USD Fundamental Analysis: Five Months of Strength, Five Weeks of Consolidation, French Elections to Determine Next Direction (June 30)

Saturday, 15 June, Week 24: The USD has exhibited remarkable strength over the past five months, appreciating significantly against most major currencies. This robust performance can be attributed to a combination of factors, including the Federal Reserve's aggressive monetary policy tightening, the relative strength of the US economy, and safe-haven demand amid global uncertainty. However, over the past five weeks, the USD has entered a period of consolidation, as investors assess the evolving economic outlook and the potential for a shift in the Fed's policy stance. The upcoming French parliamentary elections, scheduled for June 30, represent a pivotal risk event that could significantly influence the USD's next direction. A potential victory for the far-right National Rally could trigger risk aversion and a flight to safety, potentially boosting the USD. Conversely, a more centrist outcome could ease concerns about political and economic instability in Europe, potentially weighing on the USD.

Fiscal Policy

The US fiscal policy stance has been expansionary in recent years, with significant government spending on pandemic relief, infrastructure, and other initiatives. This has contributed to the strong economic recovery but has also led to a widening budget deficit and an increase in government debt. The Congressional Budget Office projects that the Federal budget deficit will reach $1.865 trillion in 2025, or 6.4% of GDP, under current law. The President's 2025 Budget proposes to reduce the deficit by $3 trillion over the next 10 years through a combination of tax increases on wealthy individuals and corporations and spending cuts on certain programs. However, the feasibility of these proposals remains uncertain, given the divided Congress.

Over the next five weeks, the fiscal policy outlook is likely to remain largely unchanged. The focus will be on the ongoing negotiations over the debt ceiling, which is expected to be reached sometime in the summer. A failure to raise the debt ceiling could lead to a government shutdown and a potential default on US debt obligations, which would have severe consequences for the USD and financial markets.

Economics

The US economy has demonstrated remarkable resilience in recent years, weathering the COVID-19 pandemic and the subsequent global economic slowdown. However, recent data suggests that growth is moderating, and inflation remains elevated, posing challenges for policymakers.

Economic Growth

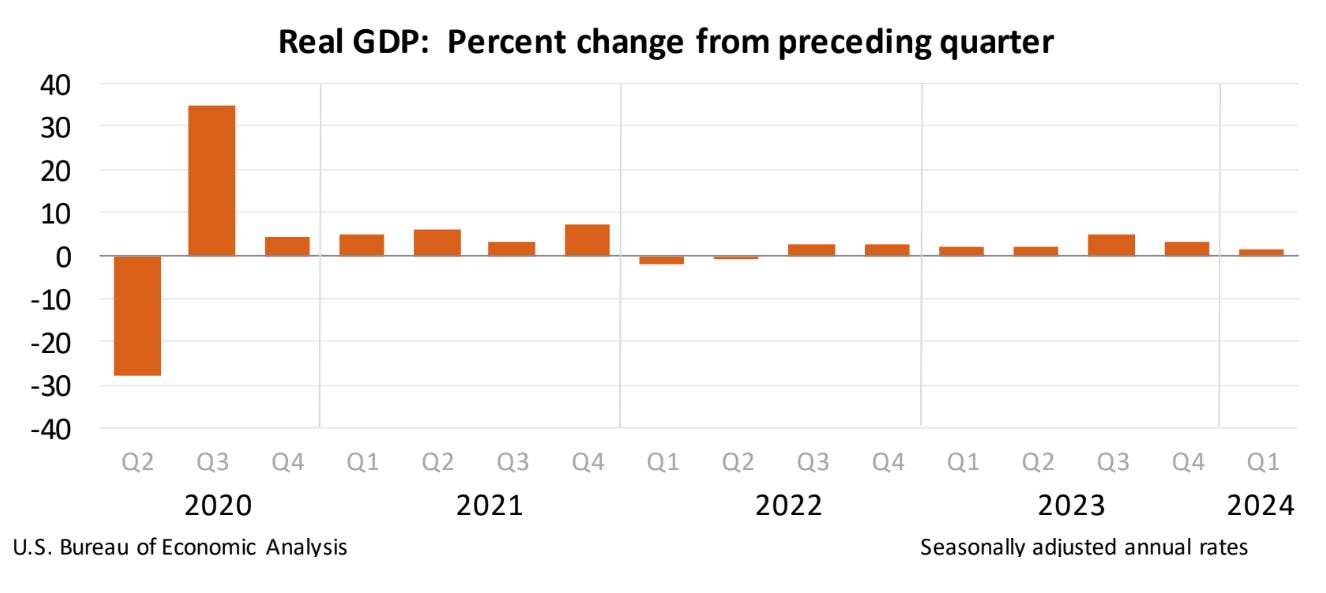

The US economy expanded by an annualised 1.3% in the first quarter of 2024, below the 1.6% advance estimate and the 3.4% growth rate in the fourth quarter of 2023. The slowdown was primarily attributed to a downward revision in consumer spending. The second estimate came in line with market forecasts and continues to point to the lowest growth since the contractions in the first half of 2022.

Looking ahead, the economic growth outlook for the next five weeks is mixed. The Atlanta Fed's GDPNow model currently estimates that real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 will be 1.9 percent on June 14, down from 2.9 percent on June 8. The decline in the estimate was primarily attributed to downward revisions to the contributions of real consumer spending growth and real gross private domestic investment growth. However, other indicators, such as consumer confidence and business sentiment, remain relatively strong, suggesting that the economy could continue to expand at a moderate pace.

Labour

The US labour market remains strong, with robust job growth and a low unemployment rate. However, there are signs that the labour market is cooling, with wage growth moderating and the number of job openings declining. The unemployment rate in the United States rose to 4% in May 2024, the highest since January 2022, up from 3.9% in the previous month. The number of unemployed individuals increased by 157,000 to 6.649 million, while employment levels went down by 408,000 to 161.083 million. Meanwhile, the labour force participation rate dropped to 62.5% from 62.7%, and the employment-population ratio decreased to 60.1% from 60.2%.

Over the next five weeks, the labour market is expected to remain relatively strong, with continued job growth and a stable unemployment rate. However, the pace of job growth is likely to moderate, and wage growth is expected to remain subdued. The upcoming release of the June employment report on July 5 will be closely watched for signs of further cooling in the labour market.

Price Changes

Inflation remains elevated in the US, although it has eased somewhat from its peak in 2023. The annual inflation rate in the US unexpectedly slowed to 3.3% in May 2024, the lowest in three months, compared to 3.4% in April and forecasts of 3.4%. Consumer prices in the US were unchanged in May 2024, after rising 0.3% in the previous period and below forecasts of a 0.1% increase.

The inflation outlook for the next five weeks is uncertain. The Fed's preferred measure of inflation, the core PCE price index, is expected to remain above the Fed's 2% target. However, there are signs that inflation could be moderating, with supply chain disruptions easing and commodity prices stabilising. The upcoming release of the May PCE price index on June 20 will be closely watched for signs of further progress on inflation.

Trade

The US trade deficit widened to $74.6 billion in April 2024, the largest since October 2022 from a downwardly revised $68.6 billion in March and below forecasts of a $76.1 billion gap. Imports increased 8.7% to $338.2 billion, mostly due to passenger cars, computer accessories, telecommunications equipment and crude oil, while falling for transport. Exports edged up a meagre 0.8% to $263.7 billion, mainly pharmaceutical preparations, electric apparatus and semiconductors.

The trade deficit is expected to remain elevated in the coming weeks, as strong domestic demand continues to drive imports. However, the deficit could narrow somewhat if export growth picks up, supported by a weaker USD and stronger global growth. The upcoming release of the May trade balance data on July 3 will be closely watched for signs of improvement in the trade balance.

Monetary Policy

The Federal Reserve has raised interest rates aggressively over the past year in an effort to combat inflation. The Fed's policy rate, the federal funds rate, is currently in a target range of 5.25 - 5.50%. The Fed has also been reducing its holdings of Treasury securities and agency mortgage-backed securities, a process known as quantitative tightening.

The Fed's monetary policy stance is currently restrictive, and the Fed has signalled that it is prepared to maintain this stance until it is confident that inflation is moving sustainably toward its 2% target. The Fed's dot plot, which shows policymakers' individual projections for the federal funds rate, indicates that the median participant expects only one rate cut this year and four reductions in 2025. Back in March, the Fed was seeing three cuts in 2024 and three in 2025.

Over the next five weeks, the Fed's monetary policy outlook is likely to remain largely unchanged. The Fed is expected to maintain its restrictive stance, and the market will be closely watching for any signals from Fed officials about the timing and extent of future rate cuts. The upcoming release of the minutes from the June FOMC meeting on June 19 could provide further insights into the Fed's thinking on monetary policy.

Geopolitics and Market Themes

Several geopolitical situations and market themes are currently influencing or could influence the US economy, monetary policy, and the USD.

Political Uncertainty in Europe

Synopsis: Political instability in France following the European Parliament elections is raising concerns about fiscal stability and the country's ability to implement reforms. The prospect of a far-right victory in the upcoming parliamentary elections is adding to market uncertainty.

Key Developments:

French President Macron called for snap legislative elections after the far-right National Rally's strong performance in the EU elections.

The gap between French and German bond yields has widened, reflecting concerns about France's fiscal outlook.

European equities have declined as investors assess the potential for political instability in France.

Market Impact: The euro has weakened against the dollar, reflecting concerns about political and fiscal risks in France. French bond yields have risen, while German bund yields have fallen as investors seek safe-haven assets. European equities are facing headwinds from political uncertainty, particularly in the financial sector.

Geopolitical Tensions

Synopsis: Geopolitical tensions, including the ongoing war in Ukraine and rising tensions between the US and China, are contributing to market volatility and risk aversion. These tensions are impacting commodity prices, supply chains, and investor sentiment.

Key Developments:

Russia continues its military offensive in Ukraine, raising concerns about energy security and global economic growth.

The US and China are engaged in a strategic competition, leading to trade disputes and technological decoupling.

Market Impact: Oil prices remain elevated due to concerns about supply disruptions related to the war in Ukraine. Gold prices are finding support as a safe-haven asset amid geopolitical uncertainty. Global supply chains are facing disruptions, contributing to inflationary pressures.

Conclusion

The USD's outlook for the next five weeks is uncertain, with several factors potentially influencing its direction.

Upward Support

The USD could come under upward support if:

The French parliamentary elections result in a victory for the far-right National Rally, triggering risk aversion and a flight to safety.

US economic data continues to surprise to the upside, reinforcing the view that the US economy is outperforming other major economies.

The Fed maintains its hawkish stance on monetary policy, signalling that it is not yet ready to begin cutting interest rates.

The upcoming release of the minutes from the June FOMC meeting on June 19 will be pivotal in determining whether the Fed is likely to maintain its hawkish stance.

Indifference

The USD could trade sideways if:

The French parliamentary elections result in a more centrist outcome, easing concerns about political and economic instability in Europe.

US economic data comes in mixed, with some indicators pointing to continued strength while others suggest that growth is moderating.

The Fed remains data-dependent on monetary policy, signalling that it is prepared to adjust its policy stance based on the evolving economic outlook.

The upcoming release of the May PCE price index on June 20 will be pivotal in determining whether inflation is moderating as expected.

Downside Pressure

The USD could come under downside pressure if:

The French parliamentary elections result in a clear victory for centrist parties, boosting confidence in the euro and reducing safe-haven demand for the USD.

US economic data disappoints, suggesting that the US economy is slowing more than expected.

The Fed signals that it is considering cutting interest rates sooner than expected, reducing the attractiveness of USD-denominated assets.

The upcoming release of the June employment report on July 5 will be pivotal in determining whether the US labour market is weakening.

References

Federal Reserve: https://www.federalreserve.gov/

U.S. Bureau of Economic Analysis: https://www.bea.gov/

U.S. Bureau of Labor Statistics: https://www.bls.gov/

U.S. Census Bureau: https://www.census.gov/

Congressional Budget Office: https://www.cbo.gov/

Atlanta Fed: https://www.atlantafed.org/

Trading Economics: https://tradingeconomics.com/

Bloomberg: https://www.bloomberg.com/

Reuters: https://www.reuters.com/

Financial Times: https://www.ft.com/

The Economist: https://www.economist.com/

Axios: https://www.axios.com/

Politico: https://www.politico.com/

CBS News: https://www.cbsnews.com/

The Washington Post: https://www.washingtonpost.com/

Yahoo Finance: https://finance.yahoo.com/

Market News International: https://www.marketnews.com/

Nikkei: https://asia.nikkei.com/

Marketplace: https://www.marketplace.org/