USD/CAD, EUR/USD, GBP/USD, and AUD/CAD

Thursday, 05 September, Week 36

This report provides a comprehensive analysis of four major currency pairs: USD/CAD, EUR/USD, GBP/USD, and AUD/CAD. These pairs have been selected due to their sensitivity to global macroeconomic trends, central bank policies, and geopolitical developments, making them attractive for forex traders seeking potential trading opportunities.

The release of the US jobs report for August on Friday, September 6th, will be crucial for gauging the health of the US labour market and assessing the risk of a recession. The release of the CPI data for August on September 11th will provide further insights into the trajectory of inflation in the US. Additionally, the release of the Australian GDP data for Q2 on September 5th will be closely watched by forex traders.

USD/CAD: Loonie's Uncertain Path Amidst Dovish Fed and BoC Rate Cut

USD/CAD pair influenced by commodity prices, especially oil. Key market players include producers, consumers, hedge funds, and central banks. Oil price fluctuations affect liquidity. Inverse correlation with S&P 500 indicates stronger US economy leads to weaker Canadian dollar. Understanding market dynamics crucial for effective trading strategies.

USD/CAD: Navigating Shifting Tides

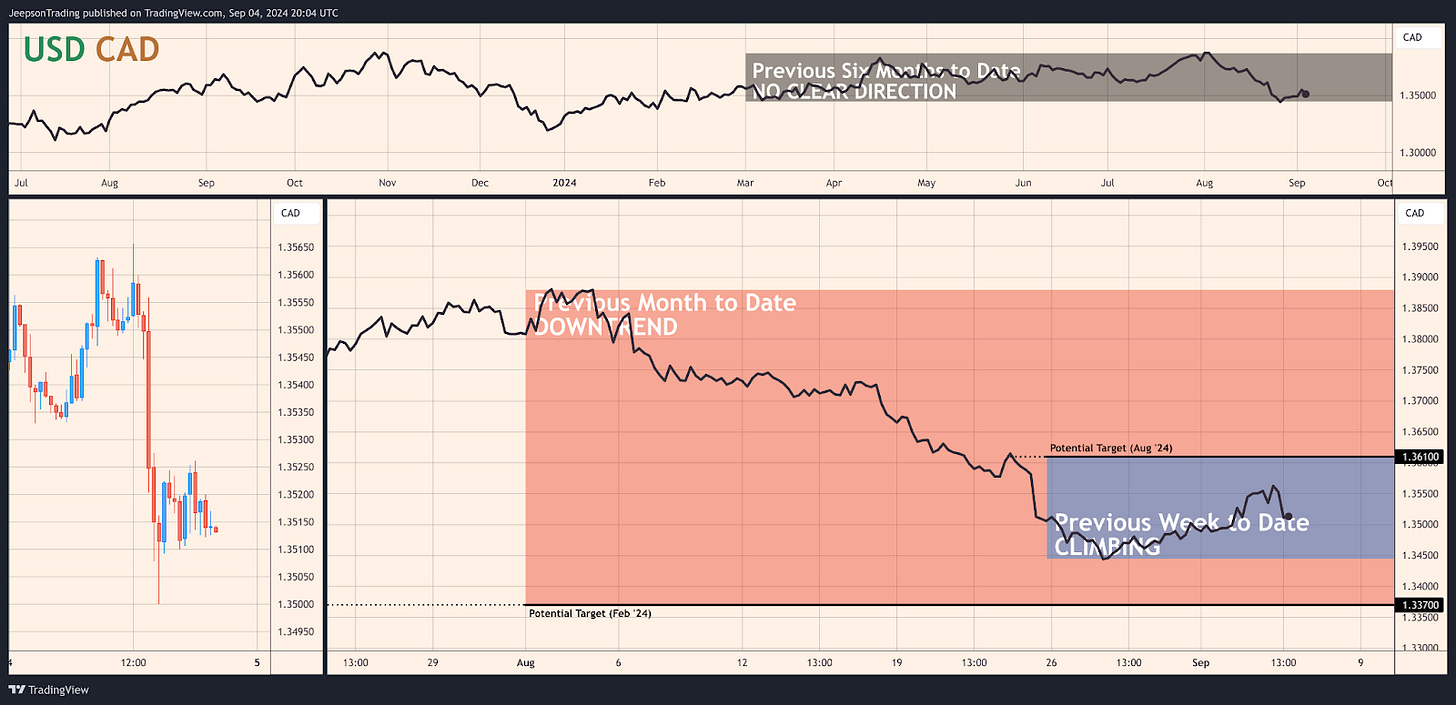

The USD/CAD pair has been climbing during the week to date, potentially targeting 1.361. This upward movement contrasts with the downtrend observed during the previous month to date, potentially targeting 1.337.

The recent uptrend in the USD/CAD pair can be attributed to several factors. The recent rebound in oil prices, driven by supply disruptions in Libya and geopolitical tensions in the Middle East, has supported the Canadian dollar and weighed on the USD/CAD pair. Additionally, the market's anticipation of the upcoming Federal Reserve interest rate decision has contributed to the pair's volatility. The market is currently pricing in a high probability of a rate cut by the Fed in September, which could further weaken the US dollar and support the Canadian dollar. The Bank of Canada's recent interest rate cut to 4.25% on September 4th has reduced the interest rate differential between the US and Canada, potentially limiting further Canadian dollar strength and supporting the USD/CAD pair.

A thesis for the USD/CAD pair to climb during the upcoming week is based on the potential for a smaller-than-expected rate cut by the Fed or a more hawkish tone from the Federal Reserve. This could occur if upcoming economic data releases, such as the US Non-Farm Payrolls for August (due Friday, September 6th, Week 36), point to a more resilient US economy. A smaller rate cut by the Fed or a more hawkish tone could strengthen the US dollar and weigh on the Canadian dollar, leading to an appreciation of the USD/CAD pair.

Conversely, a thesis for the USD/CAD pair to fall during the upcoming week is based on the potential for further Canadian dollar strength.

The bullish thesis for the USD/CAD pair has a moderate conviction level and is most likely. The Bank of Canada's recent rate cut has reduced the interest rate differential between the US and Canada, potentially limiting further Canadian dollar strength and supporting the USD/CAD pair. Additionally, a smaller-than-expected rate cut by the Fed or a more hawkish tone from the Federal Reserve could further strengthen the US dollar and weigh on the Canadian dollar. If the bullish thesis plays out, the pair could rise towards the resistance level of 1.377 established on August 12th. The uptrend observed during the week to date, following a downtrend in the previous month, suggests that the pair could continue its upward trajectory in the upcoming month, potentially targeting 1.361.

Key Indicators / Events to Watch

Friday, September 6th, Week 36: US Non-Farm Payrolls AUG (United States). The consensus forecast for US non-farm payrolls in August is 163K. A weaker than expected result could reinforce the view that the US economy is slowing and increase the likelihood of a larger rate cut by the Fed, potentially weakening the US dollar and putting downward pressure on the USD/CAD pair.

Friday, September 6th, Week 36: Unemployment Rate AUG (United States). The consensus forecast for the US unemployment rate in August is 4.20%. A higher than expected result could further support the view of a slowing US economy and increase the likelihood of a larger rate cut by the Fed, potentially weakening the US dollar and putting downward pressure on the USD/CAD pair.

EUR/USD: Euro's Uncertain Trajectory Amidst Dovish Fed and ECB Caution

The EUR/USD pair serves as a medium for multinational corporations, hedge funds, and central banks to manage their exposure to the Euro-Area and US economies. Its high liquidity is driven by substantial trading volume and investment flows between the two regions. The pair exhibits an inverse relationship with the US dollar and a positive correlation with Eurozone bond yields, with rising bond yields often indicating a stronger euro and a weaker dollar, leading to an appreciation of the EUR/USD pair.

EUR/USD: Navigating the Crosscurrents

The EUR/USD pair has been falling during the previous week to date, potentially targeting 1.090. This downward movement contrasts with the uptrend observed during the previous month to date, potentially targeting 1.123. However, the pair has been on an overall uptrend during the previous six months to date.

The recent downtrend in the EUR/USD pair can be attributed to several factors. The strengthening of the US dollar, driven by safe-haven demand amid escalating geopolitical tensions and the potential for a less aggressive Federal Reserve rate cut than initially anticipated, has weighed on the euro. Additionally, the unexpected contraction of the German economy in Q2 2024 has raised concerns about the Euro-Area's economic outlook, further dampening sentiment towards the euro.

A thesis for the EUR/USD pair to climb during the upcoming week is based on the potential for a weaker US dollar. This could occur if the upcoming US jobs report for August, scheduled for release on Friday, September 6th, Week 36, shows weaker-than-expected job growth, reinforcing the view that the US economy is slowing and increasing the likelihood of a larger rate cut by the Fed. A weaker US dollar could support the euro, leading to an appreciation of the EUR/USD pair.

Conversely, a thesis for the EUR/USD pair to fall during the upcoming week is based on the potential for a more hawkish ECB. This could occur if the upcoming release of Eurozone CPI Flash YY for August (due Friday, August 30th, Week 35) shows a higher-than-expected inflation rate, suggesting that the Euro-Area's disinflationary trend is slowing and potentially leading to a more hawkish ECB. A more hawkish ECB could weigh on the euro, leading to a depreciation of the EUR/USD pair.

The bearish thesis for the EUR/USD pair has a moderate conviction level and is most likely. The strengthening US dollar, potential Federal Reserve rate cuts, and the ECB's cautious approach to monetary policy suggest continued euro weakness against the US dollar in the short term. However, the potential resurgence of risk aversion and the upcoming Euro-Area GDP data release pose risks. The steady performance of the EUR/USD pair during the month to date, following an uptrend in the previous month, suggests that the pair could continue its upward trajectory in the upcoming month, potentially targeting 1.123.

Key Indicators / Events to Watch

Friday, September 6th, Week 36: Eurozone GDP Flash Estimate QQ (Q2 2024). The preliminary estimate for Eurozone GDP growth in Q2 is 0.30%. If the actual result confirms the preliminary estimate, it could suggest that the Euro-Area's economic recovery remains fragile, potentially weighing on the euro and supporting the EUR/USD pair.

Friday, September 6th, Week 36: US Non-Farm Payrolls AUG (United States). The consensus forecast for US non-farm payrolls in August is 163K. If the actual result is significantly lower than the forecast, it could reinforce the view that the US economy is slowing and increase the likelihood of a larger rate cut by the Fed, potentially weakening the US dollar and supporting the EUR/USD pair.

Thursday, September 12th, Week 37: ECB Interest Rate Decision (Euro Area). The benchmark interest rate in the Euro Area was last recorded at 4.250%. If the ECB cuts rates, it could weaken the euro and support the EUR/USD pair.

GBP/USD: Sterling's Steady Climb Amidst Dovish Fed and UK Economic Concerns

The GBP/USD pair is popularly traded by multinational corporations, hedge funds, and central banks to manage their exposure to the UK and US economies. Its high liquidity arises from substantial trade and investment flows between the two countries. The pair generally correlates positively with UK gilt yields and inversely with the US dollar. Higher UK gilt yields indicate a robust UK economy, strengthening the British pound and weakening the US dollar, leading to GBP/USD appreciation.

GBP/USD: Navigating the Post-Brexit Landscape

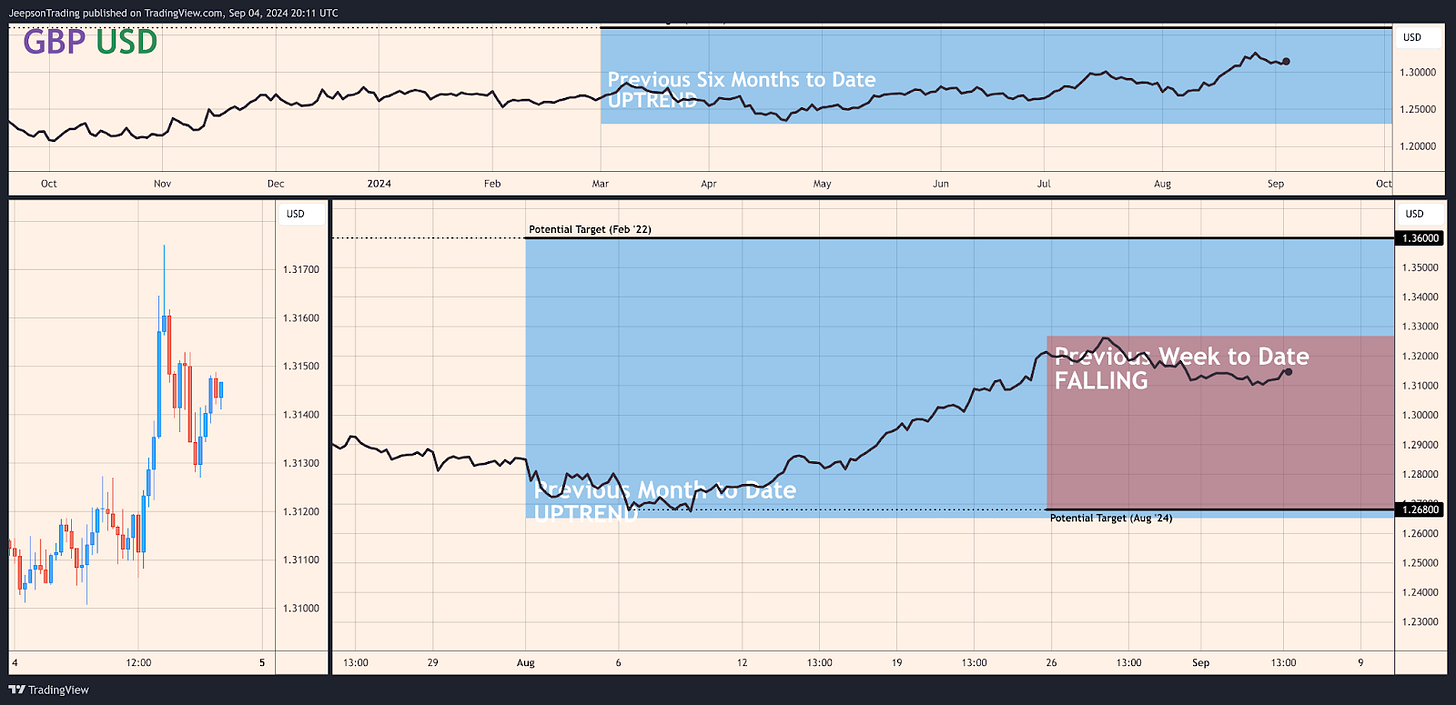

The GBP/USD pair has been falling during the previous week to date, potentially targeting 1.268. This downward movement contrasts with the uptrend observed during the previous month to date, potentially targeting 1.360. However, the pair has been on an overall uptrend during the previous six months to date.

The recent downtrend in the GBP/USD pair can be attributed to several factors. The strengthening of the US dollar, driven by safe-haven demand amid escalating geopolitical tensions and the potential for a less aggressive Federal Reserve rate cut than initially anticipated, has weighed on the British pound. Additionally, the Bank of England's recent rate cut to 5.00% has reduced the interest rate differential between the UK and the US, further dampening sentiment towards the British pound.

A thesis for the GBP/USD pair to climb during the upcoming week is based on the potential for a weaker US dollar. This could occur if the upcoming US jobs report for August, scheduled for release on Friday, September 6th, Week 36, shows weaker-than-expected job growth, reinforcing the view that the US economy is slowing and increasing the likelihood of a larger rate cut by the Fed. A weaker US dollar could support the British pound, leading to an appreciation of the GBP/USD pair.

Conversely, a thesis for the GBP/USD pair to fall during the upcoming week is based on the potential for a weaker British pound. This could occur if the upcoming release of the UK GDP data for Q2, scheduled for release on Thursday, September 5th, Week 36, shows weaker-than-expected growth, raising concerns about the UK's economic outlook and the potential for further rate cuts by the Bank of England. A weaker British pound could weigh on the GBP/USD pair, leading to a depreciation.

The bullish thesis for the GBP/USD pair has a moderate conviction level. The weakening US dollar and the potential for further Federal Reserve rate cuts, coupled with the BoE's cautious approach to monetary policy and the potential for positive surprises in UK economic data, suggest that the British pound could continue to strengthen against the US dollar in the near term. However, the potential for a resurgence of risk aversion in global markets and the upcoming release of the UK GDP data for Q2 pose risks to this outlook. The uptrend observed during the month to date, following an uptrend in the previous month, suggests that the pair could continue its upward trajectory in the upcoming month, potentially targeting towards 1.360.

Key Indicators / Events to Watch

Friday, September 6th, Week 36: US Non-Farm Payrolls AUG (United States). The consensus forecast for US non-farm payrolls in August is 163K. If the actual result is significantly lower than the forecast, it could reinforce the view that the US economy is slowing and increase the likelihood of a larger rate cut by the Fed, potentially weakening the US dollar and supporting the GBP/USD pair.

AUD/CAD: Aussie's Uncertain Path Amidst Chinese Economic Uncertainty

The AUD/CAD pair is traded by commodity producers, consumers, hedge funds, and central banks to manage exposure to the Australian and Canadian economies and commodity price fluctuations. Liquidity is driven by changes in commodity prices, as both nations are major exporters of raw materials. The AUD/CAD pair typically has a positive correlation with the price of iron ore and an inverse correlation with the US dollar.

AUD/CAD: Navigating the Commodity Rollercoaster

The AUD/CAD pair has been falling during the previous week to date, potentially targeting 0.897. This downward movement contrasts with the uptrend observed during the previous month to date, potentially targeting 0.925. However, the pair has been on an overall uptrend during the previous six months to date.

The recent downtrend in the AUD/CAD pair can be attributed to several factors. The strengthening of the US dollar, driven by safe-haven demand amid escalating geopolitical tensions and the potential for a less aggressive Federal Reserve rate cut than initially anticipated, has weighed on both the Australian and Canadian dollars. Additionally, concerns about the Chinese economy, a major importer of Australian commodities, have contributed to the pair's weakness. The Bank of Canada's recent interest rate cut to 4.25% on September 4th has also weighed on the AUD/CAD pair, as it has reduced the interest rate differential between Australia and Canada.

A thesis for the AUD/CAD pair to climb during the upcoming week is based on the potential for a weaker US dollar. This could occur if the upcoming US jobs report for August, scheduled for release on Friday, September 6th, Week 36, shows weaker-than-expected job growth, reinforcing the view that the US economy is slowing and increasing the likelihood of a larger rate cut by the Fed. A weaker US dollar could support both the Australian and Canadian dollars, potentially leading to an appreciation of the AUD/CAD pair.

Conversely, a thesis for the AUD/CAD pair to fall during the upcoming week is based on the potential for a weaker Australian dollar. This could occur if the upcoming release of the Australian GDP data for Q2, scheduled for release on Wednesday, September 4th, Week 36, shows weaker-than-expected growth, reinforcing concerns about the Australian economy and potentially weighing on the Australian dollar. A weaker Australian dollar could lead to a depreciation of the AUD/CAD pair.

The bearish thesis for the AUD/CAD pair has a moderate conviction level and is most likely. The strengthening US dollar and the potential for further Federal Reserve rate cuts, coupled with the uncertainty surrounding the Chinese economy and the recent BoC rate cut, suggest that the Australian dollar could weaken against the Canadian dollar in the near term. However, the potential for a resurgence of risk aversion in global markets and the potential for positive surprises in Australian economic data pose risks to this outlook. If the bearish thesis plays out, the pair could fall towards the support level of 0.890 established on April 15th. The steady performance of the AUD/CAD pair during the month to date, following a downtrend in the previous month, suggests that the pair could continue its upward trajectory in the upcoming month, potentially targeting 0.925.

Key Indicators / Events to Watch

Friday, September 6th, Week 36: US Non-Farm Payrolls AUG (United States). The consensus forecast for US non-farm payrolls in August is 163K. If the actual result is significantly lower than the forecast, it could reinforce the view that the US economy is slowing and increase the likelihood of a larger rate cut by the Fed, potentially weakening the US dollar and supporting the AUD/CAD pair.

Sources

Bank of England

Office for National Statistics

Trading Economics

BRC - British Retail Consortium

Confederation of British Industry

GfK Group

S&P Global

Nationwide Building Society

Office for Budget Responsibility

Eurostat

US Bureau of Labor Statistics

Reserve Bank of Australia

Australian Bureau of Statistics

Australian Government

Westpac Banking Corporation

Melbourne Institute

National Australia Bank

S&P Global

Australian Industry Group

CoreLogic

Bank of Canada

Statistics Canada

Department of Finance Canada

2024 Third-Quarter Forecast

2024 Canadian Federal Budget

Bloomberg

Reuters

OECD

IMF

GfK Group

Ifo Institute

Centre for European Economic Research (ZEW)

S&P Global

Ministère de l'Économie et des Finances, France

Bundesagentur für Arbeit, Germany

DARES, France

Newsquawk

Stratfor Worldview

ForexLive