What to Trade this Week Amidst a Tariff Tsunami

The Forex Market Roundup

Monday, March 03, 2025, Week 10

Welcome. As we enter the first week of March, global markets are bracing for significant volatility driven primarily by the imminent implementation of U.S. tariffs on March 4th. This trade policy development intersects with a critical economic calendar, headlined by the ECB's rate decision on Thursday and culminating in the U.S. employment report on Friday.

The fundamental strength of major currencies is as follows:

U.S. Dollar (USD) - Strong, Bullish: The dollar maintains its dominant position, supported by the Fed's relatively hawkish stance compared to other central banks, safe-haven flows amid trade tensions, and a still-resilient economy despite some mixed signals. This strength assessment remains unchanged from the previous report.

Japanese Yen (JPY) - Strong, Bullish: The yen has strengthened since our last analysis, benefiting from the BOJ's policy normalization process, persistent above-target inflation, and enhanced safe-haven appeal amid growing global trade uncertainties.

Swiss Franc (CHF) - Strong, Bullish: The franc continues to attract safe-haven flows despite Switzerland's slowing growth and declining inflation, maintaining its fundamental strength unchanged from the previous report as geopolitical risks intensify.

British Pound (GBP) - Indifferent (Mixed), Indifferent (Mixed): Sterling occupies a middle ground, with BOE rate cuts balanced against relatively resilient economic data and the potential for positive UK-US trade relations, showing little change from previous assessments.

Euro (EUR) - Weak, Bearish: The euro's fundamental weakness has intensified since our last report, pressured by expected ECB easing, stagnant economic growth, and the threat of U.S. tariffs specifically targeting European exports.

Canadian Dollar (CAD) - Weak, Bearish: The loonie remains fundamentally weak despite surprisingly strong GDP data, as the imminent U.S. tariffs targeting Canadian exports present significant headwinds to economic performance.

Australian Dollar (AUD) - Weak, Bearish: The aussie maintains its weak fundamental position as the RBA's easing cycle, concerns about Chinese demand, and global trade tensions continue to pressure the currency.

New Zealand Dollar (NZD) - Very Weak, Very Bearish: The kiwi remains at the bottom of our rankings, with its fundamentally weak position unchanged following the RBNZ's aggressive 50 bp cut and the currency's vulnerability to global trade disruptions.

US Dollar (USD): Strong Fundamentals Support Bullish Outlook Amid Trade Tensions

The US dollar has been strong due to the Federal Reserve's relatively hawkish monetary policy compared to other central banks. This policy divergence has been reinforced by mixed economic data, which has raised questions about economic momentum. Meanwhile, President Trump's trade policies and goal to balance the US budget have increased uncertainty and triggered risk-off sentiment in global markets.

Looking ahead to the upcoming week, several factors could influence the dollar's trajectory. Upward support is likely to come from continued safe-haven flows as markets digest the initial impact of tariff implementation, the Fed's relatively hawkish stance compared to other central banks, and any positive surprises in economic data, particularly Friday's employment report. Conversely, downward pressure could emerge from signs of economic slowdown in response to trade disruptions, concerns about the potential inflationary impact of tariffs, or indications that the Fed might need to adjust its policy stance in response to changing economic conditions.

The dollar remains a speculative buy based on both fundamental strength and current market positioning. The CFTC Commitments of Traders report for the U.S. Dollar Index shows dealers maintaining a significant net short position (53.6% of open interest) while asset managers hold substantial net long positions (36.6% of open interest). This divergence suggests potential for continued dollar strength as global uncertainties persist, with substantial room for dealer short covering if safe-haven flows intensify. The dollar's fundamental case is further strengthened by its status as the world's reserve currency during periods of elevated trade tensions, which typically leads to increased demand for USD-denominated assets.

Key Economic Indicators (March 3-7, 2025)

ISM Manufacturing PMI (Mar 3): Expected to remain in expansion territory.

ISM Services PMI (Mar 5): Modest improvement expected.

Non-Farm Payrolls (Mar 7): Employment growth expected to slow.

Unemployment Rate (Mar 7): Expected to remain unchanged.

Fed Chair Powell Speech (Mar 7): Comments will be closely analyzed for any shift in policy stance.

Japanese Yen (JPY): Strong Fundamentals Drive Bullish Outlook Amid Policy Normalization

The Bank of Japan (BOJ) has been gradually normalizing its policy, raising rates three times since March 2024 due to high inflation and wage growth. This has strengthened the Japanese yen. However, recent economic indicators show a softening economy, with industrial production and housing starts declining. This raises the question of whether the BOJ will continue tightening policy despite these signs.

Looking to the week ahead, several factors could influence the yen's performance. Upward support is likely to come from continued inflation readings above the BOJ's 2% target, hawkish signals from BOJ officials reinforcing the normalization path, and safe-haven flows amid escalating global trade tensions following the March 4th implementation of U.S. tariffs. Downward pressure could emerge from further signs of economic weakness in upcoming data releases, any softening in the BOJ's rhetoric suggesting a slower normalization pace, or a broad improvement in global risk sentiment that would reduce safe-haven demand.

The yen should be considered a speculative buy based on its strong fundamentals and bullish sentiment outlook. The CFTC Commitments of Traders report reveals an extraordinary positioning divergence, with dealers holding a massive net short position (42.5% of open interest) while asset managers maintain a substantial net long position. This creates significant potential for a powerful short squeeze if the BOJ maintains its hawkish stance or if safe-haven flows intensify following the implementation of U.S. tariffs. The fundamental case for yen strength is further supported by Japan's significant current account surplus, which tends to provide underlying support during periods of global uncertainty.

Key Economic Indicators (March 3-7, 2025)

Consumer Confidence (Mar 4): Slight improvement expected. Stronger-than-expected reading would support yen.

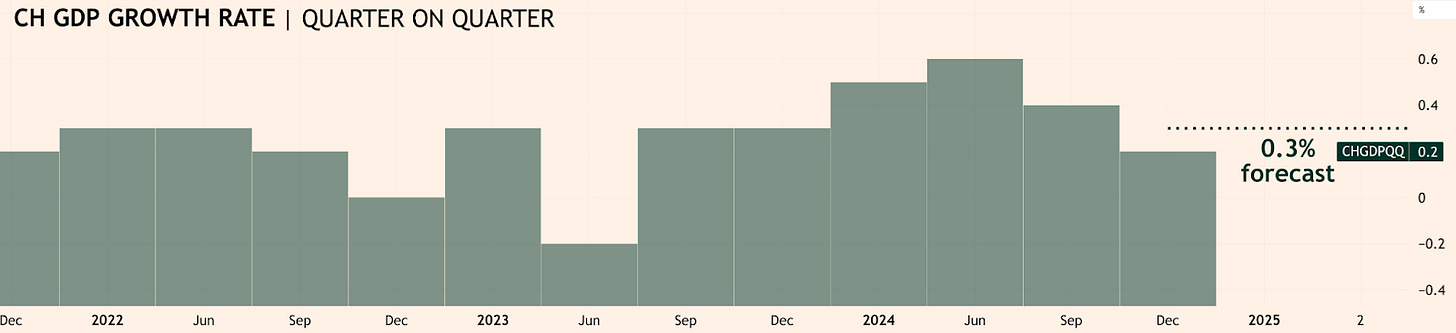

Swiss Franc (CHF): Strong Safe-Haven Status Maintains Bullish Outlook Despite Policy Easing

The Swiss franc has remained strong due to its safe-haven status amid global uncertainty, despite the SNB's rate cut to 0.50% in December 2024. Even with slowing GDP growth, the franc's resilience shows its ability to attract capital during market volatility.

However, Switzerland's declining inflation rate, which fell to 0.4% in January, is challenging the SNB's target and raising expectations for further easing at the March 21st policy meeting. The combination of slowing growth and declining inflation strengthens the case for additional monetary accommodation.

For the upcoming week, several factors could influence the franc's trajectory. Upward support will likely come from intensified safe-haven flows as markets digest the March 4th implementation of U.S. tariffs, Switzerland's political stability relative to its European neighbors amid ongoing uncertainty in Germany and France, and the close association with gold, which has been trading near record levels. Conversely, downward pressure could emerge from growing expectations for additional SNB rate cuts following the upcoming inflation report, signs of further economic slowdown in manufacturing data, and concerns about the strong franc's negative impact on export competitiveness.

The franc should be considered a speculative hold despite its strong fundamentals and bullish sentiment outlook. This cautious stance is primarily due to the extreme positioning revealed in the CFTC Commitments of Traders report, which shows dealers overwhelmingly long (71.5% of open interest) while asset managers are substantially short (47.5% of open interest). This significant divergence suggests potential for volatility but limited room for sustained moves in either direction without substantial new catalysts. While safe-haven demand provides fundamental support, the growing expectations for further SNB easing create countervailing pressure that could limit appreciation potential.

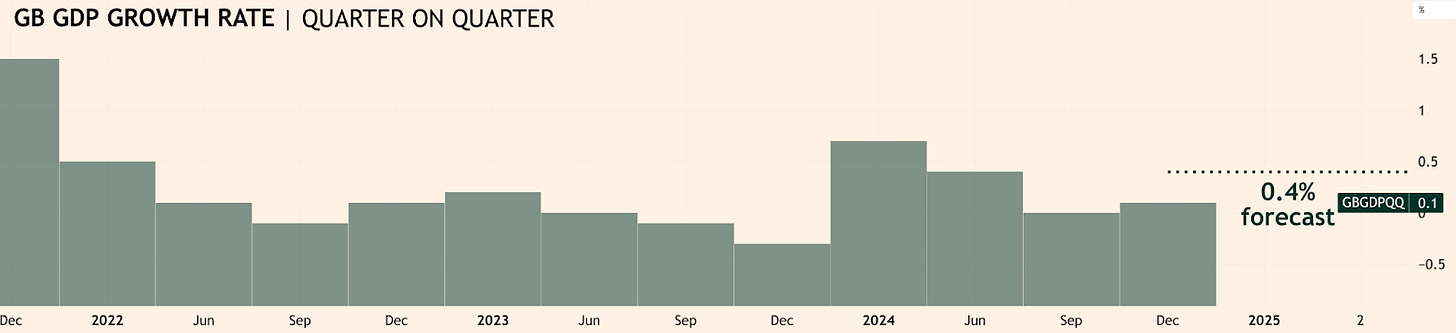

British Pound (GBP): Mixed Fundamentals Create Neutral Outlook Amid Economic Resilience

The Bank of England's shift towards monetary easing, marked by the February 6th rate cut to 4.50%, has been the dominant theme influencing the British pound. The BOE maintains a cautious approach to further rate cuts due to uncertainty surrounding the UK labor market and inflation outlook. The UK's relatively strong economic performance compared to peers is an emerging theme, with Q4 2024 GDP and other economic indicators showing positive surprises. However, inflation remains a concern, creating a complex picture for the BOE as it balances growth support against persistent inflation pressures.

Looking ahead to the coming week, several factors could influence sterling's performance. Upward support could come from continued economic resilience in upcoming PMI data, potential progress in UK-US trade relations following Prime Minister Starmer's recent meeting with President Trump (which hinted at a possible tariff-free trade deal), and the BOE's careful approach to further easing. Downward pressure might emerge from persistent inflation concerns, spillover effects from global trade tensions as U.S. tariffs take effect, or any signals suggesting a more aggressive BOE easing path than currently anticipated.

The pound warrants a speculative hold position based on mixed fundamental signals and balanced market positioning. The CFTC report shows asset managers are substantially short (36.9% of open interest) while leveraged funds and dealers maintain modest net long positions. This positioning structure suggests potential for pound appreciation if economic data continues to surprise positively, but limited room for dramatic moves without significant new catalysts. The fundamental case is similarly balanced, with BOE easing offset by economic resilience and potential UK-US trade advantages relative to the EU.

Euro (EUR): Weak Fundamentals Drive Bearish Outlook Amid ECB Easing Expectations

The euro has faced downward pressure due to the European Central Bank's dovish monetary policy, including a recent rate cut, and concerns about economic stagnation in the Eurozone. Differing inflation rates within member states and political uncertainty, exemplified by Germany's potential snap elections and France's new government, further complicate the situation. Additionally, proposed tariffs on EU imports by the US add to economic concerns, particularly for Germany's export-driven economy.

Looking ahead to the coming week, several factors could influence the euro's trajectory. Upward support might emerge from better-than-expected economic data (particularly the flash inflation figures due Monday), any moderation in U.S. trade rhetoric following implementation of the initial tariffs, or signals of political stability from major economies. Downward pressure is likely to come from market expectations for another ECB rate cut at Thursday's meeting, escalating trade tensions as the U.S. tariff threat specifically targeting European exports materializes, and ongoing political uncertainty as markets await the German election results.

The euro warrants a speculative sell recommendation based on fundamentally weak conditions and bearish sentiment, particularly ahead of the March 6th ECB meeting where further easing is widely expected. The CFTC Commitments of Traders report reveals an extraordinary positioning divergence, with dealers holding a massive net short position (28.8% of open interest) while asset managers maintain a substantial net long position (48.2% of open interest). This extreme positioning suggests potential for significant volatility, but the fundamental case for euro weakness appears compelling given the combination of ECB easing, economic stagnation, and targeted trade pressure.

Key Economic Indicators (March 3-7, 2025)

Eurozone Economic Events and Their Potential Market Impact

HCOB Manufacturing PMI Final (Mar 3): Slight improvement expected, limited impact unless significant revision.

Inflation Rate YoY Flash (Mar 3): Expected to moderate, crucial for ECB policy decision. Downside surprise could pressure EUR.

Core Inflation Rate YoY Flash (Mar 3): Expected to ease slightly, higher reading could support EUR temporarily.

Inflation Rate MoM Flash (Mar 3): Monthly dynamics provide insight into inflation momentum, limited independent impact.

Unemployment Rate (Mar 4): Expected to remain stable, limited impact unless significant deviation.

HCOB Composite PMI Final (Mar 5): Confirmation of stagnation expected, limited impact unless significant revision.

HCOB Services PMI Final (Mar 5): Continued expansion but at slower pace expected, limited impact unless significant revision.

Retail Sales MoM (Mar 6): Modest recovery expected, better reading could support EUR temporarily.

ECB Interest Rate Decision (Mar 6): Widely anticipated cut, market reaction depends on forward guidance, key event risk for EUR.

ECB Press Conference (Mar 6): Lagarde's comments crucial, potentially more market-moving than the rate decision.

ECB Staff Macroeconomic Projections (Mar 6): Updated forecasts will influence policy expectations, critical for shaping medium-term rate expectations.

ECB President Lagarde Speeches (Mar 6, 7): Initial policy explanation and follow-up remarks important, high market-moving potential.

GDP Growth Rate QoQ 3rd Est (Mar 7): Expected to confirm stagnation, limited impact unless significant revision.

Canadian Dollar (CAD): Weak Fundamentals Drive Bearish Outlook Despite Growth Surprise

The Bank of Canada has been aggressively easing monetary policy, cutting rates by 200 basis points since June 2024 and ending quantitative tightening. This move was driven by concerns about economic momentum, but recent data showing strong Q4 GDP growth suggests the policy is working. At the same time, political uncertainty following Prime Minister Trudeau's resignation and upcoming elections adds complexity to Canada's outlook, especially with trade tensions and impending US tariffs on Canadian goods.

Looking to the week ahead, several factors could influence the Canadian dollar's performance. Upward support might emerge from stronger-than-expected economic data reinforcing the positive growth surprise, stabilization in oil prices following recent weakness, or any last-minute modifications to the tariff implementation that might reduce the impact on Canadian exports. Downward pressure is likely to come from the March 4th implementation of U.S. tariffs directly targeting Canadian goods, continued weakness in oil prices below $70 per barrel, and ongoing political uncertainty ahead of the federal election cycle.

The loonie warrants a speculative hold recommendation despite fundamentally weak conditions and bearish sentiment. This cautious stance reflects competing factors in the currency's outlook. While the BOC's easing cycle and imminent U.S. tariff implementation create significant headwinds, stronger-than-expected growth data suggests economic resilience that could limit downside. The CFTC Commitments of Traders report shows extreme positioning divergence, with dealers substantially net long (61.9% of open interest) while asset managers (50.6% of open interest) and leveraged funds are significantly short. This positioning tension suggests potential for substantial volatility, particularly if fundamental or policy surprises materialize that challenge current market narratives.

Key Economic Indicators (March 3-7, 2025)

S&P Global Manufacturing PMI (Mar 3): Expected to show continued expansion. Stronger-than-expected reading could temporarily support CAD.

Balance of Trade (Mar 6): Expected to show widening surplus. Important benchmark for assessing future tariff impact. Significant deviation from forecast could impact CAD.

Ivey PMI s.a (Mar 6): Expected to return to expansion territory. Important for corroborating economic resilience. Stronger-than-expected reading could provide temporary CAD support.

Unemployment Rate (Mar 7): Will indicate whether labor market stability is continuing. Evidence of labor market strength could reduce expectations for aggressive BOC easing.

Australian Dollar (AUD): Weak Fundamentals Support Bearish Outlook Despite Mixed Signals

The Reserve Bank of Australia recently cut interest rates due to moderating inflation and subdued demand, signaling a cautious easing approach. The Australian dollar's value has been significantly impacted by this change. Additionally, Australia's economy is navigating complexities arising from its close trade relationship with China and increasing U.S.-China trade tensions, which create mixed economic signals.

Looking ahead to the coming week, several factors could influence the Australian dollar's trajectory. Upward support might emerge from resilience in commodity prices, particularly iron ore which has reached four-month highs near $107 per tonne, better-than-expected Australian economic data (especially Wednesday's GDP release), or positive Chinese economic indicators suggesting stable demand for Australian resources. Downward pressure could come from escalation of U.S.-China trade tensions following the March 4th tariff implementation, disappointing Chinese economic data revealing weakening demand, or further expectations of RBA easing based on domestic indicators.

The aussie warrants a speculative hold recommendation based on mixed signals despite its fundamentally weak position and bearish outlook. While the RBA's easing cycle and exposure to Chinese demand create significant headwinds, the cautious approach to further rate cuts and resilience in commodity prices provide some counterbalance. The CFTC Commitments of Traders report shows significant positioning divergence, with dealers net long (44.3% of open interest) while asset managers are net short (42.7% of open interest). This suggests potential for volatility but limited room for extreme moves without significant new catalysts that challenge existing market narratives.

Key Economic Indicators (March 3-7, 2025)

RBA Meeting Minutes (Mar 4): Tone of minutes and clues on future rate decisions will impact AUD.

Retail Sales MoM (Mar 4): Expected return to growth; strong data will support AUD.

GDP Growth Rate QoQ and YoY (Mar 5): Forecast to show acceleration; key release for AUD and RBA policy outlook.

Balance of Trade (Mar 6): Forecast to widen slightly; significant deviation could impact AUD.

New Zealand Dollar (NZD): Very Weak Fundamentals Drive Very Bearish Outlook Amid Trade Tensions

The New Zealand dollar has weakened due to the Reserve Bank of New Zealand's aggressive monetary policy easing, including a recent 50 basis point cut to the Official Cash Rate. This easing reflects concerns about labor market conditions and a technical recession. The kiwi hit a two-week low despite signals that future rate cuts would be smaller, suggesting global factors are at play. New Zealand's export-driven economy is vulnerable to global trade tensions, particularly its heavy reliance on China. Increased tariffs on Chinese goods by the US have raised concerns about retaliatory measures and the potential impact on New Zealand's export performance.

Looking ahead to the coming week, several factors could influence the New Zealand dollar's trajectory. Upward support might emerge from positive developments in the dairy sector, which remains crucial to New Zealand's export economy, or any stabilization in global trade tensions following the initial implementation of U.S. tariffs. Downward pressure is likely to come from further escalation of global trade disputes, continued market expectations for RBNZ rate cuts despite the signaled moderation in pace, or additional economic data that reinforces recession concerns.

The kiwi warrants a speculative sell recommendation based on fundamentally very weak conditions and very bearish sentiment. The CFTC Commitments of Traders report reveals a stark positioning divergence, with dealers maintaining substantial long positions (60.5% of open interest) while asset managers are heavily short (62.2% of open interest). While this positioning tension suggests potential for volatility, particularly in the form of short squeezes if positive catalysts emerge, the fundamental case for continued NZD weakness remains compelling given the combination of domestic recession, monetary easing, and heightened vulnerability to global trade disruptions.

Navigating a Pivotal Market Week: Focus on Tariffs and Central Bank Decisions

As we conclude our analysis, several key themes emerge that will shape currency markets in the week ahead. The implementation of U.S. tariffs on March 4th represents a critical inflection point that could trigger significant volatility across all major pairs. Traders should closely monitor not just the initial market reaction but also potential retaliatory measures and corporate responses as these trade barriers take effect. Simultaneously, the ECB's rate decision on Thursday will provide essential insights into the European monetary policy trajectory, potentially widening the divergence with the Federal Reserve and further pressuring the euro.

The week's economic calendar features several high-impact releases that could significantly influence currency movements. Based on our analysis, these are the top five economic indicators to watch:

ECB Interest Rate Decision (Mar 6) - The widely anticipated 25bp cut would bring the deposit rate to 2.50%, but market reaction will depend primarily on forward guidance provided during President Lagarde's press conference. Dovish signals beyond the expected cut could trigger substantial euro weakness, particularly against the dollar and Swiss franc.

U.S. Non-Farm Payrolls (Mar 7) - February employment data, with a forecast of 133K new jobs compared to January's 143K, will be crucial for Federal Reserve policy expectations. A stronger-than-expected report would reinforce the Fed's relatively hawkish stance and support dollar strength, while disappointment could trigger dollar weakness by raising the possibility of accelerated rate cuts.

Australian GDP Growth Rate QoQ (Mar 5) - Q4 data, with a forecast of 0.40% growth versus 0.30% in Q3, will provide critical insights into Australia's economic resilience amid global headwinds. This release carries significant market-moving potential for the Australian dollar, with implications for RBA policy expectations and AUD crosses.

Canadian Employment Report (Mar 7) - February labor market data will reveal how Canada's economy is performing ahead of tariff implementation. With employment growth expected to moderate significantly to 17.8K from January's robust 76K, any substantial deviation could trigger volatility in the Canadian dollar as traders reassess BOC policy expectations.

Eurozone Inflation Rate YoY Flash (Mar 3) - February inflation data, forecast at 2.30% versus January's 2.50%, will influence expectations for Thursday's ECB decision. A lower-than-expected reading would reinforce dovish expectations and potentially pressure the euro, while higher inflation could temper expectations for aggressive easing.

These indicators, combined with the implementation of U.S. tariffs and ongoing central bank divergence, create a complex trading environment requiring careful risk management and strategic positioning.

Sources

Federal Reserve, European Central Bank, Bank of Japan, Bank of England, Reserve Bank of Australia, Reserve Bank of New Zealand, Swiss National Bank, Bank of Canada, Bloomberg, Reuters, Trading Economics, Financial Juice, S&P Global, Halifax, Nationwide, ISM, HCOB, procure.ch.