Census Bureau and the next version is out on November 15th.

US sales have steadily increased over the past four months, and beats the slight uptrend seen over the previous year (although has been volatile). This is a sign of a growing economy, as consumers increase spending, perhaps due to higher earnings but also the high inflation rate.

September sales (0.7%) showed a slight improvement over August (0.8%). The trend-following forecasting model predicted 0.6% which was very close and now is showing 0.4% for October. Trading Economics are less optimistic with their forecast of 0.2% by the end of Q4.

Sources: Census Bureau, Trading Economics, FXStreet

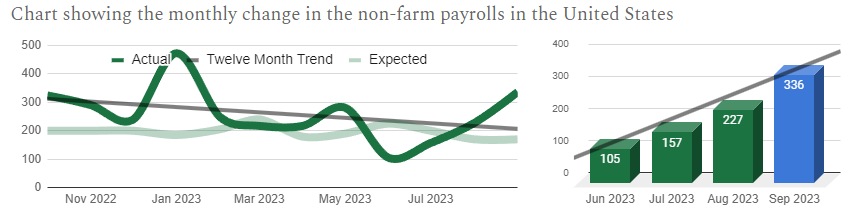

Outlook for NFP signals a tailwind for growth

The US non-farm payrolls (NFP) report measures the change in the number of paid workers not employed by farms (due to seasonality) over a given month compared with the previous. The latest data covers the August period and was published on October 6th by the Bureau of Labor Statistics and the next version is out on November 3rd.

US NFP has rapidly increased over the past four months, and pushed beyond the general downtrend seen over the previous year. This is a sign of a growing economy and increased investment, as businesses speed up their rate of growth to defy this era of expensive borrowing.

September numbers (336K) showed a big improvement over August (227, revised up from 187K). The trend-following forecast model predicts payrolls of 334K for October, which would shallow the recent uptrend. Trading Economics are less optimistic with their forecast of 100K in December.

Sources: Bureau of Labor Statistics, Trading Economics, FXStreet

Outlook for unemployment signals a light tailwind to growth

The US unemployment rate report measures the number of people actively looking for a job as a percentage of the labour force over a given month. The latest data covers the August period and was published on September 1st by the Bureau of Labor Statistics and the next version is out on November 3rd.

US unemployment has been historically low and stable over the past four months, matching the stability seen over the previous year. This is a sign of a healthy economy.

September unemployment of 3.8% matches June’s 3.8% and just below the gentle uptrend. The trend-following forecast model predicts unemployment at 3.7% for October which would be a slight improvement and maintains the stable trend. Trading Economics are less optimistic with a forecast of 4.0% in December.

Sources: Bureau of Labor Statistics, Trading Economics, FXStreet

Geopolitical Events

October 2023 Israel-Hamas War has the potential to add uncertainty

The war began on October 7, 2023, when Palestinian militants launched a surprise attack on Israel. The militants fired rockets into Israel and invaded Israeli territory. The Israeli military responded with airstrikes and ground forces. Reports indicate deaths of over 2,600 Palestinians and 1,400 Israelis.

Recent Key Events

Palestinian militants break through the Gaza–Israel barrier and invade Israel's Southern District

126 Israeli and foreign hostages taken by Palestinian militants

Israeli military carries out airstrikes in the Gaza Strip and imposes a total blockade

Israel orders the evacuation of northern Gaza including Gaza City

The conflict is limited in scope and its influence on the wider world. However, if the conflict were to escalate and regional powers such as Iran were to become involved then there are likely to be significant safe-haven flows into the USD.

Russian invasion of Ukraine adds uncertainty

On February 24, 2022, Russia invaded Ukraine in an escalation of the Russo-Ukrainian War which began in 2014. The invasion is the largest military conflict in Europe since World War II and has resulted in tens of thousands of casualties on both sides. The invasion has also caused a humanitarian crisis, with millions of Ukrainians displaced from their homes. The international community has condemned the invasion and imposed sanctions on Russia. The International Criminal Court is investigating possible war crimes and crimes against humanity committed by Russian forces.

Recent Key Events

June 2023: The Ukrainian counteroffensive in June 2023 made significant progress, with Ukraine liberating villages and reclaiming territory in the eastern Donbas region. The Wagner Group's rebellion against the Russian government was a major setback for Russia.

August 2023: Ukraine counteroffensive slowed by millions of mines laid by Russia. Ukrainian drones damage the Russian landing ship Olenegorsky Gornyak.

September: An attack on Russian naval targets in Sevastopol damages the Black Sea fleet. Several oil and gas drilling platforms on the Black Sea held by Russia since 2015 have been retaken.

The war in Ukraine is having a negative impact on the global economy, including the value of the US dollar. The war has caused energy prices to soar and disrupted supply chains, which are putting upward pressure on inflation and increasing demand for US dollars as a safe-haven.

China-United States trade war adds uncertainty

The US and China have been engaged in a trade war since 2018, with each side imposing tariffs on the other's goods in an attempt to force changes in trade practices. The trade war has had a negative impact on both economies.

Recent Key Events

December 2022: WTO ruled against US tariffs on steel, aluminium, and Hong Kong origin marking. The US is in breach of global trade rules for its tariffs on steel and aluminium, as well as its origin marking requirement for products imported from Hong Kong. The US has disputed the WTO rulings and has not taken any steps to comply.

January 2023: EU and US announce joint effort to block sale of advanced semiconductor chip technology to China.

February 2023: China expands Unreliable Entities List to include US defence contractors.

June 2023: US Secretary of State visits China, seeks to clarify US economic stance, but Chinese officials reject explanation.

July 2023: US Treasury Secretary criticises China's economic restrictions during visit to Beijing, stresses US goal to expand economic partnership.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-